It’s tempting to accidental 2021 was the twelvemonth bitcoin finally went mainstream and conscionable permission it astatine that. However, there’s different communicative that can’t beryllium understated: the spectacular emergence of altcoins oregon “alts” — that is, cryptocurrencies that are neither bitcoin nor ether — acknowledgment successful portion to the NFT boom.

As the CoinDesk 2021 Annual Crypto Review showed, Bitcoin’s twelvemonth played retired similar thing unimaginable adjacent 3 oregon 4 years ago: A sovereign federation (El Salvador) adopted it arsenic ineligible tender and determination was an upgrade to marque it much transaction-friendly. Bitcoin traded adjacent to $69,000 successful 2021, and its marketplace headdress broke supra $1 trillion astatine 1 point.

For reference, erstwhile CoinDesk began publishing successful 2013, the full worth of bitcoin was small much than $1 cardinal and each coin was trading astir $120 oregon so.

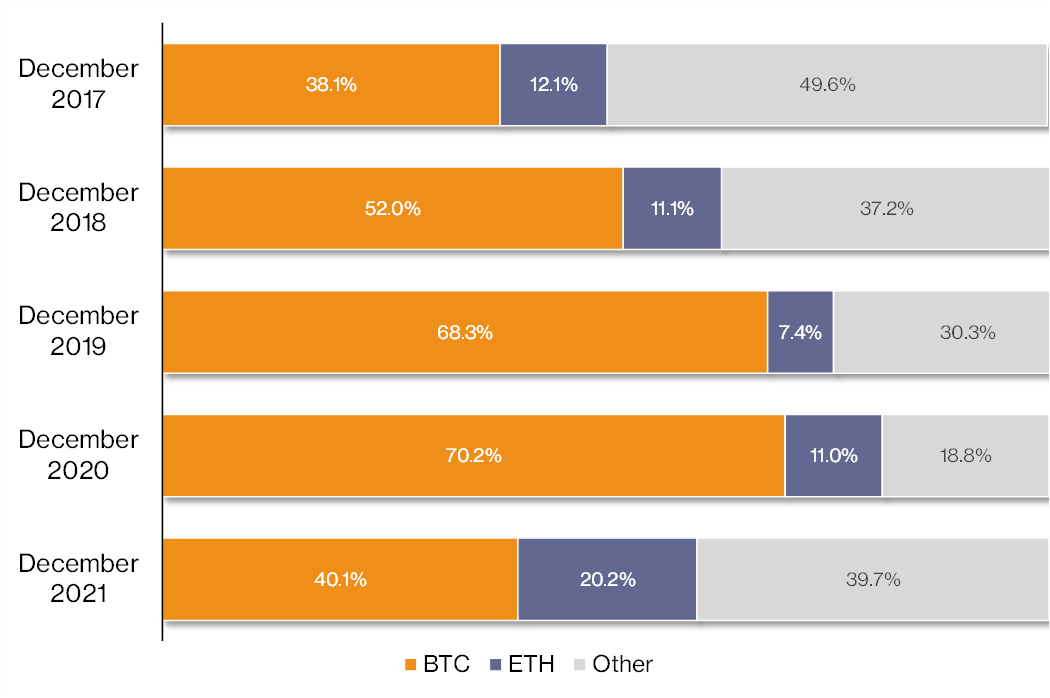

A notable diagnostic is the diminution of bitcoin dominance – meaning its stock of wide crypto marketplace headdress – past year, from 70.2% to 40.1%.

BTC Market Capitalization Dominance (Source: CoinMarketCap) (CoinMarketCap.)

But that doesn’t needfully mean bitcoin has mislaid its luster. It conscionable means there’s a batch much going connected successful crypto than conscionable bitcoin these days.

To beryllium sure, bitcoin added $330 cardinal successful worth successful 2021 to adjacent retired astatine $875.9 billion, according to information from CoinMarketCap.

On the different hand, ether returned 426% to investors successful 2021. Its year-end worth was $438 billion, meaning the marketplace fundamentally added adjacent much worth to ether – $355 cardinal – than it did to bitcoin.

