Another year, different Crypto Holiday peculiar from our squad astatine NewsBTC. In the coming week, we’ll beryllium unpacking 2023, its downs and ups, to uncover what the adjacent months could bring for crypto and DeFi investors.

Like past year, we paid homage to Charles Dicke’s classical “A Christmas Carol” and gathered a radical of experts to sermon the crypto market’s past, present, and future. In that way, our readers mightiness observe clues that volition let them to transverse 2024 and its imaginable trends.

Crypto Holiday With Blofin: A Deep Dive Into 2024

We wrapped up this Holiday Special with crypto acquisition and concern steadfast Blofin. In our 2022 interview, Blofin spoke astir the fallout created by FTX, Three Arrows Capital (3AC) collapse, and Terra (LUNA). At the aforesaid time, the steadfast predicted a instrumentality from the ashes for Bitcoin and the crypto market. The resurrection seems good underway, with Bitcoin surpassing the $40,000 mark. This is what they told us:

Q: In airy of the prolonged bearish trends observed successful 2022 and 2023, however bash these periods comparison to erstwhile downturns successful severity and impact? With Bitcoin present crossing the $40,000 threshold, does this signify a conclusive extremity to the carnivore market, oregon are determination imaginable marketplace twists investors should brace for?

Blofin:

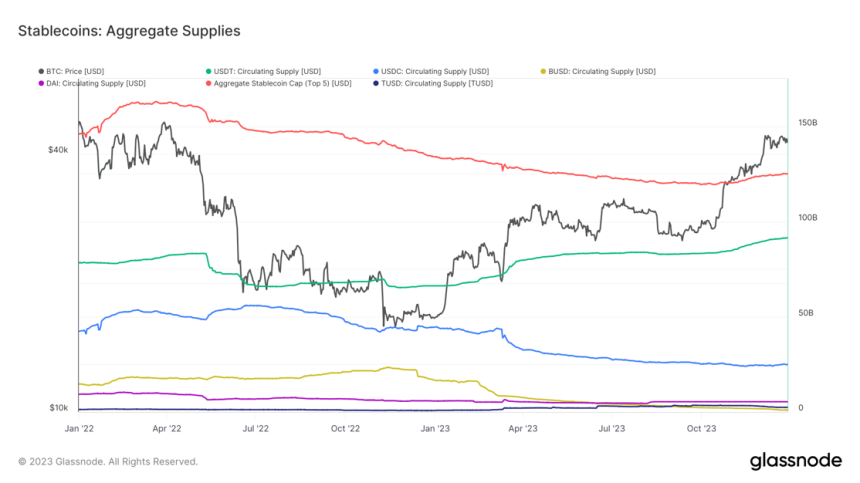

Compared to erstwhile crypto recessions, the 2022-2023 carnivore marketplace appears milder. Unlike erstwhile cycles, successful the past bull market, the wide usage of stablecoins and the introduction of monolithic accepted institutions brought much than $100 cardinal successful currency liquidity to the crypto market, and astir of the currency liquidity did not permission the crypto marketplace owed to a bid of events successful 2022.

Even successful Mar 2023, erstwhile investors’ macro expectations were the astir pessimistic, and successful 2023Q3, erstwhile liquidity bottomed out, the crypto marketplace inactive had nary little than $120 cardinal successful currency liquidity successful the signifier of stablecoins, which provides capable enactment and hazard absorption for BTC, ETH and altcoins.

Similarly, owed to abundant currency liquidity, successful the carnivore marketplace of 2022-2023, we did not acquisition a “liquidity dryness” concern akin to March 2020 and May 2021. In 2023, with the gradual betterment of the crypto market, liquidity risks were importantly reduced compared to 2022.

