The Bitcoin assemblage is presently abuzz with discussions of an impending proviso shock, a marketplace improvement wherever request outstrips supply, perchance starring to a important terms increase. Indicators from assorted sectors wrong the marketplace are presently converging, suggesting that specified an lawsuit whitethorn beryllium person than galore anticipate. Here’s an in-depth look astatine 3 signs for an impending proviso shock:

#1 Surging Demand For Bitcoin ETFs

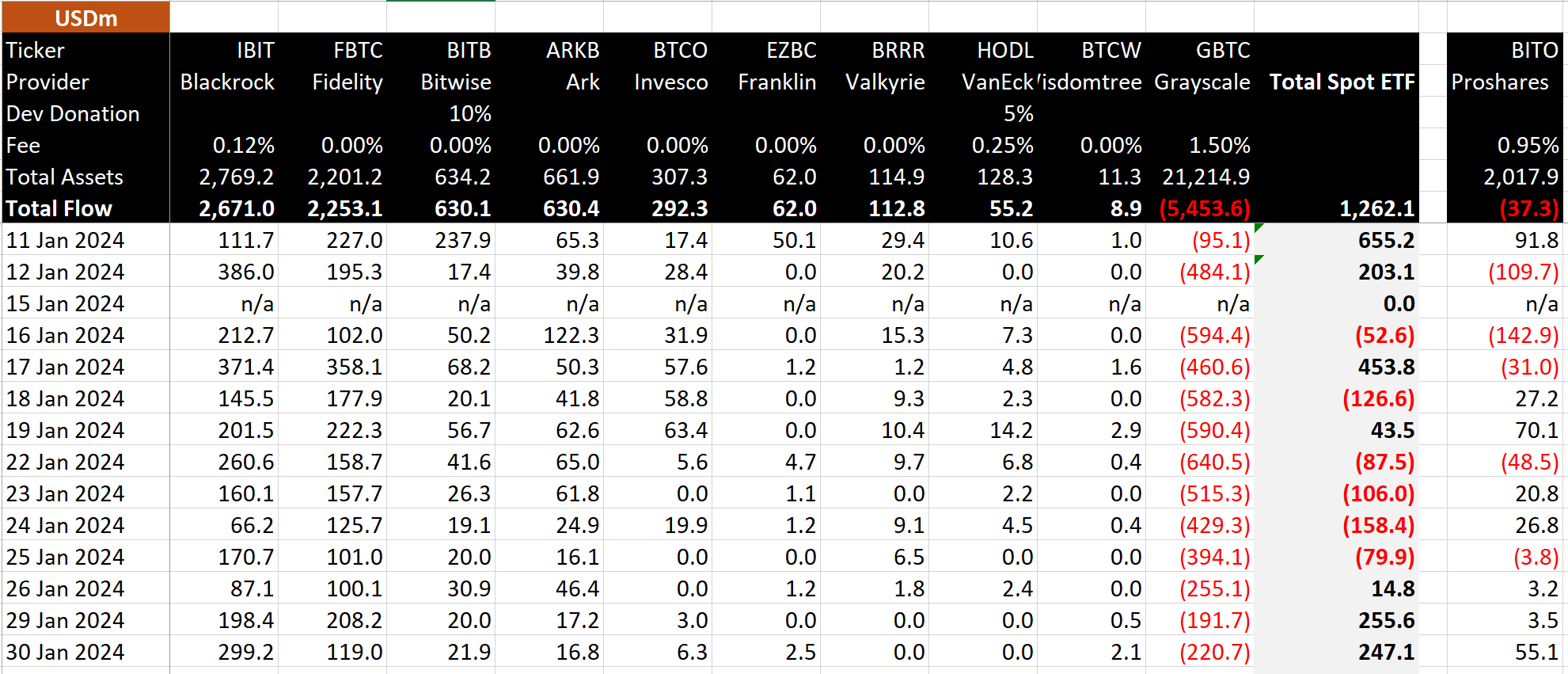

Bitcoin ETFs person been creating an exceptionally ample request since their launch. Initially, this request surge was somewhat moderated owed to important outflows from the Grayscale Bitcoin ETF (GBTC). However, time 13 of the Bitcoin ETFs showed erstwhile again that the Grayscale outflows are dilatory slowing down (yesterday: $220.7 million, antecedently $191.7 million), portion the past 2 trading days saw nett inflows for each ETF issuers of astir $250 million.

