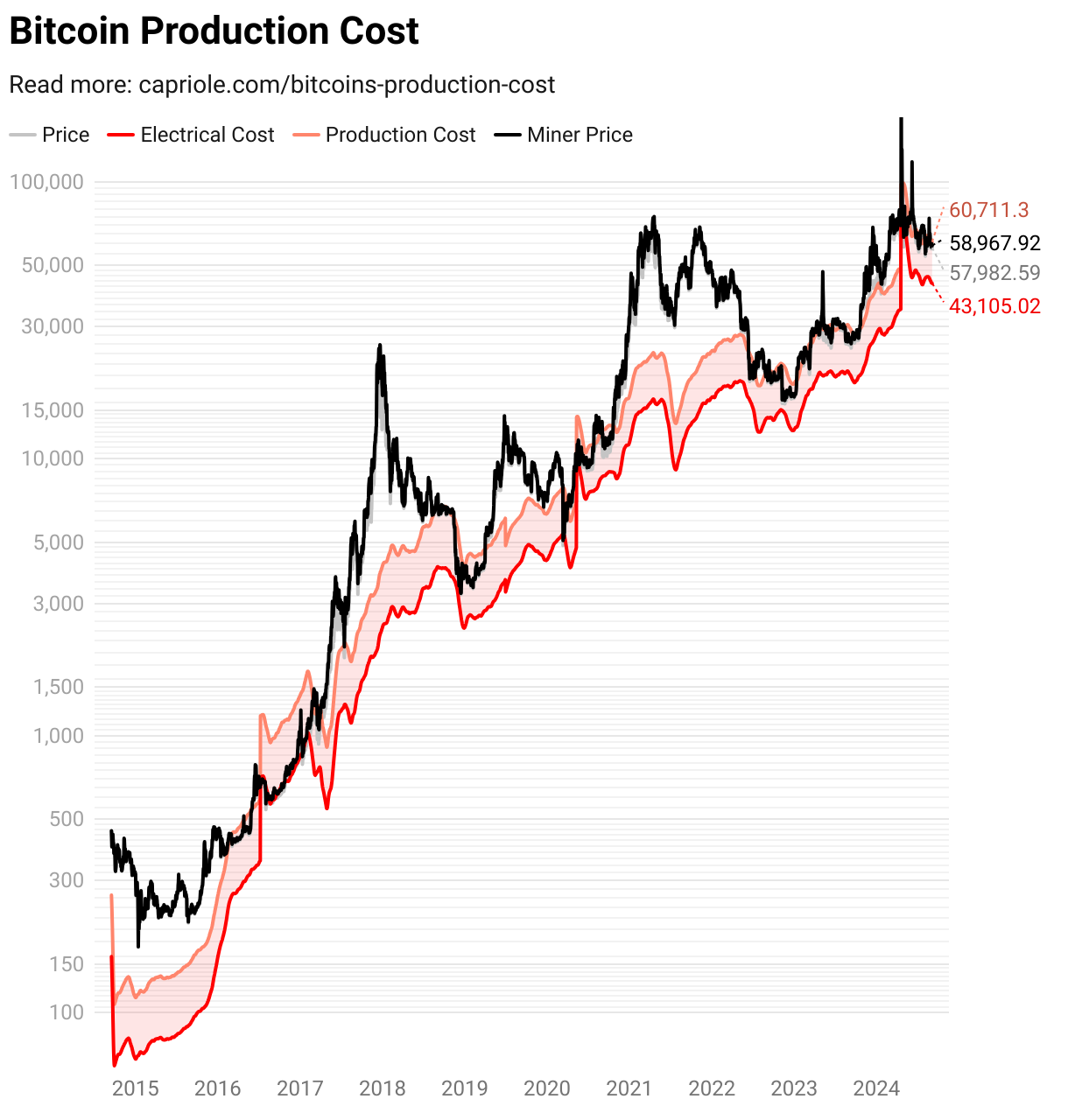

Crypto expert Astronomer, known by the grip @astronomer_zero connected X, has enactment distant a perchance compelling bottommost awesome for Bitcoin, which hinges connected the energy costs incurred by miners to nutrient BTC. According to him, this peculiar metric has historically served arsenic a reliable indicator for identifying optimal buying opportunities wrong Bitcoin’s terms cycles.

Is The Bitcoin Bottom In?

The analysis titled “BTC Miners energy cost, a 100% close bottommost signal,” leverages information to exemplify a script wherever the outgo of Bitcoin accumulation dips beneath its marketplace price, suggesting a pivotal infinitesimal for imaginable investors. Astronomer elaborated connected his methodology and findings by referencing his erstwhile predictions which successfully pinpointed marketplace tops, notably a 30% driblet from a $70,000 peak, which was guided by likewise data-driven signals.

Astronomer’s existent absorption connected the outgo of mining stems from its important implications connected Bitcoin’s proviso dynamics. Despite the halving events designed to trim the reward for mining Bitcoin, determination remains a 0.84% yearly ostentation successful its supply, equating to astir $10 cardinal worthy of Bitcoin entering the marketplace each year. This is equivalent to the full holdings of important firm investors similar MicroStrategy, indicating a important influx of Bitcoin from miners, who are inclined to merchantability gradually to prolong their operations.

However, the existent marketplace conditions, arsenic described by Astronomer, person reached a uncommon authorities wherever the marketplace terms of Bitcoin has fallen beneath the mean weighted outgo of energy required to excavation it. This concern typically constrains miners from selling their holdings astatine a profit, frankincense perchance reducing the sell pressure connected the market.

