At the opening of the year, erstwhile the crypto marketplace was reddish hot, it was highly pugnacious to recognize what was going connected successful the NFT industry.

The monolithic influx of collections, caller marketplaces, and casual wealth successful the abstraction created the cleanable premix of incentives for fraudulent activity. As we know, I published an nonfiction successful October astir NFT lavation trading, respective “OpenSea killers” were built wholly connected fake activity, and not everything was arsenic it seemed erstwhile you looked astatine NFT postulation leaderboards. As the marketplace crashed, truthful did enactment crossed the committee (both fake and organic).

But not each was negative. Several highly innovative NFT collections broke the mold of zany PFP images and proved a marketplace for digital, non-fungible creation existed.

While determination was a proliferation of tiny collections and grassroots community-building successful immoderate corners of the manufacture (e.g., Solana and Magic Eden), the twelvemonth besides saw consolidation with the commencement of the archetypal NFT megacorp successful Yuga Labs.

Instead of telling you what to deliberation astir 2022 and wherever the NFT satellite is heading successful 2023, this nonfiction has the indispensable stats from past twelvemonth truthful you tin make your ain analysis.

9 Stats astir the NFT Industry

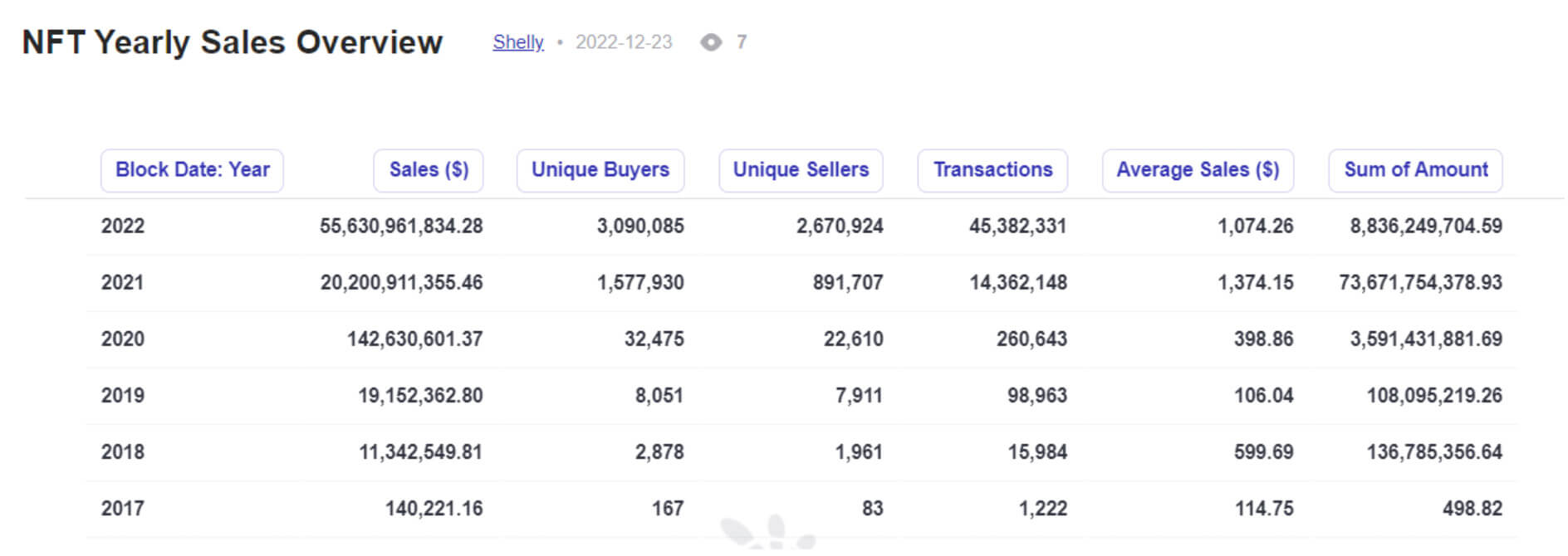

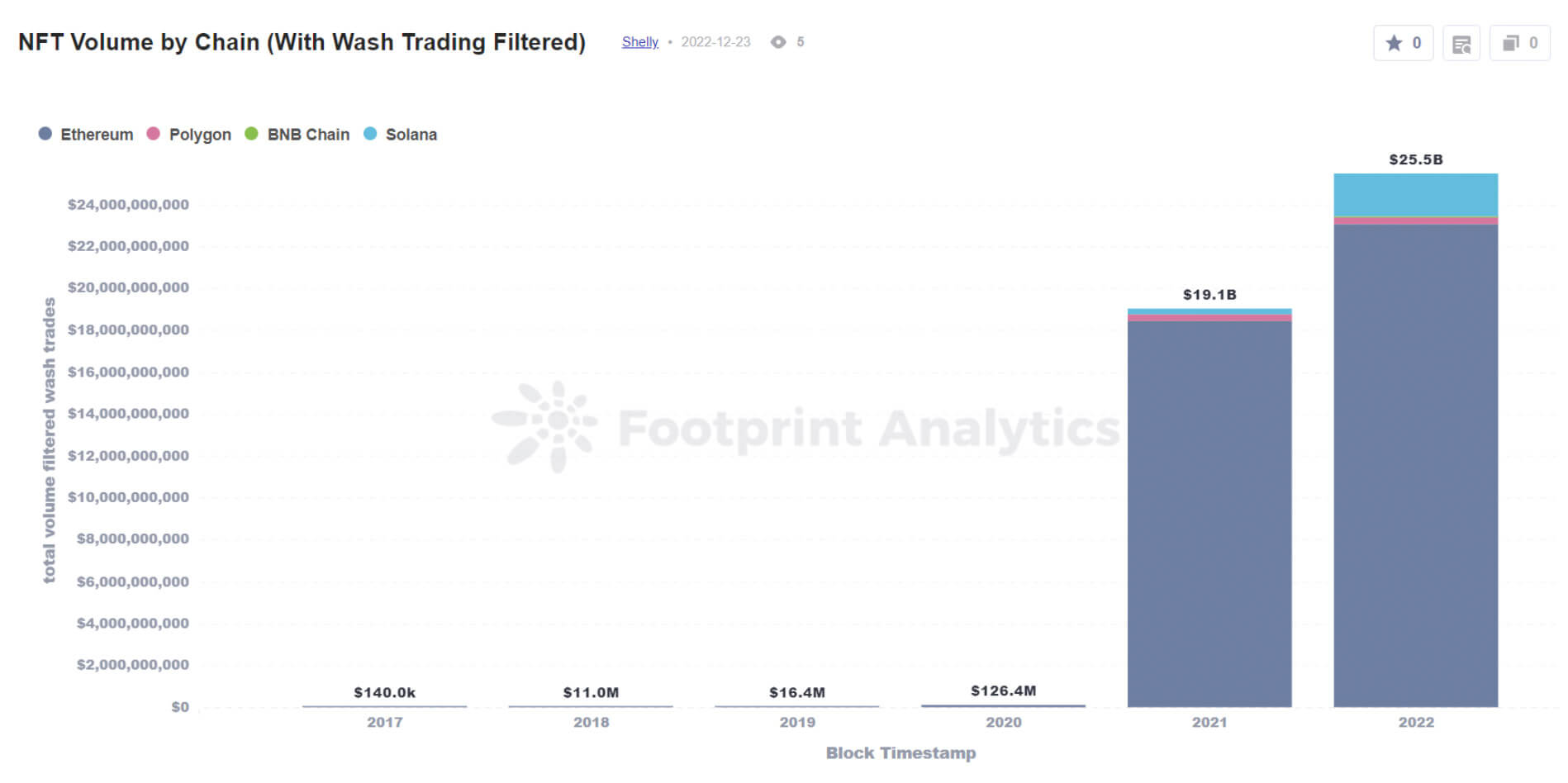

1. Total income of NFTs successful 2022 was $55.5B

This is up 175% from $20.2B successful 2021. When you comparison 2020 to 2022 full sales, it is 390X more.

