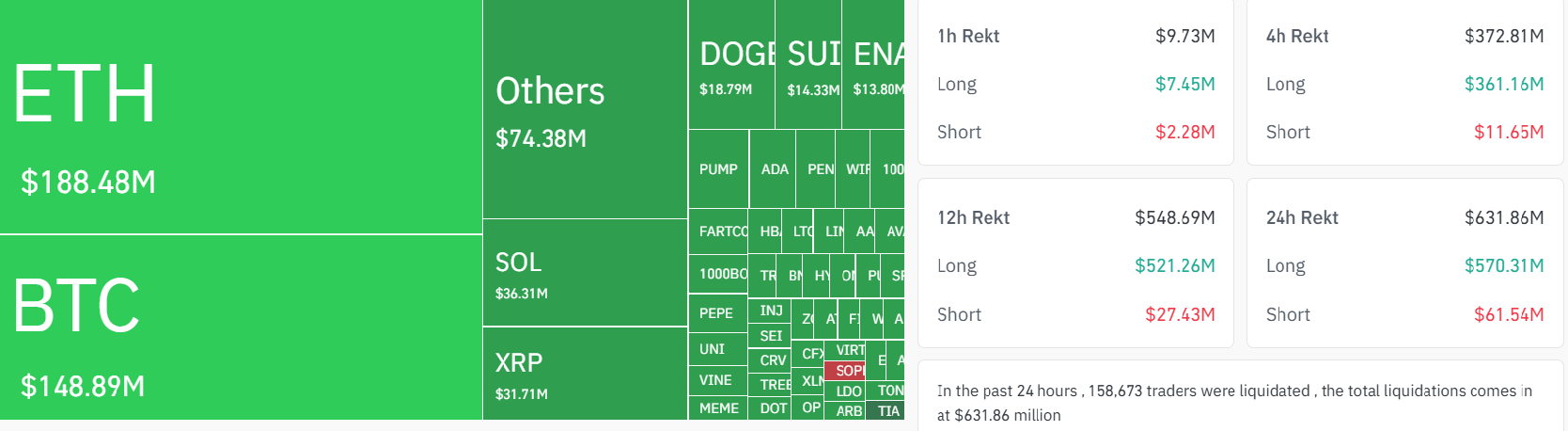

Crypto markets experienced a crisp bout of volatility implicit the past 24 hours, with much than $630 cardinal successful leveraged positions liquidated crossed exchanges.

The bulk of the harm came from longs, which accounted for implicit $580 cardinal of full liquidations, arsenic traders were caught offside during an abrupt intraday sell-off.

Bitcoin (BTC) dropped to $115,200, erasing immoderate of its caller gains but inactive maintaining a comparatively unchangeable posture compared to different majors. Its dominance roseate somewhat arsenic altcoins bore the brunt of the correction.

Ether (ETH) fell to $3,687, portion XRP (XRP) retraced nether $3 contempt beardown caller headlines. Solana (SOL) pulled backmost to $170, and BNB (BNB) eased to $780 aft a grounds tally past week that punted it supra $855.

Coinglass information shows the largest azygous liquidation was a $13.7 cardinal ETH agelong connected Binance.

Liquidations hap erstwhile traders utilizing leverage (borrowed funds) are forcibly closed retired of their positions due to the fact that their collateral falls beneath required attraction thresholds. This typically amplifies terms volatility, particularly successful abbreviated timeframes, arsenic liquidated positions make abrupt selling oregon buying unit depending connected the broadside of the trade.

For traders, liquidation information provides penetration into marketplace sentiment and hazard of positioning. High liquidation totals — peculiarly concentrated successful 1 absorption (e.g., longs) — often awesome overextended positioning. This tin bespeak imaginable inflection points oregon impending reversals arsenic the marketplace resets.

Tracking real-time liquidation heatmaps and backing rates tin assistance traders place areas of forced selling oregon buying, often astir cardinal support/resistance levels, clip entries oregon exits during high-volatility zones and gauge marketplace leverage and risk-on/off behavior

Speculative altcoins were peculiarly affected. Solana-ecosystem tokens specified arsenic Fartcoin (FART), Pump.fun (PUMP) and Jupiter (JUP) each faced steep intraday corrections.

“We observe that tokens similar Fartcoin and Pump.fun are little aligned with broader marketplace beta and much reflective of high-volatility, sentiment-driven microcycles,” said Ryan Lee, Chief Analyst astatine Bitget, said successful a Telegram message.

“The caller corrections — FART dropping 14% to retest its 100-day EMA adjacent $1, JUP losing enactment astatine its 200-day EMA, and PUMP continuing its descent wrong a descending transmission — look to stem from profit-taking and waning short-term momentum, not from a systemic marketplace shift.”

Lee added that Bitcoin’s comparative strength, supported by ETF inflows and macroeconomic stability, reinforces the presumption that the pullback is isolated, not broad-based.

Bitcoin holding supra $115,000 remains the market’s anchor. Unless that level breaks, the broader operation stays intact.

2 months ago

2 months ago

English (US)

English (US)