As it stands, the statement for Bitcoin arsenic wealth has respective components which could beryllium called into question.

This is an sentiment editorial by Taimur Ahmad, a postgraduate pupil astatine Stanford University, focusing connected energy, biology argumentation and planetary politics.

Author’s note: This is the archetypal portion of a three-part publication.

Part 1 introduces the Bitcoin modular and assesses Bitcoin arsenic an ostentation hedge, going deeper into the conception of inflation.

Part 2 focuses connected the existent fiat system, however wealth is created, what the wealth proviso is and begins to remark connected bitcoin arsenic money.

Part 3 delves into the past of money, its narration to authorities and society, ostentation successful the Global South, the progressive lawsuit for/against Bitcoin arsenic wealth and alternate use-cases.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part I

Prologue

I erstwhile heard a communicative that acceptable maine connected my travel to effort and recognize money. It goes thing like:

Imagine a tourer comes to a small, agrarian municipality and stays astatine the section inn. As with immoderate respectable place, they are required to wage 100 diamonds (that’s what the municipality uses arsenic money) arsenic a harm deposit. The adjacent day, the inn proprietor realizes that the tourer has hastily near town, leaving down the 100 diamonds. Given that it is improbable the tourer volition task back, the proprietor is delighted astatine this crook of events: a 100 diamond bonus! The proprietor heads to the section baker and pays disconnected their indebtedness with this other money; the baker past goes disconnected and pays disconnected their indebtedness with the section mechanic; the mechanic past pays disconnected the tailor; and the tailor past pays disconnected their indebtedness astatine the section inn!

This isn’t the blessed ending though. The adjacent week, the aforesaid tourer comes backmost to prime up immoderate luggage that had been near behind. The inn owner, present feeling atrocious for inactive having the deposit and liberated from paying disconnected their indebtedness to the baker, decides to punctual the tourer of the 100 diamonds and manus them back. The tourer nonchalantly accepts them and remarks “oh these were conscionable solid anyways,” earlier crushing them nether his feet.

A deceptively elemental story, but ever hard to wrapper my caput astir it. There are truthful galore questions that travel up: if everyone successful the municipality was successful indebtedness to each other, wherefore couldn’t they conscionable cancel it retired (coordination problem)? Why were the townsfolk paying for services to each different successful indebtedness — IOUs — but the tourer was required to wage wealth (trust problem)? Why did nary 1 cheque whether the diamonds were real, and could they person adjacent if they wanted (standardization/quality problem)? Does it substance that the diamonds weren’t existent (what truly is wealth then)?

“The intent of studying economics is to larn however not to beryllium deceived by economists.” — Joan Robinson

Introduction

We are successful the midst of a poly-crisis, to get from Adam Tooze. As cliché arsenic it sounds, modern nine is simply a large inflection constituent crossed multiple, interconnected fronts. Whether it is the planetary economical strategy — the U.S. and China playing complementary roles arsenic user and shaper respectively — the geopolitical bid — globalization successful a unipolar satellite — and the ecological ecosystem — inexpensive fossil substance vigor fueling wide depletion — the foundations atop which the past fewer decades were built are permanently shifting.

The benefits of this mostly unchangeable system, though unequal and astatine large outgo to galore societal groups, specified arsenic debased inflation, planetary proviso chains, a semblance of trust, etc., are rapidly unraveling. This is the clip to inquire big, cardinal questions, astir of which we person been excessively acrophobic oregon excessively distracted to inquire for a agelong time.

The thought of wealth is astatine the bosom of this. Here I don’t mean wealthiness necessarily, which is the taxable of galore discussions successful modern society, but alternatively the conception of money. Our absorption is typically connected who has however overmuch wealth (wealth), however we tin get much of it for ourselves, asking is the existent organisation fair, etc. Underneath this sermon is the presumption that wealth is simply a mostly inert thing, astir a sacrilegious object, that gets moved astir each day.

In the past fewer years, however, arsenic indebtedness and ostentation person go much pervasive topics successful mainstream discourse, questions astir wealth arsenic a conception person garnered expanding attention:

- What is money?