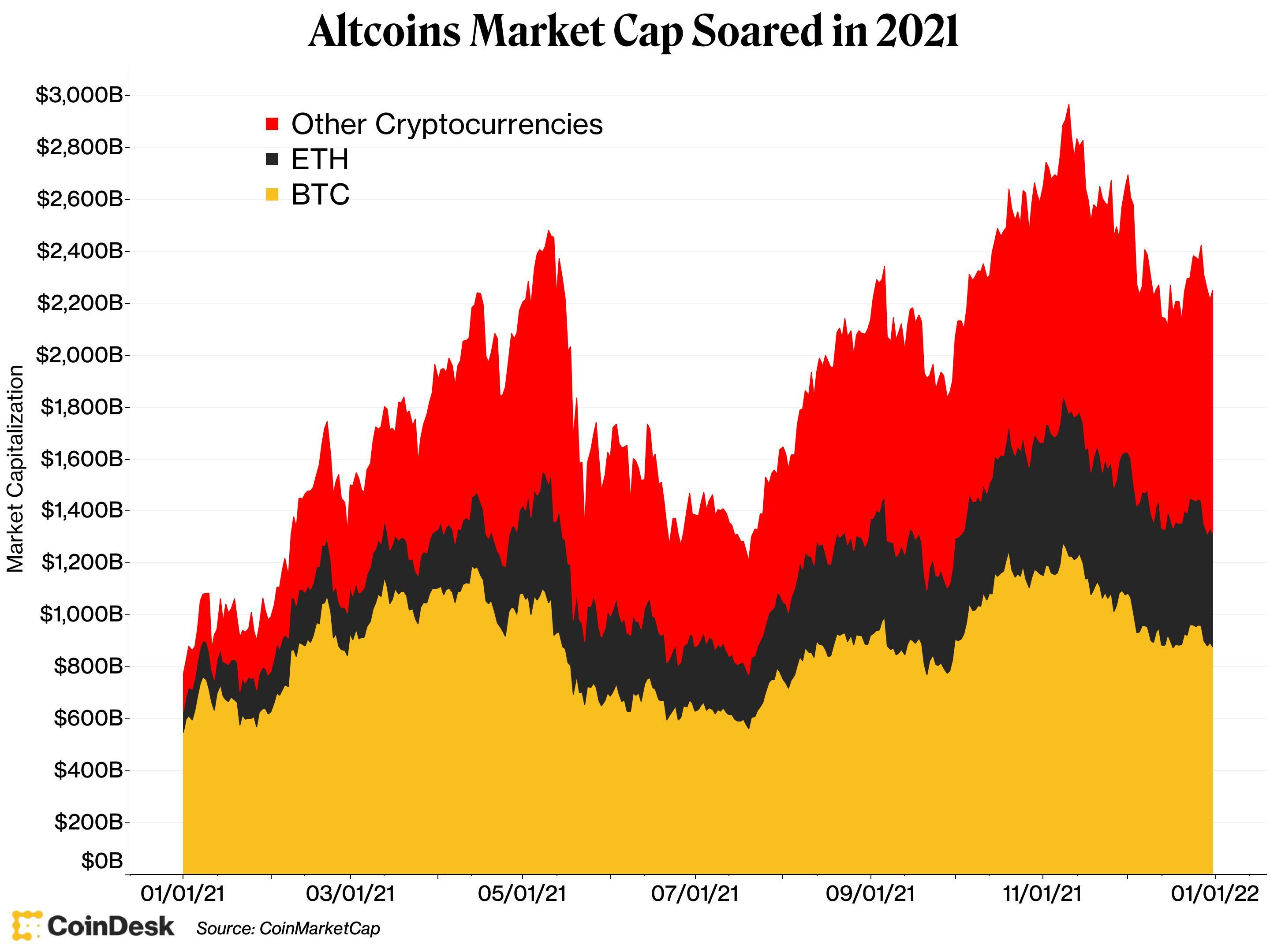

Yet the large marketplace worth gains past twelvemonth were successful the combined capitalizations of each the different cryptocurrencies retired determination – the altcoins. Taken together, these thousands of cryptocurrencies closed 2021 valued astatine $934 billion, oregon 39.7% of the full marketplace headdress of the full crypto complex. That year-end fig is simply a summation of $791 billion, oregon a 550% increase.

In different words, the marketplace has decided that it likes bitcoin much than it did a twelvemonth ago, but it really, truly likes ether and the alts.

Drilling down a small spot and 1 tin spot the underlying taxable of the alts was intelligibly the emergence of the Layer 1s, meaning the autochthonal tokens of smart contract platforms that vie with Ethereum.

BNB, the autochthonal token of Binance Smart Chain, went from $5 cardinal to $85 billion, Solana’s SOL exploded from $85 cardinal to $55 billion, and Cardano’s ADA took disconnected from $5.5 cardinal to $46 cardinal (though it was astatine $95 cardinal implicit the summer). To beryllium sure, a melodramatic emergence was to beryllium recovered successful Layer 2 protocols, too. Polygon, a supplemental web to Ethereum, saw its autochthonal token MATIC emergence successful worth from conscionable $91 cardinal astatine the commencement of 2021 to $18 cardinal astatine twelvemonth end.