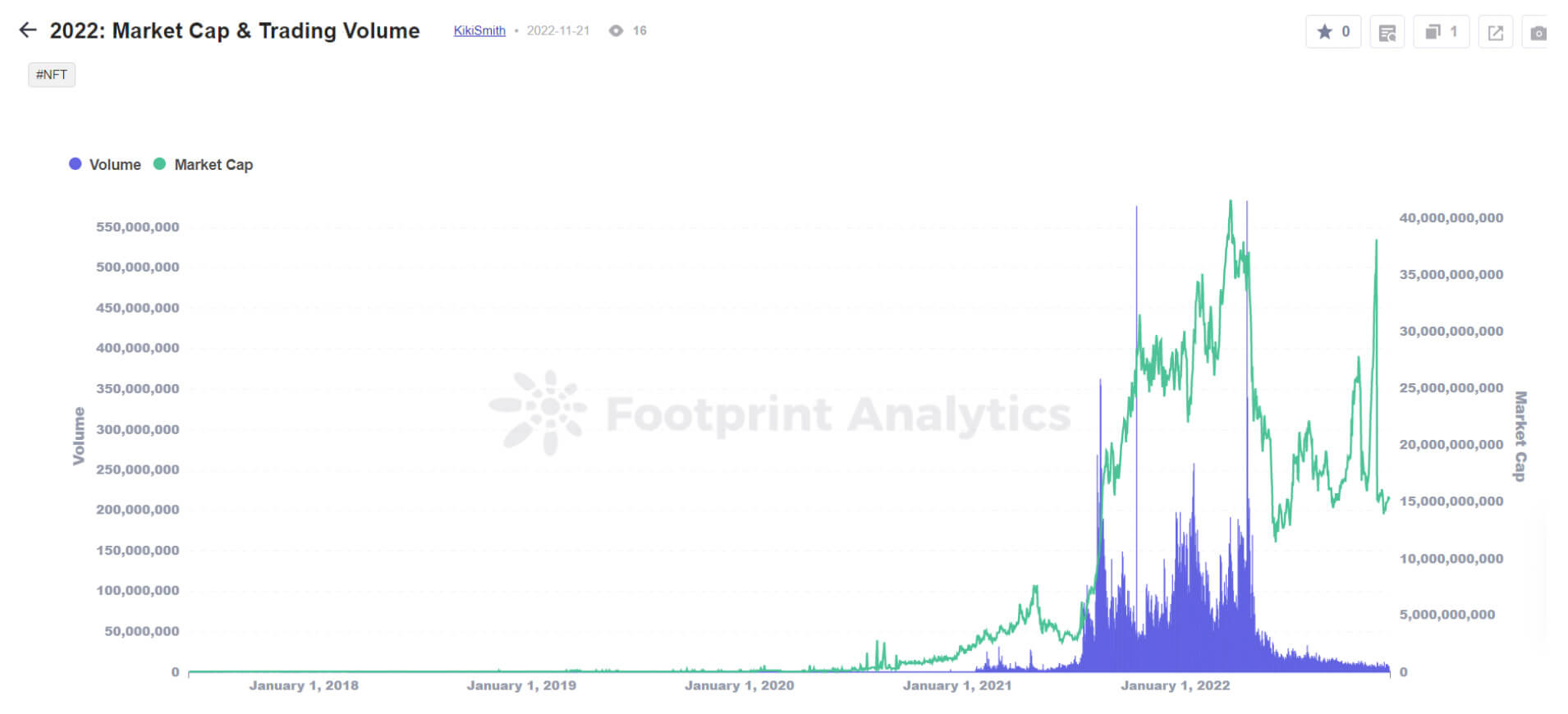

2. The marketplace capitalization of the NFT manufacture peaked connected April 4th astatine $41.5B

Market capitalization is calculated arsenic the sum of each NFT valued astatine the greater of its past traded terms and the level terms of the collection, respectively. Suspected lavation trades person been filtered out.

