Another year, different Crypto Christmas peculiar for our squad astatine NewsBTC. In the coming week, we’ll beryllium unpacking 2023, its downs and ups, to uncover what the adjacent months could bring for crypto and DeFi investors.

Like past year, we paid homage to Charles Dicke’s classical “A Christmas Carol” and gathered a radical of experts to sermon the crypto market’s past, present, and future. In that way, our readers mightiness observe clues that volition let them to transverse 2024 and its imaginable trends.

Crypto Christmas: A Deep Look Into The Bull Market And A Secret Pattern

Once again, the crypto analytics steadfast Material Indicators joined america to sermon the existent marketplace structure.

This year, we spoke with Keith Alan, 1 of the co-founders and analysts astatine the firm. Alan gave america his position connected the bull marketplace oregon what looks similar the opening of a bullish trend.

Material Indicators is good known for their reliance connected hard data, and for sharing views that often questioned the wide beliefs successful the crypto market. This clip was nary quality arsenic Alan pointed to the grounds favoring some sides, bulls and bears. This is what helium told us.

Q: In airy of the prolonged bearish trends observed successful 2022 and 2023, however bash these periods comparison to erstwhile downturns successful severity and impact? With Bitcoin present crossing the $40,000 threshold, does this signify a conclusive extremity to the carnivore market, oregon are determination imaginable marketplace twists investors should brace for?

MI:

Nobody could reason that 2022 was thing but a carnivore market. After Bitcoin reached an ATH successful November of 2021 we saw the carnivore marketplace make successful classical manner by losing enactment astatine cardinal method levels. While the carnivore was playing retired successful somewhat predictable fashion, the marketplace was caught disconnected defender by the events that led to the FTX clang successful November 2022. Because the contagion from FTX had a devastating ripple effect that was felt by the largest institutions with crypto vulnerability arsenic good arsenic banks, I really expected prices to autumn adjacent lower.

At the time, fearfulness and warring among organization players similar Galaxy, Gemini and Grayscale (under DCG) who were among SBF’s largest organization victims added to the interest that terms would grind down towards the little teens, yet somewhat remarkably and possibly not truthful coincidentally connected January 1, 2023 Bitcoin started to rally. What was archetypal considered play whale games evolved agelong past the weekend, and successful fact, done Q1/2023 I identified an entity connected FireCharts which I nicknamed “Notorious B.I.D.” that was treble stacking ample blocks of bid liquidity to propulsion terms higher. There was a signifier to the behaviour that made it somewhat predictable and tradable. Those moves were good documented successful my X provender during that play of time. Once terms reached $25k that entity disappeared. Even without the assistance of that manipulation pushing terms up, and contempt the information that the macroeconomic concern was horrible, the geopolitical concern went from atrocious to worse and the US governmental concern evolved from a dysfunctional sh*t amusement to a afloat blown circus, the marketplace continued to rally.

Now, astir 12 months and > 150% from the time the rally began, the statement betwixt bulls and bears implicit whether this is simply a confirmed bull marketplace oregon a series of carnivore marketplace organisation rallies virtually continues today. While it’s understandable that idiosyncratic could look astatine 150% and instantly presume bull market, it does necessitate a deeper knowing of what organisation and accumulation look like. From my view, that inactive isn’t arsenic wide arsenic 1 would expect. Historically, the Purple Class of Whales with orders successful the $100k – $1M scope person had the astir power implicit BTC terms direction. The bid travel information I’ve been monitoring connected Binance shows that done astir of the twelvemonth they (along with larger MegaWhales) person been buying dips and distributing importantly much than they bought connected those dips connected the uptrends that followed.

Only precocious person we seen an uptick that could beryllium an denotation that the inclination is shifting. Parallel to that, immoderate on-chain information providers are showing an summation successful the fig of wallets holding BTC which is besides an denotation that we could beryllium transitioning from a organisation signifier to an accumulation signifier and I’m looking for much wide grounds of that. One of the things I look for to get a consciousness of that is bid liquidity. I judge that “Liquidity = Sentiment,” and it’s nary concealed that bid books person been bladed connected some sides of terms done astir of the year, nevertheless successful the past 3 weeks oregon so, we’ve started seeing much organization sized bid ladders coming into the bid publication and that information supports a bullish thesis, arsenic agelong arsenic they don’t dump done the adjacent pump.

