Bitcoin’s inception successful 2009 was steeped successful hopes of doing distant with trusted 3rd parties for online peer-to-peer transactions. In fact, that is the first condemnation successful the abstract of its achromatic paper.

Given the improvement of Bitcoin implicit the past 13 years, astir notably elevated transaction fees, assorted cryptocurrency projects and protocols person popped up arsenic a means to nonstop online payments, some connected Bitcoin and connected different blockchains. Be it the accrued adoption of Bitcoin’s Lightning Network oregon the tremendous maturation of the gaggle of stablecoins, some collateralized and algorithmic, there’s nary denying that cryptocurrencies are hyper-focused connected solving payments.

This nonfiction is portion of CoinDesk’s Payments Week series.

What follows is simply a snapshot of assorted information figures that outline the authorities of crypto payments.

Bitcoin’s Lightning Network capacity

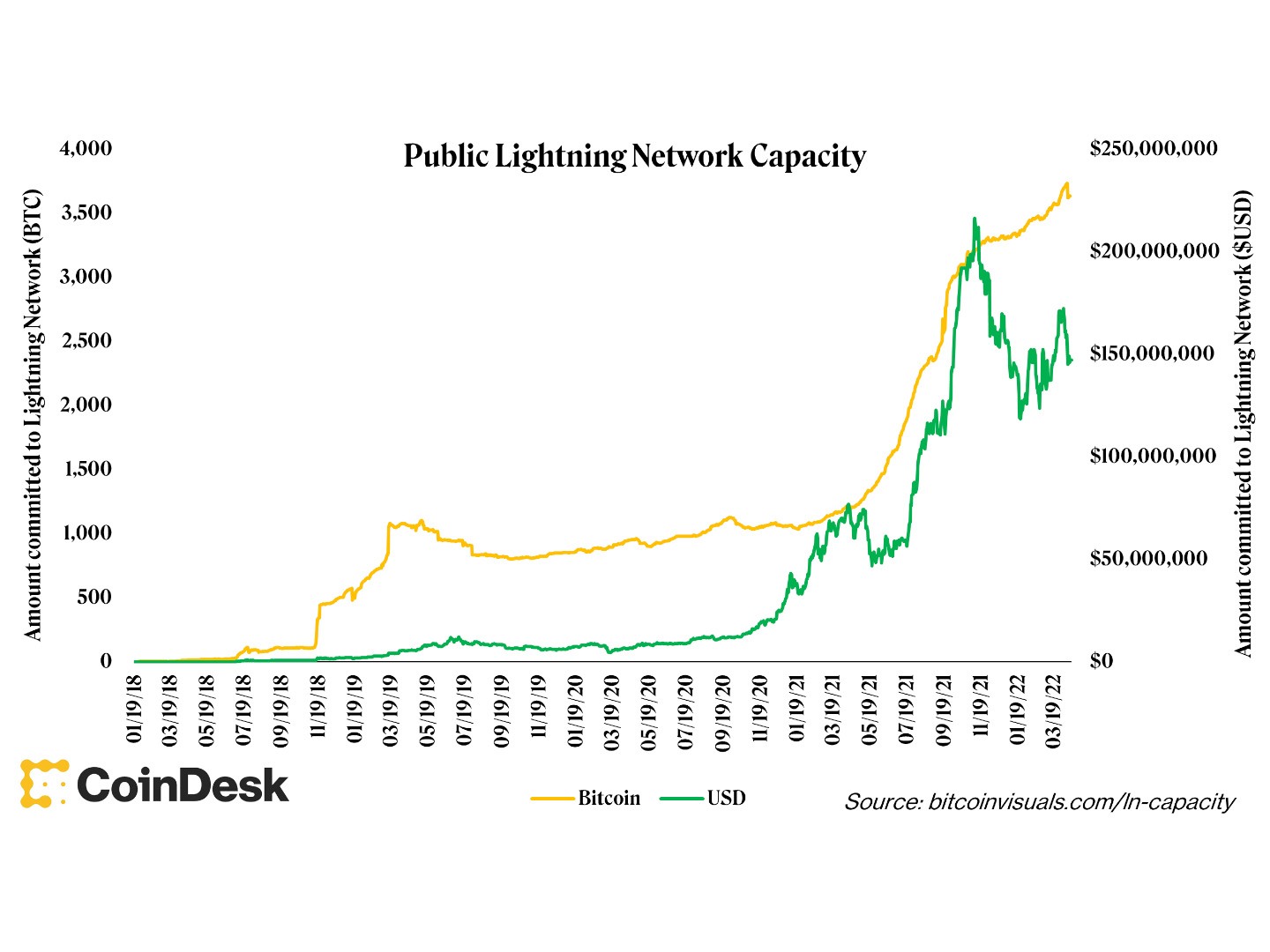

The Lightning Network is an overlay web oregon “second layer” built connected apical of the Bitcoin blockchain that uses user-generated micropayment channels to behaviour transactions instantaneously. To make those channels, users perpetrate bitcoin (BTC) for a play of time. The sum of bitcoin committed to Lightning is known arsenic its capacity. The larger the capacity, the much outgo measurement that tin travel done the network.

Following muted maturation betwixt 2019 and mid-2021, Lightning’s capableness has accrued rapidly successful the past 12 months adding ~2,400 BTC, a maturation complaint of 195%. Of note, this information is typical lone of the capableness successful publically announced channels – unannounced, and truthful private, channels bash exist. As a result, this information is an understatement of the full Lightning Network capacity.

Public Lightning Network capableness (Bitcoin Visuals) (George Kaloudis)

