Arbitrum is present the starring subordinate of each Layer 2 networks.

Footprint Analytics · December 26, 2021 astatine 12:49 americium UTC · 3 min read

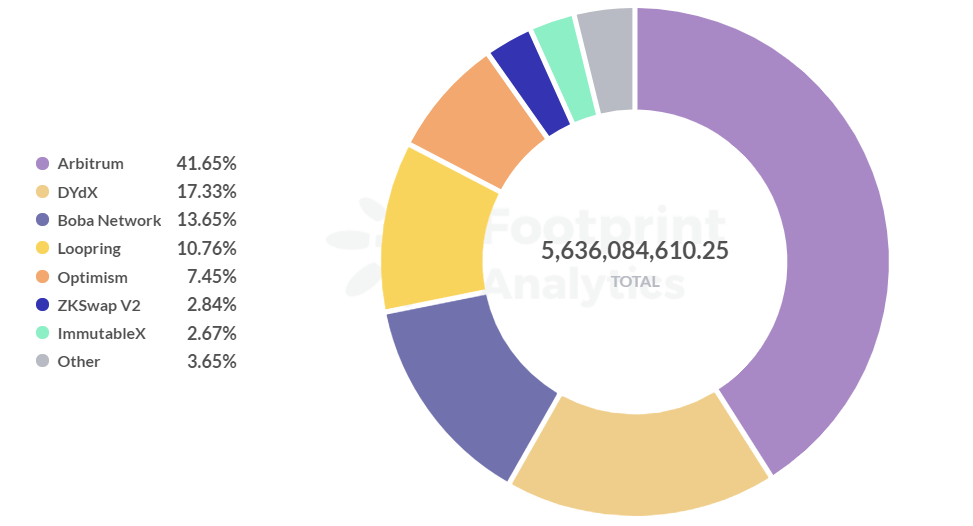

Arbitrum, 1 of Ethereum’s Layer 2 networks, has gained important attraction from crypto users and developers since its launch. According to Footprint Analytics, Arbitrum has contributed 41.88% of each Layer 2 TVL, totaling $2.25 cardinal arsenic of Dec. 8. Arbitrum is present the starring subordinate of each Layer 2 networks.

Data Source: Footprint Analytics – TVL Share by Layer 2

Data Source: Footprint Analytics – TVL Share by Layer 2Arbitrum launched its main web connected Sept. 1, 2021, which seems precocious compared to different Layer 2 networks. Despite this, Arbitrum’s TVL rapidly overtook different projects, exceeding expectations.

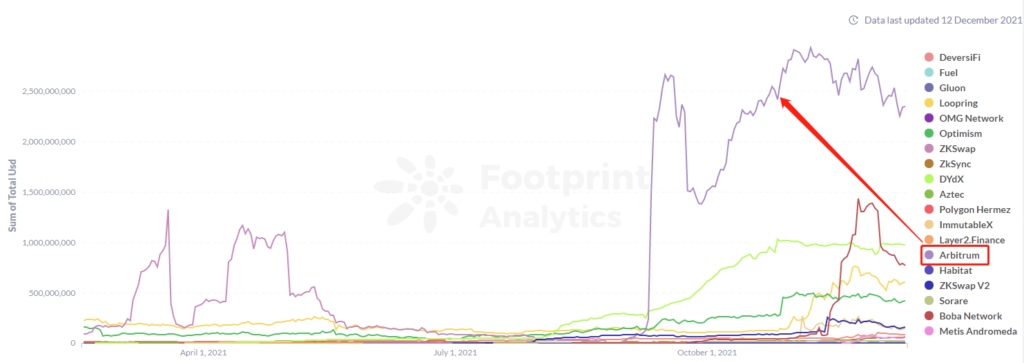

Data Source: Footprint Analytics – Layer 2 TVL Growth Trending

Data Source: Footprint Analytics – Layer 2 TVL Growth TrendingWhat makes Arbitrum basal retired from the crowd?

Reason 1: Low exertion migration costs

Arbitrum’s Optimistic rollups solution is much fashionable with developers successful the abbreviated word than the much technically analyzable ZK rollups solution. In the agelong term, however, ZK rollups’ web whitethorn person the imaginable to drawback up acknowledgment to its faster velocity and stronger security.

Reason 2: Low Gas interest cost

Arbitrum processes 40,000 transaction requests per second, overmuch larger than Ethereum’s 15-30 requests, greatly reducing web congestion, expanding velocity and reducing transaction costs. According to outer data, Arbitrum’s transaction outgo is 1.8 Gwei compared to Ethereum’s 64 Gwei, astir 36 times that of Arbitrum.