2022 Market Cap & Trading Volume

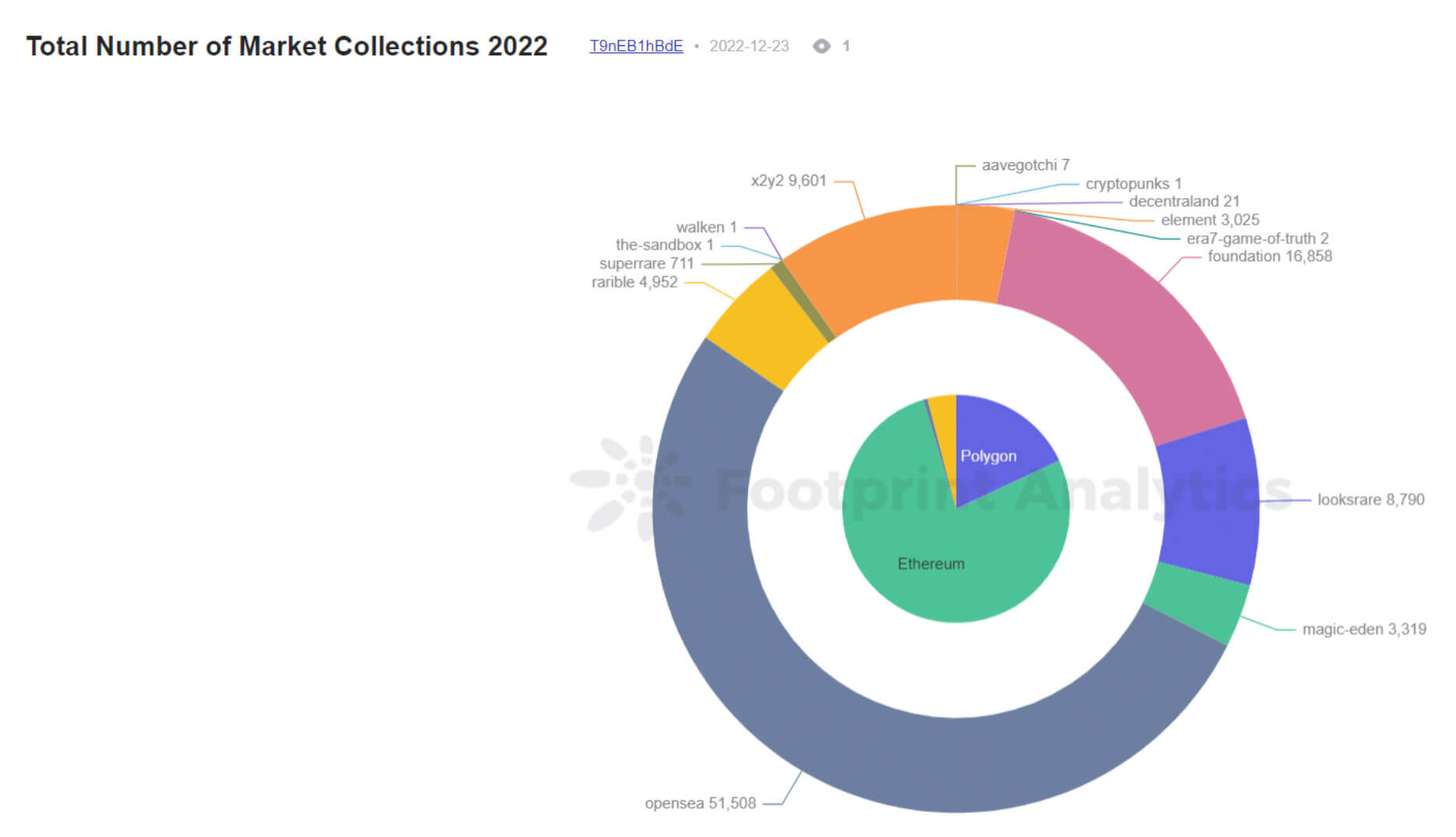

2022 Market Cap & Trading Volume3. Roughly 85K NFT collections were launched past year

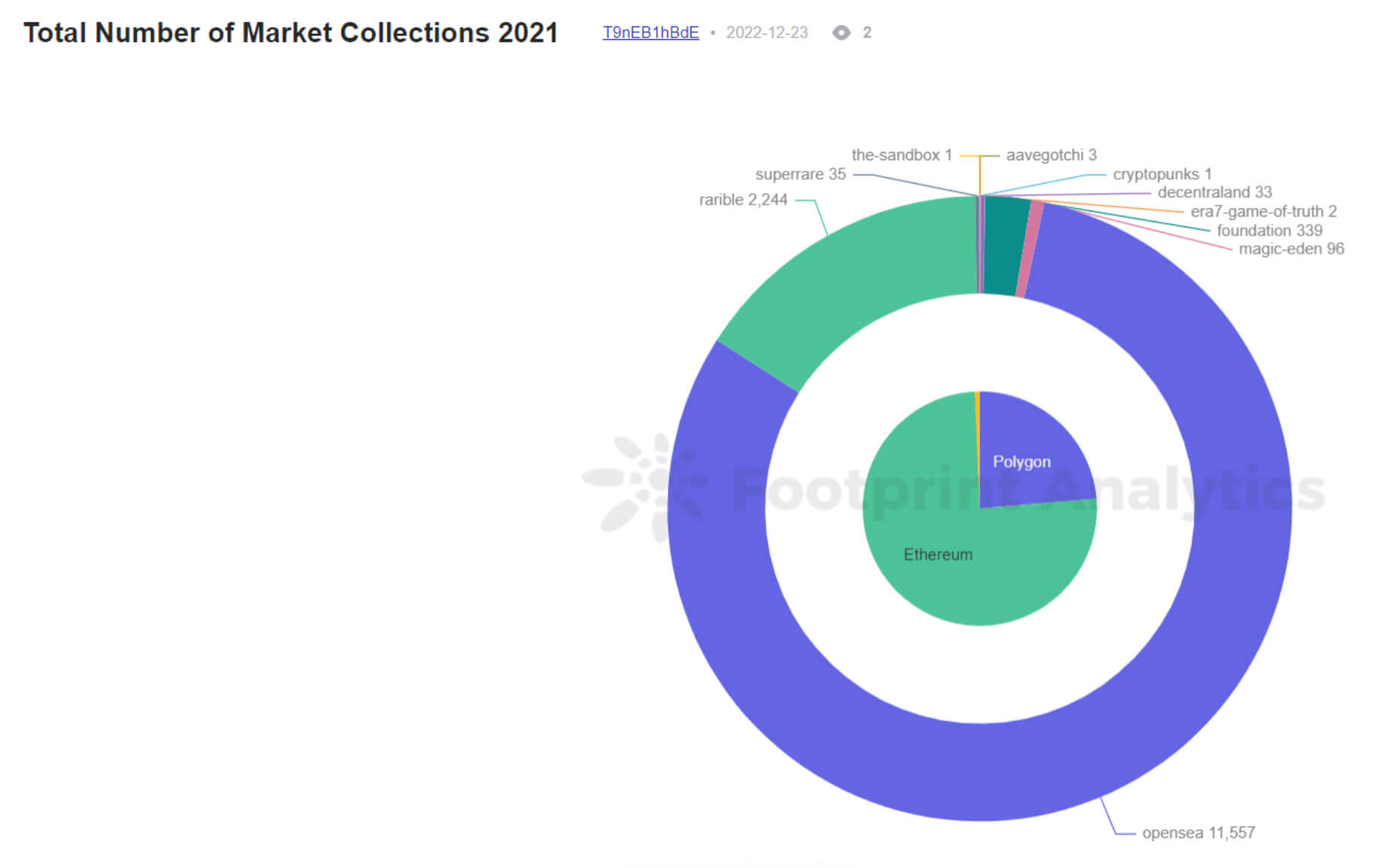

In 2021, determination were astir 14.5K collections, portion the fig astir reached 99K by the extremity of 2022. Notice that Opensea remains the person successful some years.

Total Number of Market Collections 2021

Total Number of Market Collections 2021 Total Number of Market Collections 2022 / Reference: Total Number of Market Collections 2021 vs Total Number of Market Collections 2022

Total Number of Market Collections 2022 / Reference: Total Number of Market Collections 2021 vs Total Number of Market Collections 20224. About 7,700 collections had trading measurement implicit $100K

Do enactment that the bulk of this enactment did not travel from a legitimate, integrated involvement successful the task based connected the day collected.