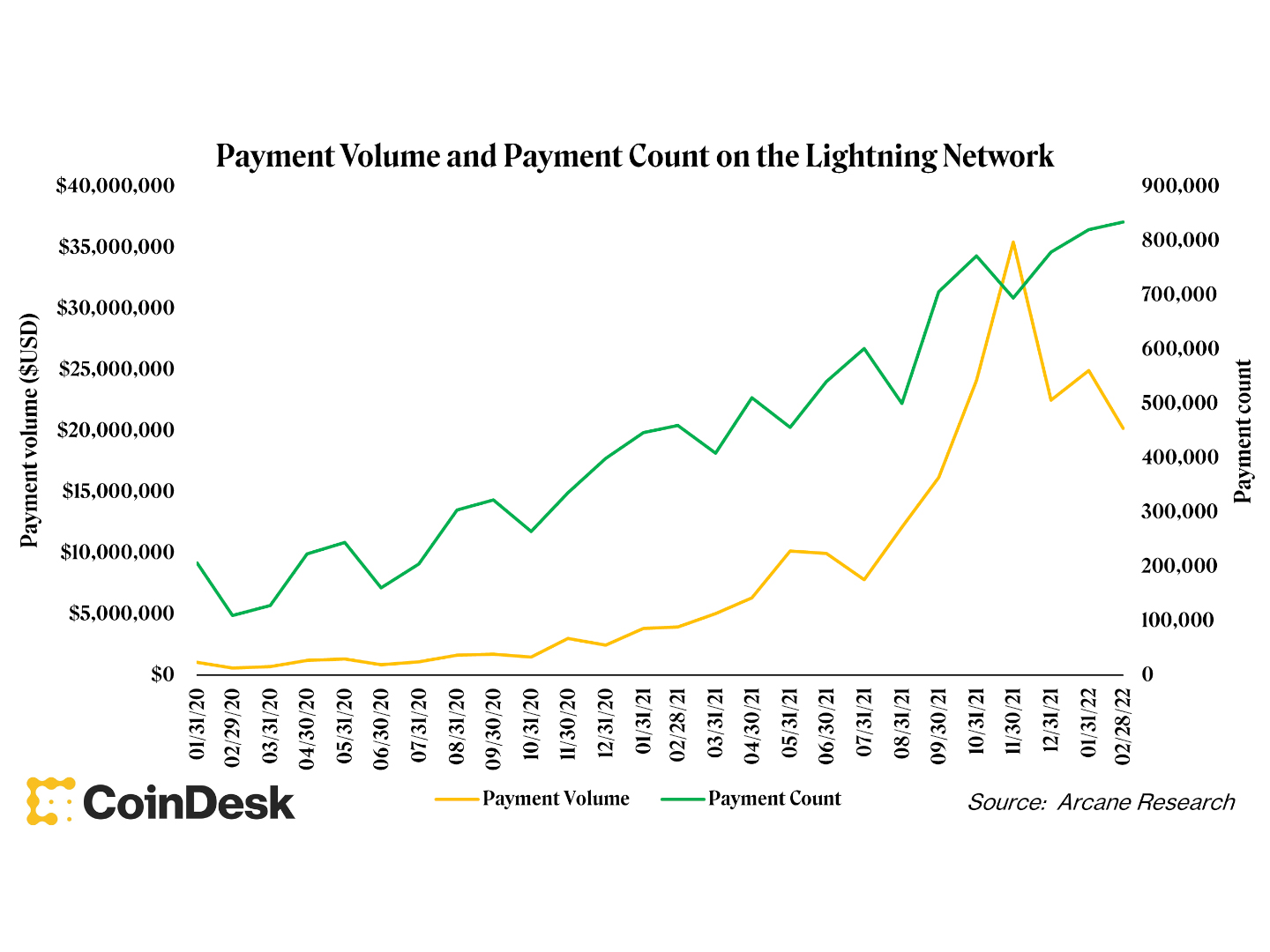

Transactions implicit the Lightning Network are not announced publically arsenic they are connected the regular Bitcoin blockchain; therefore, the existent usage complaint of the Lightning Network is unknown. However, nationalist information tin beryllium utilized to estimation outgo measurement and outgo count.

According to information from Arcane Research, we’ve seen outgo measurement and outgo number turn consistently since the opening of 2020. This continued maturation highlights however Bitcoin is gaining crushed connected its archetypal stated usage lawsuit arsenic a viable peer-to-peer integer currency done the usage of the Lightning Network. The dip successful outgo measurement successful November 2021 coincides with the terms of bitcoin tumbling from implicit $66,000 to $46,000 successful December. All the while, outgo number connected Lightning ticked up adjacent arsenic bitcoin’s terms dipped.

Payment measurement and number connected the Lightning Network (Arcane Research) (George Kaloudis)

