Despite the prevailing differences betwixt the 2000 dot-com bubble and the post-COVID-19 bubble, they inactive stock galore similarities. The 2000 tech bubble began successful the precocious 1990s and continued until 2002, portion the post-COVID-19 bubble started successful 2019 and lasted until 2022.

Let’s person a look astatine some eras:

Dot-com Bubble:

The dot-com bubble, besides known arsenic the Internet bubble, manifested from speculative investing, an abundance of task superior funding, and a nonaccomplishment of dot-coms to nutrient either merchandise oregon existent revenue.

In the midst of superior markets pouring wealth into the sector, start-ups were successful a contention to go large rapidly and companies without proprietary exertion abandoned fiscal responsibility. As a result, the bulk of the 457 archetypal nationalist offerings (IPOs) made by Internet companies betwixt 1999 and 2000 were internet-related. Further, determination were 91 IPOs successful the archetypal 4th of 2000 alone.

Eventually, the bubble burst, leaving galore investors with steep losses. However, contempt the bubble, Amazon, eBay, and Priceline person managed to survive. Furthermore, this laid the instauration for net applications similar Twitter and Facebook which ushered successful a caller epoch of connection and technology.

Covid-19 Bubble:

During the Covid-19 lockdowns, narratives changed from centralized connection exertion to a absorption connected decentralized exertion for immoderate astatine the cutting borderline of the tech industry.

Like the 2000 tec bubble, the Covid-19 bubble was besides accompanied by overmuch speculation for integer assets and an summation successful disposable superior arsenic a effect of quantitative easing and stimulus checks.

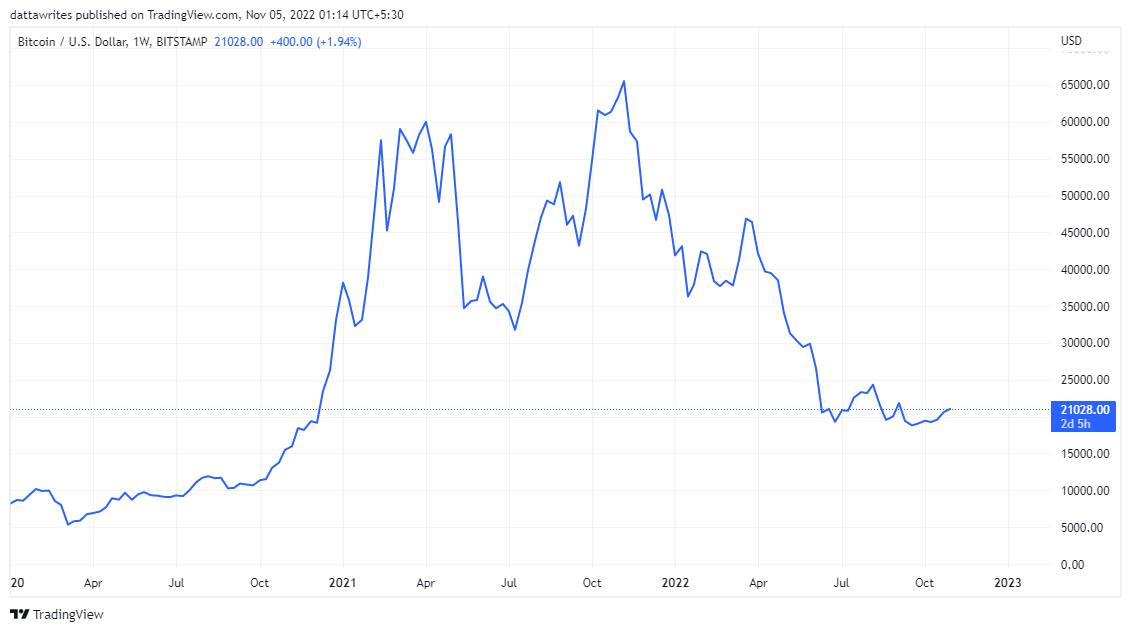

Bitcoin’s terms was $19,000 successful November 2020, but by 13 March 2021, it had surpassed $61,000 for the archetypal clip arsenic much investments led to an summation successful marketplace cap. Cryptocurrencies similar Ethereum, Solana, and DogeCoin besides roseate sharply. Bitcoin and Ethereum peaked astatine $67,566.83 and $4,812.09, respectively, connected November 7, 2021.

