In an investigation shared connected X, crypto expert Patric H. from CryptelligenceX outlines 7 reasons wherefore investors should beryllium bullish astir the Bitcoin terms trajectory this week. “How tin anyone beryllium bearish here?! BTC broke the play downtrend, closing supra cardinal levels, and immoderate radical inactive telephone for sub-$40k?! Sorry, bears, you intelligibly missed the cardinal changes of the past 2 weeks,” helium states.

#1 Mt. Gox Bitcoin Repayment Deadline Extension

The defunct speech Mt. Gox has filed for a alteration successful its repayment deadline, which has been approved by the court. The caller deadline to refund the remaining creditors is present acceptable for October 31, 2025, a afloat twelvemonth aboriginal than the antecedently scheduled October 2024. This hold removes the contiguous marketplace selling unit of astir 44,905 BTC (around $2.9 billion), which was anticipated to flood the market.

#2 China’s Economic Stimulus

China is acceptable to contented $325 cardinal successful bonds to stimulate its economy. Concurrently, crypto speech OKX has launched a afloat licensed trading level successful the United Arab Emirates (UAE), offering a ineligible avenue for Chinese investors to prosecute successful cryptocurrency trading nether UAE jurisdiction. Patric H. predicts, “Chinese wealth is gonna participate crypto successful Q4.”

#3 Declining Bitcoin Exchange Reserves

Bitcoin speech reserves proceed to dwindle arsenic organization investors and whales accumulate the cryptocurrency astatine unprecedented rates. This inclination indicates a proviso shortage connected exchanges, which, coupled with expanding demand, could pb to a proviso shock. “Eventually, this volition origin a supply shock, starring to higher prices successful owed time,” notes the analyst.