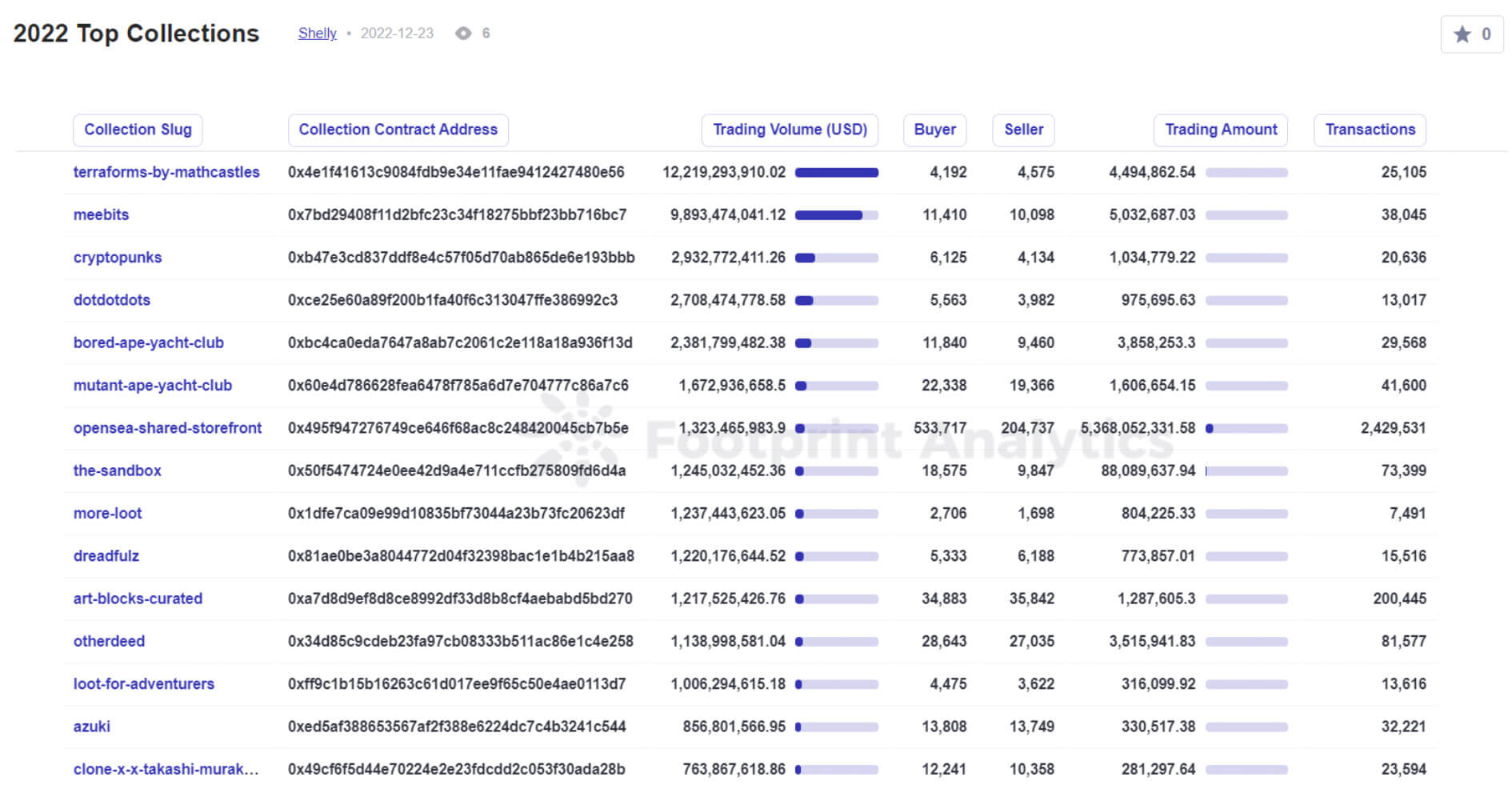

2022 Top Collections / Reference: Top Collections 2022

2022 Top Collections / Reference: Top Collections 20225. Only 2,623 collections had much than 1000 unsocial buyers

As with each stats successful the NFT industry, this 1 should beryllium taken with a atom of brackish owed to the important magnitude of lavation trading, particularly during the year’s archetypal half.

