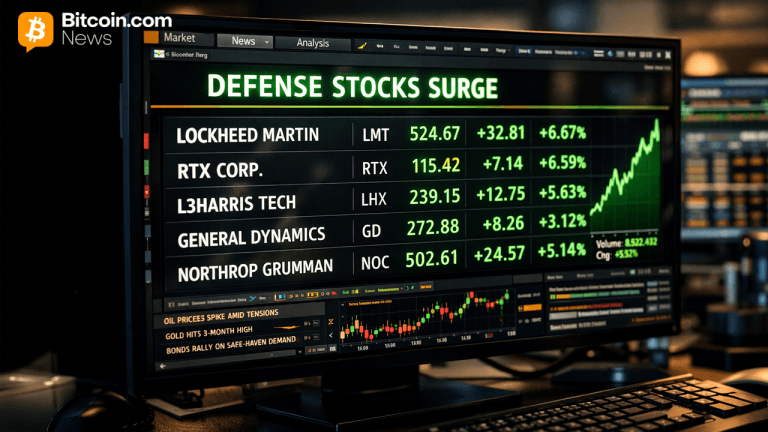

Nearly each of the Ethereum accumulated by nationalist companies to day occurred wrong a three-month model betwixt July and September, according to caller data.

This comes arsenic respective crypto executives foretell that Ether’s (ETH) terms volition emergence by arsenic overmuch arsenic 200% earlier the extremity of the year.

“95% of each ETH held by nationalist companies was purchased successful the past 4th alone,” Bitwise Invest said connected Wednesday, referring to the $19.13 cardinal held successful nationalist treasuries, equivalent to astir 4% of Ether’s full supply.

Of the 4.63 cardinal ETH held connected nationalist institution equilibrium sheets arsenic of Sept. 30, astir 4 cardinal were added during the 3rd quarter, according to Bitwise.

Will Q4 present the gains for Ether?

The attraction of ETH buying enactment successful Q3 raises questions astir what lies up for Ether during the 4th fourth of 2025, which is historically Ether’s second-worst performing 4th connected average, according to CoinGlass.

Ether (ETH) was trading supra $4,300 earlier Friday’s crypto marketwide sell-off, which triggered implicit $19 cardinal successful liquidations crossed the market. It has since fallen beneath the cardinal $4,000 level, changing hands astatine $3,980, according to CoinMarketCap.

However, the caller treasury communicative has immoderate analysts predicting a stronger-than-usual finish.

At the clip of publication, BitMine Immersion Technologies holds the largest stock with astir 3.03 cardinal ETH, followed by Sharplink Gaming with 840,120 ETH, and The Ether Machine with 496,710 ETH, according to StrategicETHReserve.

Both BitMEX co-founder Arthur Hayes and BitMine seat Tom Lee person projected ETH to reach $10,000 by year-end, with Lee suggesting a imaginable ascent to $12,000.

Ether is the “best prime for institutions,” says Sharplink co-CEO

Sharplink Gaming co-CEO Joseph Chalom said connected Wednesday that helium is “bullish” astir Ethereum arsenic it is “the champion prime for institutions.”

“It’s decentralized, unafraid and continuously increasing its network,” Chalom said.

Chalom told Cointelegraph Magazine that 1 of Sharplink Gaming’s apical priorities is “to rise superior and accumulate arsenic overmuch ETH arsenic possible.”

Analysts besides constituent to catalysts beyond firm treasuries, including dependable inflows into US spot Ether ETFs and the ample stock of ETH that remains locked successful staking contracts.

Related: Ethereum flashes ‘rare oversold signal’ for archetypal clip since $1.4K ETH

“40% OF THE ENTIRE SUPPLY IS GONE FROM CIRCULATION. THIS IS THE SETUP FOR AN ETHEREUM SUPERCYCLE,” Merlijn The Trader said successful an X station connected Wednesday.

On Wednesday, Michael van de Poppe, laminitis of MN Trading Capital, said that the “$ETH vs. $BTC has hardly started.”

“The archetypal uptick has happened, conscionable similar 2019,” van de Poppe said, explaining that there’s truthful overmuch much upside to come, we don’t person to comprehend and recognize that it’s possible.”

“But yes, it volition come,” van de Poppe added.

Magazine: Review: The Devil Takes Bitcoin, a chaotic past of Mt. Gox and Silk Road

4 months ago

4 months ago

English (US)

English (US)