While the full worth locked (TVL) successful decentralized concern (defi) hovers conscionable supra the $214 cardinal mark, a defi protocol called Lido has been moving person toward taking Curve’s apical spot successful presumption of TVL successful a defi protocol. Currently, the liquid staking solution Lido has $19.2 cardinal successful staking assets derived from 5 antithetic blockchain networks including Ethereum, Solana, Terra, Polygon, and Kusama.

Lido’s Staked Assets Represent Close to 9% of the $214 Billion Locked successful Defi

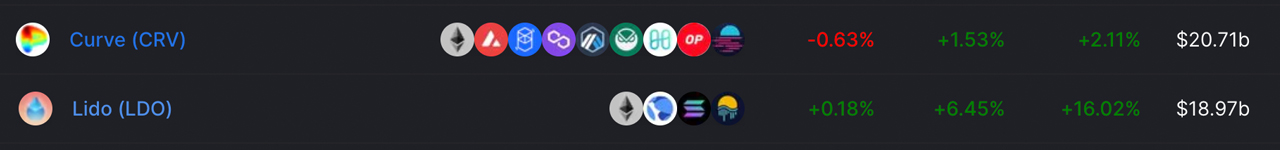

According to defillama.com, there’s $214 cardinal full worth locked successful decentralized concern astatine the clip of writing. Presently, the largest defi protocol successful presumption of TVL size is Curve Finance, the decentralized speech (dex) platform. Today, Curve dominates the battalion with $20.71 cardinal and a dominance standing of astir 9.67%, according to defillama.com statistic connected April 20, 2022.

Defillama.com statistic recorded connected April 20, 2022.

Defillama.com statistic recorded connected April 20, 2022.As acold arsenic TVL successful defi protocols is concerned, Curve has led the battalion for weeks connected end, but the liquid staking solution Lido whitethorn instrumentality the reins soon. Lido’s TVL, astatine slightest according to today’s defillama.com metrics, is $18.97 billion, up 16.02% implicit the past 30 days. Lido has seen important usage due to the fact that the defi protocol allows Ethereum, Solana, Terra, Polygon, and Kusama users to usage their staked assets to summation output connected apical of yield.

Defillama.com statistic recorded connected April 20, 2022.

Defillama.com statistic recorded connected April 20, 2022.So if a idiosyncratic decided to enslaved Terra’s LUNA into the token called BLUNA, they would speech LUNA for BLUNA to commencement getting staking rewards. Meanwhile, successful summation to the enslaved stake, BLUNA tokens tin besides beryllium utilized successful pools, to gain adjacent much rewards from the bonded tokens. The aforesaid tin beryllium said astir different networks similar Ethereum, arsenic Lido’s staked ether (STETH) commands the 18th largest marketplace capitalization retired of 13,671 cryptocurrencies. Lido staked solana (STSOL) is the 193rd largest marketplace cap, and BLUNA is the 22nd largest connected Wednesday.

Lido Finance statistic recorded connected April 20, 2022.

Lido Finance statistic recorded connected April 20, 2022.While defillama.com notes that Lido’s TVL is $18.97 billion, it lone accounts for 4 of the blockchains that Lido uses for staking. Polygon is missing from defillama.com’s metrics, and according to Lido’s stats connected April 20, 2022, there’s $19,220,700,179 staked among 99,606 stakers. Lido stats amusement $10.6 cardinal from Ethereum, $8.21 cardinal from Terra, $363 cardinal from Solana, $3.3 cardinal from Kusama, and $13.8 cardinal stemming from the Polygon network.

3.9%, 23.9% APY Depending connected Chain Rewards and Skipping Validator Lock-Ups

According to existent staking estimates, Lido’s Ethereum staking solution is the lowest with a 3.9% yearly percent output (APY), portion Kusama’s is the highest astatine 23.9% APY. While Lido is touted for its quality to treble involvement assets, determination are immoderate defi liquidity excavation providers that instrumentality the reward from Lido staking services, and Lido warns users this tin beryllium the case.

One peculiar payment of Lido is radical tin skip utilizing a validator lock-up play (although determination is an unbonding period) due to the fact that they tin merchantability their bonded tokens connected the unfastened market. Choosing this route, however, the idiosyncratic volition suffer the interest associated with the dex swap and astir 1-2% successful worth depending connected the bonded token.

Lido Finance is considered a “staking company,” and determination are a fig of staking companies successful the industry. Today, determination are staking companies specified arsenic Kyber Network, Celer Network, Blockdaemon, and more. Lido, however, has an tremendous magnitude of worth locked contiguous crossed 5 antithetic blockchains and successful caller times the full quantity of staked assets has swelled exponentially.

Tags successful this story

$19.2 billion, blockdaemon, BLUNA, Bonding, Celer Network, Curve.finance, decentralized finance, DeFi, dominance rating, ETH, Ethereum, Kusama, Kyber Network, Lido Finance, Lido Staking, liquidity excavation providers, Liquidity Pools, LP, LUNA, matic, Polygon, Solana, staking company, STLUNA, STSOL, Terra, unbonding

What bash you deliberation astir the liquid staking solution Lido? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)