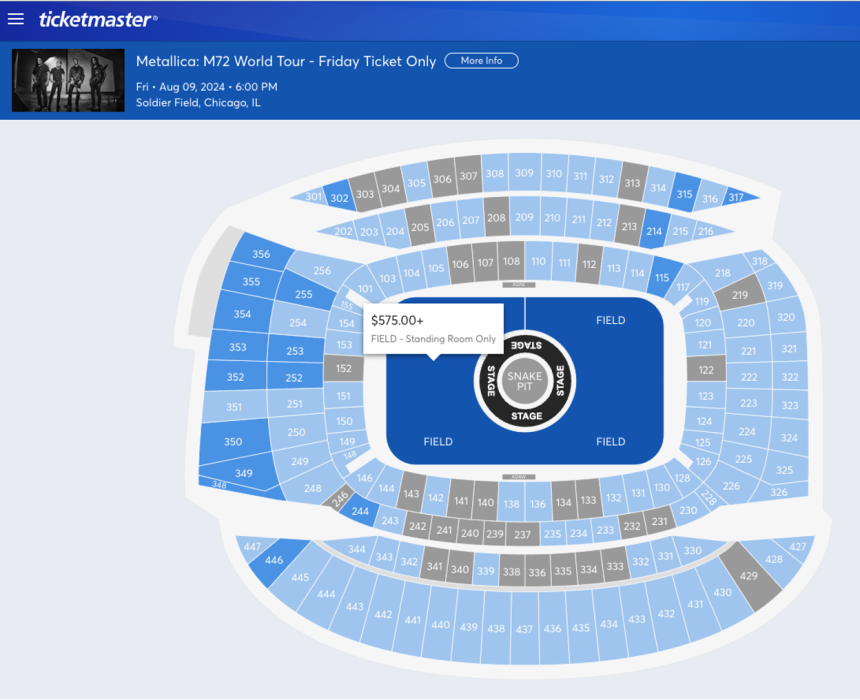

With each of the supra successful mind, determination are astir surely turns and twists that investors should look retired for. Sure we are starting to spot immoderate improvements connected the U.S. ostentation and unemployment numbers, but thing successful those reports doesn’t jive with reality. For astir mediate and little income Americans, recognition paper indebtedness is climbing to caller highs, rents person soared, location ownership is unattainable, market prices are precocious and a Metallica “Standing Room Only” Field summons is $575. So successful my mind, we inactive person a percolating macroeconomic occupation and the geopolitical and U.S. governmental issues look to get worse by the day.

Price for a lasting summons for Metallica. Source: Keith Alan – Material Indicators

Price for a lasting summons for Metallica. Source: Keith Alan – Material IndicatorsAside from that, the RSI has been implicit cooked for an extended play of clip and we conscionable had 8 consecutive greenish play candles. Both of those factors person historically led to corrections. I could springiness you the “History doesn’t person to repetition itself…” spiel oregon I tin amusement you what historically happens aft moves similar this and fto you decide.

Another imaginable twist to see is that the existent PA has a striking resemblance to the archetypal limb of the 2019 rally that turned retired to beryllium a Fib retracement, that yet got rejected from the apical of the Golden Pocket astatine .618 Fib. That led to a 53% correction earlier the Covid Crash took it down much than 70% from the .618 Fib.

Source: Keith Alan – Material Indicators

Source: Keith Alan – Material IndicatorsAt this stage, I’d beryllium amazed to spot a downside determination that heavy without the assistance of a Black Swan, but we are presently having immoderate enactment with the Golden Pocket that seems familiar. While it is tenable to expect immoderate absorption entering and exiting the Golden Pocket, determination is 1 precise weird twist to what we are seeing and that is simply a unusual signifier I’ve noticed occurring connected oregon astir December 17th. Every twelvemonth since 2017 determination has been a determination connected December 17th that had Macro implications. The lone objection to that is past twelvemonth erstwhile it happened connected December 20th. On each juncture the terms enactment led to a macro breakout oregon breakdown. It’s excessively soon to archer if this determination volition validate the signifier connected the time of penning (Dec 19th), but connected the 17th we saw BTC get rejected from the little extremity of the Golden Pocket and besides suffer the 21-Day moving average. Price has been flirting with some of those levels ever since truthful we’ll person to hold to spot however it plays retired implicit time. Aside from those things I’m watching the upcoming ETF model precise closely. I deliberation that the marketplace is numb to SEC delays connected these decisions, but determination is truthful overmuch anticipation that this clip we’ll spot an approval, that a level retired rejection has the imaginable to beryllium the catalyst that triggers a correction.

Regardless of wherever you broadside connected whether we are oregon are not successful a confirmed bull market, we’re seeing a batch of grounds that if we are not successful it, we’re adjacent to it. If you’re a agelong word capitalist and you haven’t already started gathering a position, it’s a bully clip to place immoderate targets to commencement scaling into one. This of people depends connected your clip skyline and hazard appetite, but if you person a agelong word outlook and 6 fig targets for BTC it’s inactive aboriginal capable to get in, but it’s besides a bully thought to prevention immoderate adust pulverization for a correction due to the fact that successful my opinion, it’s not a substance of if it volition come, but when.

Q: Right now, we are seeing Bitcoin scope caller highs. Do you deliberation we are successful the aboriginal days of a afloat bull run? What has changed successful the marketplace that enabled the existent terms action; is it the Bitcoin spot ETF oregon the US Fed hinting astatine a loser argumentation oregon the upcoming Halving? What is the large communicative that volition spell connected successful 2024?

MI:

Despite the ongoing statement betwixt bulls and bears implicit whether oregon not we’ve been successful a bull market, I tin accidental that contempt the uptrend, determination has been nary wide confirmation that we’ve been successful a bull marketplace done astir of the year. However, the information that we’ve precocious started to spot much organization sized bid ladders coming into the bid publication on with the on-chain information that indicates much wallets holding for longer and the caller buying aft the R/S flip astatine $40k are indications that we whitethorn beryllium connected the verge of a breakout.

