- Ethereum could find a level astatine $1,900

- ETH’s $3,000 enactment seemed beardown earlier this year, but has since been lost

- Ethereum underwent a decease transverse successful precocious January and could beryllium gearing up for much losses amidst planetary geopolitical tensions betwixt Ukraine and Russia

- $2,150 could clasp for Ethereum forming a treble bottom

The 2nd astir invaluable integer plus according to marketplace capitalization, Ethereum (ETH), could bottommost astatine the $1,900 terms area. This estimation was provided by Crypto expert Timothy Peterson of Cane Island Alternative Advisors, who besides explained that Ethereum has an 84% accidental of being valued beneath $3,000 immoderate clip betwixt February 28th and December 31st, 2022.

Ethereum Could Increase by 2x After $1,900

Mr. Peterson shared his investigation via the pursuing Tweet which besides pointed retired that Ethereum could summation by a origin of two, 12 months, oregon more, aft hitting the imaginable bottommost of $1,900.

I decidedly blew it connected this one. After further probe I re-calibrated and present it's 84% accidental of beneath 3k astatine immoderate clip betwixt Feb 28 – Dec 31.

Plus side: $1900 looks similar a floor. Then 2x from determination successful < 12 mos. https://t.co/atRI4mlnKq

— Timothy Peterson (@nsquaredcrypto) February 20, 2022

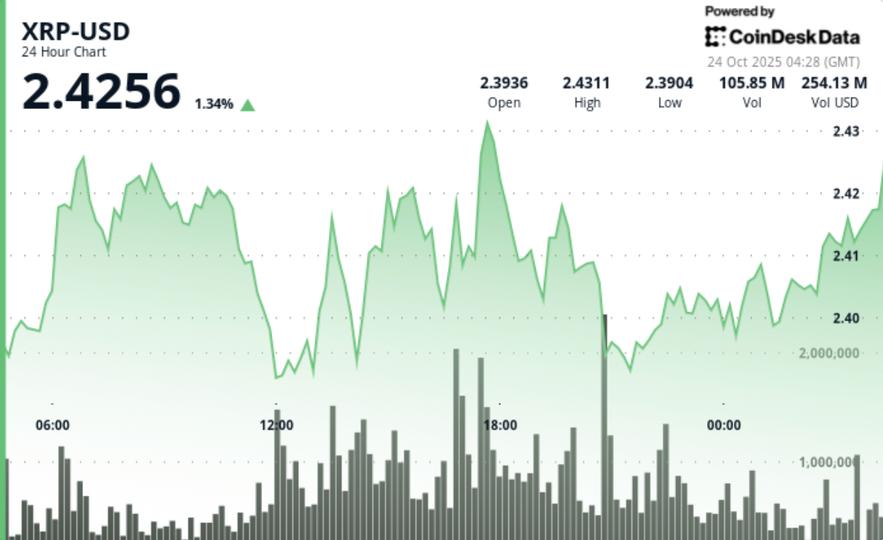

What the Ethereum Daily Chart Says

A speedy glimpse astatine the regular ETH/USDT illustration reveals that Ethereum is precise overmuch successful carnivore territory aft experiencing a decease transverse successful the dwifinal days of January arsenic seen successful the pursuing chart.

ETH/USDT connected the regular chart

ETH/USDT connected the regular chartAlso from the chart, it tin beryllium observed that Ethereum (ETH) is trading beneath the 200-day moving mean (green), frankincense confirming the bearish scenario. Additionally, the histograms connected Ethereum’s regular MACD bespeak continuous selling unit for the 4 days.

In presumption of resistances, the erstwhile formidable $3,000 enactment is present Ethereum’s newest terms hurdle connected the upside, with January’s debased of $2,150 offering enactment moving forward.

Russia/Ukraine Standoff Continues to Negatively Affect the Crypto Markets

However, the regular MFI and RSI are successful oversold territory and could foreshadow a imaginable bounce for Ethereum arsenic the satellite digests quality of President Putin ordering troops into ‘separatist-held’ Eastern Ukraine.

The determination by President Putin comes aft helium signed decrees formally recognizing the independency of the Donetsk People’s Republic and Lugansk People’s Republic, from Ukraine.

Consequently, Bitcoin, Ethereum, and the full crypto markets person been negatively affected by the geopolitical tensions brought astir by Russian troops entering the caller republics, arsenic NATO and the United States reason the move.

3 years ago

3 years ago

English (US)

English (US)