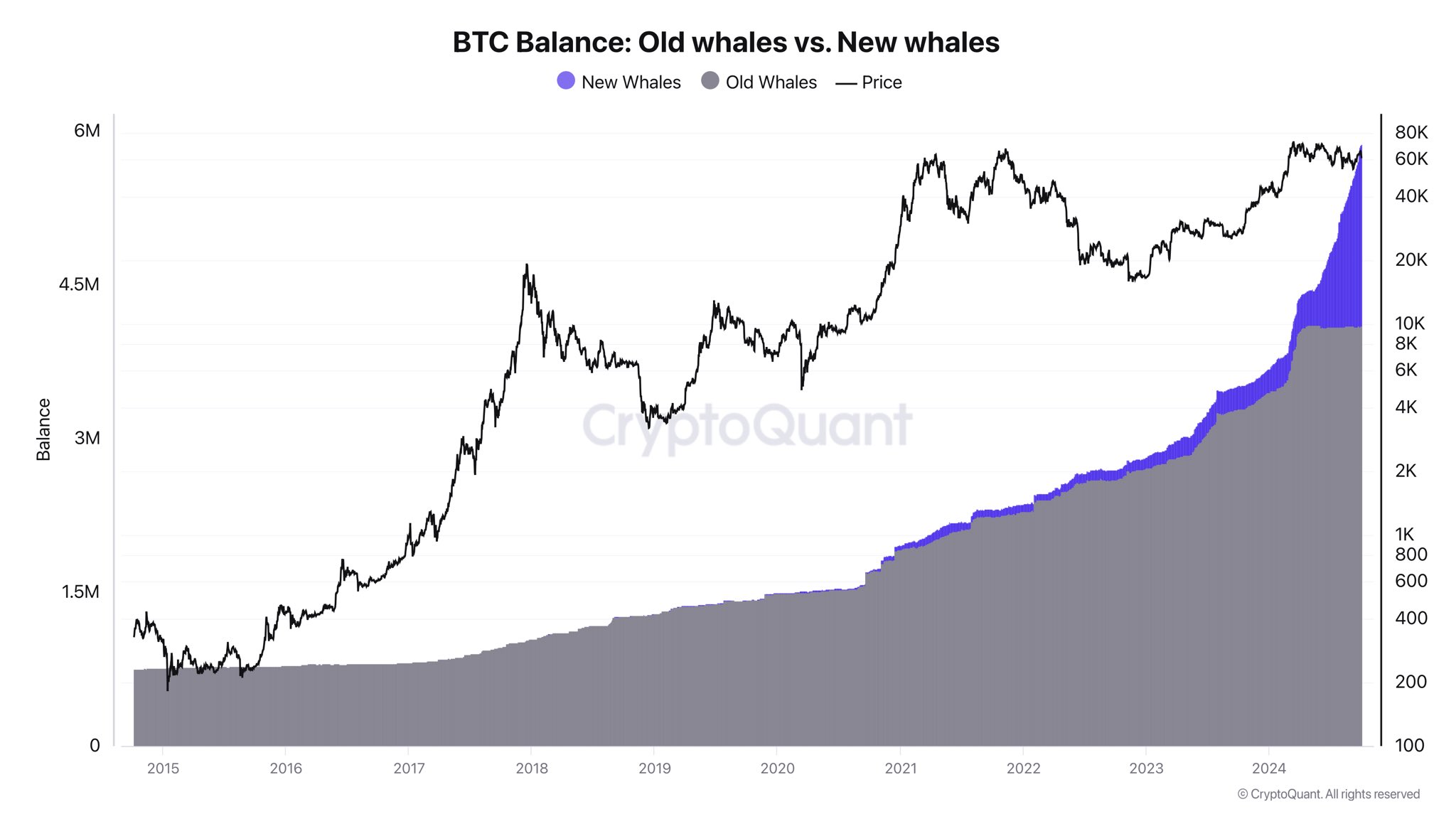

#4 Surge In Bitcoin Whale Accumulation

On-chain information reveals that caller Bitcoin whales are accumulating assets similar ne'er before. Ki Young Ju, CEO and laminitis of CryptoQuant recently, commented, “The existent marketplace volatility is conscionable a crippled successful the futures market. Real whales determination the marketplace done spot trading and OTC markets. That’s wherefore on-chain information is crucial.”

He added that these caller whales are improbable to merchantability until important liquidity from retail investors enters the market. “Look astatine however fiercely the caller whales are stacking Bitcoin; this marketplace has ne'er seen specified accumulation,” helium emphasized. Notably, the deficiency of correlation with the US spot ETF inflows suggests that these could beryllium strategical organization accumulations.

Old Bitcoin whales vs. caller whales | Source: X @CryptelligenceX

Old Bitcoin whales vs. caller whales | Source: X @CryptelligenceX#5 Trump Is Leading The Polls

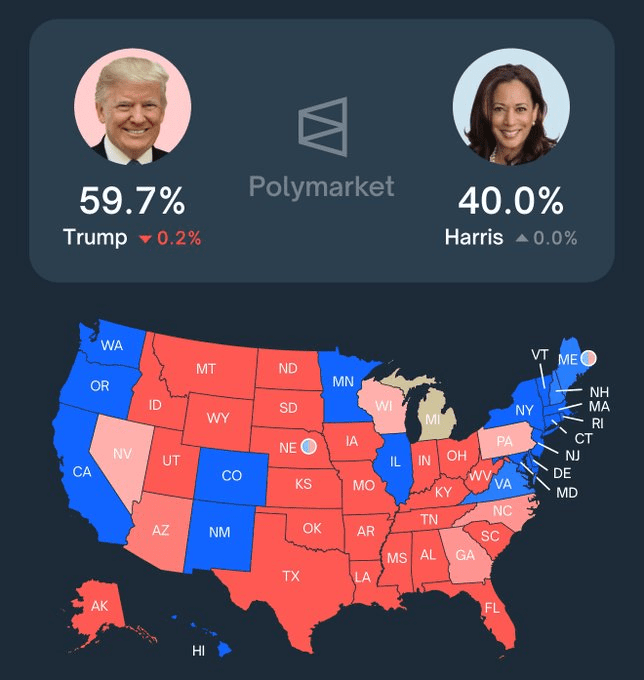

Political forecasts bespeak that erstwhile US President Donald Trump is gaining favour successful plaything states up of the upcoming elections. According to Polymarket’s latest data, Trump is projected to triumph each 7 cardinal plaything states. Patric H. reminds readers, “Trump is pro-crypto; Elon Musk volition pb a Department of Government Efficiency (DOGE).”

Polymarket likelihood Trumps vs. Harris | Source: X @CryptelligenceX

Polymarket likelihood Trumps vs. Harris | Source: X @CryptelligenceX#6 S&P 500 As Trailblazer

The S&P 500 scale is trading astatine an all-time high, historically signaling affirmative momentum for Bitcoin and crypto. “There has not been a clip successful past erstwhile Bitcoin and the altcoins marketplace did not drawback up to the show of the S&P 500,” Patric H. points out, dismissing skepticism with, “But ‘this clip is different’… yeah, sure.” The correlation betwixt accepted markets and cryptocurrencies suggests that bullish trends successful equities could spill implicit into the Bitcoin and crypto sector.

#7 Seasonality

Historically, the 4th fourth (Q4) has been the most bullish period for Bitcoin, particularly successful halving years. “Bitcoin and the crypto marketplace thin to outperform each plus classes successful a halving year,” argues the analyst.

