Bitcoin whitethorn inactive beryllium connected way to scope $200,000 by the extremity of the year, adjacent aft a grounds $19 cardinal marketplace liquidation and renewed tariff threats from US President Donald Trump, according to Standard Chartered’s planetary caput of integer assets research, Geoff Kendrick.

The crypto marketplace experienced a grounds $19 cardinal liquidation event connected the play of Oct. 10, which caused Bitcoin’s (BTC) terms to dip to a four-month low of $104,000 by Friday, Cointelegraph reported astatine the time.

As the particulate settles aft the monolithic liquidation event, investors whitethorn spot this arsenic different buying opportunity. This dynamic whitethorn substance a Bitcoin rally to $200,000 by the extremity of 2025, said Kendrick. Despite the volatility, helium remains assured that Bitcoin volition rebound arsenic markets stabilize.

“My authoritative forecast is $200,000 by the extremity of the year,” helium told Cointelegraph during an exclusive interrogation astatine the 2025 European Blockchain Convention successful Barcelona.

Despite the “Trump sound astir tariffs,” Kendrick said helium inactive sees a terms emergence “well northbound of $150,000” successful the carnivore lawsuit for the extremity of the year, assuming the US Federal Reserve continues cutting involvement rates to conscionable marketplace expectations.

Bitcoin fell 6% implicit the past period and traded astatine astir $108,260 astatine the clip of writing, Cointelegraph information shows.

Related: Bitcoin whale opens $235M BTC short, aft netting $200M from marketplace crash

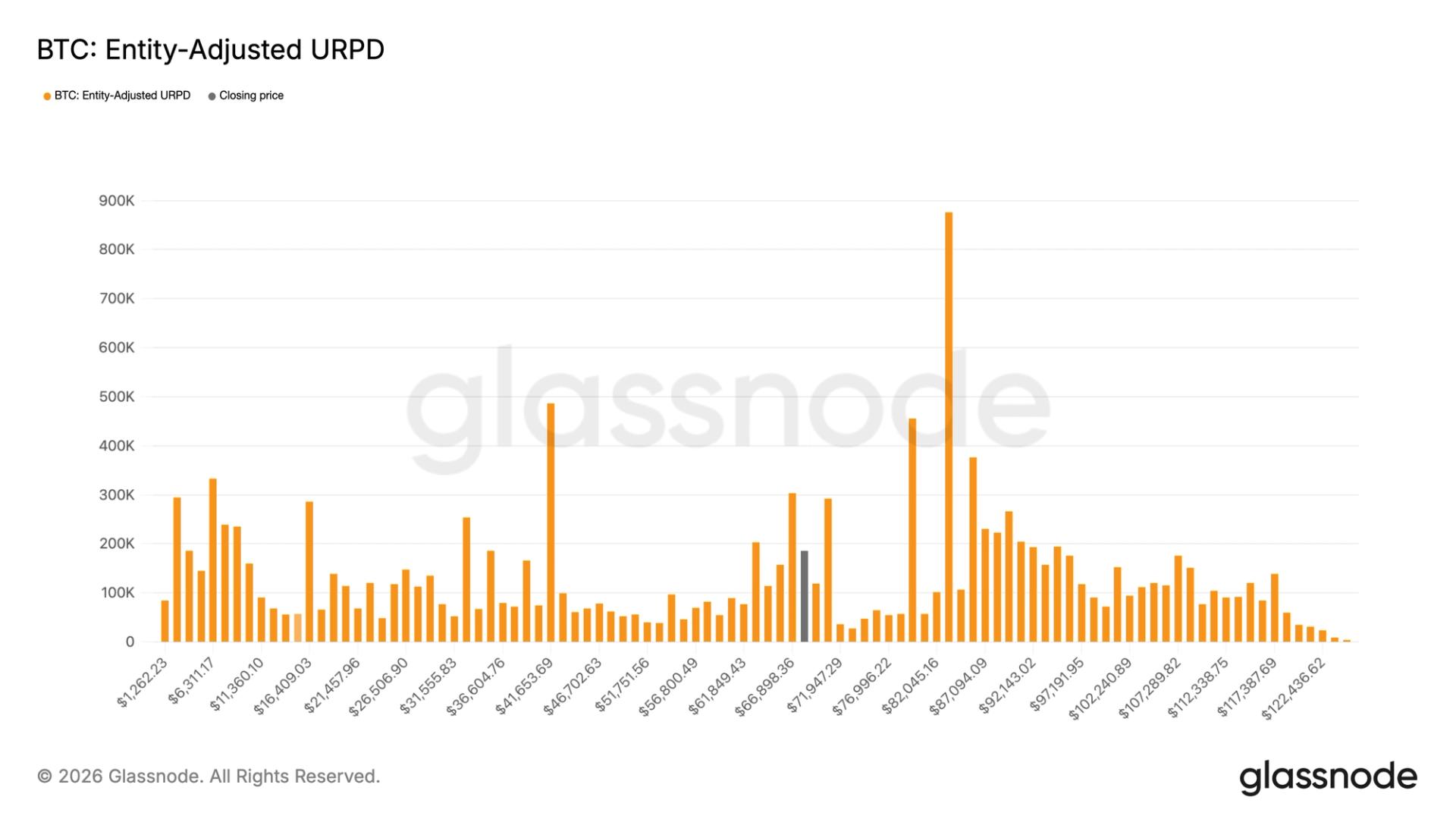

Kendrick said the aftermath of the liquidation lawsuit whitethorn instrumentality respective weeks to settle, but helium believes investors could soon presumption the caller sell-off arsenic different accumulation phase.

This could yet go the adjacent important “buying opportunity” for investors, helium said.

Related: SpaceX moves $257M successful Bitcoin, reignites questions implicit its crypto play

Bitcoin to rally connected the backmost of ETFs, golden price: Geoff Kendrick

Kendrick predicted continued inflows to Bitcoin exchange-traded funds (ETFs) arsenic the superior operator of Bitcoin’s terms momentum for the remainder of the year.

The existent dip volition acceptable america up for different limb up, “mostly connected the backmost of the ETF inflows,” Kendrick said, adding:

“There’s nary crushed for them to stop. The US authorities shutdown, Fed complaint cuts. All that communicative is playing retired already successful gold.”Gold’s caller all-time highs volition besides construe into much momentum for Bitcoin, arsenic its safe-haven plus communicative reemerges, helium added.

Bitcoin ETFs recorded a crisp rebound successful flows this week aft several days of political-driven outflows. On Tuesday, the funds saw $477 cardinal successful nett affirmative inflows, according to Farside Investors, breaking a four-day losing streak.

In a February interview, Kendrick predicted that Bitcoin could surge to $500,000 by the clip President Trump concludes his 2nd word successful 2028, Cointelegraph reported.

Magazine: Bitcoin to endure if it can’t drawback gold, XRP bulls backmost successful the fight: Trade Secrets

4 months ago

4 months ago

English (US)

English (US)