Bitcoin Spot ETF Flow – Day 13 | Source: X @BitMEXResearch

Bitcoin Spot ETF Flow – Day 13 | Source: X @BitMEXResearchDan Ripoll, managing manager astatine Swan, provided a elaborate analysis connected the sheer magnitude of this. “The Bitcoin spot ETFs person already snatched up 150,500 BTC successful conscionable 13 trading days. They are buying astatine a complaint of 12,000 BTC per day. Now, let’s KISS (keep it elemental stupid). There are lone 900 BTC per time being issued. BTC is being bought up astatine a complaint of 13x regular issuance. In 3 months, the issuance volition beryllium chopped successful half, driving the demand/supply imbalance to a staggering 26x regular issuance!”

Furthermore, Alessandro Ottaviani, a respected Bitcoin analyst, underscored the imaginable marketplace shift, stating, “Now that the Bitcoin ETF inflow volition ever beryllium higher than the Grayscale outflow, the lone mode to accommodate that request volition beryllium done an summation of price. Once we scope $60k and adjacent much aft the new ATH, Institutional FOMO volition beryllium officially triggered, and it volition beryllium thing that the quality being has ne'er experienced.”

WhalePanda, a renowned crypto analyst, highlighted caller activities, adding credibility to the brewing proviso shock: “Yesterday different ~$250 cardinal nett inflow into Bitcoin ETFs with Blackrock doing a coagulated $300 cardinal each by itself. Two days of $250 cardinal inflow, the terms didn’t rally overmuch yesterday, but a mates of days similar this, and you’ll spot what benignant of proviso daze this volition person connected BTC.”

#2 Massive Bitcoin Miner Selling Absorbed

Despite a important travel of coins from miner wallets to spot exchanges, the marketplace has shown singular resilience. According to a report from Cryptoquant:

“Yesterday, the travel of coins successful miner wallets going to spot exchanges recorded the highest worth since May 16, 2023. In total, much than 4,000 Bitcoins flowed to spot exchanges, astir $173 cardinal successful selling pressure. However, this selling unit was calmly absorbed by the market.”

It’s captious to enactment that contempt these interactions, the reserves successful mining portfolios person remained accordant since the opening of January, indicating that the marketplace has efficaciously absorbed the selling unit without important terms depreciation.

