The cryptocurrency marketplace has been deed with different question of sell pressure arsenic some the Bitcoin and Ethereum prices plunged sharply, triggering widespread panic and uncertainty. With implicit $536 cardinal successful Spot Bitcoin ETF outflows successful a azygous day, the downturn has sparked renewed fears of an extended bearish phase. Analysts are calling this correction a “Bloody Friday,” a little but inactive terrible reflection of past week’s brutal selloff that wiped billions successful the marketplace and saw BTC and ETH spiraling downwards.

ETF Outflows Trigger Bitcoin And Ethereum Price Crash

The caller clang successful Bitcoin and Ethereum prices is being attributed to caller large-scale outflows from US Spot Bitcoin ETFs. Crypto expert Jana connected X societal media described the lawsuit arsenic 1 of the bloodiest play downturns of the quarter, with Bitcoin tumbling 13.3% successful 7 days and Ethereum sliding 17.8% implicit the past month. At property time, Bitcoin is trading somewhat supra $106,940 portion Ethereum sits astir $3,870, some suffering steep retracements from their caller highs.

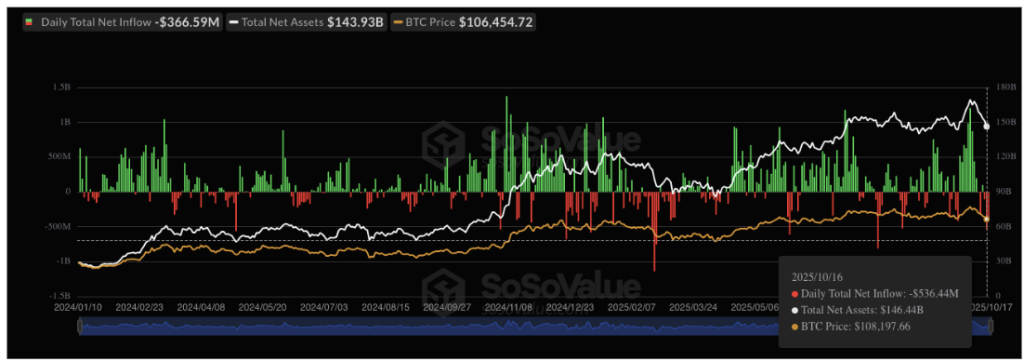

Data from SoSoValue shows that Thursday, October 16, saw a staggering $536.4 cardinal successful regular nett outflows from Spot Bitcoin ETFs, marking the largest single-day antagonistic travel since August 1, erstwhile $812 cardinal exited the market. Out of twelve US Bitcoin ETFs, 8 registered large outflows, led by $275.15 cardinal leaving Ark & 21Shares’ ARKB, followed by $132 cardinal from Fidelity’s FBTC. Notably, funds managed by different large companies similar Grayscale, BlackRock, Bitwise, VanEck, and Valkyrie besides reported important withdrawals.

These persistent outflows person present stretched into their 3rd consecutive day, with October 17, conscionable a time ago, signaling a monolithic outflow of $366.5 million. The sustained antagonistic ETF flows underscore waning capitalist assurance and suggest that the broader marketplace downturn could proceed successful the adjacent term. Combined with the $19 cardinal liquidation event past Friday, accrued outflows successful ETFs could enactment much selling unit connected the already fragile market.

Experts Warn Of Deeper Market Pain Ahead

Many experts judge that the crypto marketplace whitethorn inactive person more country for a decline. Data from Polymarket, 1 of the world’s largest prediction platforms, show that 52% of participants expect Bitcoin to driblet beneath $100,000 earlier the extremity of October. Veteran economist and Bitcoin professional Peter Schiff has besides warned that the coming months could beryllium catastrophic for the industry, predicting wide bankruptcies, defaults, and layoffs arsenic Bitcoin and Ethereum look different large limb down.

Meanwhile, method analysts are pointing to signs of deeper weakness successful Ethereum’s structure. According to Crypto Damus, Ethereum has breached cardinal play enactment and is displaying a bearish setup connected the charts. He says that MACD is astir to “cross red,” leaving a important magnitude of country for a crash.

Other analysts similar Marzell person echoed akin concerns, stating that Ethereum is present nearing a “crash zone.” However, helium besides highlighted the $3,690 – $3,750 scope arsenic a imaginable short-term request country wherever buyers could measurement successful again and trigger the adjacent limb up.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)