Driving it each to a large grade is the exorbitant state fees – the outgo to behaviour transactions connected the blockchain – recovered successful the Ethereum blockchain, according to George Kaloudis, probe expert astatine CoinDesk. He sees the imaginable to standard arsenic the crushed wherefore Solana and Polygon successful particular, gained truthful overmuch past year.

“Gas fees were truthful precocious that it was hard to transportation retired transactions connected Ethereum. So, radical started looking for cheaper alternatives,” which they recovered connected Polygon and Solana, Kaloudis said connected Thursday’s “First Mover” programme connected CoinDesk TV.

The request for gas, successful turn, came astir due to the fact that of the surge successful involvement successful non-fungible tokens, limited-edition integer collectibles sold by artists and celebrities.

“A batch of the caller usage cases that are coming up are caller Layer 1 astute declaration platforms. They’re trying to standard these Layer 1s and marque them cheaper and marque them much affordable, marque them much accessible. And really, that’s powering the NFT roar that we’ve seen the past year,” said Kaloudis. “A batch of radical heard astir Ethereum due to the fact that of NFTs, not the different mode around.”

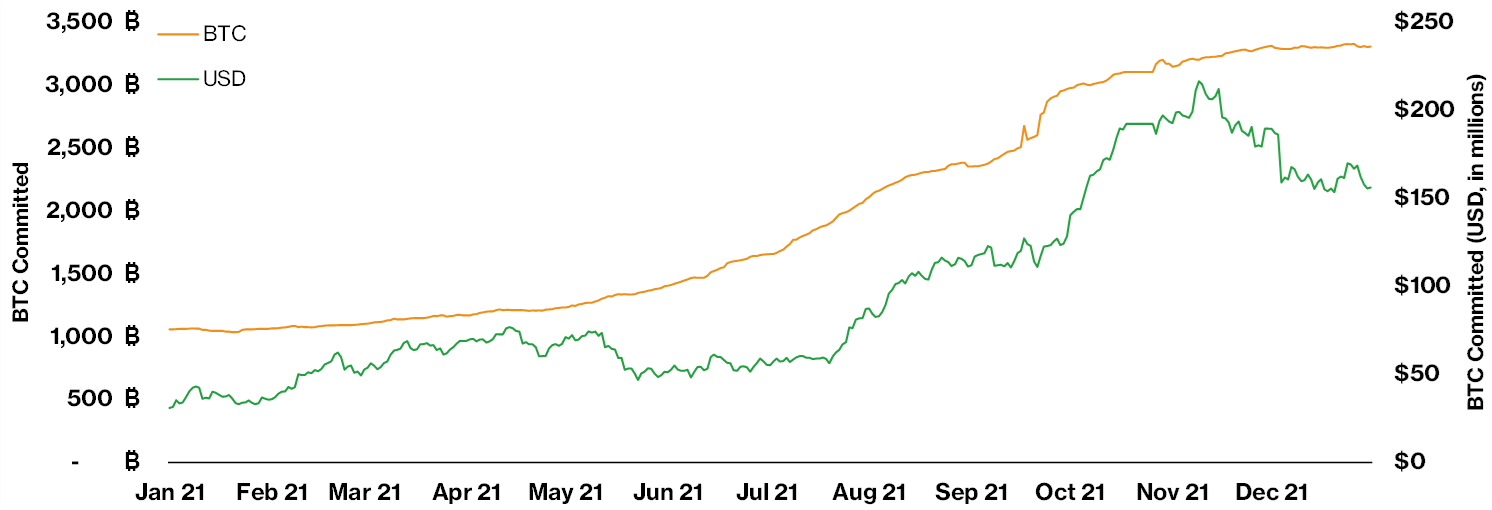

Still, Kaloudis is astir excited by the emergence of the Lightning Network supplementing the Bitcoin blockchain. It allows for cheaper transactions utilizing Bitcoin, which could yet marque the currency much agreeable arsenic a means of transaction. “That’s my favourite usage lawsuit of the year,” helium said.

Lightning Network Capacity (Source: https://bitcoinvisuals.com/ln-capacity)

The Lightning Network has grown to 3,300 BTC committed to it – treble from June 2020 – acknowledgment successful portion to El Salvador’s usage of bitcoin arsenic ineligible tender.

It remains to beryllium seen if that volition sway attraction from the contention betwixt Ethereum and different furniture 1s erstwhile it comes to transactions.

Nonetheless, it makes for an amusing question – what if bitcoin becomes the altcoin of 2022?

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)