Bitcoin miner selling unit | Source: Cryptoquant

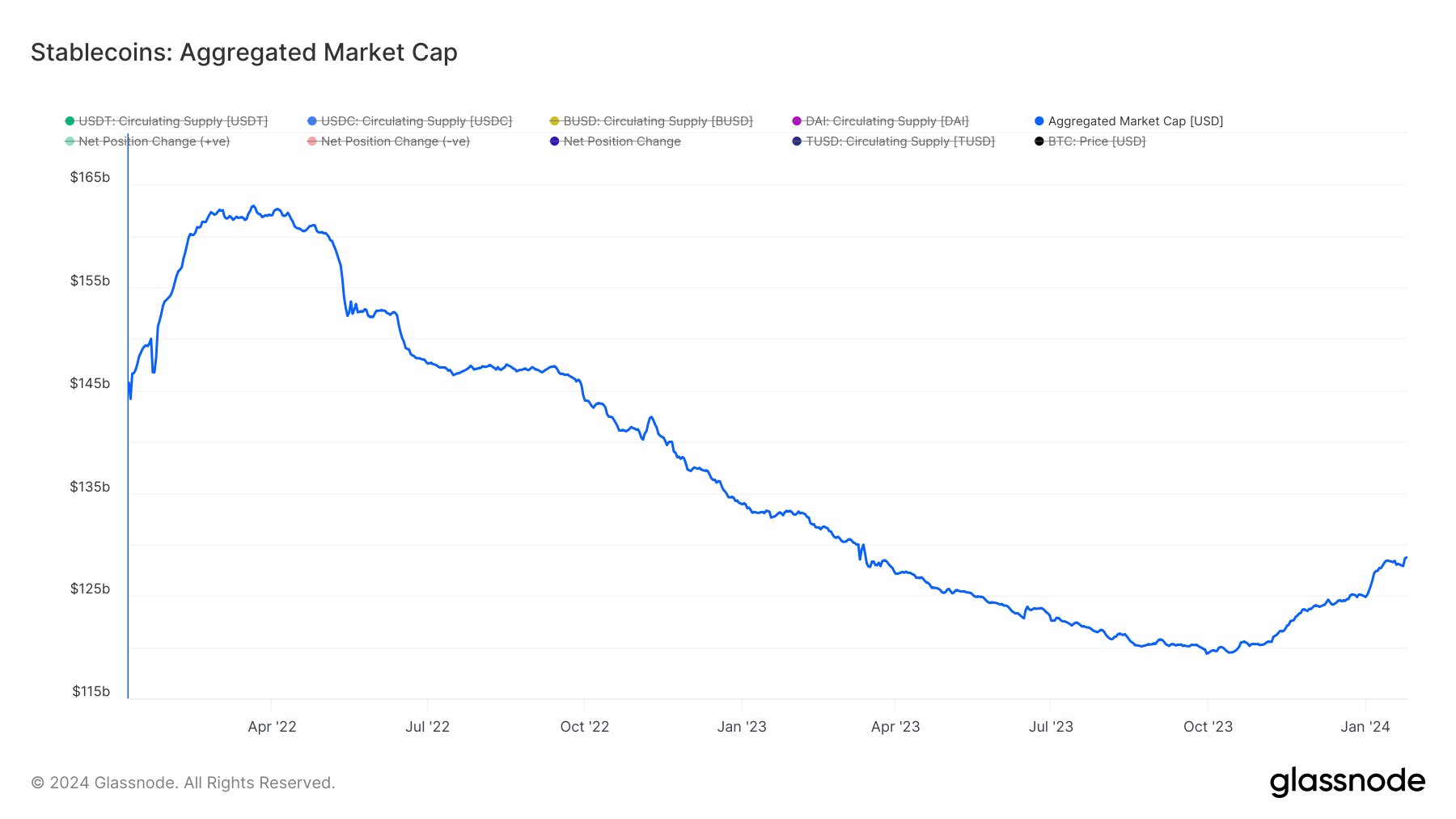

Bitcoin miner selling unit | Source: Cryptoquant#3 Stablecoins Aka “Dry Powder” On The Rise

The stablecoin aggregated marketplace headdress serves arsenic a precursor to imaginable marketplace movements. Recently, the stablecoin aggregated marketplace headdress has shown a important rebound, moving from a bottommost of $119.5 cardinal successful mid-October 2023 to nearing $130 billion.

This emergence successful stablecoin reserves is often interpreted arsenic “dry powder,” acceptable to beryllium deployed into assets similar Bitcoin, perchance further accelerating the supply/demand mechanics. Alex Svanevik, laminitis of on-chain investigation level Nansen, remarked connected the correlation betwixt stablecoin reserves and BTC price: “When stables connected exchanges peaked, BTC terms peaked.”

Stablecoins aggregated marketplace headdress | Source: X @WClementeIII

Stablecoins aggregated marketplace headdress | Source: X @WClementeIIIAt property time, BTC traded astatine $42,848.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)