While the Bitcoin terms hasn’t reclaimed the important $60,000 level to reenter the erstwhile 4-month trading range, Ikigai Asset Management Chief Investment Officer (CIO) Travis Kling thinks that the existent bearish signifier is not much than a “boogeyman.” Via X, Kling listed 8 reasons to beryllium bullish connected Bitcoin. He stated: “NFA. I’m incorrect often. The existent “bearish” backdrop seems easier to look done and bargain than astir of the boogeymen we’ve had successful these markets implicit the past 6 years.”

#1 Rapid Bitcoin Liquidations By Germany

Travis Kling observes that Germany has importantly decreased its Bitcoin holdings, from 50,000 BTC to 22,000 BTC successful caller weeks. According to him, “Germany is speedrunning their #Bitcoin dump.” He predicts the selling volition soon cease, suggesting, “By the clip they get down to ~5k, the marketplace volition look done it.” Kling implies that the marketplace interaction of Germany’s Bitcoin liquidations is impermanent and nearing its end.

#2 Mt. Gox’s Overestimated Market Impact

Kling addressed the imaginable marketplace effects of the Mt. Gox repayments, characterizing the fearfulness of monolithic sell-offs arsenic much speculative than based connected the creditors’ apt actions. He stated, “Gox seems much FUD than existent wide selling (just a conjecture but feels that way).”

He believes the creditors, galore of whom are blase investors, are apt to merchantability their holdings methodically, e.g. via TWAPs, frankincense reducing the interaction connected the market. Regarding the retail investors, Kling asked a rhetorical question, “You’ve hung connected for decennary erstwhile you could person sold ages ago. You’re conscionable going to aggressively dump now, 3 months aft the halving?”

#3 US Government’s Bitcoin Strategy

Regarding the US government’s Bitcoin sales, Kling emphasized the measured attack taken truthful far. He stated, “But they’ve been beauteous measured with selling truthful far, truthful I presume they’ll proceed to beryllium beauteous measured.” While helium admits that the US authorities selling is the “hardest to get your caput astir successful presumption of pace/method, and their stack is huge,” helium claims that the selling is improbable to disrupt marketplace stability.

#4 Retail Investment Boost Through ETFs

Kling highlighted a surge successful retail concern successful Bitcoin, peculiarly done ETFs, pursuing caller terms dips. He remarked, “You person boomers slurping the dipperino successful the BTC ETFs Fri and Mon.” This inclination indicates beardown retail capitalist involvement successful capitalizing connected little prices, suggesting a bullish sentiment among this capitalist segment.

#5 Ethereum ETF Anticipation

With the anticipation of US spot Ethereum ETFs, Kling noted that the terms of ETH remains lone somewhat beneath its level anterior to the emergence of ETF rumors, indicating minimal speculative hype has been priced in. This reflection suggests that the marketplace could respond positively to the launches.

#6 Interest Rate Cuts Are Near

Kling besides discussed the imaginable for upcoming Federal Reserve rate cuts, noting the marketplace has priced successful a important probability of specified an lawsuit successful September. He stated, “If inflation/labor information is airy this month, Powell volition apt archer the marketplace that Sept is simply a unrecorded gathering astatine the 7/31 FOMC. Nickileaks has already teased this.”

The money manager is referring to Wall Street Journal’s Nick Timiraos who is besides known arsenic “mouthpiece of the Fed”. A fewer days ago, Timiraos wrote via X that the June jobs study volition marque the July Fed gathering “more interesting” because. “For the archetypal clip each year—a existent statement implicit whether to chopped astatine the *next* gathering (in September),” helium remarked.

#7 The Potential Trump Pump

Kling speculated connected the governmental landscape’s power connected Bitcoin, peculiarly nether a imaginable Trump presidency. Kling posed a rhetorical question, “What other would you alternatively ain than crypto going into a Trump presidency?” with regards to the latest pro-Bitcoin and crypto comments by the starring statesmanlike campaigner successful the polls.