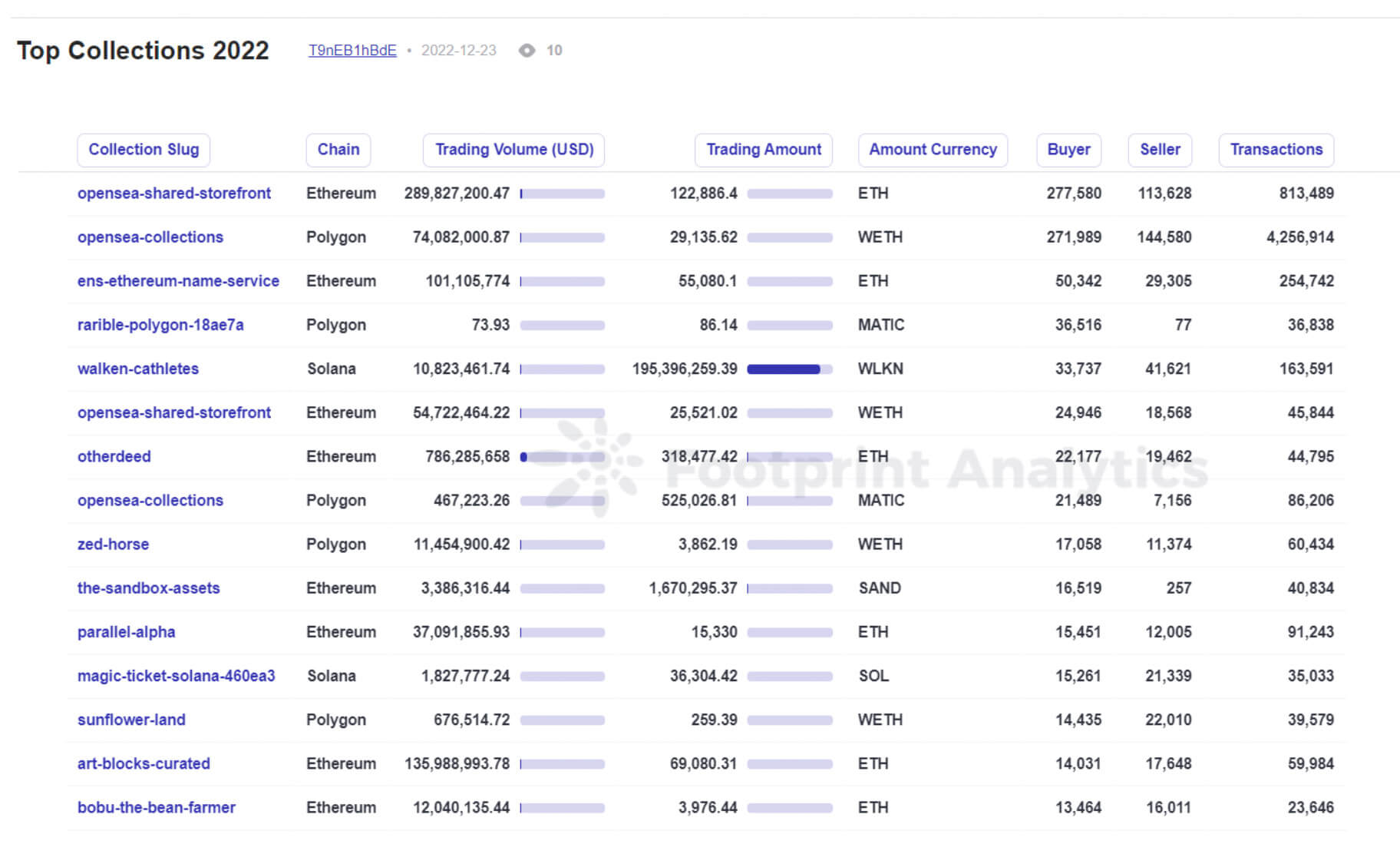

Top Collections 2022

Top Collections 2022Reference: Top Collections 2022

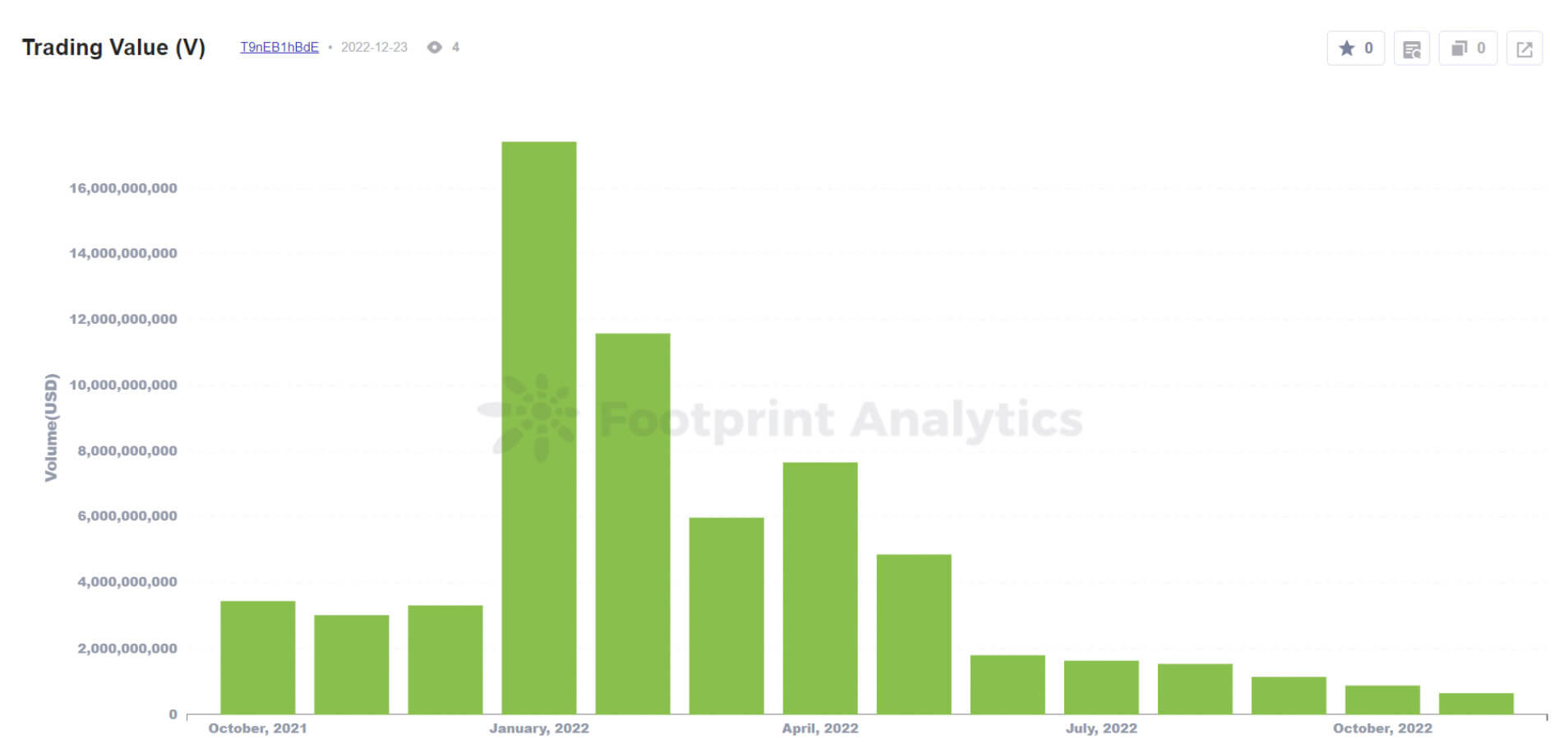

6. NFT trading measurement reached its 2022 highest successful January, with $17.4B successful value

This was much than a 4x leap from the erstwhile period (December 2021). This was besides the period erstwhile Google searches for the keyword “NFT” reached their all-time high.

NFT Trading Value

NFT Trading ValueReference: Trading Value (V)

