A clump of long-idle Bitcoin moved backmost into circulation Wednesday, raising caller questions astir selling unit arsenic prices descent from caller highs.

Sleeping Coins Stir After Years

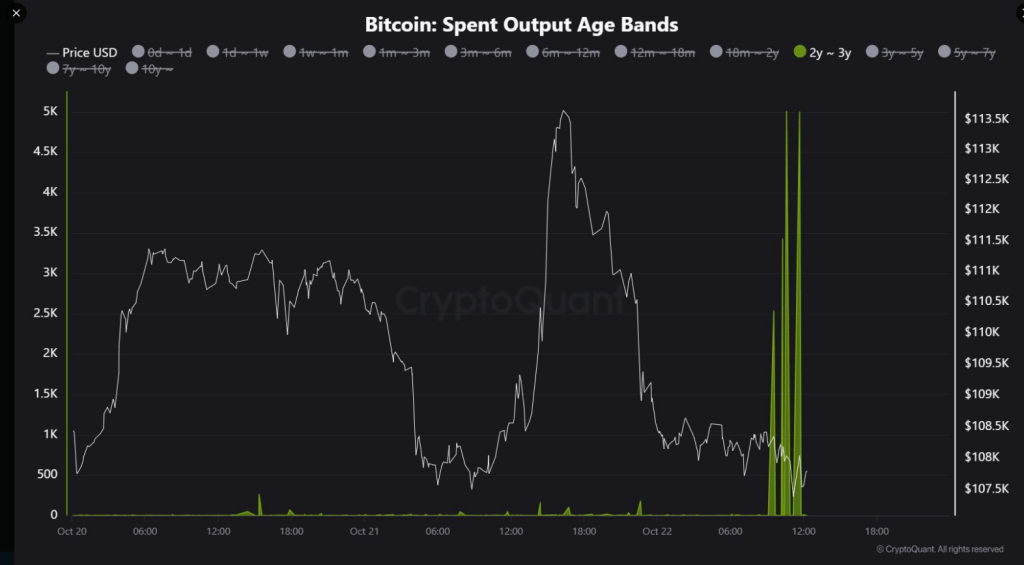

According to CryptoQuant expert JA Maartun, precisely 15,965 BTC that had been idle for astir 3 years were shifted earlier successful the day. The coins moved portion Bitcoin traded beneath $110,000, and astatine astir $108,000 a coin the batch is worthy astir $1.724 billion.

CryptoQuant’s on-chain records amusement these addresses had small to nary enactment since precocious 2022 and aboriginal 2023, and the funds were sent to undisclosed destinations.

Market watchers flagged the timing. Old coins waking up during a pullback tin awesome profit-taking, oregon simply interior reshuffles betwixt backstage accounts and trading venues.

Reports person disclosed that specified moves sometimes bespeak taxation planning, speech custody changes, oregon ample holders adjusting positions — but the nonstop motive present is not public.

15,965 BTC aged 2–3 years conscionable moved on-chain ⏱️

This cohort has been dormant since precocious 2022–2023—until now. pic.twitter.com/vw2z0fjHvv

— Maartunn (@JA_Maartun) October 22, 2025

New Whales Underwater

Data from marketplace trackers constituent to unit connected newer ample holders who bought adjacent caller highs. Those alleged caller whales transportation an mean outgo of $113,000 per BTC, leaving galore positions underwater portion prices commercialized beneath that level. The unrealized losses tied to these wallets are approaching $7 billion, according to the aforesaid datasets.

At the aforesaid time, accumulation by different large wallets continues. Analysts reported that astir 26,500 BTC person flowed into accumulation addresses successful caller days, a motion that immoderate ample players are adding softly during the dip.

This premix of selling and buying creates a tug-of-war successful terms action. Short-term dynamics are fragile. Support astir $107,000–$108,000 is 1 level traders are watching closely. If that portion holds, a bounce is possible; if it fails, further downside toward $100,000 could follow.

Price Targets Spark Debate

The large movements person intensified statement implicit however precocious Bitcoin mightiness spell next. According to nationalist comments, the CEO of Galaxy Digital said reaching $250,000 by year-end would necessitate “a heck of a batch of crazy stuff.”

Other marketplace figures support much bullish targets successful play: Fundstrat’s Tom Lee and BitMEX’s Arthur Hayes person each voiced condemnation successful $200,000–$250,000 outcomes, pointing to imaginable argumentation moves and inflows arsenic drivers.

Institutional numbers are portion of the backdrop. Galaxy Digital reported a grounds 4th with $29 cardinal successful revenue, a fig that supporters mention arsenic grounds of increasing organization engagement successful the market. That maturation is portion of wherefore immoderate investors stay assured adjacent arsenic short-term charts wobble.

Open Interest Falls, Risk Eases

Meanwhile, on-chain analytics supplier Glassnode shows unfastened involvement has dropped by astir 30%, reducing immoderate of the excess speculative unit that tin amplify moves.

Lower unfastened involvement often cools convulsive swings and makes terms trends easier to read, astatine slightest until caller catalysts arrive.

Featured representation from Pexels, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)