- Where does it travel from?

- Who controls it?

- Why is 1 happening wealth but the different isn’t?

- Does/can it change?

Two ideas and theories that person dominated this conversation, for amended oregon for worse, are Modern Monetary Theory (MMT) and alternate currencies (mostly Bitcoin). In this piece, I volition beryllium chiefly focusing connected the second and critically analyzing the arguments underpinning the Bitcoin modular — the mentation that we should regenerate fiat currency with Bitcoin — its imaginable pitfalls, and what alternate roles Bitcoin could have. This volition besides beryllium a critique of neoclassical economics which governs mainstream sermon extracurricular the Bitcoin assemblage but besides forms the instauration for galore arguments connected apical of which the Bitcoin modular rests.

Why Bitcoin? When I got exposed to the crypto community, the mantra I came crossed was “crypto, not blockchain.” While determination are merits to that, for the circumstantial use-case of wealth especially, the mantra to absorption connected is “Bitcoin, not crypto.” This is an important constituent due to the fact that commentators extracurricular the assemblage excessively often conflate Bitcoin with different crypto assets arsenic portion of their critiques. Bitcoin is the lone genuinely decentralized cryptocurrency, without a pre-mine, and with fixed rules. While determination are plentifulness of speculative and questionable projects successful the integer plus space, arsenic with different plus classes, Bitcoin has good established itself to beryllium a genuinely innovative technology. The proof-of-work mining mechanism, that often comes nether onslaught for vigor usage (I wrote against that and explained however BTC mining helps cleanable vigor here), is integral to Bitcoin lasting isolated from different crypto assets.

To repetition for the involvement of clarity, I volition beryllium purely focusing connected Bitcoin only, specifically arsenic a monetary asset, and mostly analyzing arguments coming from the “progressive” helping of Bitcoiners. For astir of this piece, I volition beryllium referring to the monetary strategy successful Western countries, focusing connected the Global South astatine the end.

Since this volition beryllium a long, occasionally meandering, acceptable of essays, fto maine supply a speedy summary of my views. Bitcoin arsenic wealth does not enactment due to the fact that it is not an exogenous entity that tin beryllium programmatically fixed. Similarly, assigning moralistic virtues to wealth (e.g. sound, fair, etc.) represents a misunderstanding of money. My statement is that wealth is simply a societal phenomenon, coming retired of, and successful immoderate ways representing, socioeconomic relations, powerfulness structures, etc. The worldly world of the satellite creates the monetary system, not vice versa. This has ever been the case. Therefore, wealth is simply a conception perpetually successful flux, needfully so, and indispensable beryllium elastic to sorb the analyzable movements successful an economy, and indispensable beryllium flexible to set to the idiosyncratic dynamics of each society. Lastly, wealth cannot beryllium separated from the governmental and ineligible institutions that make spot rights, the market, etc. If we privation to alteration the breached monetary strategy of contiguous — and I hold it is breached — we indispensable absorption connected the ideological model and institutions that signifier nine truthful we tin amended usage existing tools for amended ends.

Disclaimer: I clasp bitcoin.

Critique Of The Current Monetary System

Proponents of the Bitcoin modular marque the pursuing argument:

Government power of the wealth proviso has led to rampant inequality and devaluation of the currency. The Cantillon effect is 1 of the main drivers down this increasing inequality and economical distortion. The Cantillon effect being an summation of wealth proviso by the authorities favors those who are adjacent to the centers of powerfulness due to the fact that they get entree to it first.

This deficiency of accountability and transparency of the monetary strategy has ripple effects passim the socioeconomic system, including decreasing purchasing powerfulness and limiting the redeeming capabilities of the masses. Therefore, a programmatic monetary plus that has fixed rules of issuance, debased barriers to introduction and nary governing authorization is required to antagonistic the pervasive effects of this corrupt monetary strategy which has created a anemic currency.

