Arcane Research’s 2022 year-end study cited that 2022 was the second-worst-performing twelvemonth for Bitcoin (BTC), arsenic the starring crypto saw a 65% alteration passim the year, lone beaten by the 73% descend recorded successful 2018.

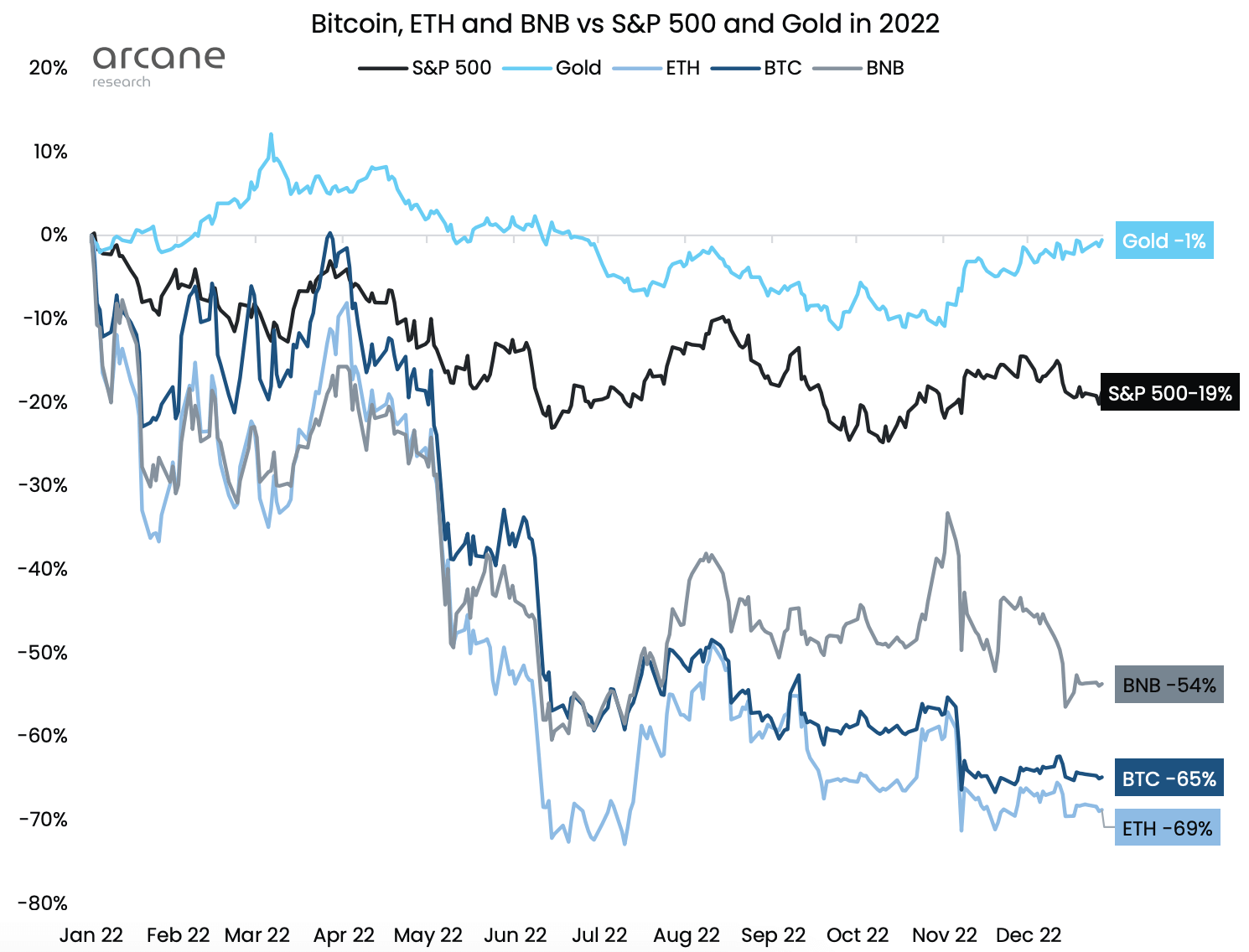

BTC, ETH, BNB, S&P500, and Gold successful 2022

BTC, ETH, BNB, S&P500, and Gold successful 2022BTC’s show was the second-worst of the twelvemonth compared to Binance Coin (BNB), Ethereum (ETH), S&P 500, and Gold. ETH recorded the astir important alteration by falling 69%. Gold was the astir resilient, signaling lone a 1% fall.

