The crypto system has shed tremendous worth implicit the past 3 months and the starring crypto plus bitcoin is down much than 46% since it’s all-time precocious (ATH) astatine $69,044 per unit. The aforesaid tin beryllium said for a large fig of integer currencies arsenic the alleged crypto carnivore marketplace has lasted 78 days truthful far.

78 Days Into the Current Downturn, Crypto Supporters Question How Long the Bear Market Will Last

At the clip of writing, a large fig of crypto proponents are wondering whether oregon not the existent crypto system downturn is simply a carnivore market. Following a phenomenal 2021, bitcoin’s terms fell aft reaching a $69K ATH connected November 10, and due to the fact that BTC’s worth has been good beneath 20% from the ATH for a prolonged play of time, astir presume this is simply a carnivore market.

BTC/USD Weekly illustration via Bitstamp connected January 27, 2022.

BTC/USD Weekly illustration via Bitstamp connected January 27, 2022.If we are to number the days betwixt present and BTC’s past ATH, it would beryllium astir 78 days. Currently, bitcoin is much than 46% down from the $69K ATH and ethereum (ETH) is down 48% little than its $4,878 ATH.

ETH/USD Weekly illustration via Bitstamp connected January 27, 2022.

ETH/USD Weekly illustration via Bitstamp connected January 27, 2022.If we are to presume the crypto system is successful a carnivore marketplace pursuing BTC’s ATH, 78 days is simply a batch shorter than the agelong crypto carnivore markets of the past. Bitcoin’s carnivore tally successful July 2013 lasted 89 days and aft the ATH successful 2013, the pursuing crypto carnivore marketplace was extended for 406 days.

In 2017, aft BTC tapped an ATH astatine conscionable beneath $20K per unit, the pursuing carnivore marketplace lasted 251 days until prices started to crook bullish again. 2017 was fueled by the archetypal coin offering (ICO) boom, which largely deflated erstwhile galore of the projects were recovered to beryllium vaporware.

Questioning the Crypto Industry’s Maturity, Downturn Is the Second Deepest Drawdown successful This Halving Cycle

This clip around, galore radical judge the crypto manufacture has matured a large woody and decentralized concern (defi) projects, Web3, and non-fungible token (NFT) exertion person seen a roar implicit the past 12 months. While each 3 person go billion-dollar industries, crypto supporters don’t cognize however galore of them volition really go coagulated foundations successful the blockchain sphere.

There’s been important criticism toward Web3 and much than $60 cardinal has left the defi system since November 2021. During the past 7 days, NFT income person dropped 5.73% according to today’s metrics.

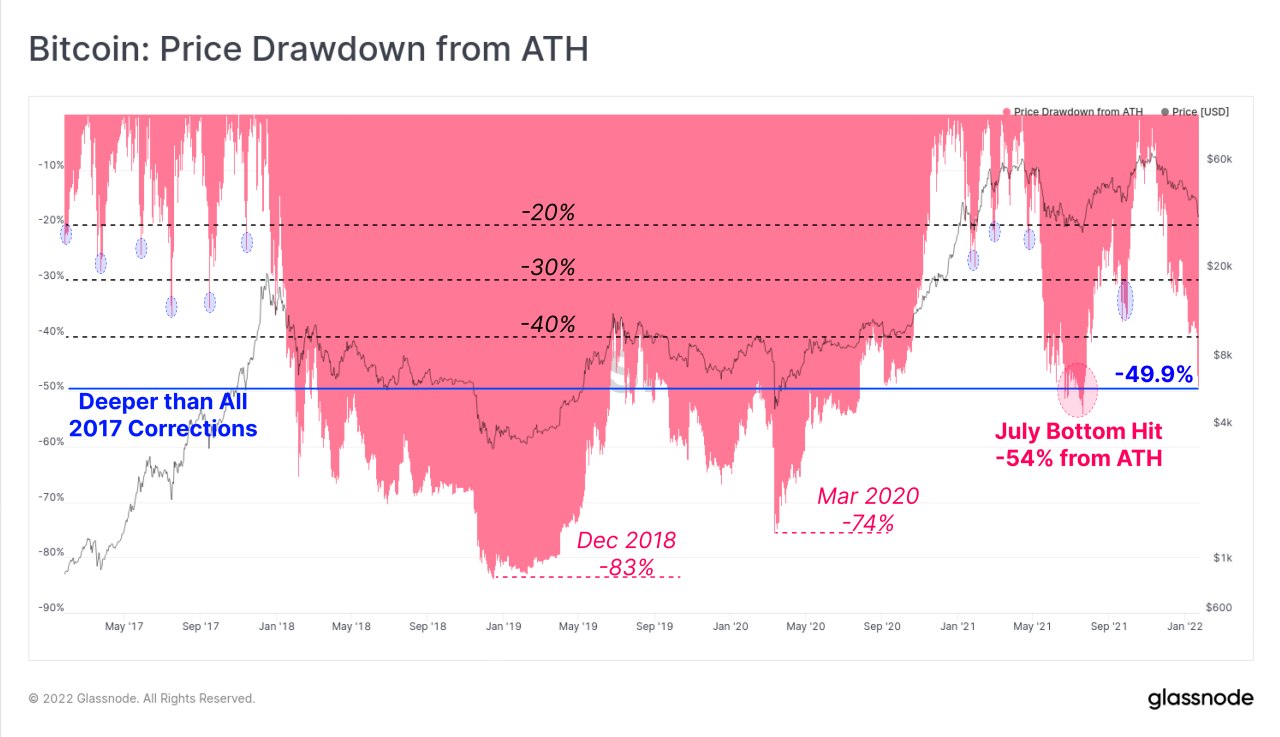

Metrics shared by Glassnode’s Telegram transmission connected January 23, 2022.

Metrics shared by Glassnode’s Telegram transmission connected January 23, 2022.It’s assumed the crypto industry’s maturity, its bundle applications, and the existent involvement successful blockchain tech is simply a batch much robust than successful 2017. Meanwhile, bitcoin already had a tiny carnivore tally successful betwixt its 2021 April ATH and the mid-November ATH of 97 days. All of the past downturns person been overmuch longer than the existent 78-day period.

However, market stats from Glassnode amusement that the existent downturn is the 2nd deepest drawdown successful this halving cycle. “Corrections successful 2017, and early-2021 were overmuch shallower betwixt 20% and 40%, whilst July 2021 reached a drawdown of -54%,” Glassnode wrote connected its Telegram transmission connected January 23.

Tags successful this story

2013 run, 2017 run, April downturn, bear markets, Bear Run, Bearish, Bitcoin (BTC), BTC, Bull Markets, Bull run, Bullish, Cycle Drawdown, DeFi, defi economy, ETH, Ethereum (ETH), Extended Downturn, Featured, Glassnode Stats, ICOs, initial coin offerings, Markets, NFTs, Non-fungible Token, Onchain stats, Prices, Prolonged Downturn, Web3

What bash you deliberation astir the existent terms cycle? Do you deliberation this is an extended carnivore marketplace scenario? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Glassnode, Tradingview, Twitter, Will Clemente

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)