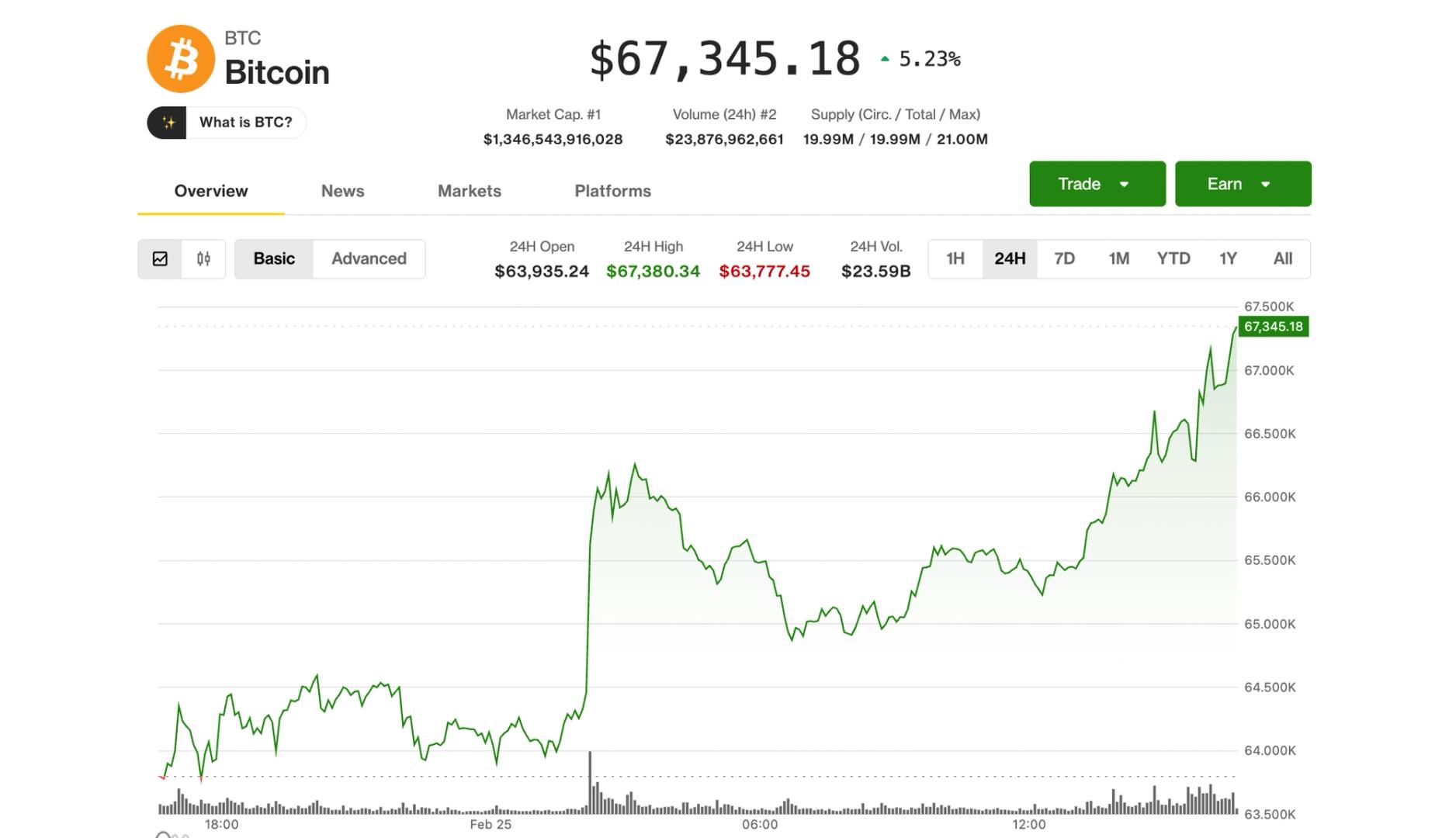

While 2022 ended connected a grim enactment with macro headwinds providing small anticipation of a revival successful 2023, the commencement of a caller twelvemonth has amazed bears with a surge successful Bitcoin (BTC), Ether (ETH) and altcoin prices. The play of sparse volatility successful the crypto marketplace appears to beryllium ending with a breakout connected the upside.

