A monolithic crypto presumption opened by a high-net-worth holder has traders debating whether a short, crisp bounce is coming — oregon if the marketplace is mounting up for much pain. According to on-chain trackers, an $11 cardinal Bitcoin whale precocious sold assets and placed astir 3 quarters of a cardinal dollars connected bets for higher prices successful Bitcoin, Ether and Solana.

Whale Opens Massive Longs

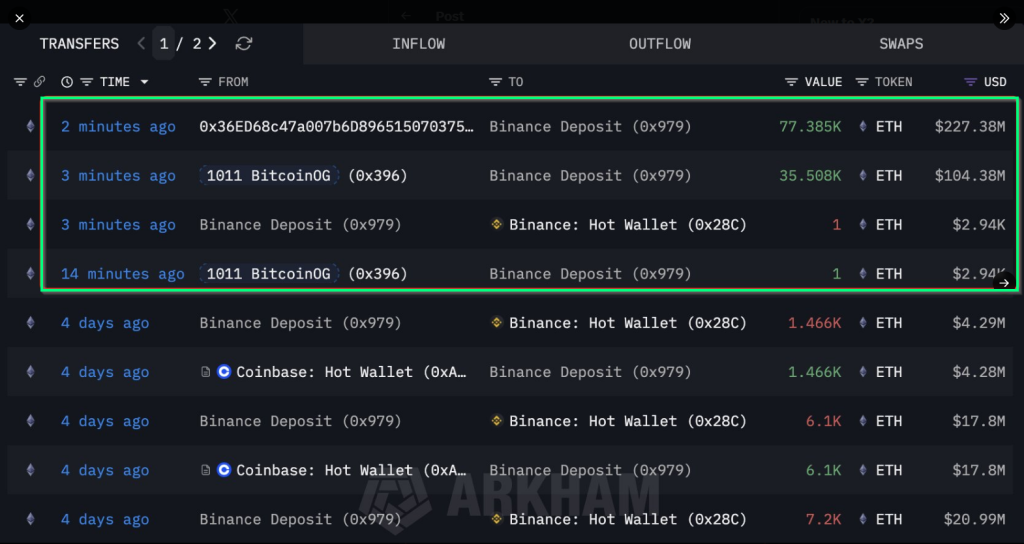

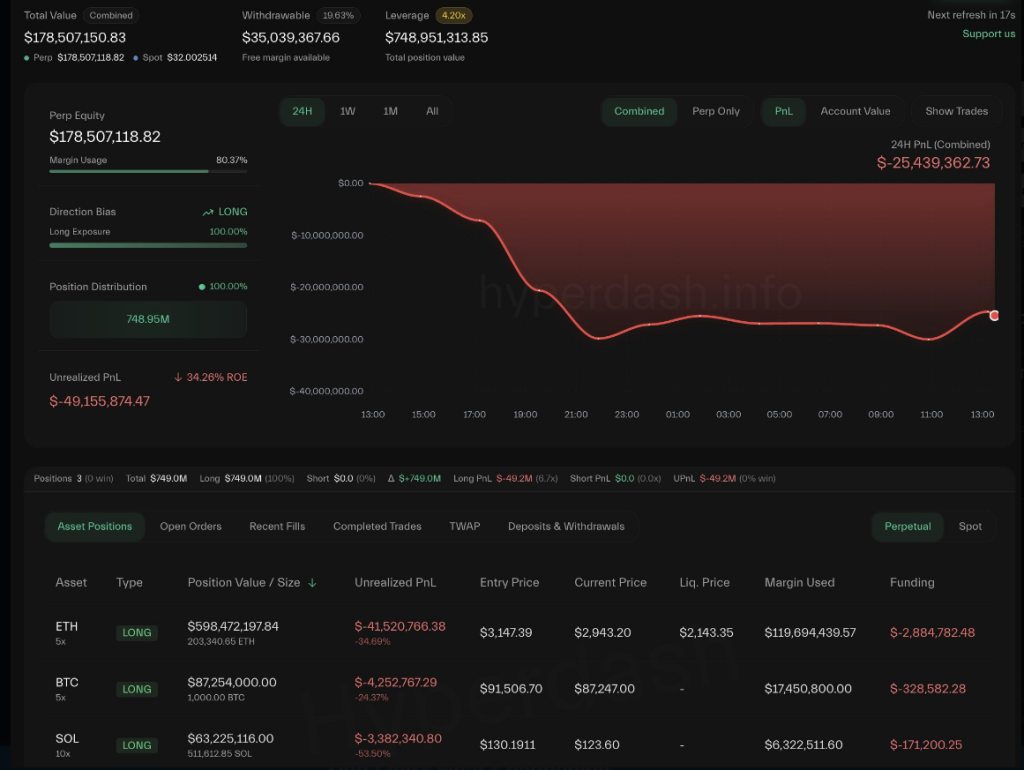

Based connected reports by Lookonchain, the wallet sold astir $330 cardinal worthy of Ether earlier opening 3 leveraged agelong positions totaling $748 million. The azygous biggest presumption is simply a $598 cardinal agelong connected Ether opened astatine $3,147 with a liquidation trigger nether $2,143.

The aforesaid reports database introduction prices adjacent BTC $87,883 and SOL $124.43 for the different parts of the bet. At the clip of the trades, Ether was trading astir $2,975. The whale is carrying adjacent to $50 cardinal successful unrealized losses connected those leveraged bets, according to the on-chain data.

BREAKING!

The #BitcoinOG(1011short) with a monolithic $749M agelong presumption successful $BTC, $ETH, and $SOL, conscionable deposited 112,894 $ETH($332M) into #Binance again.https://t.co/rM9dXV3Ln4https://t.co/Fsi6okD47f pic.twitter.com/qVlZ4c6Htx

— Lookonchain (@lookonchain) December 30, 2025

Smart Money Still Cautious

Reports person disclosed that different whale addresses besides piled into spot Ether astir the aforesaid window. One thread of transactions shows astir $5B of Bitcoin moved into Ether holdings since August, with an earlier swap that saw $2.59B of BTC exchanged for $2.2 cardinal successful spot ETH and a $577M perpetual long.

In 1 burst of activity, 9 ample addresses added a combined $456 cardinal successful ETH wrong a day. Nansen information shows 19 wallets collecting a full of 7.43 cardinal spot ETH successful caller weeks.

Nansen’s information tells a precise antithetic story. Based connected figures from the analytics firm, high-performing traders reduced their bullish Ether positions by $6.5 cardinal successful a azygous time and are present holding nett abbreviated positions of $121 cardinal connected ETH.

The aforesaid radical is besides betting little connected Bitcoin, with $192 cardinal successful abbreviated exposure, and connected Solana, totaling $74 million. While ample holders buying connected the spot marketplace tin propulsion prices higher successful the abbreviated run, experienced traders look to beryllium bracing for further weakness alternatively than a sustained determination up.

Year-End Rally Failed As Liquidity Thinned

Bitcoin and Ether ended December without the expected year-end rally, highlighting the fragility of crypto markets erstwhile liquidity is debased and hazard appetite declines. Repeated attempts by Bitcoin to reclaim cardinal levels were unsuccessful, and the 4th closed with antagonistic show portion precious metals specified arsenic golden posted gains.

The marketplace is present watching whether the alpha crypto tin clasp enactment into the caller year; the failed rally whitethorn mean a deeper reset is needed earlier a sustained recovery.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)