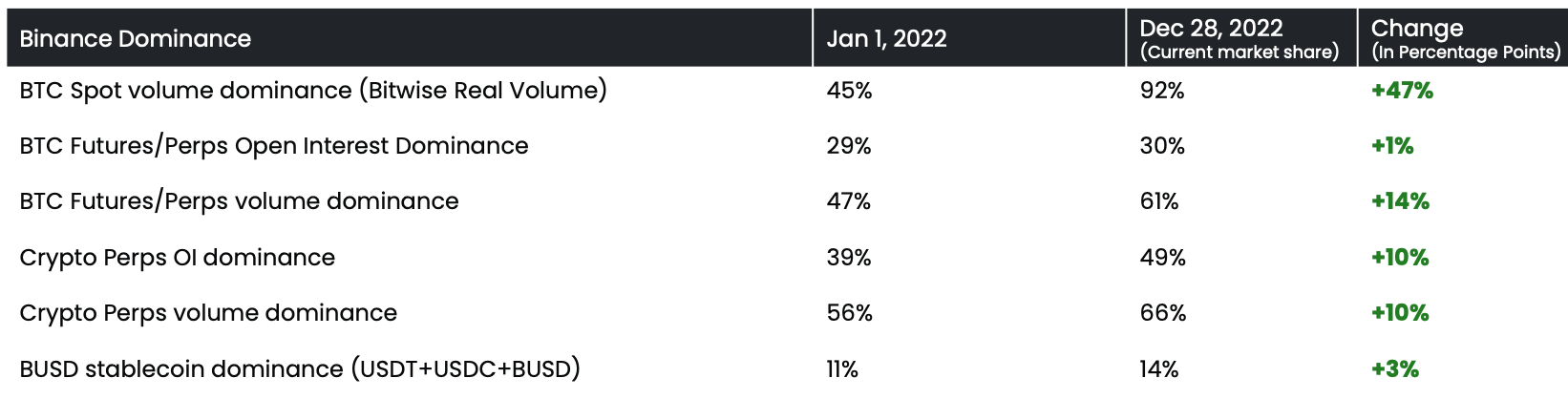

Binance

Crypto speech Binance’s maturation was different item of 2022. Binance’s dominance successful BTC spot measurement grew by 47% passim the year, expanding to 92% astatine the existent marketplace stock from the 45% recorded connected the archetypal time of the year.

Binance was liable for 66% of the crypto perp measurement and 61% of the BTC derivatives measurement arsenic the twelvemonth concludes. The speech recorded a 10% summation successful some areas, compared to 49% and 56% astatine the opening of the year.

Binance 2022 growth

Binance 2022 growthThe study predicted Binance’s dominance successful the spot marketplace volition decline, and the BUSD dominance volition increase.

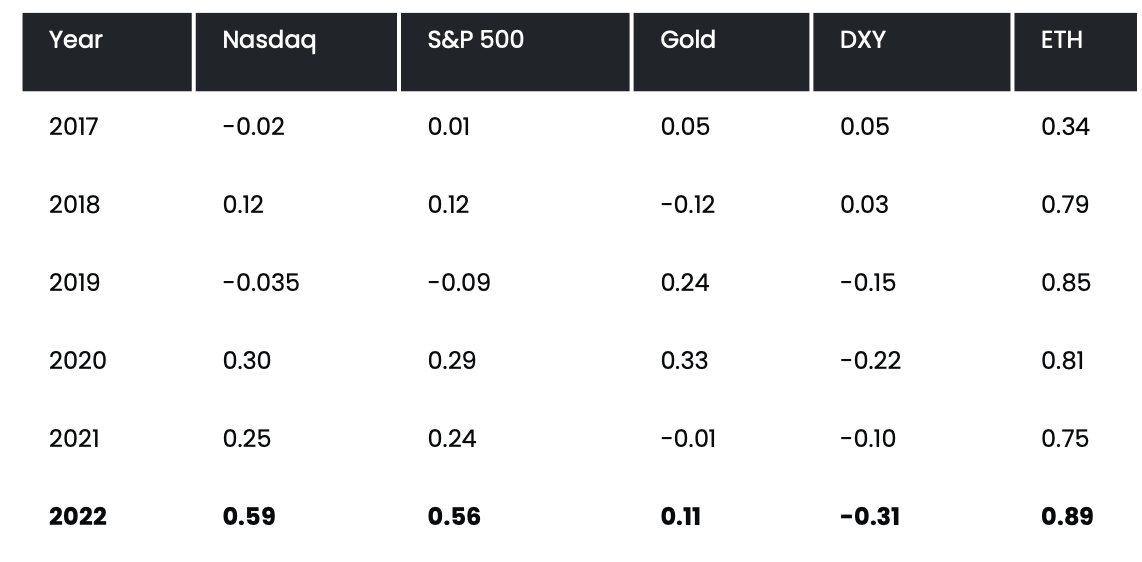

BTC and equities correlation

BTC’s correlation with different equities has besides been importantly precocious successful 2022. The study looked into BTC’s yearly correlation with Nasdaq, S&P 500, Gold, DXY, and ETH since 2017.

BTC correlation with equities

BTC correlation with equitiesThe information showed that BTC’s correlation with ETH has been beardown since 2017. However, 2022 was the archetypal twelvemonth BTC demonstrated specified a beardown correlation with different equities.

BTC’s correlation with Nasdaq was robust passim the twelvemonth astatine 0.59, intimately followed by S&P 500 astatine 0.56. However, the study expects BTC’s correlation with different assets to diminution successful the pursuing years arsenic the trading enactment successful crypto declines.

Stablecoins

Stablecoins’ marketplace headdress comparative to BTC besides grew exponentially successful 2022, expanding to 41% from 15% astatine the opening of the year.

The study claimed that the increasing stablecoin dominance has a self-evident explanation. It stated:

“Cryptocurrency valuations person deteriorated this year, and stablecoins are stable.”

The combined marketplace headdress of stablecoins represented 28% of BTC’s and ETH’s combined marketplace headdress and 17% of the full crypto marketplace cap. This percent was 10% and 6% astatine the opening of the year.

The station 2022 second-worst twelvemonth ever for Bitcoin price – Arcane appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)