Ethereum is showing signs of weakness arsenic it struggles to reclaim higher terms levels amid sustained selling unit and broader marketplace uncertainty. After respective failed attempts to interruption supra cardinal absorption adjacent $3,600, the plus remains range-bound, reflecting the cautious sentiment crossed the crypto market. Despite this, respective analysts judge the existent signifier could correspond the last shakeout earlier Ethereum begins its adjacent large rally.

According to caller on-chain data, ample holders — including organization players and crypto whales — proceed to accumulate ETH adjacent arsenic volatility persists. This dependable inflow from large buyers suggests increasing assurance successful Ethereum’s semipermanent potential, peculiarly arsenic web fundamentals stay beardown and liquidity conditions statesman to stabilize.

The divergence betwixt terms weakness and whale accumulation highlights a recurring signifier seen successful erstwhile cycles, wherever accumulation intensifies adjacent section lows earlier a important recovery. While short-term traders stay defensive, semipermanent investors look to beryllium positioning up of a imaginable breakout erstwhile macro conditions improve.

Whale Activity Signals Renewed Ethereum Accumulation Ahead of Potential Rally

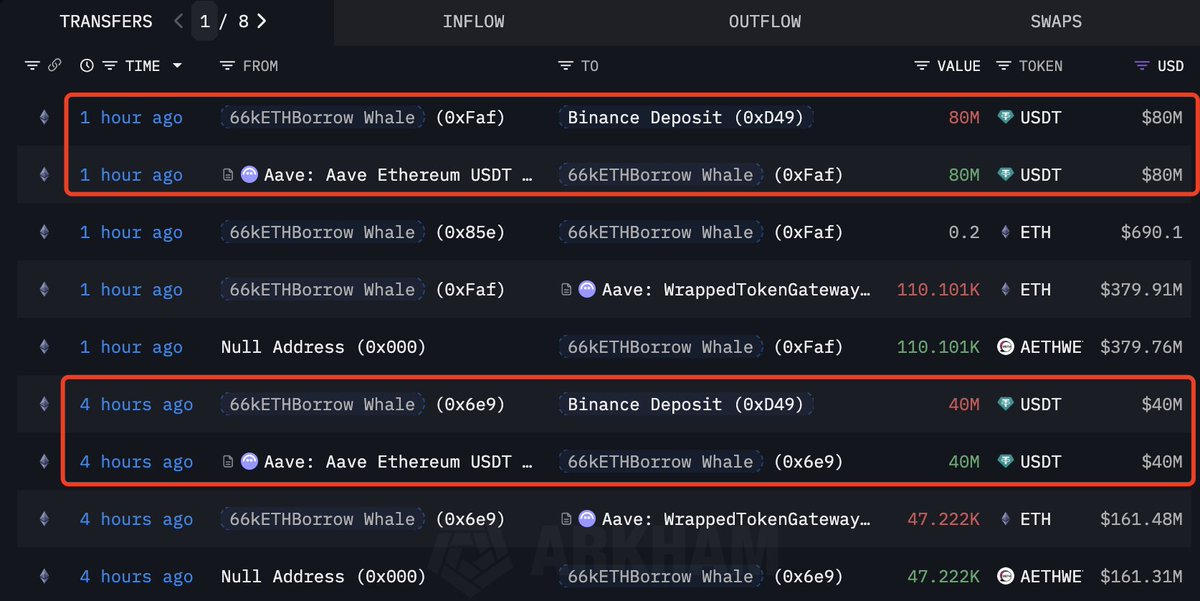

According to on-chain data, the well-known Ethereum whale “66kETHBorrow” — already 1 of the astir progressive ample buyers successful caller weeks — has made different large move. After purchasing 385,718 ETH worthy astir $1.33 cardinal since aboriginal November, this whale has present borrowed an further $120 cardinal USDT from Aave and transferred it to Binance, a determination wide interpreted arsenic mentation for further accumulation.

Ethereum Whale Transfers | Source: Lookonchain

Ethereum Whale Transfers | Source: LookonchainSuch behaviour from a high-capital marketplace subordinate often signals renewed assurance successful Ethereum’s medium-term outlook. By leveraging borrowed funds, the whale is expanding exposure, suggesting expectations of a important terms rebound. This benignant of leveraged accumulation tin make upward unit connected the market, particularly erstwhile liquidity is bladed and sellers are exhausted.

However, this strategy besides carries risks. If Ethereum fails to prolong its existent enactment adjacent $3,400–$3,500, the whale could look mounting liquidation unit — amplifying volatility crossed the broader market. Still, the standard and persistence of these purchases bespeak that astute wealth continues to bargain the dip, positioning up of what could beryllium a large betterment phase.

Ethereum Consolidates Above arsenic Bulls Attempt to Regain Control

The regular Ethereum illustration shows a wide consolidation signifier forming supra the $3,450–$3,500 zone, signaling an ongoing conflict betwixt bulls and bears. After weeks of selling pressure, ETH is attempting to stabilize, uncovering enactment astatine the 200-day moving mean (red line), which continues to enactment arsenic a captious semipermanent defence level.

ETH investigating cardinal enactment | Source: ETHUSDT illustration connected TradingView

ETH investigating cardinal enactment | Source: ETHUSDT illustration connected TradingViewDespite failing to reclaim the 50-day moving mean (blue line), presently adjacent $3,700, the operation suggests that downside momentum is weakening. Recent candles amusement tighter ranges and declining volume, often a motion of equilibrium earlier a imaginable breakout. For Ethereum to corroborate a displacement successful trend, bulls request a decisive adjacent supra $3,650, which would unfastened the doorway toward $3,900–$4,000, wherever the adjacent cardinal absorption clump sits.

On the downside, if ETH loses the $3,400 enactment zone, the adjacent large country of involvement lies astir $3,100, aligning with erstwhile absorption lows and the intelligence obstruction wherever buyers person historically stepped in.

Featured representation from ChatGPT, illustration from TradingView.com

3 months ago

3 months ago

English (US)

English (US)