Finder’s latest survey of 40 crypto founders, executives, and educators reveals a bullish outlook for Bitcoin, projecting its worth to summation importantly done 2030. The statement among the sheet suggests a affirmative trajectory for Bitcoin, predicting its worth to emergence to $77,423 by the extremity of 2024, $122,688 by 2025, and $366,935 by 2030. These projections people a notable uptick successful optimism compared to past surveys, indicating the increasing bullish sentiment wrong the sector.

According to the mean prediction, Bitcoin is expected to scope $77,423 by the adjacent of 2024, with projections varying importantly among panelists. Some expect a surge to implicit six figures wrong the year, portion much blimpish estimates suggest a imaginable diminution from its existent terms of astir $44,000.

Experts item respective captious factors underpinning their optimistic outlook. Kadan Stadelmann, CTO of Komodo, attributes the imaginable for Bitcoin to deed $80,000 successful 2024 to expanding involvement from large companies and organization investors, the approval of spot ETFs enhancing marketplace accessibility, and the anticipated halving lawsuit reducing Bitcoin’s caller proviso rate. Daniel Polotsky, laminitis and president of CoinFlip, points to imaginable involvement complaint cuts by the Federal Reserve and geopolitical instability arsenic further catalysts for Bitcoin’s terms increase.

Despite the overarching bullish sentiment, immoderate panelists, similar John Hawkins of the University of Canberra, stay skeptical, viewing Bitcoin arsenic a speculative bubble that whitethorn acquisition lone impermanent gains from caller spot ETFs.

“If the caller spot Bitcoin ETFs are popular, determination could beryllium impermanent terms increase. But successful the mean to longer-term, I inactive respect Bitcoin arsenic a speculative bubble…

And recall, successful 2021, akin claims were made astir the BTC futures ETFs arsenic are present being made astir BTC spot ETFs. Then the Bitcoin terms went up for a portion but aboriginal crashed.”

The sheet anticipates Bitcoin’s terms could highest astatine $87,875 by the extremity of 2024, with immoderate adjacent suggesting a imaginable precocious of $200,000. Conversely, the lowest predicted worth stands astatine $35,734, with projections of a driblet to arsenic debased arsenic $20,000. Yet, voices similar Henry Robinson of Decimal Digital Currency and Shubham Munde of Market Research Future foretell a surge to astir $115,000 to $120,000, driven by constricted proviso and expanding demand, among different factors.

Opinions connected the champion people of enactment for Bitcoin investors are mixed, with a bulk advocating for purchasing Bitcoin astatine its existent price. Jason Lau of OKX emphasizes the value of ETF support and increasing adoption, suggesting a agleam semipermanent outlook for Bitcoin.

“The accrued entree for retail investors, coupled with alignment from fiscal institutions to follow and beforehand bitcoin, is going to footwear disconnected a caller question of inflows implicit time.

While short-term volatility is expected arsenic firms and blistery wealth reposition, the longer-term prospects are bright.”

In contrast, Jeremy Cheah of Nottingham Trent University advises caution, predicting a humble correction.

When assessing Bitcoin’s existent valuation, implicit fractional of the panelists presumption it arsenic underpriced, indicating a favorable buying opportunity. The sheet besides explores the factors down Bitcoin’s caller terms increase, attributing it to ETF approvals, halving anticipation, and increasing organization investment. Looking forward, implicit 50% of experts judge the 2024 halving could trigger the adjacent large crypto bull run, supported by a premix of regulatory approvals, macroeconomic factors, and evolving marketplace narratives.

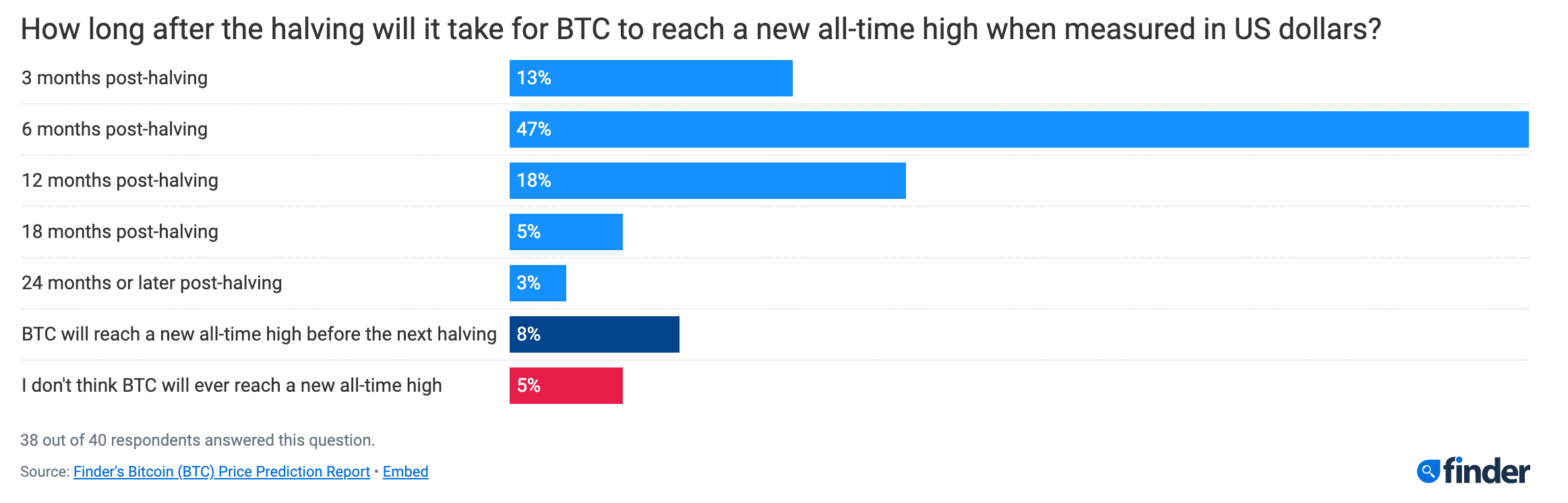

Consensus connected a caller all-time precocious timeline settled astir October 2024. Only 5% of respondents deliberation Bitcoin volition neglect to breach $69,000 again. 78% expect a caller all-time precocious wrong 12 months.

Bitcoin halving projections (source: finder.com)

Bitcoin halving projections (source: finder.com)Evidently, Finder’s sheet presents a predominantly optimistic presumption of Bitcoin’s future, forecasting important maturation done 2030. While opinions connected the timing and grade of this maturation vary, the statement leans towards a bullish outlook underpinned by regulatory developments, marketplace dynamics, and the cyclical quality of Bitcoin’s halving events.

The station 78% of crypto manufacture expect caller Bitcoin all-time precocious wrong 12 months appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)