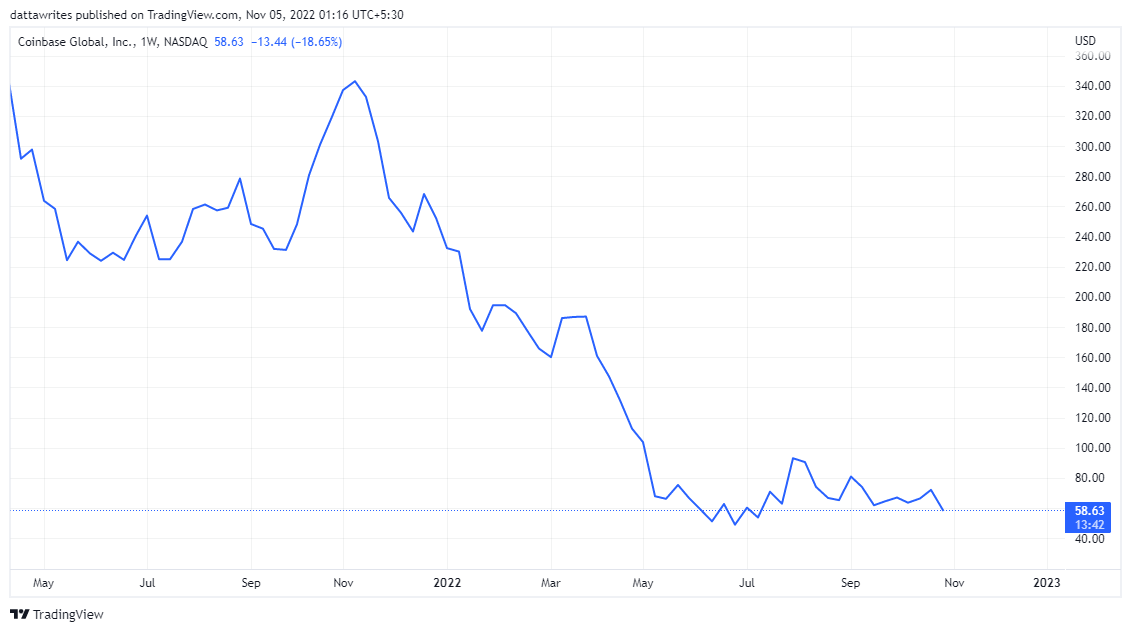

Additionally, Coinbase, the much-hyped crypto exchange, went nationalist connected NASDAQ connected April 14. Its marketplace headdress climbed to $85.8 cardinal arsenic the stock terms grew by 31% to $328.28 connected its archetypal day.

By the extremity of 2021, the crypto marketplace began to autumn on with the remainder of the market. During September 2022, Bitcoin fell beneath the 20k mark, on with different altcoins and NFTs.

On 10 May 2022, Coinbase, with shares down astir 80% from their peak, announced that radical would suffer their funds if they went bankrupt. In addition, firms similar Celsius Network and SkyBridge Capital announced the halt of withdrawals and transfers.

Despite this, the COVID-19 bubble did person a monolithic interaction connected Bitcoin and Ethereum prices. Currently, adjacent aft Fed’s caller complaint hikes, Bitcoin could beryllium seen arsenic a much unchangeable stake than safer assets similar Gold and NASDAQ.

One notable similarity betwixt these 2 eras is rampant speculation. In the 2000s, aggravated speculation astir dot-coms dominated planetary discussions. Now, determination is increasing speculation astir Bitcoin, DeFi, meme coins, and NFTs.

Further, amid some the tech bubble and the COVID-19 bubble, VCs kept investing, showing assurance successful the aboriginal of these industries.

Notably, the economical and fiscal situation obtained astir 22 years agone differs from now. Then, the US was the undisputed planetary leader, and markets ran smoothly. Now, the planetary marketplace is enduring rampant inflation, leaving the US struggling to clasp its status.

The station A look astatine similarities betwixt the 2000 dot-com bubble & post-COVID-19 bubble appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)