Transaction values crossed coins alteration widely

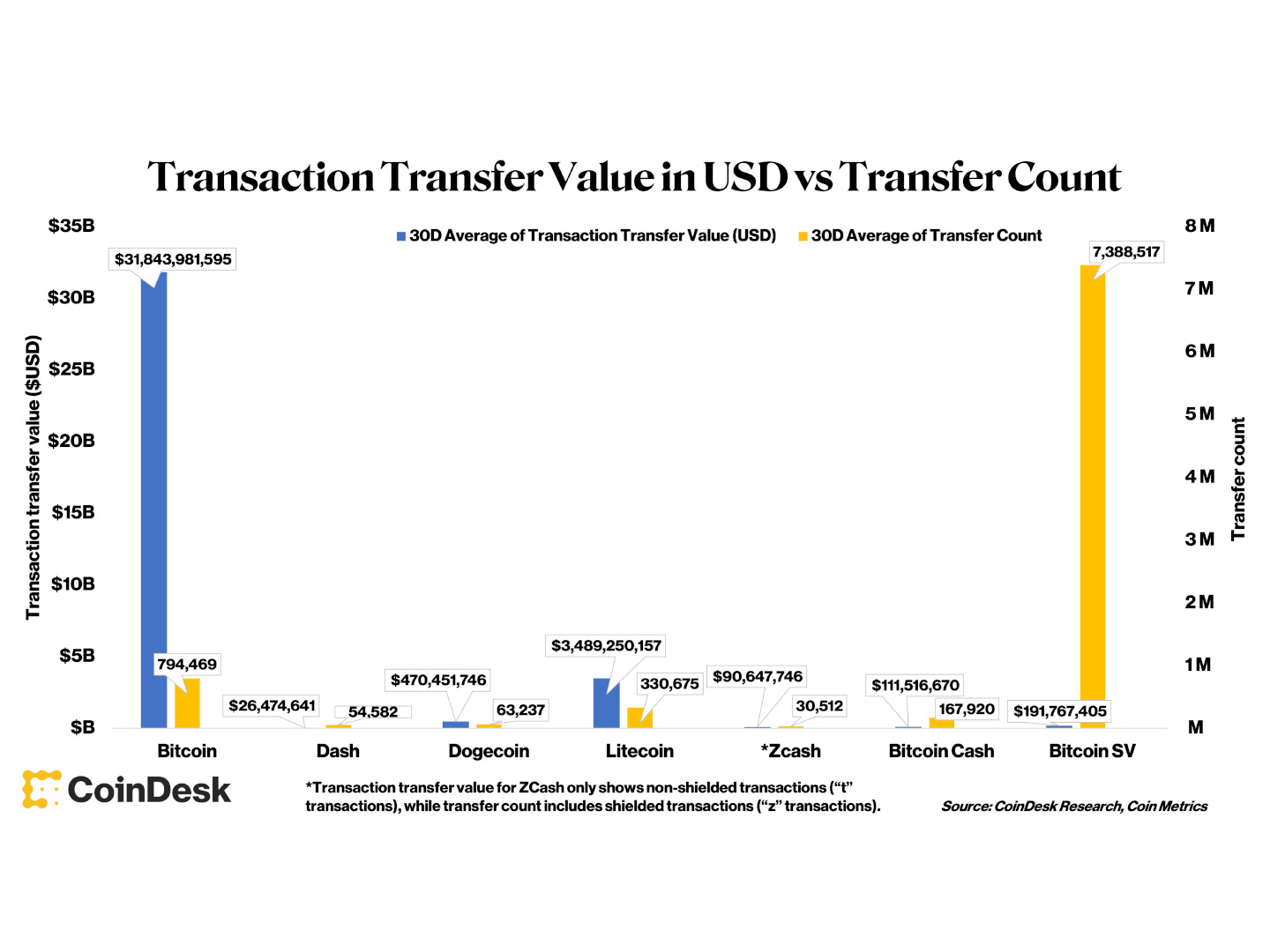

The 7 coins included successful this illustration are defined by CoinDesk Indices' Digital Asset Classification Standard arsenic portion of the Currency Sector. Their superior relation is to enactment arsenic currency and marque payments.

Transaction transportation worth for assorted cryptocurrencies (Coin Metrics) (Sage D. Young)

Looking astatine the transaction transportation worth (the U.S. dollar magnitude of the plus worth transferred) of these coins successful operation with the full magnitude of transfers oregon transactions allows america to glean penetration into each cryptocurrency’s usage.

A cryptocurrency blockchain could person galore transactions, suggesting precocious levels of activity, but if the USD worth of that enactment is rather tiny it mightiness suggest thing else. This is the lawsuit with bitcoin SV (BSV). BSV has respective cardinal much transfers than different cryptocurrencies, yet the idiosyncratic worth of these transfers tends to beryllium comparatively small. On average, BTC transfers $40,000 per transaction portion BSV transfers $25.95 per transaction. After bitcoin, the adjacent lowest worth per transaction of the coins included successful the information acceptable is dash with $485 of worth transferred per transaction.

