While Bitcoin is usually considered the backbone of the crypto industry, 1 should ne'er underestimate the relation stablecoins play successful the market.

Stablecoins are fundamentally the fiat currency of the crypto ecosystem and enactment arsenic the main supplier of liquidity to the market.

When looking astatine the crypto marketplace arsenic a closed strategy containing lone stablecoins and cryptocurrencies, the proviso of stablecoins and their behaviour becomes progressively important. This is particularly utile erstwhile analyzing Bitcoin’s performance, arsenic the ratio betwixt the 2 tin bespeak a imaginable terms rise.

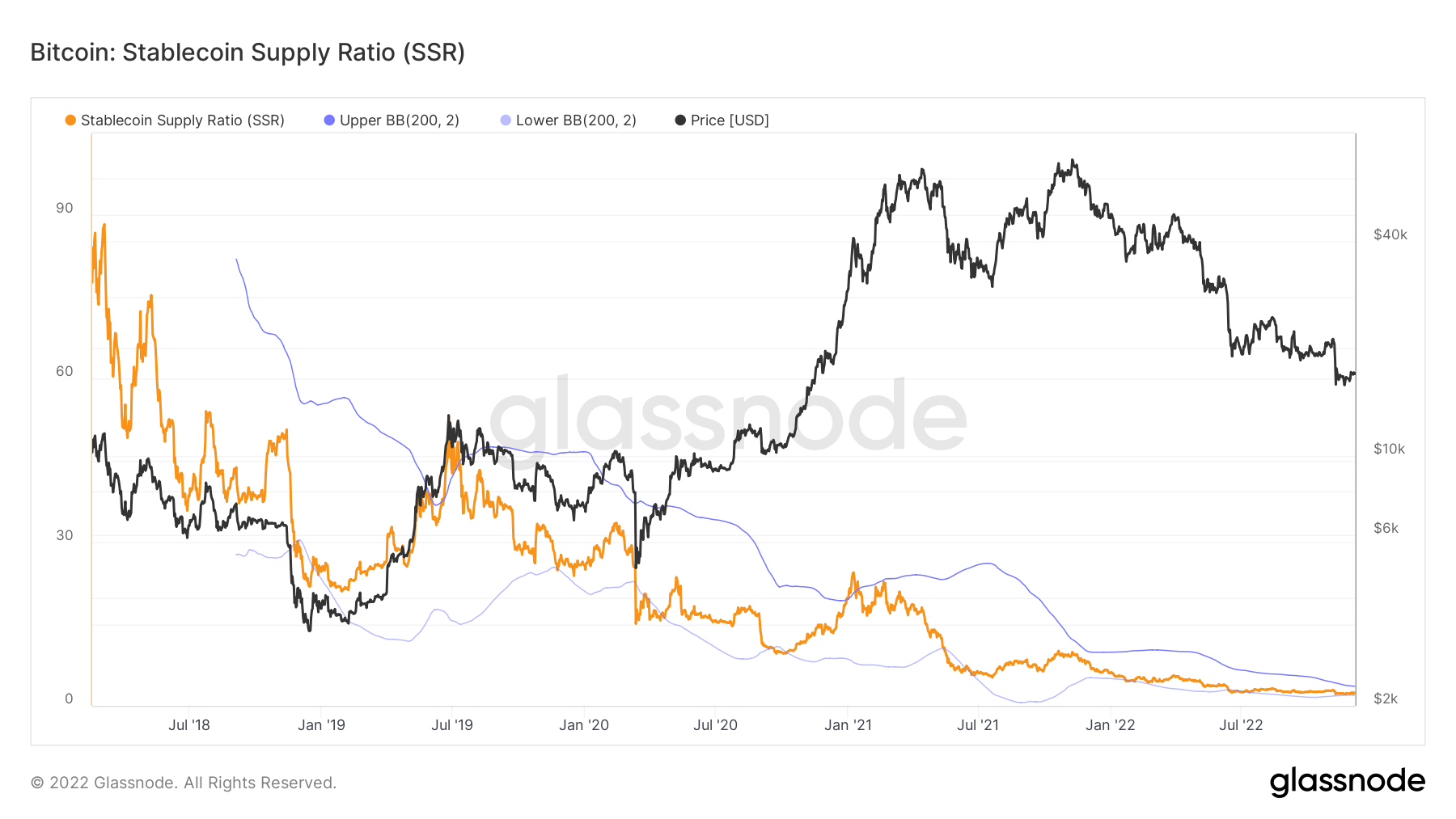

The Stablecoin Supply Ratio (SSR) shows the ratio betwixt Bitcoin’s circulating proviso and the proviso of stablecoins.

Any question seen successful SSR provides penetration into what has much value connected the marketplace — Bitcoin oregon stablecoins. The ratio fundamentally compares the powerfulness presumption betwixt the two.

When the SSR is high, it shows that the proviso of stablecoins is debased erstwhile compared to Bitcoin’s marketplace cap. This indicates that determination is small buying unit connected the market, arsenic determination are less stablecoins (i.e. liquidity) to spell around. Low buying unit tin bespeak that Bitcoin’s terms could driblet and is considered to beryllium a bearish sign.

