Crypto supporters were taken aback this past July erstwhile the infrastructure measure brought to the U.S. Congress claimed it could rise $28 cardinal from crypto investors by applying caller information-reporting requirements to exchanges and different parties. This projection ended up getting bushed down connected the net arsenic the dollar magnitude seemed to beryllium plucked retired of bladed air. In reality, figuring retired however overmuch taxes crypto investors beryllium based connected their superior gains is incredibly hard to estimate.

Theoretically, the Internal Revenue Service (IRS) could look done each transaction connected each blockchain to spot profits and losses successful each wallet oregon account. From there, the IRS could fig retired the magnitude of on-chain gains it could tax. However, that raises the contented of whether those assets were sent from 1 wallet to different with the aforesaid owner, thing that whitethorn not marque it a taxable event. On apical of that, there’s the trouble of getting bully accusation from exchanges to fig retired the magnitude of off-chain gains the IRS could tax. In practice, this postulation and estimation process is simply a mess.

This portion is portion of CoinDesk’s Tax Week.

If the U.S. authorities wants to rise wealth done taxation connected crypto, it could see encouraging bitcoin miners to acceptable up shop. Doing truthful could bring successful taxation gross inflows from the companies that acceptable up mining operations.

For Tax Week, we wanted to estimation the magnitude of gross the U.S. authorities could basal to summation from bitcoin mining companies. While the effect of this workout is taxable to the assumptions underpinning the model, they are worthy the look. The information that this workout is adjacent imaginable is simply a testament to bitcoin mining’s transparency and simplicity.

We built a comparatively elemental estimation of bitcoin mining profitability utilizing an open-sourced model developed by Galaxy Digital to approximate the outgo of mining a bitcoin (the study the exemplary came from is disposable here), applying simplifying assumptions to correspond the full bitcoin market.

A fewer caveats earlier we dive into a little overview of the methodology are worthy mentioning: Right now, determination are respective publically traded bitcoin mining companies (which is sometimes referred to arsenic CHARM for Core Scientific, Hut 8, Argo Blockchain, Riot Blockchain and Marathon Digital). Public companies are required to stock fiscal accusation and those reports amusement that bitcoin mining companies are, by and large, not paying precise galore taxes.

In fact, immoderate of the companies publication income connection losses and are paying nary taxes astatine all. Start-ups – which bitcoin miners are – are mostly unprofitable arsenic they look to walk wealth gathering up operations. Our exemplary strips retired the concern decisions that young companies indispensable marque erstwhile they are growing, meaning that it lone works successful a satellite with a much mature bitcoin mining industry.

We besides wanted to normalize for accounting methods allowing companies to minimize taxation burdens, mostly done non-cash charges similar share-based compensation and immoderate types of depreciation. Doing truthful makes a institution look little profitable connected insubstantial than it is successful reality.

The past simplifying presumption we marque is simply a large one, successful that bitcoin mining profitability volition not inclination to zero. There is simply a coagulated theoretical statement that bitcoin mining economical nett margins volition attack zero arsenic caller entrants articulation the comparatively debased barrier-to-entry market. (The CoinDesk study "Does Bitcoin Have an Energy Problem?" suggests that “bitcoin mining [profit] margins are comparatively capped.”) In reality, businesses request to marque wealth implicit the agelong word successful bid to enactment open, truthful we presume that bitcoin miners won’t suffer each profitability for astatine slightest the near- to medium-term.

Our enactment relied connected the exemplary done by Galaxy Digital for a elemental reason. We cognize astir however overmuch gross miners volition cod annually successful bitcoin terms. The Bitcoin protocol is designed successful a mode truthful that a artifact is mined astir each 10 minutes, truthful we tin accidental with assurance that the magnitude of gross miners volition marque annually is 328,500 bitcoin positive transaction fees, which nominally marque up astir 3% of the existent artifact reward.