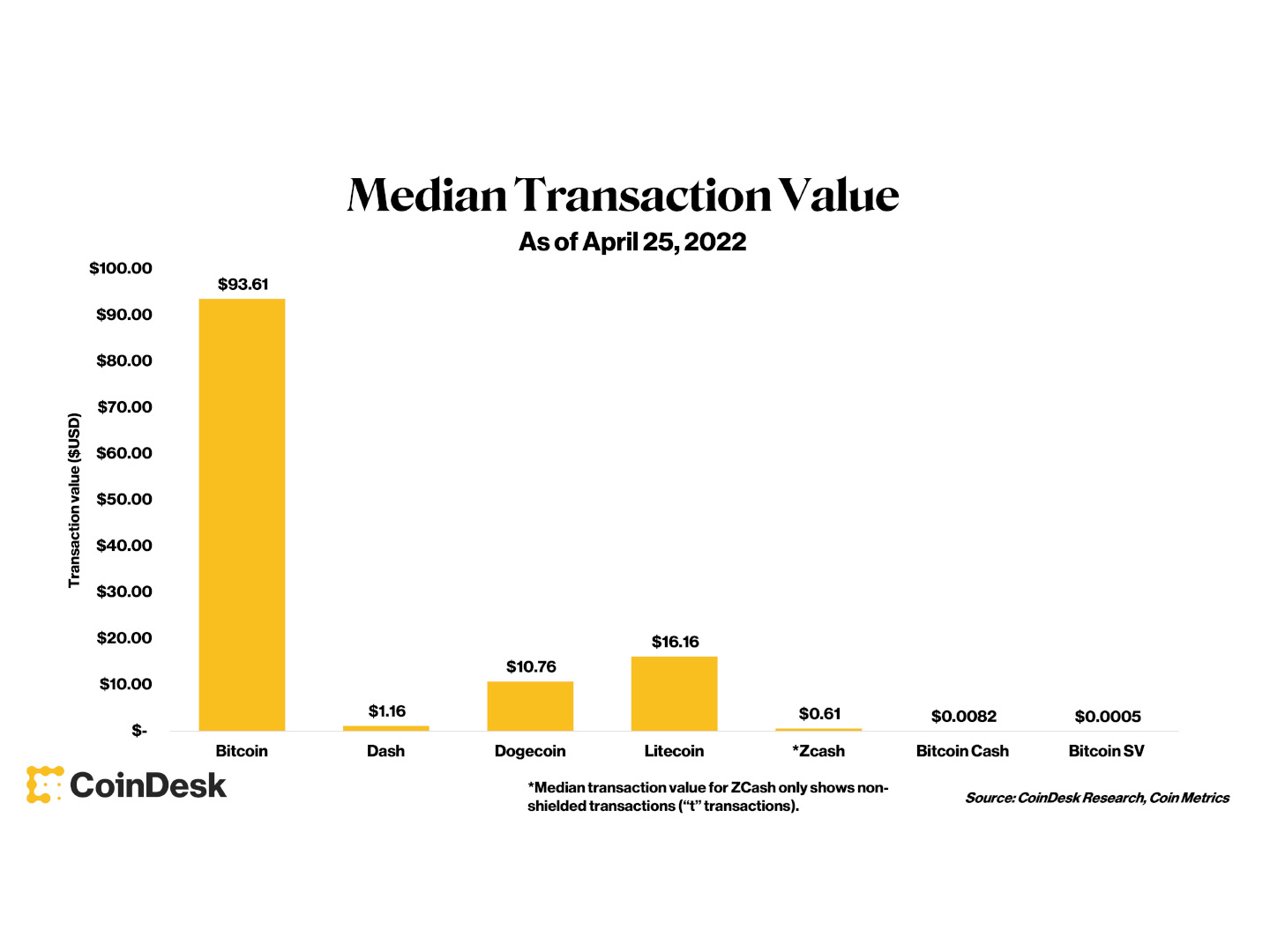

However, averages are skewed by ample transactions, truthful looking astatine median transactions successful USD tin beryllium rather utile successful determining the existent usage of these cryptocurrencies for payments.

The 30-day trailing mean for the median worth transferred utilizing bitcoin is $94 and $0.0005 for BSV. Both of these values skew to the precocious and debased extremity worth for casual commerce, truthful it mightiness beryllium the lawsuit that smaller casual crypto payments are being carried retired utilizing dogecoin (DOGE) oregon litecoin (LTC), which person median transaction values of $11 and $16, respectively.

Also worthy a caveat is zcash and its comparatively debased median transaction value. Zcash is simply a privateness coin, but successful bid to usage its privateness features, users indispensable opt in. A regular zcash transaction is “unshielded” and is called a “t” transaction. A idiosyncratic tin take to “shield” their transactions successful a “z” transaction, wherever each accusation is not publicized. As such, our information is lone capable to see unshielded transactions. Given astir 1 3rd of zcash transactions are shielded, the resultant information is apt skewed.

Median transaction worth for assorted cryptocurrencies (Coin Metrics) (Sage D. Young)

