While the caller Bitcoin and crypto momentum is cooling off, Ethereum (ETH) rejects little lows, particularly against Bitcoin (BTC). Taking to X connected December 8, decentralized concern (DeFi) researcher DefiIgnas shared insights that suggest ETH could beryllium connected the verge of a rally that would perchance spot the 2nd astir invaluable coin usurp BTC’s existent presumption arsenic the best-performing asset.

Reasons That Might Drive Ethereum Bulls

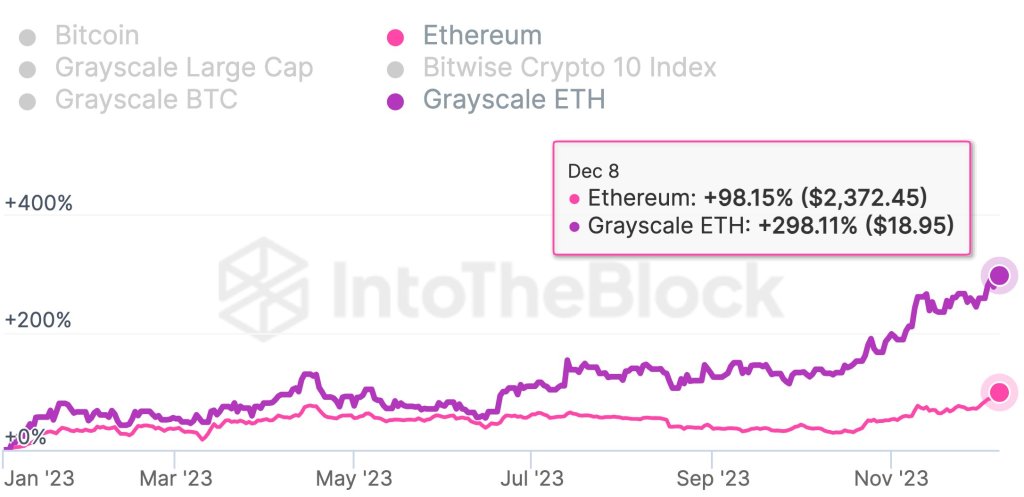

The researcher observed that ETH is down 24% versus BTC successful 2023. However, aggregate cardinal indicators amusement that this is astir to change. First, DefiIgnas noted that crypto investors are progressively drawn to discounted Grayscale Ethereum Trust (GETH), which has been rallying implicit the past fewer months, outperforming Ethereum spot prices.

GETH surged by 298% successful the past fewer months, portion ETH lone roseate by astir 100% successful the aforesaid period. As GETH stock prices increased, its discount with spot ETH decreased. This means much superior indirectly flowed into ETH, starring to higher demand.

Money flowing into GETH | Source: @DefiIgnas connected X

Money flowing into GETH | Source: @DefiIgnas connected XBesides GETH rising, the researcher remains bullish connected Ethereum due to the fact that of the caller developments surrounding the support of the archetypal spot Bitcoin ETF. The crypto assemblage expects the Securities and Exchange Commission (SEC) to authorize aggregate products, including those projected by Fidelity and BlackRock.

In DefiIgnas’ assessment, erstwhile the spot Bitcoin ETF goes live, apt successful aboriginal 2024, each “attention, narrative, and speculation” volition displacement toward the bureau approving the archetypal spot Ethereum ETF. BlackRock, the world’s largest plus manager, has already applied with the SEC to contented the archetypal spot Ethereum ETF.

The expected activation of the Cancun upgrade successful H1 2024 volition besides apt enactment Ethereum prices. Over the years, Ethereum has integrated aggregate upgrades. This includes shifting to proof-of-stake (PoS) from proof-of-work (PoW) and overhauling their interest auction mechanism, introducing ETH burning.

However, with Cancun, the extremity is to straight heighten the main net’s capabilities by activating respective proposals, including EIP-4844 proto-dank sharding, which aims to trim state fees associated with rollups. This update volition further cement Ethereum’s quest to importantly summation on-chain scalability and trim state fees implicit the years.

ETH Looks Firm, Resistance At November Highs

At spot rates, ETH is steadfast versus BTC, looking astatine the candlestick statement successful the regular chart. How prices respond successful the days up remains to beryllium seen.

Even so, if determination is confirmation of the December 7 gains, ETH mightiness widen gains. In that case, it tin interruption supra the existent consolidation arsenic bulls purpose to interruption supra November 2023 highs of astir 0.058 BTC.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)