A debased SSR means that the proviso of stablecoins is precocious erstwhile compared to Bitcoin’s marketplace cap. It’s considered a bullish motion arsenic it shows excess liquidity that’s waiting to beryllium deployed into Bitcoin.

Seeing the SSR summation shows that the buying powerfulness is slowing down, portion a decreasing inclination shows the emergence successful stablecoin buying power.

Data analyzed by CryptoSlate showed that the SSR has been gradually decreasing since the opening of the year. The ratio has seen 2 astir vertical drops this twelvemonth — 1 pursuing the illness of Luna, and the different caused by the implosion of FTX.

The ratio presently stands astatine 2.34, the lowest it has been since 2018.

Graph showing the Stablecoin Supply Ratio (SSR) from 2018 to 2022 (Source: Glassnode)

Graph showing the Stablecoin Supply Ratio (SSR) from 2018 to 2022 (Source: Glassnode)The dropping SSR is further corroborated by the rapidly rising stablecoin equilibrium connected exchanges.

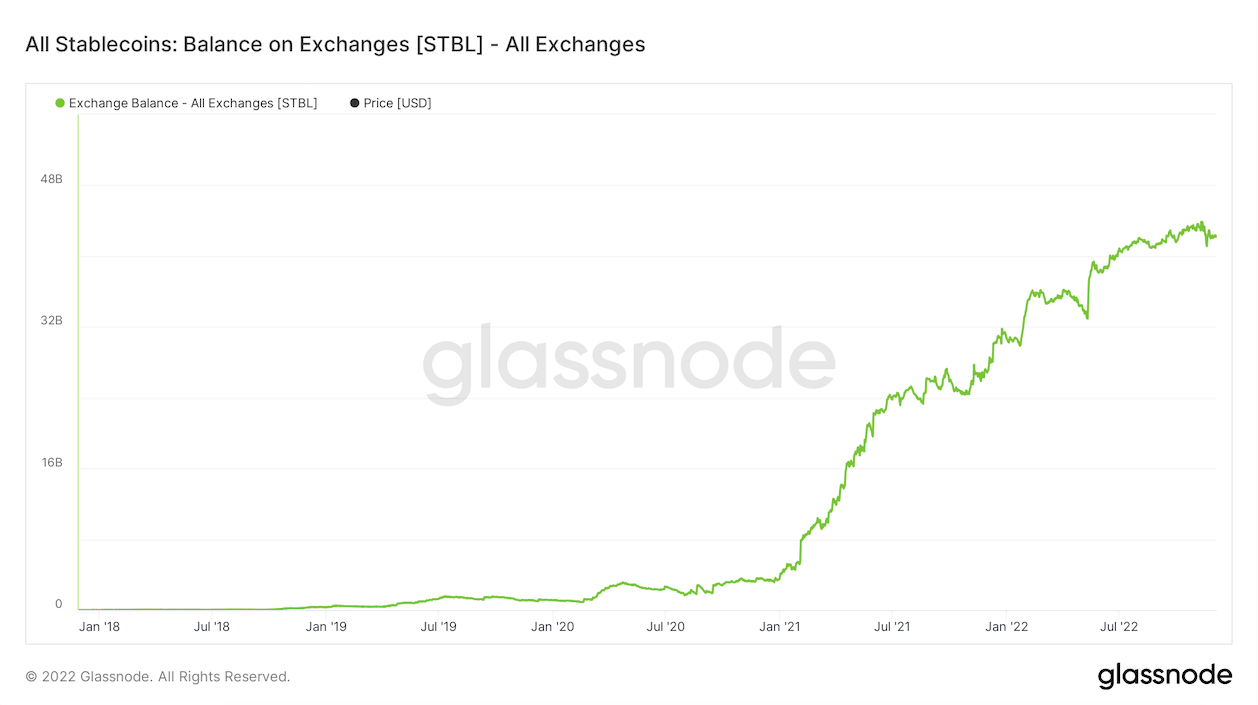

Like the SSR, the equilibrium connected exchanges shows the magnitude of “untapped” liquidity sitting connected the sidelines of centralized exchanges. According to information from Glassnode, the stablecoin equilibrium connected exchanges has grown exponentially since January 2021. And portion it saw crisp decreases successful the weeks pursuing the Luna illness and the aftermath of FTX, its increasing inclination has continued passim the year.

Graph showing the equilibrium connected centralized exchanges from January 2018 to December 2022 (Source: Glassnode)

Graph showing the equilibrium connected centralized exchanges from January 2018 to December 2022 (Source: Glassnode)As of December 6, implicit $42 cardinal worthy of stablecoins is sitting connected centralized exchanges. This indicates that determination is astir $42 cardinal successful liquidity connected the sidelines of the market, acceptable to beryllium deployed into cryptocurrencies similar Bitcoin.

The station A immense stablecoin proviso is waiting connected the sidelines to trigger a bull run appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)