The caller twelvemonth hasn’t brought stableness to Bitcoin’s price, with BTC experiencing important volatility this week. The volatility peaked connected Jan. 9, with the terms opening astatine $95,057 and reaching a precocious of $95,346 earlier dropping sharply to $90,707. This $4,640 trading scope represented a driblet of astir 4.9%.

Intense volatility similar that tends to importantly summation spot trading connected exchanges, with retail traders adding to the selling pressure.

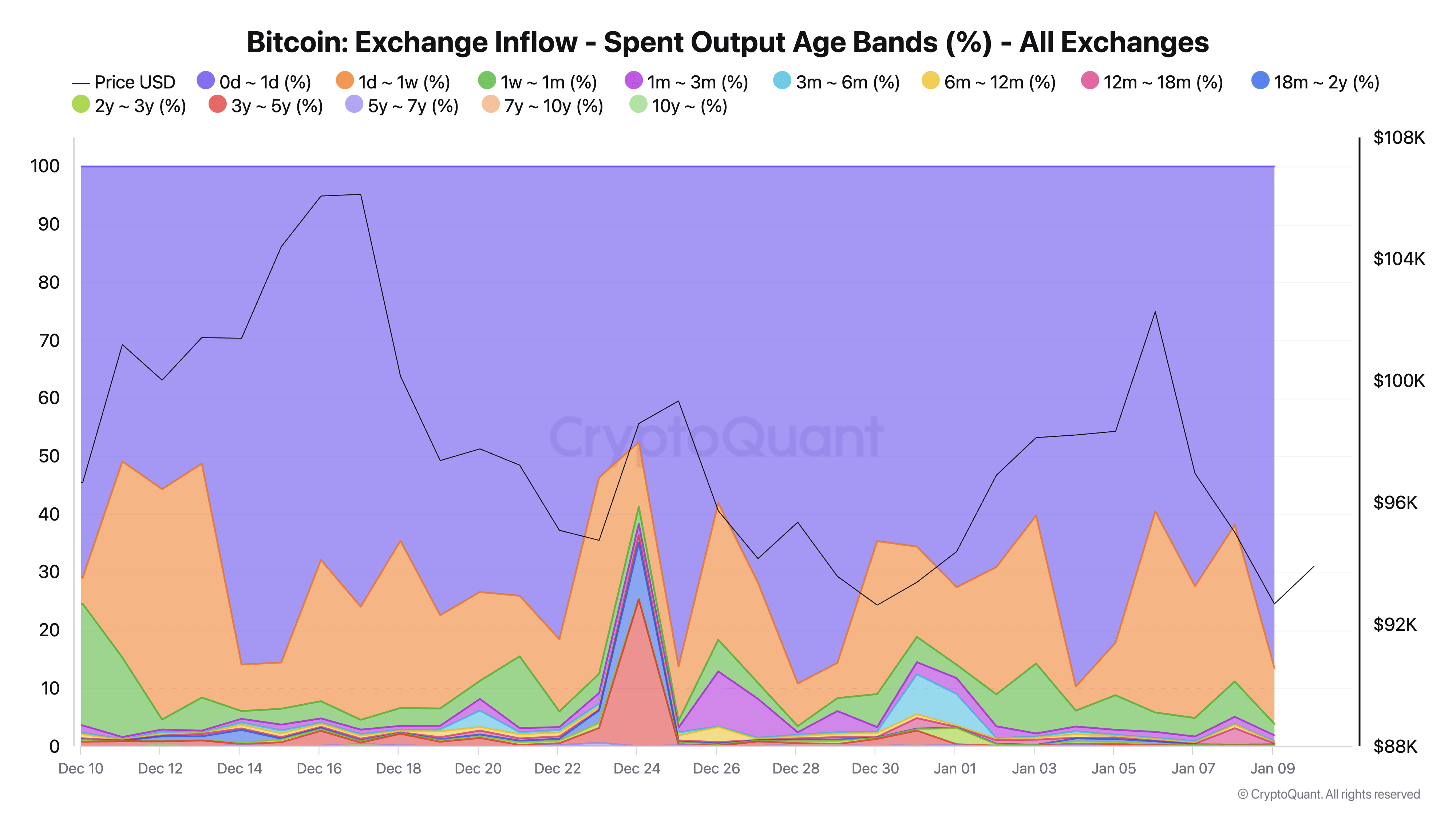

Exchange inflow information shows that 86.53% of each coins moving to exchanges during this play came from the 0-1 time band, indicating an unusually precocious level of short-term trading activity. For context, this percent importantly exceeds emblematic regular patterns we’ve seen successful the past month, wherever 0-1 time aged UTXOs often relationship for 50-70% of speech inflows.

Graph showing ratio of the full worth of spent outputs that flowed into exchanges from Dec. 9, 2024, to Jan. 9, 2025 (Source: CryptoQuant)

Graph showing ratio of the full worth of spent outputs that flowed into exchanges from Dec. 9, 2024, to Jan. 9, 2025 (Source: CryptoQuant)The dominance of short-term coin movements was further emphasized by the organisation crossed different clip bands, with 9.62% of inflows coming from coins held for 1-7 days and lone 1.97% from coins held for 1 week to 1 month. Coins held for longer than 1 period accounted for little than 2% of full speech inflows, suggesting minimal information from semipermanent holders during this marketplace movement. This organisation signifier is peculiarly applicable arsenic it shows that the day’s terms volatility was chiefly driven by short-term trading enactment alternatively than a displacement successful semipermanent holder sentiment.

The information that semipermanent holders remained mostly inactive during this terms question indicates they viewed the volatility arsenic a impermanent marketplace improvement alternatively than a cardinal displacement that requires portfolio adjustment. This behaviour signifier often emerges during corrections, wherever short-term terms movements are absorbed without triggering broader marketplace participation.

From a marketplace operation perspective, the attraction of enactment successful the 0-1 time band, contempt the important terms decline, suggests beardown marketplace extent and resilience. While the influx of short-term coins to exchanges created contiguous selling pressure, the deficiency of semipermanent holder information helped incorporate the terms decline. This is important for creating marketplace stability, arsenic accrued enactment from longer-term holders during terms declines often indicates deeper marketplace accent and tin pb to much sustained downward pressure.

The trading measurement during this play further supports this analysis, showing elevated enactment accordant with the precocious percent of short-term coin movements. The volume, terms action, and speech inflow patterns showed that the broader marketplace maintained its position.

CryptoQuant’s information showing short-term and semipermanent holder enactment during terms volatility helps america separate betwixt impermanent marketplace adjustments and much important shifts successful marketplace structure. When combined with terms and measurement data, speech inflow patterns by coin property supply much-needed discourse for marketplace movements.

The station 86% of Bitcoin’s sell-off driven by short-term retail traders appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)