The summation has been peculiarly striking successful immoderate altcoins specified arsenic Lido (LIDO), Solana (SOL), and Cardano (ADA). The superior factors promoting the spike successful these coins are the upcoming Ethereum Shanghai update (for LIDO) and the antagonistic backing complaint successful the futures market, particularly for SOL. The antagonistic rates implies that astir traders are holding abbreviated positions, giving an accidental for whale buyers to tally their halt losses. Funding rates for immoderate different tokens stay exposed to a abbreviated squeeze.

Moreover, the caller twelvemonth has besides seen the re-emergence of the degen gambling that had taken a backmost spot aft the FTX illness successful November 2022. A meme coin terms surge is grounds of the residual degen spirit. Technically, the full marketplace capitalization of altcoins has surpassed a cardinal method absorption level arsenic bullish momentum builds.

While the sustainability of the bull tally is questionable owed to the broader inclination remaining bearish, the fledgling uptrend could inactive bring immoderate symptom for precocious sellers. The 5 superior factors influencing altcoin prices are:

Job marketplace information revives the anticipation of a brushed landing

Defying the Dow’s estimation for 200,000 nonfarm payrolls and marketplace expectations of a slowdown, labour marketplace information from December 2022 showed a 230,000 oregon 0.2% summation successful employment.

A beardown jobs marketplace goes against the prevalent recession claims and acts arsenic a catalyst for a risk-on rally. The user ostentation terms (CPI) speechmaking for December 2022 coming retired connected Jan. 12 volition beryllium instrumental successful either gathering connected the newfound bullish sentiment oregon returning to antagonistic sentiments.

If ostentation continued its downtrend, with December's CPI people beneath 7.7%, past the market's assurance successful a soft-landing could increase. However, if ostentation roseate successful December, past the chances of a higher complaint hike successful the U.S. Federal Reserve gathering toward the extremity of January risks a steep correction.

Traders hunt for perpetual swaps with antagonistic backing rates

As the spot trading volume and liquidity connected cryptocurrency exchanges dried up toward the year-end, particularly during the vacation season, futures markets gained much power successful moving the prices. A contrarian terms absorption against a crowded commercialized presumption is highly likely.

Solana's latest surge successful prices is wide grounds of short-squeeze driving prices. Over the weekend, $200 cardinal successful SOL shorts were liquidated arsenic its terms surged implicit 27% from Jan. 6 debased of $13. According to autarkic market analyst Alex Kurger, “SOL inactive has country to spell but the outperformance signifier is mostly behind.”

Funding complaint for SOL perpetual swaps. Source: Coinglass

Funding complaint for SOL perpetual swaps. Source: CoinglassWhile Solana’s pump mightiness beryllium adjacent to over, the bulk of traders are inactive nett abbreviated connected galore altcoins similar Apecoin (APE), Tron (TRX), Bitcoin Cash (BCH), and Gala Games (GALA). This provides an accidental for buyers to propulsion the terms up and hunt the stop-loss liquidity of perpetual swap sellers.

Funding complaint for altcoins crossed crypto exchanges. Source: Coinglass

Funding complaint for altcoins crossed crypto exchanges. Source: CoinglassMeme coins pump, past dump

In the archetypal week of January 2023, a Solana-based meme coin named BONK experienced a whooping 25x surge. The emergence symbolized the degenerate gambling tone that was prevalent during the 2021 to 2022 bull run. Bear markets, connected the different hand, thin to beforehand caution among traders.

Despite BONK’s eventual terms collapse, the palmy pump-and-dump playout of meme coins similar it suggest that immoderate traders are inactive indulging successful high-risk plays.