“Not lone does that mean that the miners can’t merchantability their BTC for a profit. It besides means that it is simply cheaper to conscionable log into a CEX and bargain 1 Bitcoin, alternatively of going done the symptom of mining 1 Bitcoin. So not lone does this marque the miners (the radical controlling BTC) not privation to sell, it besides makes them privation to buy, due to the fact that it is cheaper to conscionable bargain alternatively of excavation them,” Astronomer suggests.

This displacement not lone impacts the selling behaviour of miners but besides their buying strategies, contributing to a alteration successful proviso unit and perchance triggering upward terms movements. Astronomer supports his assertion by pointing retired that historically, erstwhile the outgo of accumulation fell beneath the marketplace price, it has consistently led to important terms recoveries.

He elaborate instances from the caller past, including notable dips successful March 2023 erstwhile Bitcoin deed $19,500, November 2022 astatine $16,500, June 2022 astatine $18,000, May 2020 astatine $8,900, March 2020 astatine $4,700, and November 2018 erstwhile it bottomed retired astatine $3,500. Each of these moments was followed by robust bull runs, underlining the imaginable reliability of this signal.

“How galore times? 17 retired of 17 times, it meant that terms was astatine levels that, according to past (with precocious statistical significance), you would privation to buy, oregon would miss and regret it for a precise agelong time,” the expert adds.

Currently, with the accumulation outgo of Bitcoin, according to Capriole Investment’s data, lasting astatine $60,711 and the terms lingering astatine $56,713, the conditions described by Astronomer are manifesting yet again. This juxtaposition poses a captious question to the market: Is present the clip to buy?

Bitcoin Production Cost | Source: Capriole

Bitcoin Production Cost | Source: CaprioleWhile Astronomer’s investigation is backed by humanities information and elaborate marketplace observation, helium remains cautiously optimistic astir the outcomes, encapsulated successful his closing remark, “Will this clip beryllium different? Maybe.”

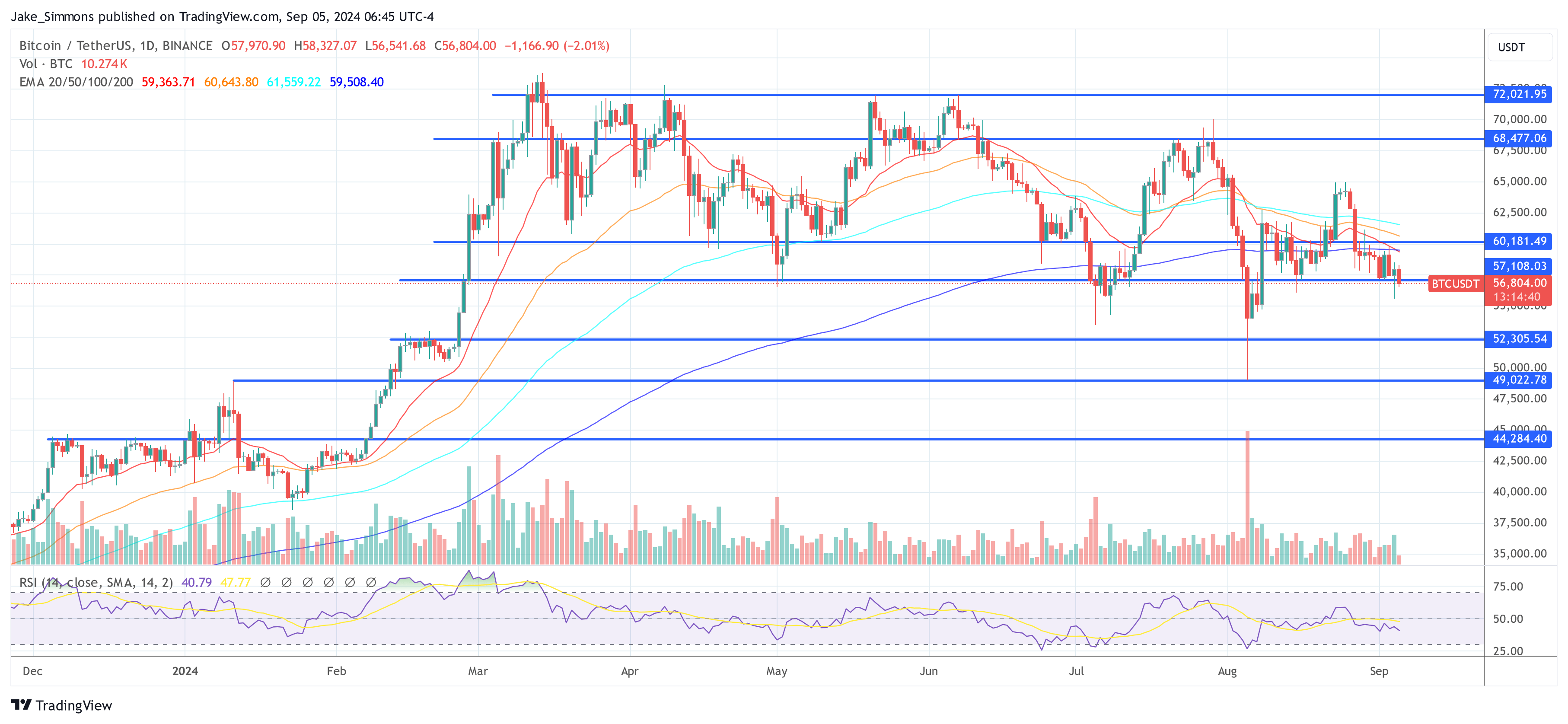

At property time, BTC traded astatine $56,804.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

![Why Crypto Market Is Crshing Today [Dec 16, 2025] | Live Updates](https://image.coinpedia.org/wp-content/uploads/2025/11/21175056/Crypto-Market-Crash-Shows-Signs-of-More-Declines-Ahead-1024x536.webp)

English (US)

English (US)