In an interview with Yahoo Finance’s “Wealth,” Ric Edelman, laminitis of the Digital Assets Council of Financial Professionals and $291 cardinal plus manager Edelman Financial Services, provided a striking forecast for the Bitcoin price. Edelman argued that Bitcoin’s terms could surge to $420,000, attributing this imaginable emergence to a humble planetary plus allocation towards Bitcoin.

Why Bitcoin Price Will Reach $420,000

During the interview, Edelman delved into the advantages of investing successful Spot Bitcoin ETFs. He noted that these instruments marque Bitcoin accessible successful the aforesaid mode arsenic accepted ETFs, which are commonplace and acquainted to investors utilizing mean brokerage accounts.

“They’re incredibly inexpensive, 20-25 ground points cheaper than going to accidental Coinbase oregon different crypto speech and being successful a brokerage account, you tin rebalance, you tin dollar outgo average, you tin taxation nonaccomplishment harvest,” Edelman highlighted. This setup simplifies the concern process, making it akin to managing immoderate different plus class, frankincense broadening its entreaty to a wider audience.

However, Edelman was besides candid astir the challenges and risks associated with Bitcoin. Despite the advantages offered by ETFs, the inherent quality of Bitcoin arsenic a volatile and risky concern persists. “It’s inactive Bitcoin, which means it’s inactive precise volatile, it’s inactive precise risky. You could inactive suffer everything,” helium cautioned.

Edelman pointed to ongoing regulatory uncertainty, imaginable lawsuits, and prevalent fraud arsenic important risks that investors request to negociate cautiously. He besides criticized the inclination of investing owed to fearfulness of missing retired (FOMO), labeling it arsenic a mediocre concern rationale.

Looking ahead, Edelman discussed the regulatory landscape, peculiarly concerning different cryptocurrencies similar Ethereum. He noted that determination are respective applications pending for Ethereum ETFs, and portion helium anticipates archetypal rejections, approvals could travel by year’s end.

“After you person the Bitcoin ETFs and the Ethereum ETFs, I’m not definite however rapidly you’ll spot thing other aft that, but these 2 volition benignant of unfastened the doors agelong term. Five years from now, determination volition beryllium dozens, possibly adjacent hundreds of crypto ETFs,” Edelman speculated. This position underscores a important displacement towards mainstream acceptance and integration of cryptocurrencies into accepted fiscal products.

Edelman’s prediction of Bitcoin reaching $420,000 is based connected an presumption of global plus diversification. By his calculations, if each planetary plus holders allocated conscionable 1% of their assets to Bitcoin, this would construe to a marketplace headdress of $7.4 trillion for Bitcoin alone.

“It’s remarkably simple. If you instrumentality a look astatine the world’s planetary assets, the worth of the banal market, globally, the enslaved market, the existent property market, the golden market, you conscionable look astatine each the assets everybody successful the satellite owns, it’s astir $740 trillion,” helium explained. Such an allocation would dramatically summation Bitcoin’s marketplace cap, driving its terms up significantly.

Moreover, Edelman highlighted a displacement successful the cognition of Bitcoin from a transactional currency to a store of value, akin to gold. “The usage lawsuit of Bitcoin, though it’s beardown for transmittal, is not the strongest argument. It’s present similar gold, a store of value,” helium stated. This cognition displacement has attracted much organization investors, who presumption Bitcoin arsenic a hedge oregon an alternate plus class, akin to different non-traditional investments similar artwork oregon collectibles.

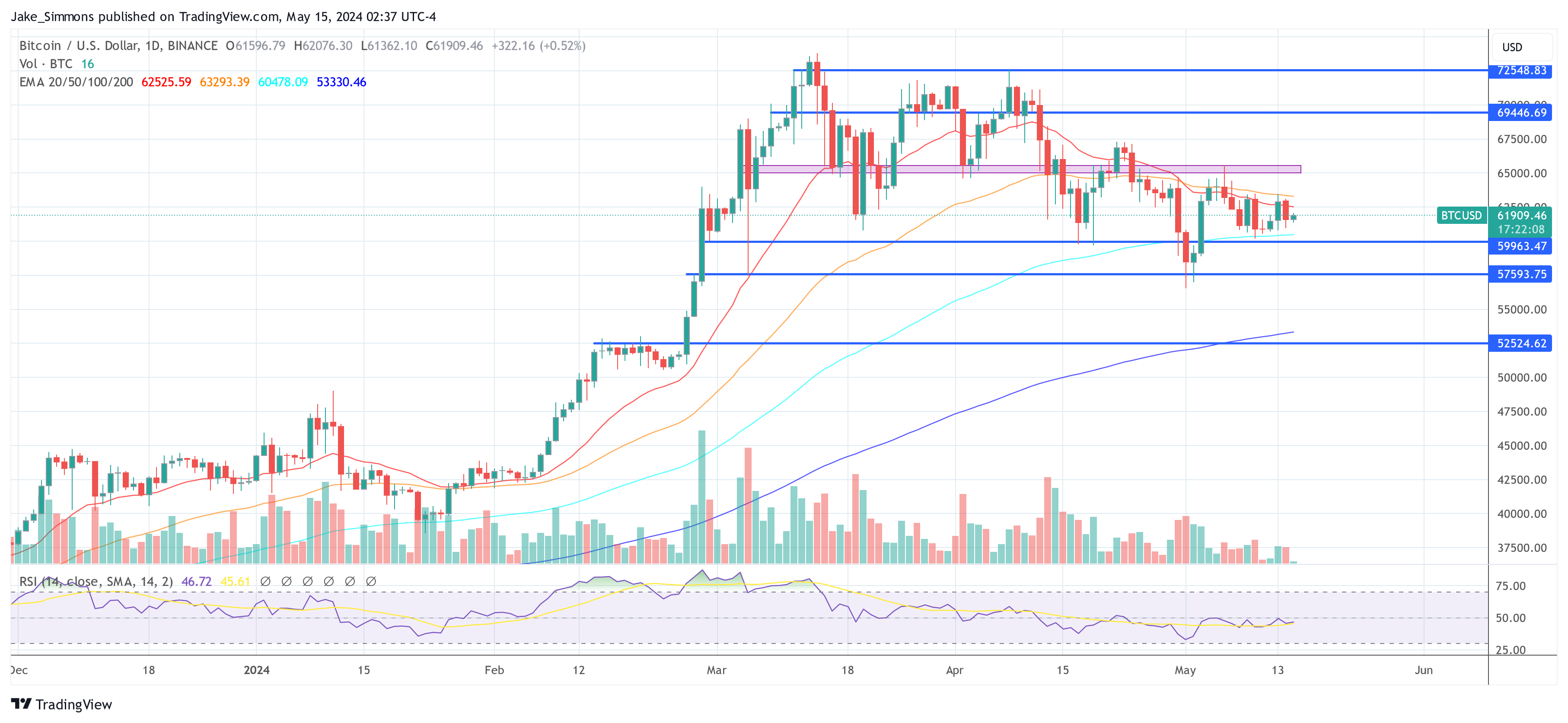

At property time, BTC traded astatine $61,909.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Wealth Management, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)