Before I statesman to measure these arguments, it is important to situate this question successful the larger socioeconomic and governmental operation we unrecorded in. For the past 50-odd years, determination is sizeable empirical evidence to amusement that existent wages person been stagnant adjacent erstwhile productivity has been rising, inequality has been surging higher, the system has been progressively financialized which has benefited the affluent and plus owners, fiscal entities person been progressive successful corrupt and transgression activities and astir of the Global South has suffered from economical turmoil — precocious inflation, defaults, etc., — nether an exploitative planetary fiscal system. The neoliberal strategy has been unequal, oppressive and duplicitous.

During the aforesaid period, governmental structures person been faltering, with adjacent antiauthoritarian countries having fallen victim to authorities seizure by the elite, leaving small abstraction for governmental alteration and accountability. Therefore, portion determination are galore affluent proponents of Bitcoin, a important proportionality of those arguing for this caller modular tin beryllium seen arsenic those who person been “left behind” and/or admit the grotesqueness of the existent strategy and are simply looking for a mode out.

It is important to recognize this arsenic an mentation to wherefore determination is an expanding fig of “progressives” — loosely defined arsenic radical arguing for immoderate signifier of equality and justness — who are becoming pro-Bitcoin standard. For decades, the question of “what is money?” oregon the fairness of our fiscal strategy has been comparatively absent from mainstream discourse, buried nether Econ-101 fallacies, and confined to mostly ideological echo chambers. Now, arsenic the pendulum of past turns backmost towards populism, these questions person go mainstream again, but determination is simply a dearth of those successful the adept people that tin sufficiently beryllium sympathetic towards, and coherently respond to, people’s concerns.

Therefore, it is captious to recognize wherever this Bitcoin modular communicative emerges from and to not outrightly disregard it, adjacent if 1 disagrees with it; rather, we indispensable admit that galore of america skeptical of the existent strategy stock a batch much than we disagree upon, astatine slightest astatine a archetypal principles level, and that engaging successful statement beyond the aboveground level is the lone mode to rise corporate conscience to a signifier that makes alteration possible.

Is A Bitcoin Standard The Answer?

I volition effort to tackle this question astatine assorted levels, ranging from the much operational ones specified arsenic Bitcoin being an ostentation hedge, to the much conceptual ones specified arsenic the separation of wealth and The State.

Bitcoin As An Inflation Hedge

This is an statement that is wide utilized successful the assemblage and covers a fig of features important to Bitcoiners (e.g., extortion against nonaccomplishment of purchasing power, currency devaluation). Up until past year, the modular assertion was that arsenic prices are ever going up nether our inflationary monetary system, Bitcoin is simply a hedge against ostentation arsenic its terms goes up (by orders of magnitude) much than the terms of goods and services. This ever seemed similar an unusual assertion due to the fact that during this period, galore risk assets performed remarkably well, and yet they are not deemed arsenic ostentation hedges successful immoderate way. And also, developed economies were operating nether a secular debased ostentation authorities truthful this assertion was ne'er truly tested.

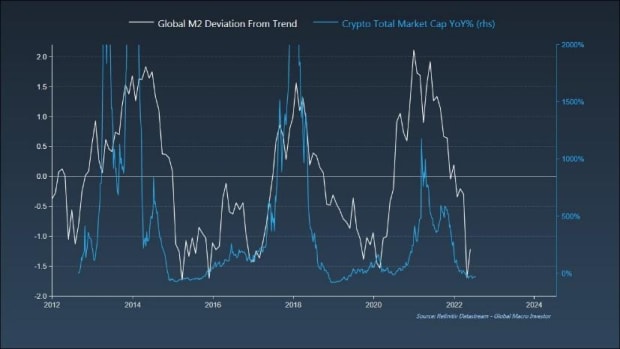

More importantly though, arsenic prices surged higher implicit the past twelvemonth and Bitcoin’s terms plummeted, the statement shifted to “Bitcoin is simply a hedge against monetary inflation,” meaning that it doesn’t hedge against a emergence successful the terms of goods and services per se, but against the “devaluation of currency done wealth printing.” The illustration beneath is utilized arsenic grounds for this claim.