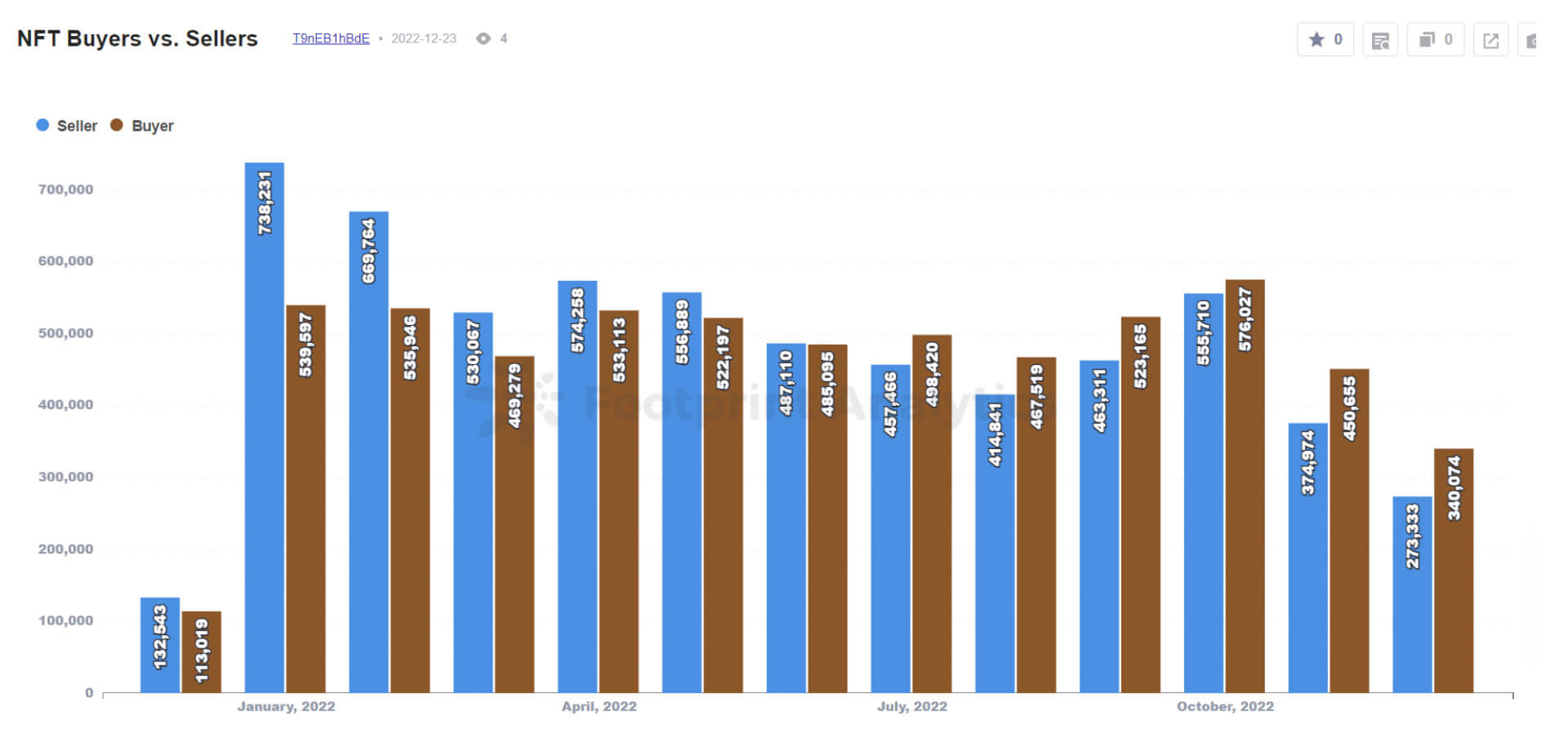

7. The biggest spread betwixt the fig of sellers and buyers was successful January, with astir 200K much sellers than determination were buyers.

Yet January was besides the hottest period for NFT prices for astir large collections, indicating that utilizing these metrics arsenic an analog for proviso and request has flaws.

NFT Buyers vs. Sellers

NFT Buyers vs. SellersReference: NFT Buyers vs. Sellers

8. Last year, 46% of full NFT trading measurement was apt to beryllium caused by lavation trading

There are respective indicators and filters to observe suspicious activity. To place these types of transactions, I usage Footprint Analytics’ filters to abstracted transactions to the pursuing formula:

- a.) Overpriced NFT trades (10x OpenSea Average Price)

- b.) Collections with 0% royalties (except CryptoPunks and ENS)

- c.) An NFT bought much than a mean magnitude of times successful a time (currently filtered for much than 3+)

- d.) An NFT bought by the aforesaid purchaser code successful a abbreviated play (currently filtered for 120 minutes)

NFT Volume by Chain / Reference: NFT Volume by Chain (With Wash Trading Filtered) vs. NFT Volume By Chain

NFT Volume by Chain / Reference: NFT Volume by Chain (With Wash Trading Filtered) vs. NFT Volume By Chain6 Stats astir NFT Collections

9. The postulation with the largest marketplace headdress by the extremity of the twelvemonth was CryptoPunks astatine $1.1B

Crypto Punks, launched by Larva Labs successful 2017, was the archetypal NFT postulation to go a household sanction and person the highest level terms successful the industry. Yuga Labs acquired the IP of the postulation successful March 2022.

Reference: 2022: Top Collections by Market Cap

10. Trading measurement of large collections successful the Yugaverse—Yuga Labs’ portfolio of products—was $3.1B

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, and CryptoPunks. It excludes Meebits, which had much trading measurement than each of these combined,

Reference: Yuga Labs (Trading Volume successful 2022)

11. Yuga Labs’ portfolio accounts for astir 20% of the full marketplace headdress of the full NFT industry

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, CryptoPunks and Meebits.

12. Without immoderate lavation commercialized filtering, Terraforms by Mathcastles had an astounding $12B successful trading volume, much than immoderate different collection, crossed 11,341 transactions

However, 99.8% of the measurement and 46.3% of transactions were detected arsenic lavation trading.

Reference: NFT – Collections

13. When filtering retired lavation trading, CryptoPunks had the highest measurement ($2.9B) followed by Bored Ape Yacht Club ($2.3B)

Reference: 2022: Top Collections by volume

14. ArtBlocks Curated was the 4th astir traded postulation by measurement and amassed a marketplace headdress $325M

ArtBlocks demonstrated that determination is simply a marketplace for high-end creator NFTs—it stands retired among Yuga PFP projects, and metaverse onshore NFTs astatine the apical of the rankings

15. There were 7 large collections whose measurement was implicit 95% lavation trading

For this stat, “major” means having implicit $1M successful existent trading volume. Terraforms by Mathcastles, More Loot, dotdotdots, Dreadfulz, Audioglyphs, CryptoPhunksV2, and Meebits.