As such, the main absorption for determining profitability should beryllium connected estimating costs. The 3 main expenses we looked to estimation were outgo of gross (mainly energy costs for mining); selling, wide and administrative expenses (general costs similar selling and rent); and depreciation (a non-cash but existent disbursal that represents the deterioration and teardrop connected machines utilized for mining).

In plain English, we looked to estimation the outgo of the energy it takes to powerfulness mining rigs and the outgo of “keeping the lights on.”

The main outgo operator for bitcoin mining is simply a relation of energy usage and price. Galaxy’s exemplary calculates the outgo of bitcoin accumulation based connected the specifications and show of 18 antithetic models of ASIC mining machines. These machines gully antithetic amounts of powerfulness astatine varying levels of efficiency. Each benignant of mining instrumentality operates astatine a antithetic level of profitability based connected the outgo of energy per kilowatt hour. Our basal lawsuit assumed $0.06 per kwh of energy cost.

Next, successful this machinery-heavy business, the mining companies that bargain ASICs person a meaningful magnitude of depreciation to woody with. Our exemplary assumes 22.5% of gross arsenic the basal lawsuit based connected the presumption that mining companies volition depreciate their ASICs implicit 5 years.

These companies past person different costs associated with SG&A which, done nationalist institution comparisons and informed by Galaxy’s work, is estimated to beryllium astir 12.5%.

Lastly, we included a catch-all for “other expenses” that made up 3.5% of revenues, arsenic a mode to curtail the imaginable overstatement of profitability. We could person easy made the aforesaid accommodation successful the different absorption and admit this is mostly a plan prime by our team.