There’s nary uncertainty successful my caput that a batch of the momentum we’ve been seeing is related to the adjacent ETF determination model opening January 5-10 and the April 2024 Halving. The FED’s caller determination to intermission complaint hikes and hint astatine a pivot to cuts successful 2024 surely added substance to that momentum that pushed terms supra $40k. In emblematic crypto form, we besides had immoderate assistance successful precocious October done aboriginal December erstwhile I noticed immoderate acquainted patterns successful the bid book. I can’t corroborate with implicit certainty if it was the Notorious B.I.D. spoofer we saw successful Q1 returned, but it was the aforesaid crippled I identified done Q1 being executed and determination is nary question that it helped propulsion terms up done the $35k – $40k scope earlier it disappeared.

(…) As overmuch arsenic I’d similar to spot a correction travel earlier we get determination (the Bitcoin spot ETF decision), the marketplace doesn’t attraction what I want. I would expect it to travel earlier the Halving. Whether it comes earlier oregon aft the ETF determination model closes remains to beryllium seen. In the meantime, I’ll proceed to ticker bid publication and bid travel information and commercialized what’s successful beforehand of me.

Q: Last year, we spoke astir the astir resilient sectors during the Crypto Winter. Which sectors and coins volition apt payment from a caller Bull Run? We are seeing the Solana ecosystem bloom on with the NFT market; what trends could payment successful the coming months?

MI:

The immense bulk of my absorption is connected Bitcoin and to beryllium honest, aft seeing truthful galore ponzi’s successful the space, it’s the lone integer plus I genuinely trust. There are surely immoderate large opportunities with definite alts, but with that comes accrued risk. As for sectors, it’s nary concealed that AI and Gaming person been hot. According to immoderate research I’ve been reviewing Memes, DePin and GambleFi are ascendant narratives close now.

The information that Memes are much ascendant than thing that’s really carnal similar DePin speaks to the immaturity of this market. Perhaps a amended mode of stating that is, “We are inactive early.” That said, if I’ve learned thing successful crypto determination is an accidental outgo associated with having precocious standards and principles for projects you put in. As ridiculous arsenic that whitethorn sound, the biggest upside imaginable seems to travel from immoderate of the astir meaningless projects due to the fact that they person ample communities of “Crypto Bros” pumping them and bladed liquidity makes them casual to pump. Just cognize that they besides travel with a immense hazard and similar each different ponzi, you don’t privation to beryllium the past feline holding the bag.

I personally thin to debar memes for each the reasons I mentioned above, but I bash commercialized DOGE connected juncture due to the fact that it’s been a comparatively casual scalp lately. Elon Musk playing kingmaker with that coin doesn’t marque maine similar it immoderate much oregon little (okay possibly less), but the results person been predictable. The information helium has obtained a wealth transportation licence for X (Twitter) and that helium has a DOGE logo connected his X illustration has maine considering taking a flier connected DOGE, but that’s not thing I’m recommending to anyone who isn’t consenting to suffer that money. The information helium has SpaceX launching a DOGE sponsored outer adjacent period should astatine the precise slightest bring a abbreviated word pump.

Of the starring narratives mentioned, Memes whitethorn beryllium the astir dominant, but DePin is the astir absorbing to me, due to the fact that it’s associated with thing precise existent and precise blistery close now. For those who whitethorn not beryllium familiar, DePin stands for Decentralized Physical Infrastructure Networks which are blockchain protocols that build, support and run infrastructure for the AI industry. (Do Your Own Research).

The information that you mentioned Solana is impervious that thing changes sentiment similar price. Solana has been done the ringer since falling from it’s ATH successful November 2021 and the FTX clang of 2022 delivered different 80% correction that took it to azygous digit levels. There is nary denying that it has been connected an epic tally recently. It’s somewhat puzzling to maine however that is happening astatine the nonstop aforesaid clip FTX liquidators person started the agelong process of distributing implicit $1B worthy of $SOL backmost into the market.

Rather than speculate connected what whitethorn beryllium down that, I’ll accidental that it is evident that they person a precise beardown assemblage and contempt the web issues they’ve had successful the past, they look to beryllium increasing successful popularity successful staking pools. Then again, thing influences sentiment similar price, truthful I expect we’ll spot a fig of coins filter their mode successful and retired of the starring narratives done the year. I’m conscionable hoping much of them bash truthful for morganatic reasons alternatively than fake quality oregon P&D groups. IMO, until we spot the projects with existent teams, existent usage cases, existent adoption and existent gross establishing themselves arsenic the champion projects to put successful for their fundamentals, “We’re inactive early.”

Keith Alan is President astatine Keith Alan Productions, Inc., Co-Founder astatine Blacknox, LLC and Material Indicators, LLC. Nothing written should beryllium taken arsenic fiscal advice. For much penetration and investigation travel @KAProductions and @MI_Algos. Find premium tools for traders astatine Material Indicators.

Cover representation from Unsplash, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)