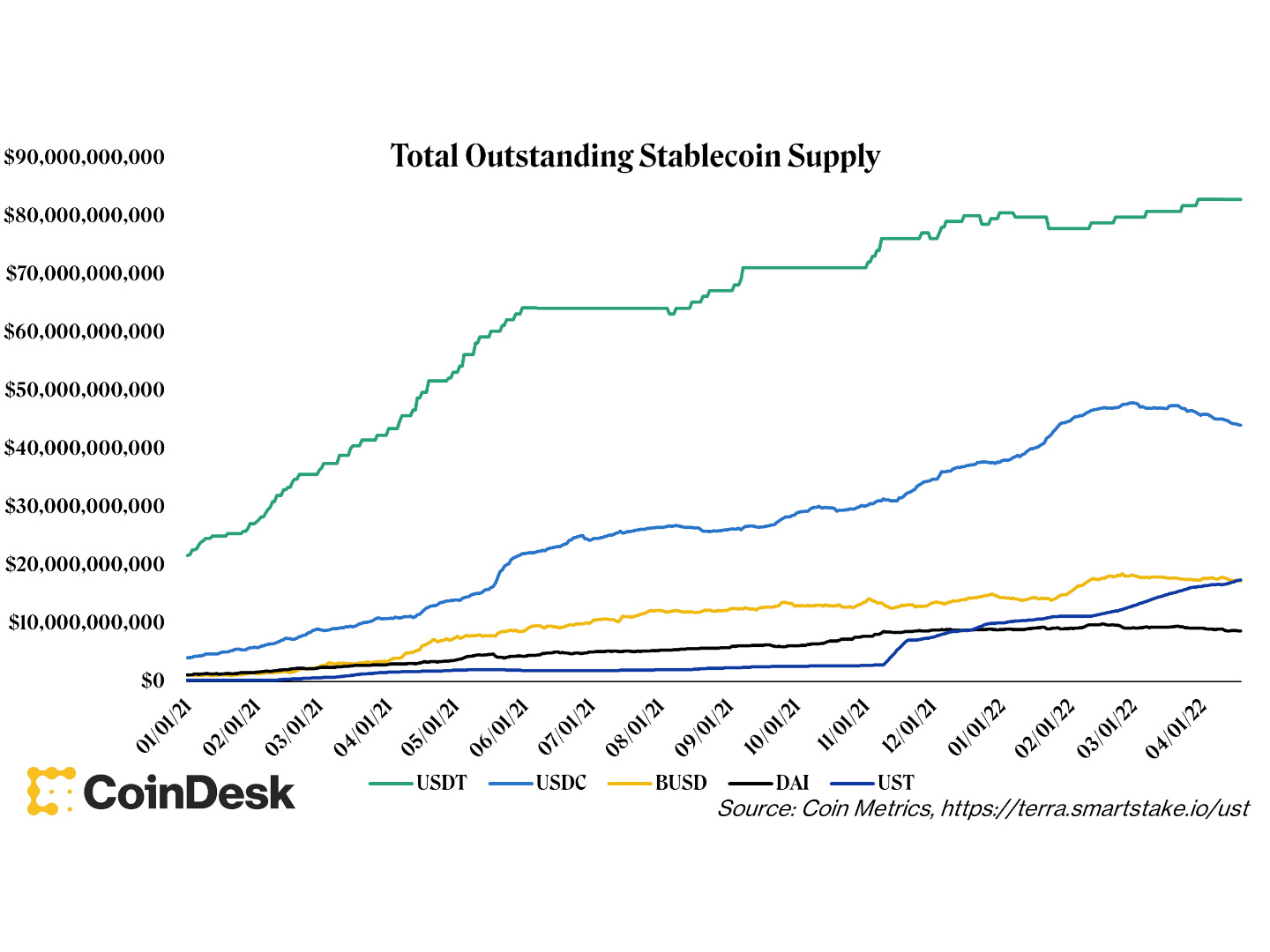

Stablecoins are pegged to the terms of a sovereign currency, usually the U.S. dollar. U.S.-pegged stablecoins play a captious relation successful payments, fixed their perceived deficiency of volatility and the dollar’s presumption arsenic a globally accepted portion of account.

Tether (USDT), the archetypal stablecoin, has agelong been the ascendant stablecoin since inception, and determination is present much than $80 cardinal of tether successful circulation. Given its popularity, different stablecoins similar USD coin (USDC) and terraUSD (UST) person popped up. In total, U.S.-pegged stablecoins present person much than $180 cardinal of marketplace value.

While impressive, it is important to enactment that a sizable information of stablecoins is utilized successful crypto trading and decentralized concern (DeFi) versus peer-to-peer payments to bargain things.

Stablecoin proviso has grown meaningfully successful the past year. (Coin Metrics, terra.smartake.io/ust) (George Kaloudis)

Payments are a slayer usage lawsuit for coins for institutions

Improving payments represents 1 of the slayer usage cases for crypto assets, evidenced by the information that determination are truthful galore antithetic projects retired determination trying to bash payments. In fact, wealth is 1 of humanity’s oldest technologies, and transacting with that wealth is simply a captious constituent of a palmy money. Be it done cutting retired third-party rent seekers oregon focusing connected velocity oregon perceived portion of relationship volatility risk, determination is nary shortage of options consumers person to marque integer payments done crypto.

As with immoderate network, it is important to recognize the usage and pertinent metrics erstwhile determining the level of spot you privation to enactment into these projects. Due to the transparency of blockchains, this benignant of penetration tin beryllium gleaned with arsenic small arsenic an net connection. That said, the main takeaway from the existent information is that we person a agelong mode to go.

Blockchains connection unsocial advantages, but these indispensable beryllium combined with a idiosyncratic acquisition that feels akin to the 1 consumers cognize today, writes Senior Vice President Jose Fernandez da Ponte.

Financial censorship has gone from an abstract thought to a harsh world for Russians who abruptly recovered themselves unbanked by the West and their ain government.

Down The Silk Road: Where Crypto Has Always Been Used for Payments

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Money Reimagined, our play newsletter exploring the translation of worth successful the integer age.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)