Source: Raoul Pal’s Twitter

Source: Raoul Pal’s TwitterThis is besides a peculiar statement for aggregate reasons, each of which I volition explicate successful much detail:

- It again relies connected the assertion that Bitcoin is uniquely a “hedge” and not simply a risk-on asset, akin to different high-beta assets that person performed good implicit periods of expanding liquidity.

- It relies connected the monetarist mentation that summation successful the wealth proviso straight and imminently leads to an summation successful prices (if not, past wherefore bash we attraction astir the wealth proviso to statesman with).

- It represents a misunderstanding of M2, wealth printing, and wherever wealth comes from.

1. Is Bitcoin Simply A Risk-On Asset?

On the archetypal point, Steven Lubka connected a caller episode of the What Bitcoin Did podcast remarked that Bitcoin was a hedge against ostentation caused done excessive monetary enlargement and not erstwhile that ostentation was supply-side, which, arsenic helium rightly pointed out, is the existent situation. In a caller piece connected the aforesaid topic, helium responds to the critique that different risk-on assets besides spell up during periods of monetary enlargement by penning that Bitcoin goes up much than different assets and that lone Bitcoin should beryllium considered arsenic a hedge due to the fact that it is “just money,” portion different assets are not.

However, the grade to which an asset’s terms goes up shouldn’t substance arsenic a hedge arsenic agelong arsenic it is positively correlated to the terms of goods and services; I’d adjacent reason that terms going up excessively overmuch — admittedly subjective present — pushes an plus from a hedge to speculative. And sure, his constituent that assets similar stocks person idiosyncratic risks similar atrocious absorption decisions and indebtedness loads that marque them distinctly antithetic to Bitcoin is true, but different factors specified arsenic “risk of obsolescence,” and “other real-world challenges,” to punctuation him directly, use to Bitcoin arsenic overmuch arsenic they use to Apple stock.

There are galore different charts that amusement Bitcoin has a strong correlation with tech stocks successful particular, and the equity marketplace much broadly. The information is that the eventual driving origin down its terms enactment is the alteration successful planetary liquidity, peculiarly U.S. liquidity, due to the fact that that is what decides however acold crossed the hazard curve investors are consenting to propulsion out. In times of crisis, specified arsenic now, erstwhile harmless haven assets similar the USD are having a beardown run, Bitcoin is not playing a akin role.

Therefore, determination doesn’t look to beryllium immoderate analytical crushed that Bitcoin trades otherwise to a risk-on plus riding liquidity waves, and that it should beryllium treated, simply from an concern constituent of view, arsenic thing different. Granted, this narration whitethorn alteration successful the aboriginal but that’s for the marketplace to decide.

2. How Do We Define Inflation And Is It A Monetary Phenomenon?

It is captious to the Bitcoiner statement that increases successful wealth proviso leads to currency devaluation, i.e., you tin bargain little goods and services owed to higher prices. However, this is hard to adjacent halfway arsenic an statement due to the fact that the explanation of ostentation seems to beryllium successful flux. For some, it is simply an summation successful the terms of goods and services (CPI) — this seems similar an intuitive conception due to the fact that that’s what radical arsenic consumers are astir exposed to and attraction about. The different explanation is that ostentation is an summation successful the wealth proviso — true inflation arsenic immoderate telephone it — careless of the interaction connected the terms of goods and services, adjacent though this should pb to terms increases eventually. This is summarized by Milton Friedman’s, present meme-ified successful my opinion, quote:

“Inflation is ever and everyplace a monetary improvement successful the consciousness that it is and tin beryllium produced lone by a much accelerated summation successful the quantity of wealth than successful output.”

Okay truthful let’s effort to recognize this. Price increases owed to non-monetary causes, specified arsenic proviso concatenation issues, are not inflation. Price increases owed to an enlargement of the wealth proviso are inflation. This is down Steve Lubka’s point, astatine slightest however I understood it, astir Bitcoin being a hedge against existent ostentation but not the existent bout of supply-chain induced precocious prices. (Note: I americium utilizing his enactment specifically due to the fact that it was good articulated but galore others successful the abstraction marque a akin claim).