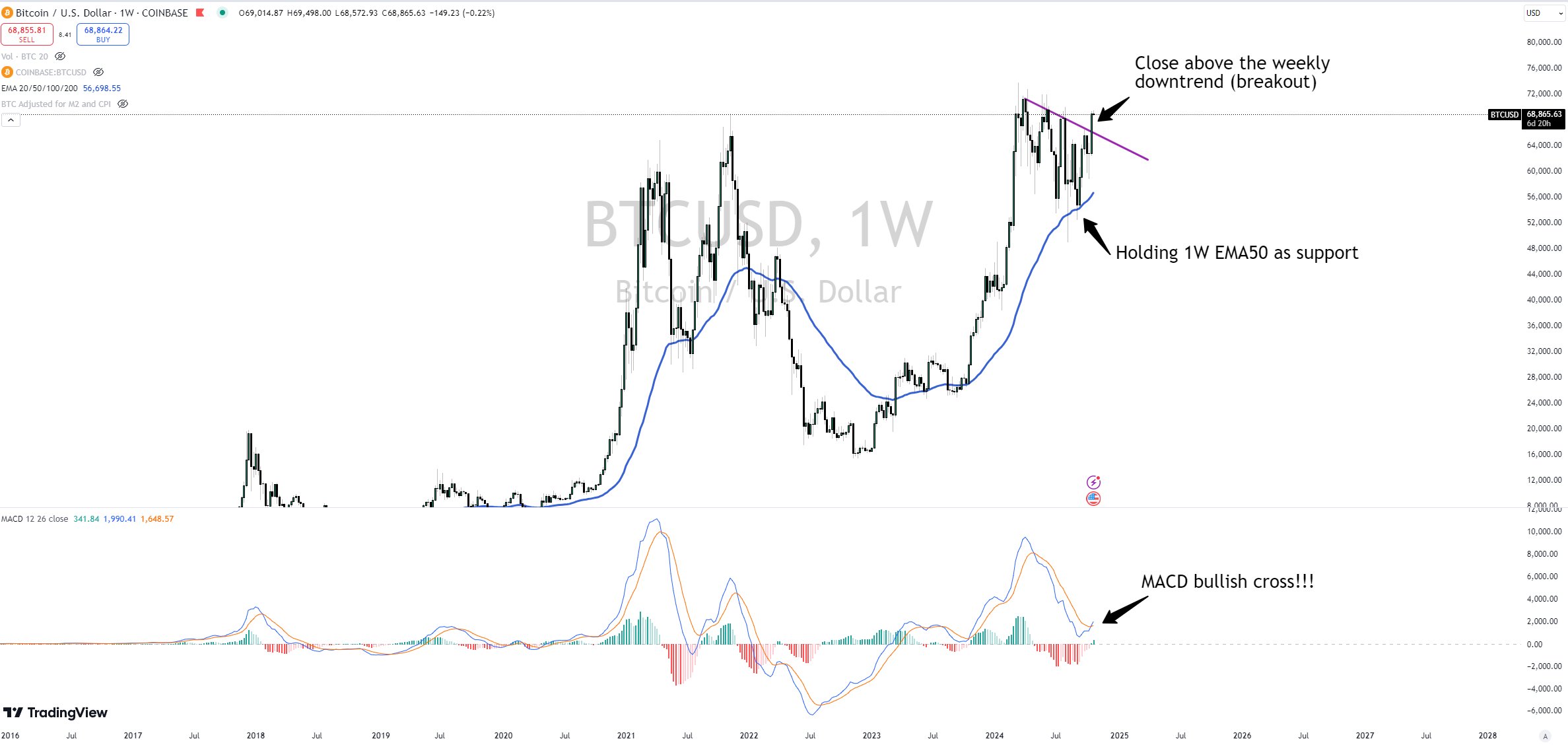

Supporting these cardinal reasons, method investigation besides paints a affirmative representation for Bitcoin. Patric H. highlights that Bitcoin has closed supra its play downtrend line, signaling a imaginable reversal from bearish to bullish momentum. Moreover, the cryptocurrency is holding firmly supra the 50-week Exponential Moving Average (EMA), a captious enactment level. Also, the Moving Average Convergence Divergence (MACD) indicator has made a bullish transverse for the archetypal clip since April, often interpreted arsenic a bargain signal.

Bitcoin play illustration (BTC/USD) | Source: X @CryptelligenceX

Bitcoin play illustration (BTC/USD) | Source: X @CryptelligenceX“Yes, determination volition beryllium pullbacks each present and then. But from present on, dips are for buying arsenic the marketplace operation intelligibly shifted from a downtrend to an uptrend,” Patric concludes.

At property time, BTC traded astatine $68,397.

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)