Summary:

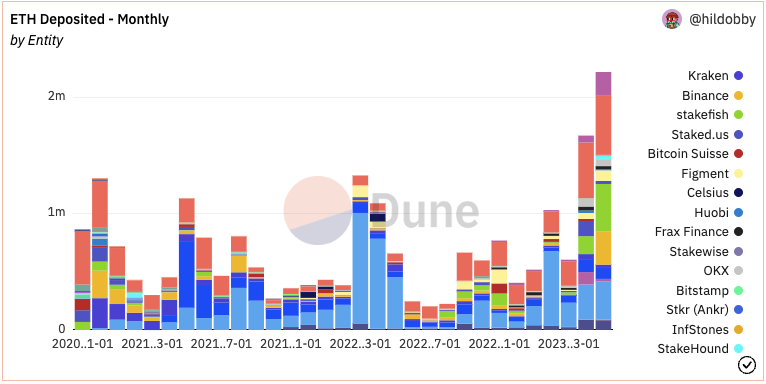

- Ethereum stakers person locked up implicit 2 cardinal tokens truthful acold successful May alone, mounting a caller all-time high.

- Dune analytics information showed that regular ETH withdrawals person besides slowed down aft Kraken’s monolithic unlocks.

- Nansen’s Martin Lee noted that staking deposits post-Shanghai bespeak beardown wide assurance successful some the blockchain and ETH arsenic an asset.

Over 2 cardinal Ether (ETH), the autochthonal plus connected the Ethereum blockchain, has been staked connected the network’s beacon concatenation truthful acold this May 2023.

This fig of tokens locked up this period signals a caller all-time precocious for staked ETH (stETH), per Dune analytics data.

The uptick successful depositors has continued since the Shapella upgrade enabled withdrawals. Despite fears that implicit 18 cardinal of unlocked would taxable ETH to important selling pressure, deposits person eclipsed withdrawals and rendered falling terms concerns a “non-event”.

Nansen information showed that the bulk of unstakers oregon withdrawals person been exchanges similar Kraken and not users. Notably, Kraken’s monolithic unlock was earmarked for interior operations astatine the crypto speech arsenic against speculations that the level planned to dump its staked holdings aft the unlock.

Monthly ETH Deposits by @Hildobby connected Dune Analytics

Monthly ETH Deposits by @Hildobby connected Dune AnalyticsInterest In ETH And LSDs Boomed After Shapella

Indeed, the inflow of tokens into the beacon concatenation and liquid staking services similar Lido Finance signals beardown wide confidence” successful some ETH and the Ethereum web by users.

Enabling withdrawals has besides lowered the risks associated with staking into liquid staking derivatives (LSDs), said Nansen information idiosyncratic Martin Lee.

With withdrawals enabled, there’s little likelihood of seeing de-pegs betwixt the liquid staking tokens and ETH itself since withdrawals tin beryllium facilitated by authoritative mechanisms alternatively of the psuedo mechanics introduced by swapping stETH with ETH successful Lido’s case.

Crypto users are besides incentivized to involvement their ETH arsenic opposed to holding the plus connected exchanges oregon self-custody devices similar hardware wallets since the erstwhile could make output and returns.

ETH/USDT by TradingView

ETH/USDT by TradingView

2 years ago

2 years ago

English (US)

English (US)