6 Stats astir Chains and Markets for NFT Projects

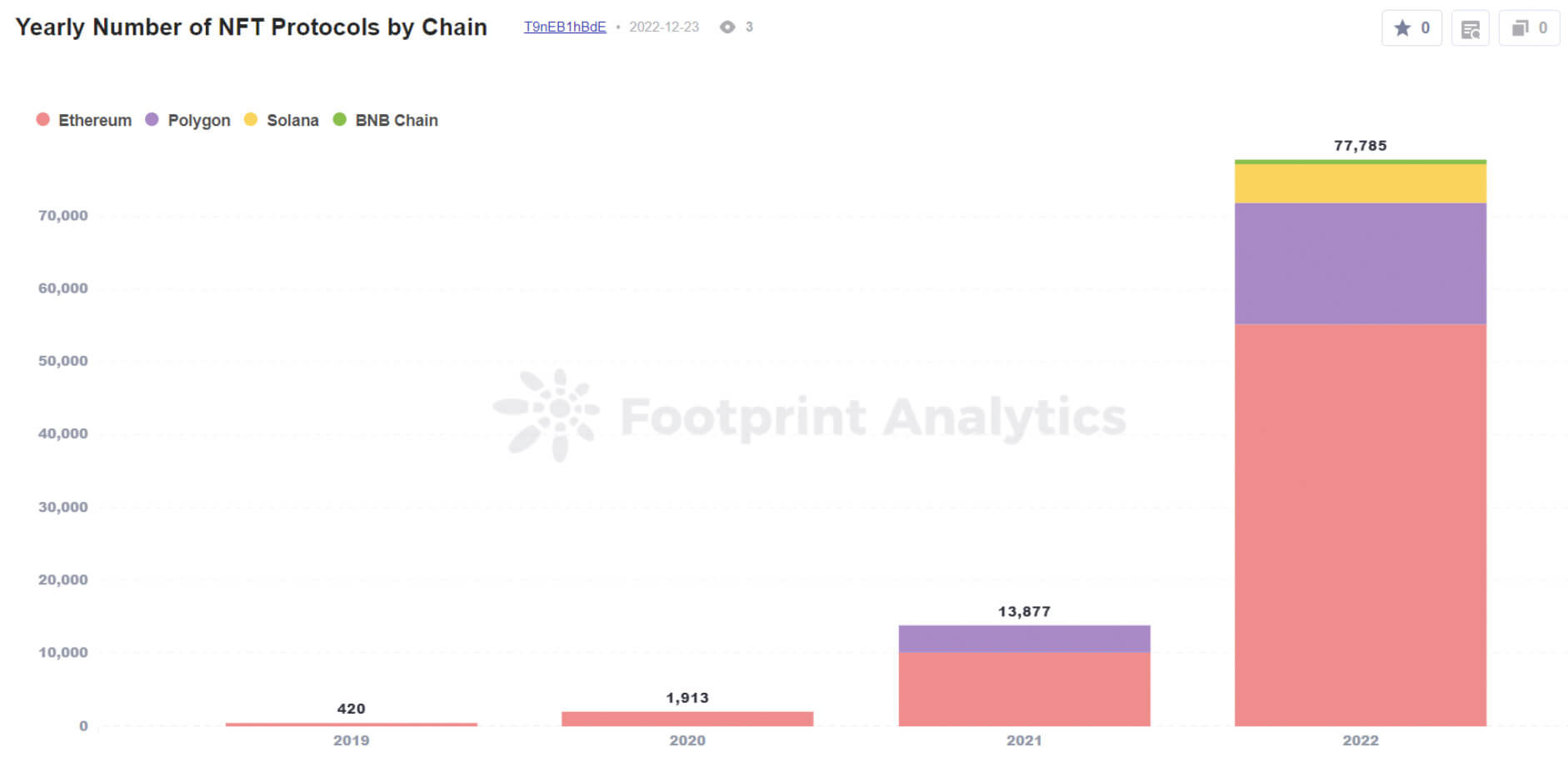

16. Ethereum had 95% percent of volume, 47% of transactions, and 71% of protocols

These figures are astir the aforesaid arsenic successful 2021. Based connected the data, Ethereum is inactive the astir wide utilized for NFT.

Reference: 2022 Market Share of Transactions by Chain and 2022 Market Share of Trading Volume by Chain and Yearly Number of NFT Protocols by Chain

17. Solana went from having nary NFT protocols successful 2021 to 5,335 successful 2022

Solana is ranked 3rd globally astatine the constituent of writing.

Another happening to enactment is that Ethereum grew from 420 successful 2019 to 55,144 successful 2022.

Yearly Number of NFT Protocols by Chain / Reference: Yearly Number of NFT Protocols by Chain

Yearly Number of NFT Protocols by Chain / Reference: Yearly Number of NFT Protocols by Chain18. OpenSea hosted 53% of each full collections

OpenSea remained the marketplace of prime for Ethereum and Polygon. However, Magic Eden capitalized connected its Solana first-mover vantage to beryllium the marketplace of prime for collections connected this concatenation (OpenSea started listing them successful April.) Note: a postulation tin database connected aggregate marketplaces.

Reference: 2022: Number of Marketplace Collections by Chain

19. Solana had much progressive users successful October, with 411K, than Ethereum, with 392K

While astir of the blue-chip collections and collectors transact connected OpenSea and Ethereum, Solana built up a sizable assemblage of NFT enthusiasts successful 2022. Solana’s progressive users hovered betwixt 20-45% of the full marketplace share—October was the lone period it overtook Ethereum for this metric

Reference: Chain Monthly Active User

20. OpenSea had 96,459 unsocial wallets marque a transaction connected the protocol connected Feb. 2

This is much transactions than immoderate different marketplace connected immoderate different day.

Reference: 2022 Marketplace Daily Active User

21. Over $903M successful level fees were generated connected OpenSea, going to some the marketplace and creators

This made OpenSea the astir profitable marketplace successful presumption of fees generated from trading (which went to the level and are disbursed to creators.)

Reference: Top Marketplaces

6 Stats astir NFT Investment & Fundraising

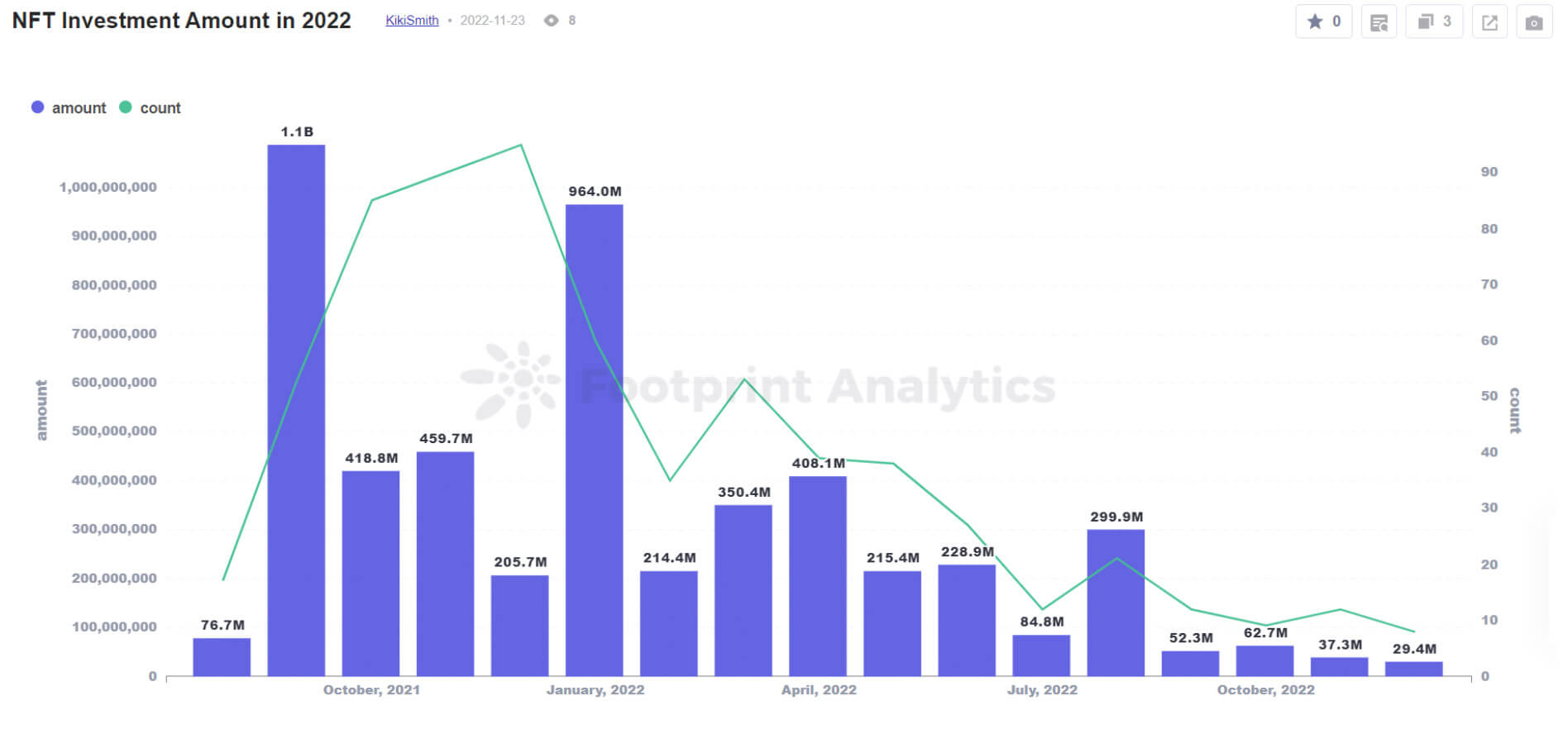

22. The NFT manufacture received a full of $2.98B successful fundraising successful 2022

The highest was successful January 2022 astatine $964M. The lowest is successful December astatine $29.4M.

