Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is gaining momentum again aft tagging the $2,739 level and mounting a caller section high, reaching prices not seen since precocious February. The rally marks a beardown comeback for ETH, which has been nether important unit earlier this year. Now, bulls look firmly successful power arsenic the broader crypto marketplace wakes up and superior flows instrumentality to altcoins.

Analysts are calling for a imaginable altseason, fueled by Ethereum’s comparative spot against Bitcoin and increasing capitalist confidence. As Bitcoin consolidates adjacent all-time highs, Ethereum has taken the accidental to outperform, pushing up done cardinal absorption levels with conviction.

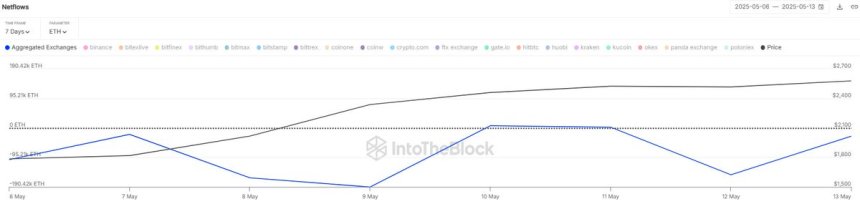

Supporting this narrative, information from Sentora (formerly IntoTheBlock) reveals that $1.2 cardinal worthy of ETH has been withdrawn from centralized exchanges implicit the past 7 days. This sustained inclination of nett outflows suggests continued accumulation and reduced sell-side pressure, some beardown signals for semipermanent bullish momentum.

With terms enactment heating up and capitalist sentiment shifting, Ethereum could beryllium preparing for a large breakout. If bulls support control, the $3,000–$3,100 portion whitethorn beryllium tested successful the coming days arsenic the adjacent large absorption zone. All eyes are present connected ETH arsenic the altcoin marketplace shows signs of life.

Ethereum Builds Momentum As Exchange Outflows Signal Accumulation

Ethereum is trading supra captious levels arsenic speculation of a sustained rally continues to grow. After weeks of sluggish movement, ETH has roared backmost to life, gaining implicit 50% successful worth since past week. This crisp determination to the upside has reignited hopes for an altseason, with galore analysts viewing Ethereum’s breakout arsenic the imaginable trigger for broader altcoin marketplace strength.

Ethereum is present holding firmly supra the $2,600 mark, a level that had acted arsenic beardown absorption for months. This breakout, coupled with expanding momentum against Bitcoin, suggests bulls are regaining control. Traders are intimately watching the adjacent large absorption portion betwixt $2,900 and $3,100, which could service arsenic a cardinal trial for Ethereum’s uptrend.

Adding to the bullish case, data from Sentora reveals that $1.2 cardinal worthy of ETH has been withdrawn from centralized exchanges implicit the past 7 days. This inclination has intensified since aboriginal May, pointing to accrued capitalist accumulation and reduced sell-side pressure. Large speech outflows are often seen arsenic a motion that holders mean to store ETH off-exchange, decreasing contiguous proviso and supporting upward terms movement.

$1.2B Ethereum withdrawn from centralized exchanges successful the past 7 days | Source: Sentora connected X

$1.2B Ethereum withdrawn from centralized exchanges successful the past 7 days | Source: Sentora connected XWith marketplace sentiment turning bullish and Ethereum starring the charge, each eyes are present connected whether ETH tin support its momentum and thrust the altcoin marketplace into a caller maturation phase. If accumulation trends persist and bulls clasp cardinal levels, Ethereum’s way toward $3,100 could unfastened the doorway to a broader marketplace rally.

Price Action Details: ETH Testing Key Levels

Ethereum’s play illustration shows a almighty breakout aft weeks of bearish pressure, with ETH present trading astir $2,599.14. The caller surge pushed the terms supra some the 200-week EMA ($2,259.65) and the 200-week SMA ($2,451.55), 2 captious semipermanent inclination indicators. Reclaiming these levels signals renewed bullish momentum and a beardown displacement successful sentiment.

ETH starts betterment rally | Source: ETHUSDT illustration connected TradingView

ETH starts betterment rally | Source: ETHUSDT illustration connected TradingViewThe breakout candle itself is 1 of the largest play greenish candles successful implicit a year, reflecting a crisp influx of purchaser involvement and perchance marking a cardinal reversal constituent aft months of downside. Notably, this determination brings ETH to levels not seen since February, with the section precocious for the week reaching $2,739.05.

Volume has accrued importantly during this move, confirming the spot down the rally. However, Ethereum present faces overhead absorption adjacent $2,800–$2,900, a portion that antecedently acted arsenic enactment during aboriginal 2024 earlier the breakdown. If bulls support momentum and adjacent this week supra $2,600, it could unfastened the doorway for a trial of the $3,100 absorption zone.

On the downside, the cardinal enactment to ticker is astir $2,450, aligned with the 200-week SMA. A nonaccomplishment to clasp that level could invitation a retest of $2,250. For now, the inclination is bullish, but follow-through adjacent week volition beryllium crucial.

Featured representation from Dall-E, illustration from TradingView

8 months ago

8 months ago

English (US)

English (US)