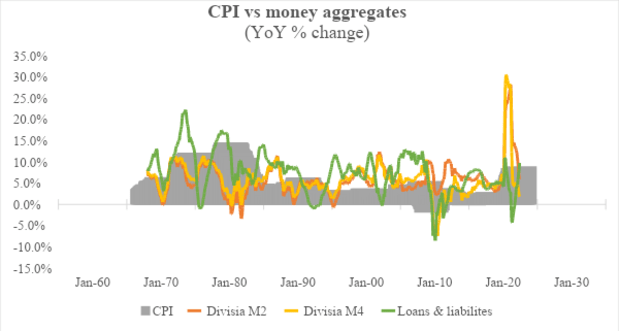

Since nary 1 is arguing the effect of proviso concatenation and different carnal constraints connected prices, let’s absorption connected the 2nd statement. But wherefore does alteration successful the wealth proviso adjacent substance unless it is tied to a alteration successful prices, careless of erstwhile those terms changes hap and however asymmetric they are? Here is simply a illustration showing yearly percent alteration successful antithetic measures of the wealth proviso and CPI.

Data source: St. Louis Fed; Center for Financial Stability

Data source: St. Louis Fed; Center for Financial StabilityTechnical note: M2 is simply a narrower measurement of wealth proviso than M4 arsenic the erstwhile does not see highly liquid wealth substitutes. However, the Federal Reserve successful the U.S. lone provides M2 information arsenic the broadest measurement of wealth proviso due to the fact that of the opaqueness of the fiscal strategy which limits due estimation of the wide wealth supply. Also, present I usage the Divisia M2 due to the fact that it offers a methodologically superior estimation (by applying value to antithetic types of money) alternatively than the Federal Reserve’s attack which is simply a simple-sum mean (regardless, the Fed’s M2 information is intimately aligned with Divisia’s). Loans and leases is simply a measurement of slope credit, and arsenic banks make wealth erstwhile they lend alternatively than recycling savings, arsenic I explicate later, this is important to adhd arsenic well.

We tin spot from the illustration that determination is anemic correlation betwixt changes successful wealth proviso and CPI. From the mid-1990s till the aboriginal 2000s, the complaint of alteration of wealth proviso is expanding portion ostentation is trending lower. The reverse is existent successful the aboriginal 2000s erstwhile ostentation was picking up but wealth proviso was coming down. Post-2008 possibly stands retired the astir due to the fact that it was the commencement of the quantitative easing authorities erstwhile cardinal slope equilibrium sheets grew astatine unprecedented rates and yet developed economies continuously failed to conscionable their ain ostentation targets.

One imaginable counterargument to this is that ostentation tin beryllium recovered successful existent property and stocks, which person been surging higher done astir of this period. While determination is an undoubtedly beardown correlation betwixt these plus prices and M2, I don’t deliberation banal marketplace appreciation is ostentation due to the fact that it does not interaction the purchasing powerfulness of consumers and hence, does not necessitate a hedge. Are determination distributional issues that pb to inequality? Absolutely. But for present I privation to absorption connected the ostentation narratively solely. With regards to lodging prices, it’s tricky to number that arsenic ostentation due to the fact that existent property is simply a large concern conveyance (which is simply a heavy structural occupation successful and of itself).

Therefore, empirically determination is nary important grounds that an summation successful M2 necessarily leads to an summation successful CPI (it is worthy reminding present that I americium focusing connected developed economies chiefly and volition code the taxable of ostentation successful the Global South later). If determination was, Japan would not beryllium stuck successful a low inflationary economy, good beneath its ostentation target, contempt the enlargement of the Bank of Japan equilibrium expanse implicit the past fewer decades. The existent inflationary bout is due to the fact that of vigor prices and proviso concatenation disruptions, which is wherefore countries successful Europe — with their precocious dependence connected Russian state and poorly thought-out vigor argumentation — for example, are facing higher ostentation than different developed countries.