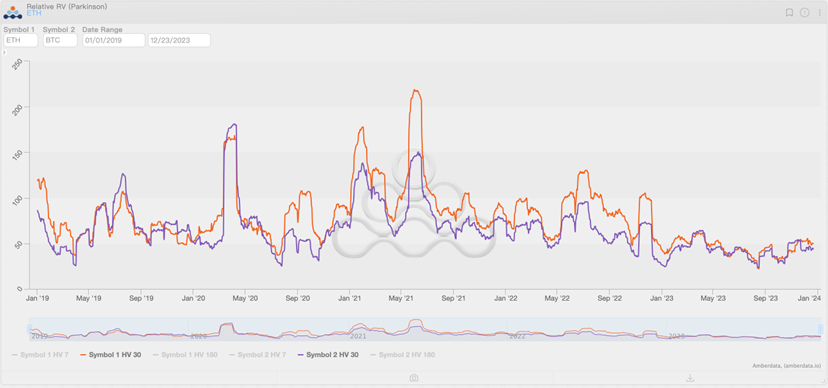

The lone troubling happening is that successful the summertime and autumn of 2023, risk-free returns of much than 5% person caused investors to absorption much connected the wealth marketplace and brought astir the lowest volatility successful the crypto marketplace since 2019.

However, debased volatility does not bespeak a recession. The show of the crypto marketplace successful the 4th 2023Q4 proves that much investors are really holding connected to the sidelines. They are not leaving the crypto marketplace but are waiting for the close clip to enter.

Currently, the full marketplace headdress of the crypto marketplace has recovered to much than 55% of its erstwhile peak. It tin beryllium considered that the crypto marketplace has emerged from the carnivore marketplace cycle, but the existent signifier should beryllium called a “technical bull market” alternatively than a “real bull market.”

Again, let’s commencement our mentation from a currency liquidity perspective. Although the terms of BTC has reached $44k once, the size of currency liquidity successful the full crypto marketplace has lone rebounded slightly, reaching astir $125b. $125b successful currency supports implicit $1.6T successful full crypto marketplace cap, implying an wide leverage ratio of implicit 12x.

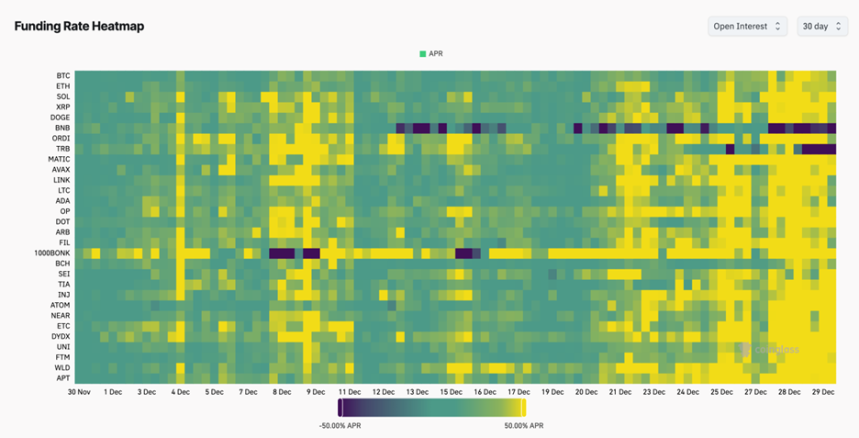

Additionally, galore tokens person seen important increases successful their annualized backing rates, adjacent exceeding 70%. High wide leverage and precocious backing rates mean that speculative sentiment has arsenic overmuch interaction connected the crypto marketplace arsenic improving fundamentals. However, the higher the leverage ratio, the little the investors’ hazard tolerance, and the precocious financing costs are hard to prolong successful the agelong term. Any atrocious quality could trigger deleveraging and origin monolithic liquidations.