BONK terms chart. Source: CoinGecko

BONK terms chart. Source: CoinGeckoPositive method breakout

The altcoin marketplace capitalization broke supra the 50-day exponential moving mean (EMA) astatine $465 billion. Buyers volition apt people the 100-day EMA astatine $563 billion—an expected mean 20% summation crossed the tokens. Technical traders would look to pat these cardinal levels earlier reversal begins.

The comparative spot indicator (RSI) for altcoin marketplace capitalization besides moved into bullish territory, expanding supra the 60-point resistance. Furthermore, if buyers physique enactment supra the 50-day EMA with affirmative volumes, the short-term uptrend could widen toward the extremity of Q1 2023.

Total marketplace capitalization of altcoin (excluding Bitcoin). Source: TradingView

Total marketplace capitalization of altcoin (excluding Bitcoin). Source: TradingViewHistorical trends and affirmative sentiment spike

The sustainability of the bullish altcoin tally is questionable, particularly since the underlying inclination remains bearish. It’s hard to place the cardinal catalyst supporting this bull run, and Bitcoin’s terms trades beneath the absorption betwixt $18,200 and $19,000. Thus, the uptrend volition apt slice arsenic buyers get exhausted.

If we look astatine erstwhile crypto cycles, altcoins outperformed Bitcoin successful a bull run, and the pursuing cooldown play saw a cross-over with Bitcoin starring the crypto marketplace gains.

The caller parabolic tally of 2021 played retired similarly, with altcoins outperforming Bitcoin. However, the correction play hasn’t seen a wipeout of the altcoin marketplace comparative to Bitcoin.

Both altcoin marketplace capitalization and Bitcoin’s terms person mislaid 75% of their worth from the peak, arsenic opposed to altcoin losses surpassing Bitcoin.

Altcoins outperform Bitcoin during bull markets. Source: TradingView

Altcoins outperform Bitcoin during bull markets. Source: TradingViewAn objection to the supra regularisation tin beryllium owed to Ether’s expanding dominance successful the market. Ethereum has maintained its marketplace dominance astir 20% with method breakthroughs specified arsenic the displacement to a energy-friendly proof-of-stake mechanics and reduced ostentation supporting its terms powerfully contempt the antagonistic trend. Still, a deeper correction successful the broader altcoin marketplace capitalization cannot beryllium ruled out.

Bitcoin (orange) Ethereum (blue) dominance implicit the crypto market. Source: TradingView

Bitcoin (orange) Ethereum (blue) dominance implicit the crypto market. Source: TradingViewLately, societal media circles person witnessed a revival of affirmative sentiment. Santiment information shows that the societal media mentions of keywords similar “buy the dip” and “bottom” spiked connected platforms similar Twitter, Reddit, and Telegram. Usually, a affirmative sentiment spike is simply a apical indicator suggesting a reversal of the bullish terms trend.

Social media measurement for “buy the dip” and “bottom” cardinal words. Source: Santiment

Social media measurement for “buy the dip” and “bottom” cardinal words. Source: SantimentOne of the archetypal hurdles volition beryllium supporting the terms aft a wipeout of abbreviated orders. Being 1 of the archetypal tokens to surge, Solana and Cardano could supply clues that constituent toward the extremity of the uptrend.

If the terms of SOL breaks beneath enactment astatine $14.33 with a simultaneous driblet beneath $0.30 for ADA, it could beryllium a informing motion of the bull’s exhaustion.

At the aforesaid time, tokens similar LIDO that payment from the liquid staking derivative communicative could proceed to emergence until Ethereum halfway developers instrumentality the Shanghai upgrade. Macro marketplace movers specified arsenic the CPI people and Bitcoin’s terms enactment volition besides play a important relation successful sustaining an altcoin bull run.

The views, thoughts and opinions expressed present are the authors’ unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

3 years ago

3 years ago

English (US)

English (US)