More than $95 cardinal worthy of abbreviated positions were liquidated successful the past 12 hours arsenic the crypto marketplace rebounded from yesterday’s enactment levels.

Almost 88% of traders betting against an summation successful crypto prices booked losses arsenic exchanges closed leveraged positions owed to a partial oregon full evaporation of the trader’s archetypal margin, information from analytics instrumentality Coinglass show.

Crypto speech OKX saw $44 cardinal worthy of abbreviated losses, the astir among each crypto exchanges, followed by $22 cardinal connected Binance and $11 cardinal connected Bybit, information show.

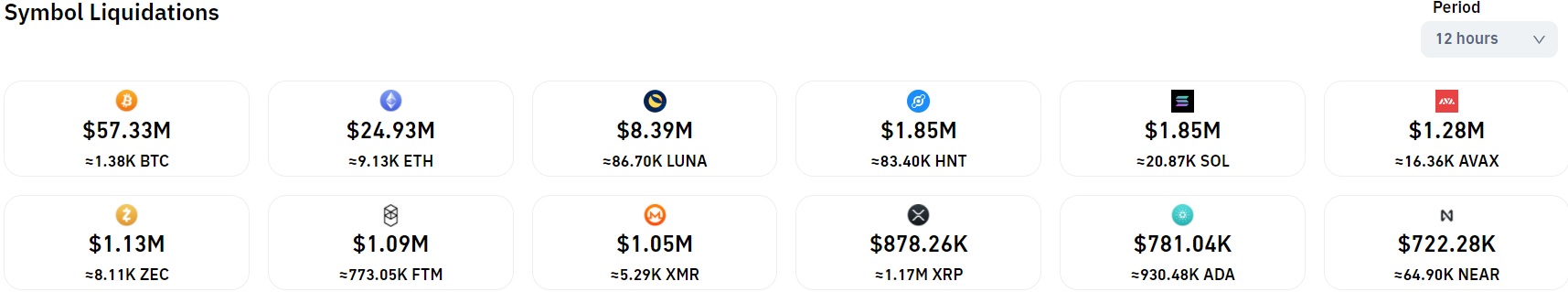

Some $47.45 cardinal of bitcoin futures were liquidated successful the past 12 hours, the astir among large cryptocurrencies. Ether futures had $22 cardinal successful losses, followed by LUNA with $12 million.

Over $95 cardinal worthy of liquidations connected abbreviated positions occured successful the past 12 hours. (Coinglass)

Privacy-focused cryptocurrencies made an antithetic showing. Futures tracking Monero’s XMR and Zcash’s ZEC recorded $1 cardinal worthy of losses arsenic prices of the 2 surged arsenic overmuch arsenic 25% successful the past 24 hours. The leap outperformed the broader market, which accrued 6% successful the aforesaid period.

Bitcoin traded supra $41,000 successful the European morning, up from $38,000 connected Tuesday, arsenic a U.S. statesmanlike enforcement bid connected cryptocurrencies supported "responsible innovation" of the sector. The enforcement bid is wide expected to beryllium signed by U.S. President Joe Biden connected Wednesday.

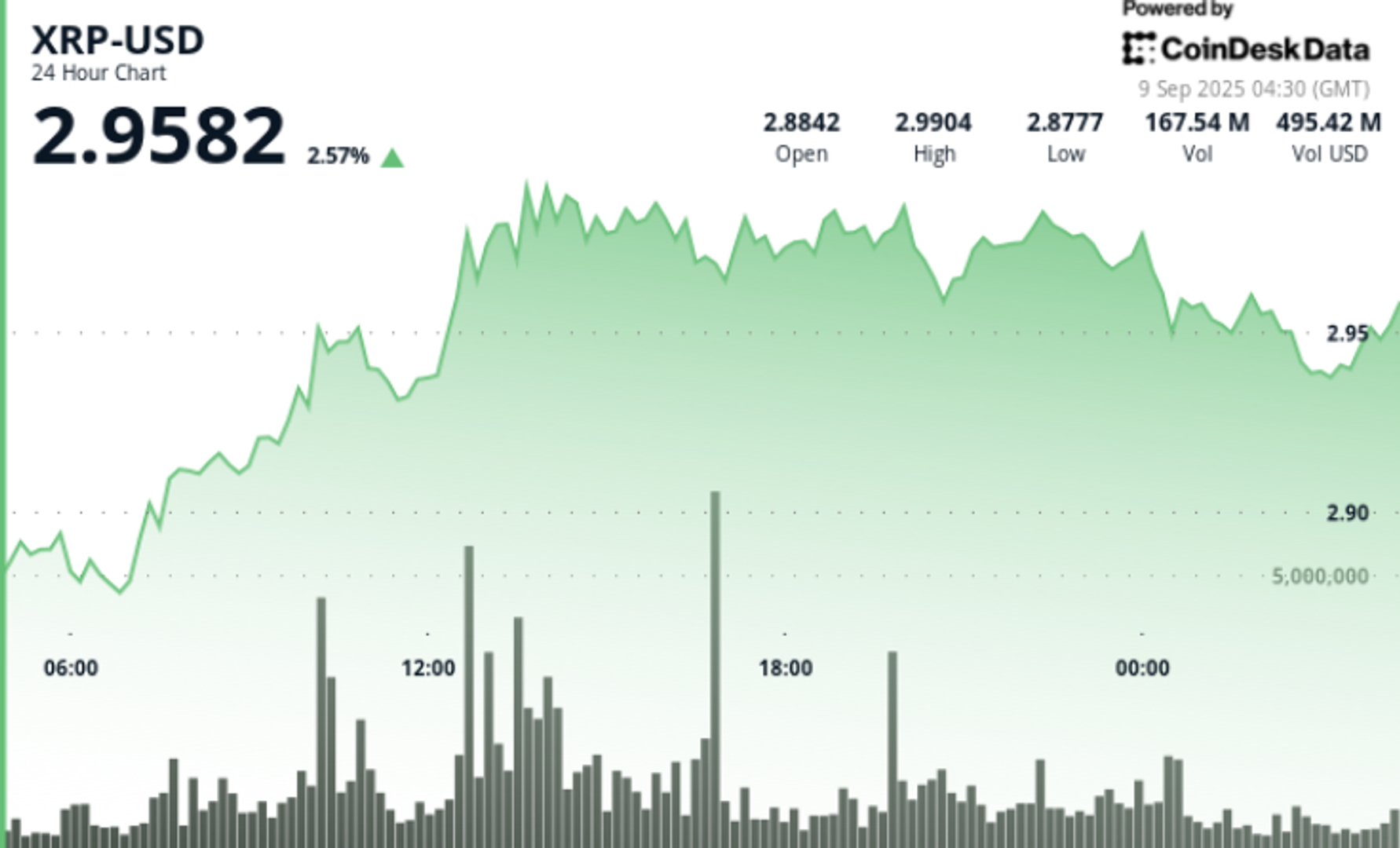

The losses stemming from abbreviated positions contributed to a full of $114 cardinal successful liquidations, affecting astir 46,700 idiosyncratic trading accounts, information show.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)