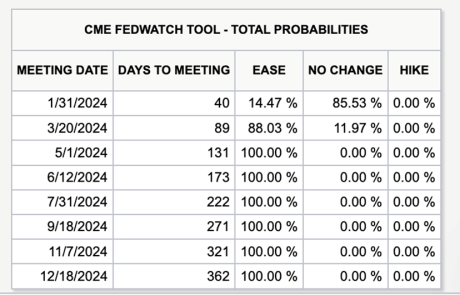

Furthermore, existent improvements successful liquidity are yet to come. The existent national funds complaint remains astatine 5.5%. In the involvement complaint market, traders expect the archetypal complaint chopped by the Federal Reserve to hap nary earlier than March and the European Central Bank and Bank of England to chopped involvement rates for the archetypal clip nary earlier than May. At the aforesaid time, cardinal slope officials from assorted countries person repeatedly emphasized that involvement complaint cuts “depend connected the data” and “will not hap soon.”

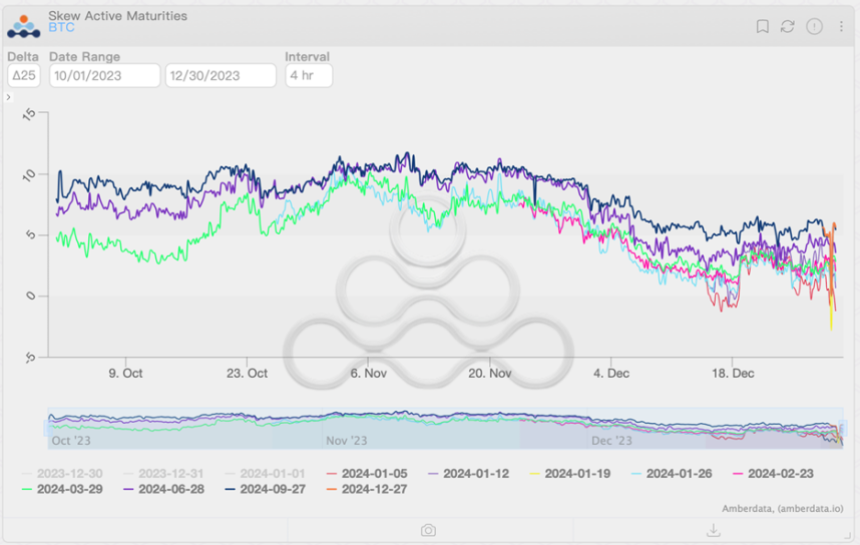

Therefore, erstwhile liquidity levels person not truly improved, the betterment and rebound of the crypto marketplace are gratifying, but the “leverage-based” betterment is importantly related to investors’ financing costs and hazard tolerance, and the imaginable callback hazard is comparatively high. In fact, successful the options market, investors person begun to accumulate enactment options aft experiencing a emergence successful December to woody with the hazard of immoderate imaginable pullback aft the commencement of 2024.

Q: Right now, we are seeing Bitcoin scope caller highs. Do you deliberation we are successful the aboriginal days of a afloat bull run? What has changed successful the marketplace that enabled the existent terms action; is it the Bitcoin spot ETF oregon the US Fed hinting astatine a loser argumentation oregon the upcoming Halving? What is the large communicative that volition spell connected successful 2024?

Blofin:

As stated above, we are inactive immoderate mode distant from the aboriginal stages of a full-blown bull market. “Technical bull market” amended describes the existent marketplace status. This circular of method bull marketplace started with improved expectations: the spot Bitcoin ETF communicative triggered investors’ expectations for the instrumentality of funds to the crypto market, portion the highest of the national funds complaint and expectations for an involvement complaint chopped adjacent twelvemonth reflected the betterment astatine the macro situation level.

In addition, immoderate funds from accepted markets person tried to beryllium the “early birds” and marque aboriginal arrangements successful the crypto market. These are each important reasons wherefore BTC’s terms is backmost supra $40k.

However, we judge that changes successful the macro situation are the astir important influencing elements among the supra factors. The accomplishment of expectations of involvement complaint cuts has allowed investors to spot the dawn of a instrumentality to the bull marketplace successful hazard assets. It is not hard to find that successful November and December, not lone Bitcoin experienced a crisp rise, but Nasdaq, the Dow Jones Index, and golden each deed all-time highs. This signifier typically occurs astatine oregon adjacent the extremity of each economical cycle.