#8 Bitcoin And Nasdaq Re-Coupling

Kling pointed retired the disparity betwixt NASDAQ’s continual caller all-time highs and Bitcoin’s comparative underperformance. He noted, “NASDAQ keeps making caller ATH aft caller ATH. Crypto has wholly decoupled to the downside.” He suggests that Bitcoin is undervalued comparative to the large marketplace scale and soon starts a catch-up rallye. “You could reason BTC is lagging QQQ by 40% YTD,” Kling concluded.

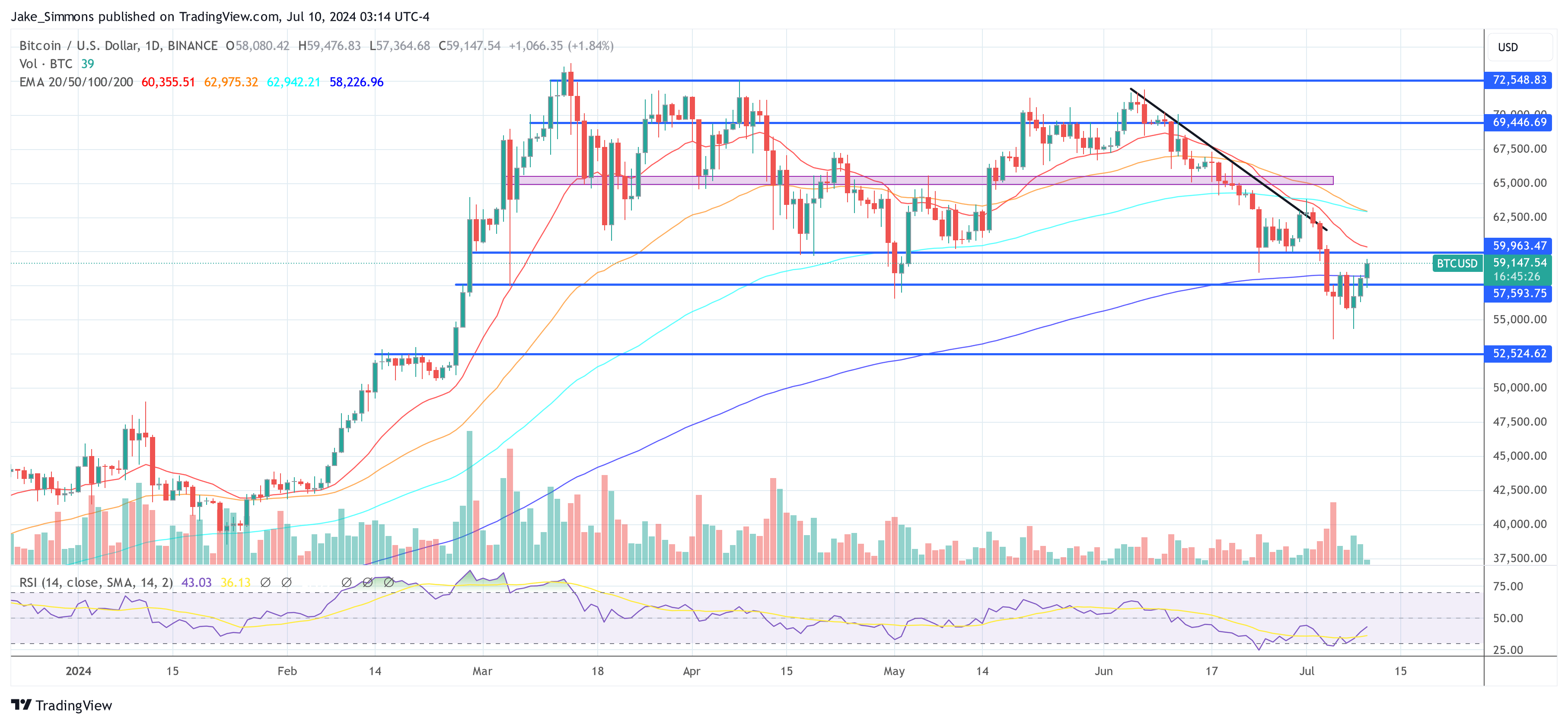

At property time, BTC traded astatine $59,147.

BTC reclaims the 200-day EMA (blue), 1-day illustration | Source: BTCUSD connected TradingView.com

BTC reclaims the 200-day EMA (blue), 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)