NFT Investment Amount successful 2022 / Reference: NFT concern Amount successful 2022

NFT Investment Amount successful 2022 / Reference: NFT concern Amount successful 202223. Animoca Brands closed the largest circular of the year, $358M led by Liberty City Ventures

Animoca has said it volition usage the backing for strategical acquisitions and investments, make its games and metaverse products, and get licenses for fashionable intelligence properties.

Reference: 2022 NFT Fundraising Details

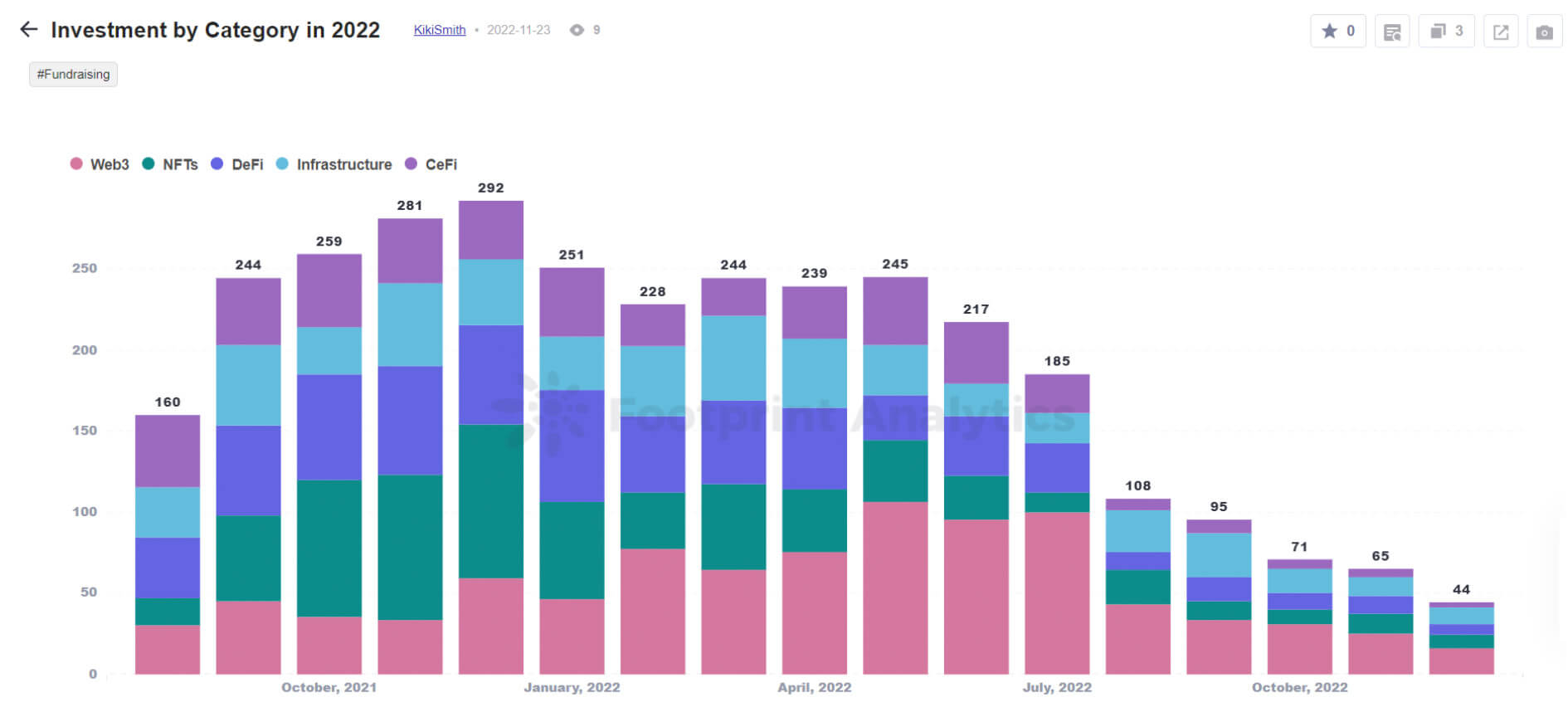

24. There were 1,992 full fundraising rounds successful 2022, 756 much than successful 2021

Reference: Investment by Category successful 2022

25. While NFT-related projects were the astir fashionable class among VCs by the fig of rounds, they were the 2nd-least fashionable successful 2022

In 2022, wide Web3 projects closed the astir rounds (711), followed by DeFi (362), infrastructure (331), NFTs (326), and, finally, CeFi (257).

NFT Investment by Category successful 2022 / Reference: Investment by Category successful 2022

NFT Investment by Category successful 2022 / Reference: Investment by Category successful 202226. Seed rounds made up 81% of full NFT backing rounds

Reference: NFTs Funding Rounds

27. The 2 largest rounds for axenic NFT projects went to OpenSea ($300M) and Dapper Labs ($250M)

The OpenSea circular was 1 of lone 5 Series C oregon D rounds successful 2022. Dapper Labs is the workplace down the NBA Top Shot collection.

Key Takeaways

As we tin see, Web 3.0 is proliferating. NFT is undoubtedly portion of the full Web 3.0 ecosystem. In the Web 3.0 ecosystem, NFTs are often utilized to facilitate the buying and selling of unsocial integer assets connected decentralized platforms. These platforms usage astute contracts to alteration transactions without the request for intermediaries. They tin facilitate the buying and selling of NFTs and let NFT holders to gain passive income by lending retired their NFTs. There are galore usage cases to showcase.

Web 3.0 volition proceed to gully much concern successful 2023 based connected immoderate of the woody flows I spot successful the market. OKX Ventures and GSRV co-lead a $2 Million effect circular for a Web 3.0 decentralized Identity platform. Binance Labs launched a $500M money to enactment promising Web 3.0 projects and start-up firms with large imaginable earlier this year. Du Jun, the co-founder of cryptocurrency speech Huobi Global, runs ABCDE Capital, a $400M Web 3.0 task superior money is dedicated to investing successful web3 builders.

Apart from the crypto firms-led firms, it’s besides existent that accepted concern companies are opening to instrumentality announcement of the Web 3.0 ecosystem and are starting to put successful companies and projects that are moving connected decentralized technologies, specified arsenic blockchain and non-fungible tokens (NFTs).

There are respective reasons wherefore accepted concern companies mightiness beryllium funny successful investing successful web3 technologies. One crushed is that the Web 3.0 ecosystem is inactive successful its aboriginal stages and has overmuch maturation potential. Decentralized technologies person the imaginable to revolutionize galore antithetic industries, from concern and existent property to creation and collectibles.

Another crushed is that the Web 3.0 ecosystem is comparatively uncorrelated with accepted fiscal markets, which tin connection diversification benefits for investors. This tin beryllium particularly appealing successful times of economical uncertainty, erstwhile accepted fiscal markets whitethorn beryllium much volatile.

Ending with a quote:

“Web 3.0 brings endless opportunities to galore people, changes lives successful Kenya, removes barriers successful India and empowers developers successful China to work planetary audiences during the COVID lockdown period. Your gateway to Web 3.0 is conscionable 1 click away. Let’s innovate.” – Anndy Lian.

The station 27 stats astir NFTs successful 2022 – who are the large winners? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)