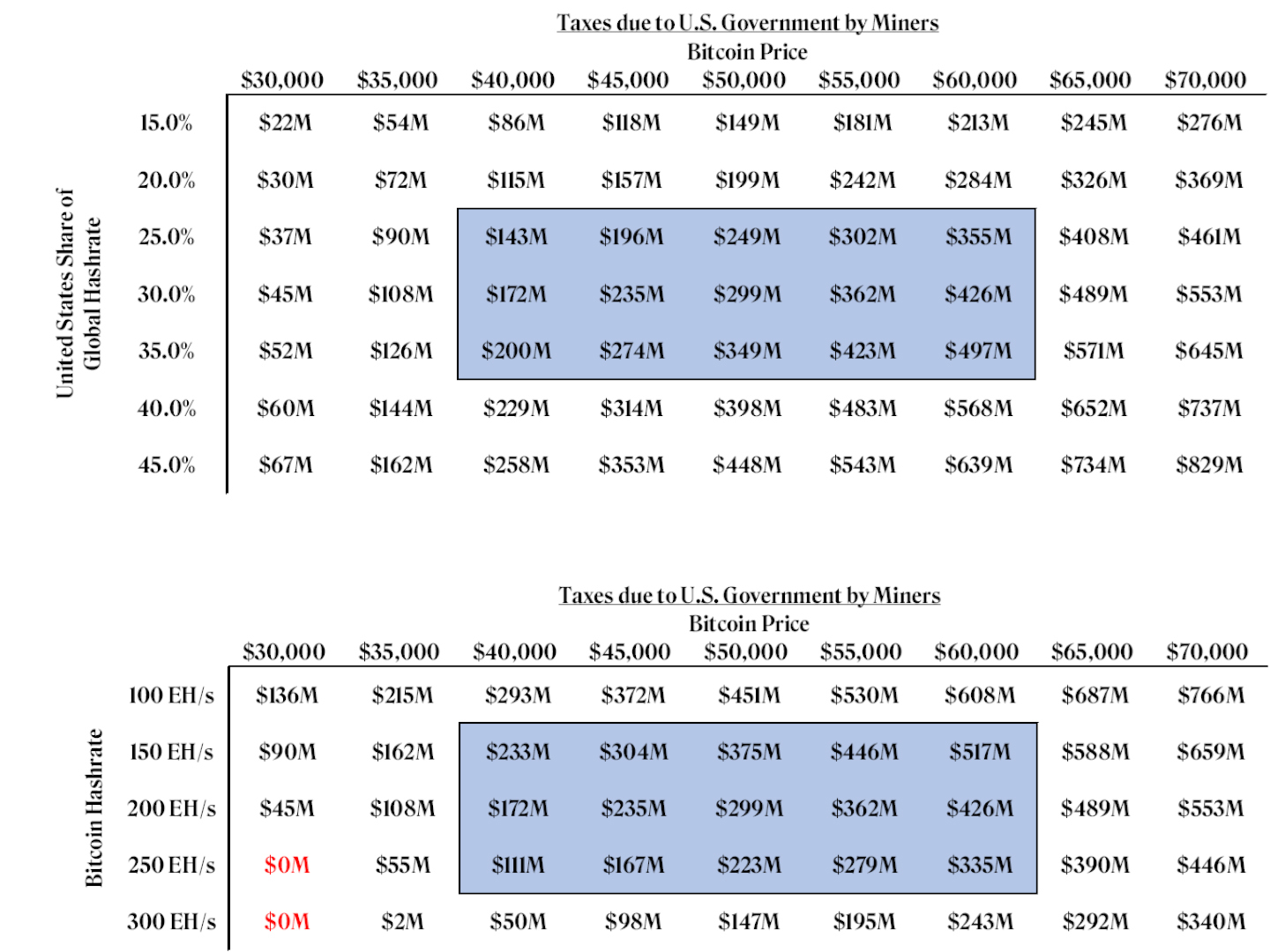

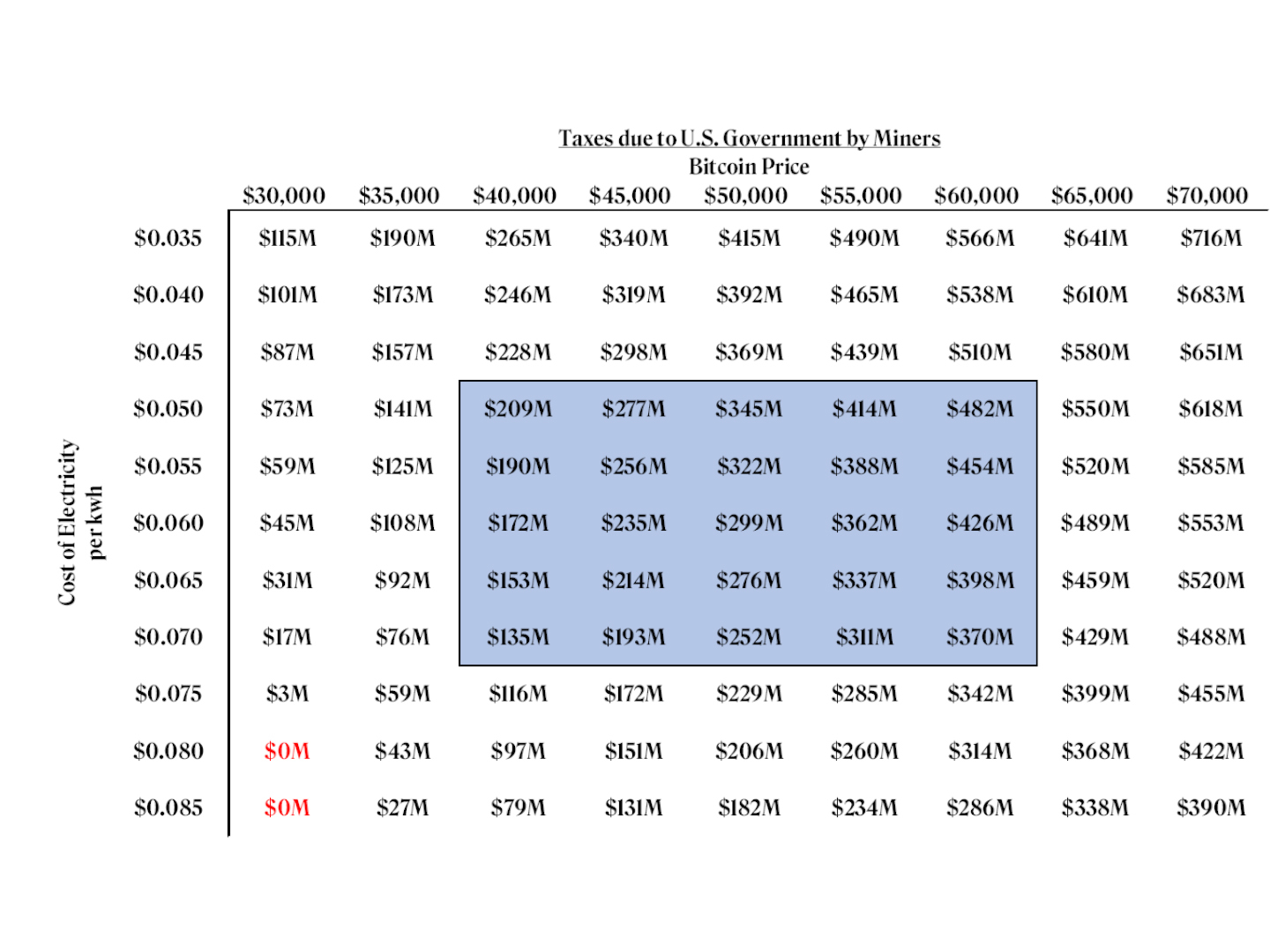

Below we contiguous our results successful two-way charts utilizing assorted scenarios adjusting for bitcoin price, Bitcoin’s full hashrate, the outgo of energy and U.S. stock of planetary hashrate. The numbers successful the illustration correspond the yearly national taxation gross to the authorities from mining companies, assuming a 21% national firm taxation rate.

In the lawsuit the input is not sensitized against successful the chart, the basal lawsuit is:

Global bitcoin hashrate of 200 EH/s

Electricity outgo of $0.06 kwh

U.S. has a 30% stock of planetary hashrate

21% national firm taxation rate

Bitcoin Price and Hashrate Tax Estimation

Bitcoin Price and Electricity Cost Tax Estimation

In the basal lawsuit scenario, bitcoin miner pre-tax profitability was estimated astatine $1.4 cardinal and a taxation measure of $299 million. That script shows up successful the mediate of each array below. All different numbers successful the tables are typical of estimated taxes if those inputs were changed. For example, if bitcoin terms were $60,000 and hashrate were 250 EH/s, taxes to the U.S. authorities would beryllium $335 million.

Conclusion and disclaimer

Of course, this workout was for informational purposes and the results provided are for illustrative purposes only.

We admit the shortcomings of our exemplary and this exercise. But astatine the precise least, bitcoin mining represents a perchance profitable manufacture that, erstwhile domiciled successful the U.S., could supply the authorities with accrued taxation revenue. While the specifics of “how much” gross this could bring the authorities alteration greatly (showcased by the wide scope of dollar amounts shown successful the two-way tables, successful immoderate scenarios adjacent hitting $0), profitable businesses correspond taxation gross opportunities for the U.S. government.

Further Reading from CoinDesk's Tax Week

Crypto won’t prevention you from taxes, but it whitethorn yet marque them easier to pay, says futurist Dan Jeffries.

Tax guidance lags innovation. So does taxation software. Meanwhile, misconceptions abound. If not careful, investors tin extremity up owing much taxation than expected and having to unload crypto to wage the bill

Investors successful MicroStrategy, Tesla, Block and Coinbase request to see however chaotic terms swings volition impact results, not lone straight but indirectly owed to analyzable taxation accounting rules.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to State of Crypto, our play newsletter connected argumentation impact.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)