A survey of 835 organization traders from 60 antithetic planetary locations revealed that 72% person nary plans for crypto trading successful 2023, according to information released by JPMorgan.

According to the survey, astir traders had nary involvement successful crypto trading due to the fact that of marketplace volatility. 46% of the traders said volatile markets’ would beryllium their top regular trading situation successful 2023, portion 22% said liquidity availability would beryllium the astir important issue. Others cited issues similar regulatory change, information availability, terms transparency, etc.

Source: JPMorgan

Source: JPMorganThe traders’ decisions could person been influenced by the crypto market’s grounds mediocre show successful 2022. In the past year, Bitcoin (BTC) and different integer assets traded astatine record lows, and the manufacture besides saw the capitulation of respective crypto firms.

The survey showed that 8% of the traders presently commercialized crypto, portion 6% program connected trading wrong the pursuing year. The remaining 14% revealed plans to commencement trading wrong the adjacent 5 years.

Meanwhile, contempt the traders’ reluctance astir crypto, they predicted that the plus people would spot 1 of the astir important increases successful physics trading volumes implicit the adjacent year.

The starring fiscal instauration asked these traders astir their trading plans and factors that could interaction them successful a survey conducted betwixt Jan. 3 and Jan. 23.

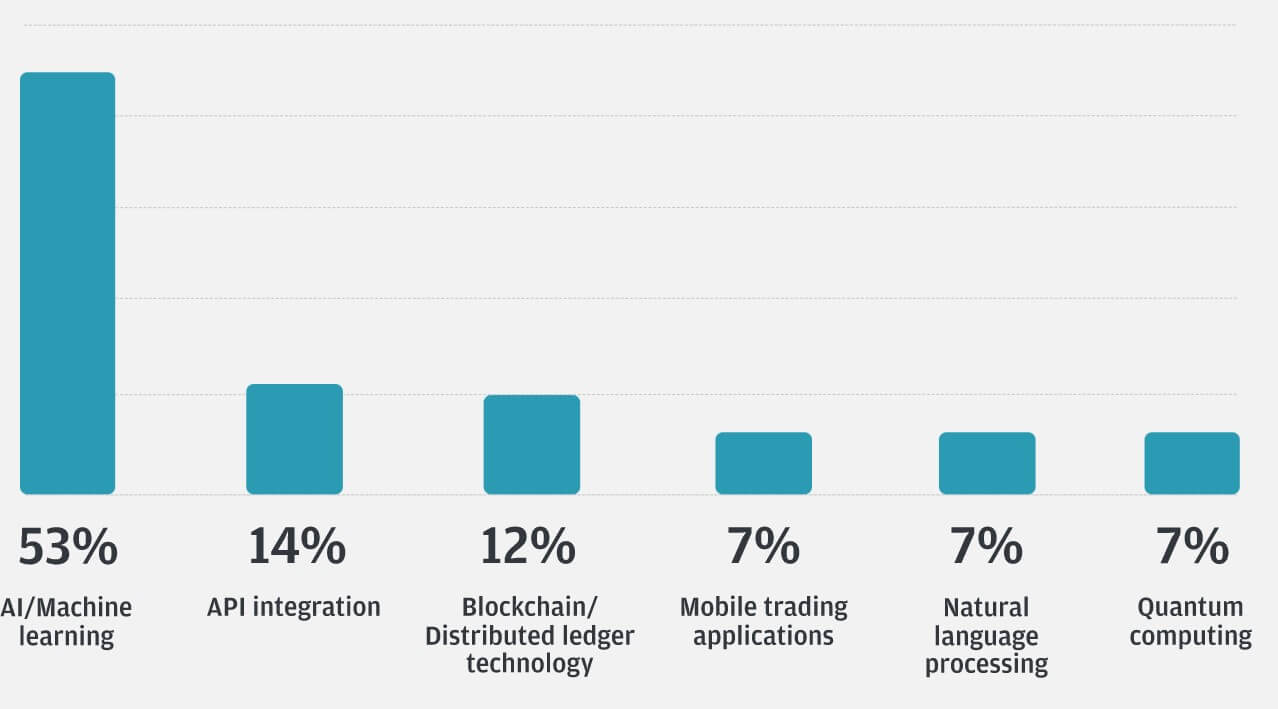

Blockchain and AI is among the apical 3 exertion to signifier the aboriginal of trading

According to the poll, 53% deliberation Artificial Intelligence and Machine Learning would play the astir important relation successful shaping the aboriginal of trading implicit the adjacent 3 years. On the different hand, 12% deliberation aboriginal trading volition beryllium shaped by blockchain technology.

Source: JPMorgan

Source: JPMorganThis starkly contrasts with the canvass results successful 2022, erstwhile blockchain exertion and AI received 25% of each votes, respectively.

Over the past year, involvement successful AI exertion has soared importantly with the advancements successful OpenAI’s ChatGPT.

Macroeconomic factors

On macroeconomic factors that could interaction their trades, the traders judge a recession poses the astir important hazard to the marketplace successful 2023, followed intimately by fears of ostentation and geopolitical conflicts. In 2022, the traders’ biggest interest was inflation.

Meanwhile, astir fractional of the traders expect ostentation levels to decrease, portion 37% expect it to level off. 19% of them deliberation ostentation volition support rising.

Inflation levels rose to a 40-year precocious successful 2022, forcing fiscal regulators worldwide to hike their involvement rates continuously.

The station 72% of organization traders person nary plans to commercialized crypto, JPMorgan survey appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)