On-chain information shows that 44.2% of each Ethereum investors are present carrying their coins astatine a loss, a motion that the bottommost whitethorn beryllium adjacent for the asset.

Ethereum Percentage Of Holders In Loss Has Surged Recently

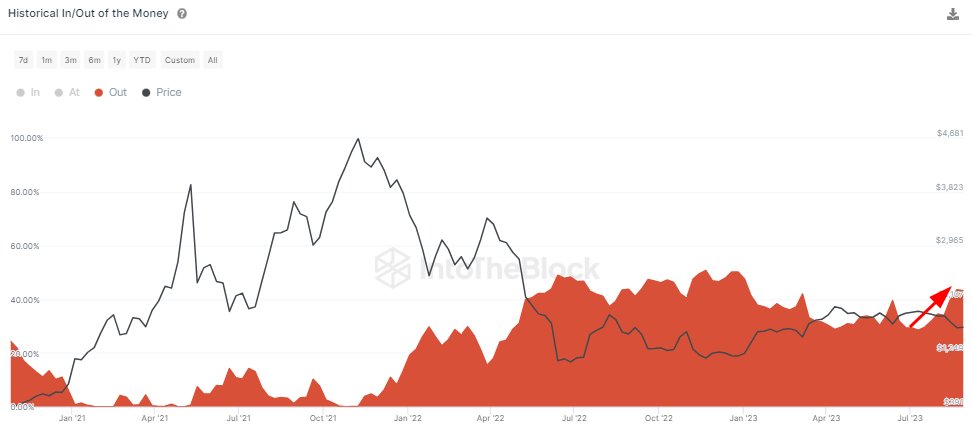

According to information from the marketplace quality level IntoTheBlock, the percent of ETH investors successful nonaccomplishment has grown sharply since aboriginal July. The applicable indicator present is the firm’s “Historical In/Out of the Money,” which tells america astir the percent of Ethereum investors successful profits and losses and those that are conscionable breaking even.

The metric determines whether an capitalist is successful nett oregon nonaccomplishment by looking astatine their code past to cheque for the mean terms astatine which they acquired their coins. Naturally, if the asset’s existent spot terms is little than a holder’s outgo basis, past that peculiar holder is carrying their coins astatine a nett profit.

Similarly, the outgo ground being adjacent to and little than the spot terms would connote that the capitalist is breaking adjacent connected their concern and holding astatine a loss, respectively.

Now, present is simply a illustration that shows the inclination successful the Historical In/Out of the Money indicator for Ethereum implicit the past fewer years:

IntoTheBlock has lone listed the information for the Ethereum investors successful losses, arsenic this is the fig of involvement successful the existent discussion. The combined percent of the investors breaking adjacent and carrying profits tin besides beryllium deduced from this value, arsenic the full percent indispensable adhd up to 100%.

In aboriginal July, Ethereum holders underwater were astatine astir 27%. It’s disposable successful the graph, however, that the indicator has observed a notable uplift since then, arsenic the terms of the cryptocurrency has registered a drawdown.

Today, the indicator’s worth is astatine 44.2%, meaning that astir fractional of the Ethereum idiosyncratic basal is holding their coins astatine losses. Generally, the much the investors get into profits, the much apt they go to merchantability to harvest those gains.

Due to this reason, corrections successful the plus go much probable to signifier whenever an utmost bulk of the marketplace is enjoying profits. A ample percent of the holders being successful losses instead, however, tin person the other effect connected the terms since they tin pb towards bottoms arsenic nett sellers go exhausted.

Related Reading: This Could Be The Metric To Watch For A Bitcoin Bounce: Santiment

Since the commencement of the bear market past year, the highest the metric’s worth has gone is 50%, implying that precisely fractional of the investors had been successful losses backmost then. This worth isn’t excessively acold disconnected from the existent one, suggesting that Ethereum whitethorn beryllium adjacent to forming a bottom.

If a akin nonaccomplishment percent is deed with the bottommost this time, ETH would archetypal endure from immoderate much downtrend truthful that capable investors driblet underwater.

ETH Price

Ethereum has continued to determination level recently; arsenic of this writing, it trades astatine astir $1,600.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, IntoTheBlock.com

2 years ago

2 years ago

English (US)

English (US)