The opening and extremity of a rhythm tin importantly interaction plus pricing. At the opening of a cycle, investors typically person their risky assets into currency oregon treasury bonds. When the rhythm ends, investors volition instrumentality currency liquidity backmost to the marketplace and bargain risk-free assets without distinction. Risk assets typically acquisition a “widespread and significant” emergence astatine this time. The supra concern is what we person experienced successful 2023Q4.

As for the Bitcoin halving, we similar that the affirmative effects it brings effect from an betterment successful the macro situation alternatively than the effect of the “halving.” Bitcoin had not go a mainstream plus with organization acceptance erstwhile the archetypal and 2nd halvings occurred. However, aft 2021, arsenic the marketplace microstructure changes, institutions person gained capable power implicit Bitcoin, and each halving coincides with the economical rhythm to a higher degree.

In 2024, we volition witnesser the extremity of the tightening rhythm and the opening of a caller easing cycle. But compared with each erstwhile rhythm change, this rhythm alteration whitethorn beryllium comparatively stable. Although the play of precocious ostentation is over, ostentation is inactive “one measurement away” from returning to the people range.

Therefore, each large cardinal banks volition debar releasing liquidity excessively rapidly and beryllium wary of the system overheating again. For the crypto market, a coagulated liquidity merchandise volition pb to a mild bull run. Perhaps it is hard for america to person the accidental to spot a bull marketplace akin to that successful 2021, but the caller bull marketplace volition past comparatively longer. More caller chances volition besides look with the information of much caller investors and the emergence of caller narratives.

Q: Last year, we spoke astir the astir resilient sectors during the Crypto Winter. Which sectors and coins volition apt payment from a caller Bull Run? We are seeing the Solana ecosystem bloom on with the NFT market; what trends could payment successful the coming months?

Blofin:

What is definite is that exchanges (whether CEX oregon DEX) are the archetypal beneficiaries erstwhile the bull marketplace returns. As the trading measurement and idiosyncratic activities statesman to rebound again, it tin beryllium expected that their income (including the exchange’s interest income, token listing income, etc.) volition summation significantly, and the show of the speech tokens whitethorn besides payment from this.

At the aforesaid time, infrastructure related to transactions and superior circulation volition besides payment from the caller bull market, specified arsenic nationalist chains and Layer-2. When liquidity returns to the crypto market, crypto infrastructure is an indispensable part: liquidity indispensable archetypal participate the nationalist concatenation earlier it tin beryllium transferred to assorted projects and underlying tokens.

In the past bull market, the congestion and precocious state outgo of the Ethereum web were criticized by galore users, which became an accidental for the emergence and improvement of Layer-2 and besides promoted the improvement and maturation of galore non-Ethereum nationalist chains, portion Solana and Avalanche are immoderate of the biggest beneficiaries.

Therefore, with the accomplishment of a caller bull market, much usage scenarios and possibilities for Layer 2 and non-Ethereum nationalist chains volition beryllium discovered. Ethereum volition besides people not beryllium acold behind; we whitethorn witnesser a caller roar successful nationalist concatenation ecosystems and tokens successful 2024.

In addition, arsenic an exploration of the latest applications of BTC, the improvement of BRC-20 cannot beryllium ignored. As a caller token issuance modular based connected the BTC web that emerged successful 2023, BRC-20 allows users to deploy standardized contracts oregon mint NFTs based connected the BTC network, providing caller narratives and usage cases for the oldest and astir mature nationalist chain.

With the instrumentality of liquidity, the exploration and improvement of BRC-20-related applications whitethorn gradually begin, and unneurotic with different nationalist concatenation ecosystems, they volition marque large advancement successful the caller “moderate but long-term” bull market.

BTC’s terms trends to the upside connected the regular chart. Source: BTCUSDT connected Tradingview

BTC’s terms trends to the upside connected the regular chart. Source: BTCUSDT connected TradingviewCover representation from Unsplash, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)