Reason 3: A much unfastened ecosystem

Many radical whitethorn inquire wherefore the Optimistic network, which besides uses the Optimistic rollups solution, is not arsenic bully arsenic Arbitrum. Arbitrum’s motorboat strategy onboarded much than 400 DeFi projects earlier it opened to the public, and dozens of projects were already online astatine the aforesaid clip astatine the commencement of its launch. This allowed users to implicit a assortment of operations successful its ecosystem. Optimistic, connected the different hand, uses a whitelisting mechanism, truthful that lone whitelisted projects tin beryllium deployed connected its main network.

Because of Arbitrum’s unfastened deployment mechanism, it was not the caput DeFi protocol that made Arbitrum famous, but alternatively the assorted “degen” investments—those offering unscrupulously precocious returns.

Arbitrum’s archetypal TVL maturation is mostly owed to ArbiNYAN, which attracts investors to involvement their autochthonal tokens with returns of 1000%-plus. These projects, portion not ever legitimate, allowed the caller ecosystem to emerge.

Introduction to the Arbitrum ecosystem

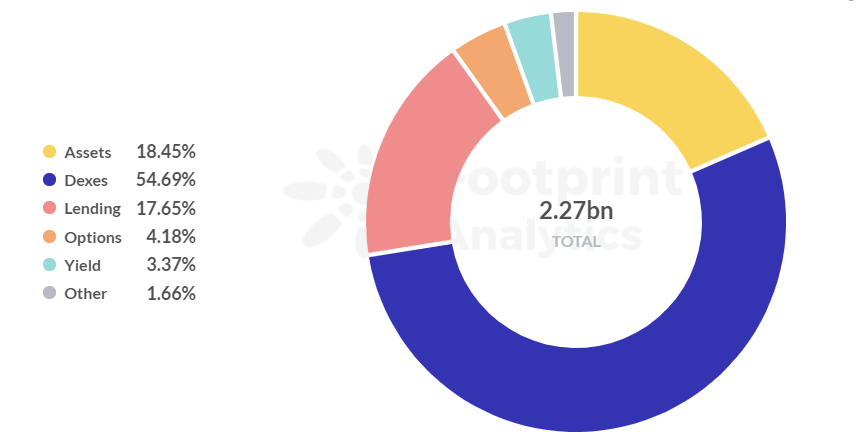

Arbitrum has conscionable 44 unrecorded projects, which is not peculiarly large. Among them, the DeFi class is dominated by DEX, lending and plus categories.

Of these, DEX accounts for 56% of TVL, assets for 18% and lending for 17.8%.

Data Source: Footprint Analytics – TVL Share of Category On Arbitrum

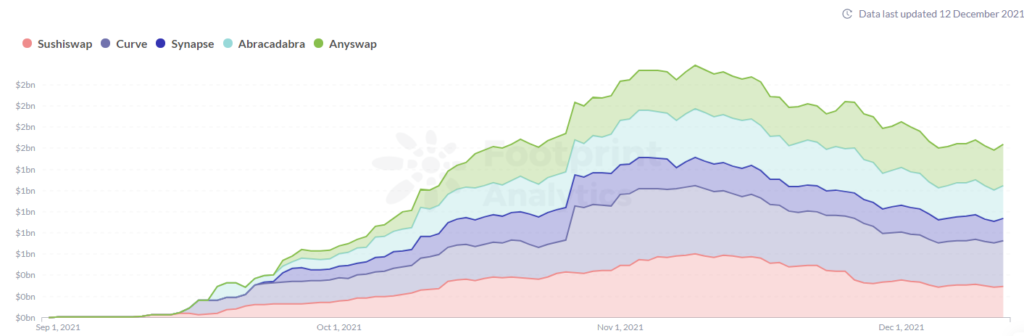

Data Source: Footprint Analytics – TVL Share of Category On Arbitrum Looking astatine the TVL ranking of DeFi projects, degen projects are nary longer successful the apical 5, with mainstream projects rising to the top. Curve is successful archetypal spot with a TVL of $420 million.

Data Source: Footprint Analytics – Top 5 DeFi Protocols connected Arbitrum

Data Source: Footprint Analytics – Top 5 DeFi Protocols connected ArbitrumConclusion

Arbitrum, a cardinal subordinate successful the enlargement of Ethereum, is already attracting a batch of superior attention, with $124 cardinal successful Series A and B backing and a valuation of $1.2 billion. Arbitrum is not presently successful a cryptocurrency launch, and the co-founder of its improvement team, Offchain Labs, has stated that determination are nary plans to motorboat a cryptocurrency successful the adjacent future.

Arbitrum is inactive successful its aboriginal stages and we expect it to proceed to enrich its ecosystem and pull much developers and investors.

This study was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

4 years ago

4 years ago

English (US)

English (US)