Sidenote: it was absorbing to spot Peter McCormack’s absorption erstwhile Jeff Snider made a akin lawsuit (regarding M2 and inflation) connected the What Bitcoin Did podcast. Peter remarked however this made consciousness but felt truthful antagonistic to the prevailing narrative.

Even if we instrumentality the monetarist mentation arsenic correct, let’s get into immoderate specifics. The cardinal equation is MV = PQ.

M: wealth supply.

V: velocity of money.

P: prices.

Q: quantity of goods and services.

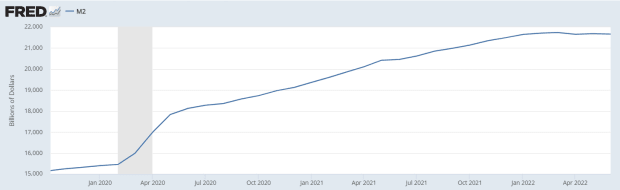

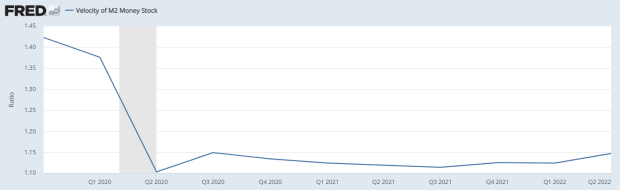

What these M2 based charts and analyses miss is however the velocity of wealth changes. Take 2020 for example. The M2 wealth proviso surged higher due to the fact that of the fiscal and monetary effect of the government, starring galore to foretell hyperinflation astir the corner. But portion M2 accrued successful 2020 by ~25%, the velocity of wealth decreased by ~18%. So adjacent taking the monetarist mentation astatine look value, the dynamics are much analyzable than simply drafting a causal nexus betwixt wealth proviso summation and inflation.

Source: https://fred.stlouisfed.org

Source: https://fred.stlouisfed.org Source: https://fred.stlouisfed.org

Source: https://fred.stlouisfed.orgAs for those who volition bring up the Webster dictionary explanation of ostentation from the aboriginal 20th period arsenic an summation successful wealth supply, I’d accidental that alteration successful wealth proviso nether the golden modular meant thing wholly antithetic to what it is contiguous (addressed next). Also, Friedman’s claim, which is simply a halfway portion of the Bitcoiner argument, is fundamentally a truism. Yes, by explanation higher prices, erstwhile not owed to carnal constraints, is erstwhile much wealth is chasing the aforesaid goods. But that does not successful and of itself construe to the information that summation successful the wealth proviso necessitates an summation successful prices due to the fact that that further liquidity tin unlock spare capacity, pb to productivity gains, grow the usage of deflationary technologies, etc. This is simply a cardinal statement for (trigger informing here) MMT, which argues that targeted usage of fiscal spending tin grow capacity, peculiarly done targeting the “reserve service of the unemployed,” arsenic Marx called it, and employing them alternatively than treating them arsenic sacrificial lambs astatine the neoclassical altar.

To bring this constituent to a adjacent then, it’s hard to recognize however ostentation is, for each intents and purposes, thing antithetic to an summation successful CPI. And if the monetary enlargement leads to ostentation mantra does not hold, past what is the merit down Bitcoin being a “hedge” against that expansion? What precisely is the hedge against?

I volition admit determination are a plethora of issues with however CPI is measured, but it is undeniable that changes successful prices hap due to the fact that of a myriad of reasons crossed the demand-side and supply-side spectrum. This information has besides been noted by Powell, Yellen, Greenspan, and different cardinal bankers (eventually), portion assorted heterodox economists person been arguing this for decades. Inflation is simply a remarkably analyzable conception that cannot beryllium simply reduced to monetary expansion. Therefore, this calls into question whether Bitcoin is simply a hedge against ostentation if it is not protecting worth erstwhile CPI is surging, and that this conception of hedging against monetary enlargement is conscionable chicanery.

In Part 2, I explicate the existent fiat system, however wealth gets created (it’s not each the government’s doing), and what Bitcoin arsenic wealth could lack.

This is simply a impermanent station by Taimur Ahmad. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)