Rising vigor costs predicted by the satellite slope whitethorn person a nonstop effect connected the bitcoin network, but volition it marque overmuch difference?

Cover art/illustration via CryptoSlate

The World Bank precocious reported that planetary vigor prices could stay “historically high” until 2024. They expect vigor prices to “rise much than 50% successful 2022.” Given that vigor is the lone nonstop outgo to the Bitcoin mining network, what mightiness this mean for the aboriginal of PoW mining?

Speaking to Mas Nakachi, Managing Director astatine XBTO, helium told us,

“A surge successful planetary vigor prices volition apt pb to tighter nett margins for bitcoin miners, lowering the wide inducement to excavation bitcoin.”

A simplification successful hashrate

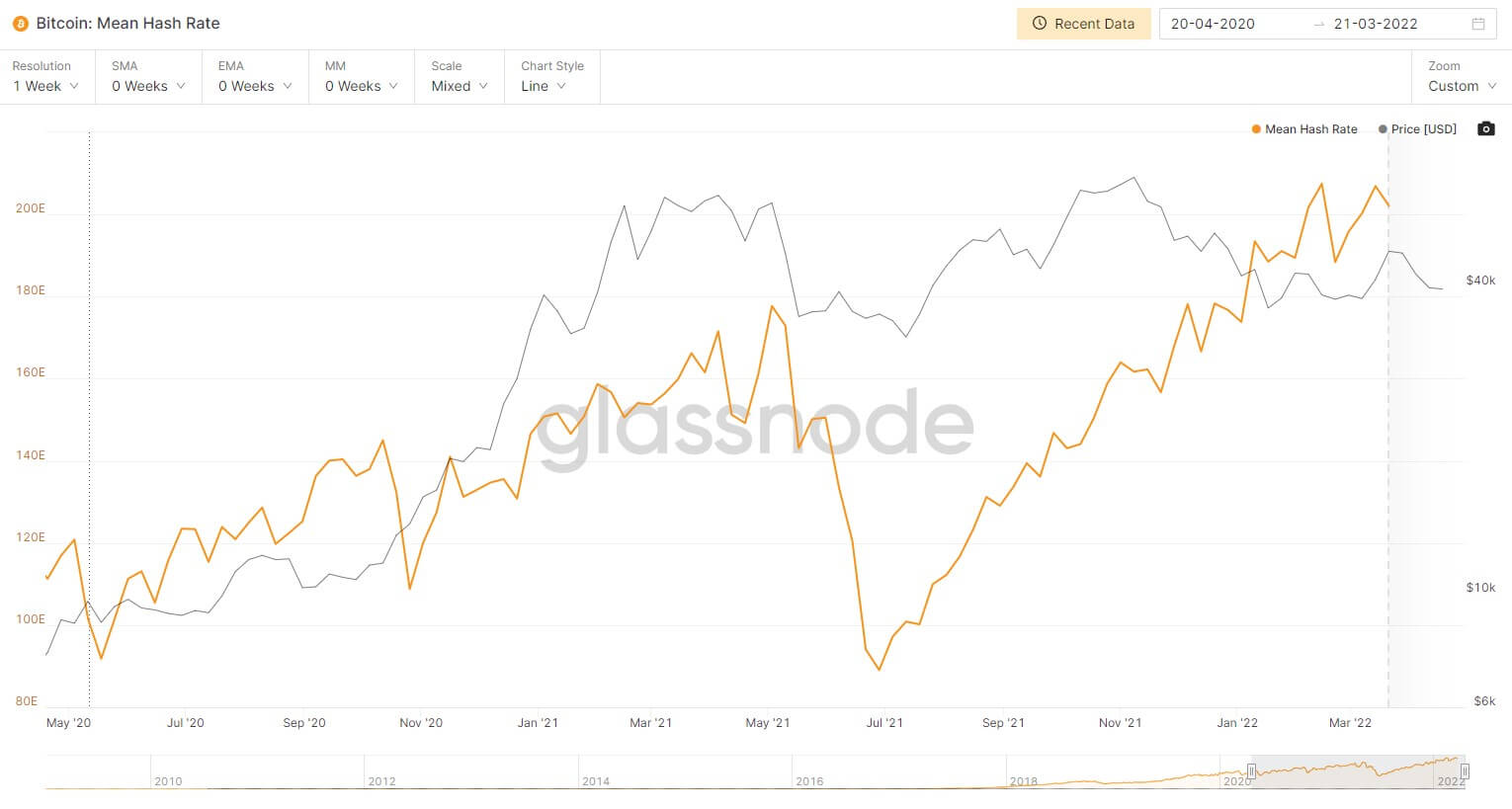

The information of the Bitcoin web relies upon maintaining the hashrate, which is the sum full of the computing powerfulness assigned to mining for caller blocks. If the inducement to excavation Bitcoin reduces, this could perchance pb to miners leaving the network. As precocious arsenic 2021, the hashrate of Bitcoin dropped by 40% successful a single month arsenic miners were shut down successful China. However, arsenic you tin spot from the beneath chart, determination is lone a escaped correlation betwixt Bitcoin’s hashrate and its terms action. However, this is simply a hotly debated taxable by Bitcoin Maxis. The driblet successful hashrate successful October 2020 did thing to halt the bull tally that came straight after. Further, arsenic the hashrate dropped drastically successful June 2021, its terms remained steady, hitting a caller all-time precocious conscionable months later.

Markets bash not panic if the hashrate drops due to the fact that determination is an in-built safeguard successful Bitcoin’s codification called ‘difficulty.’ If the fig of web participants drops, truthful does the magnitude of powerfulness required to excavation a block. The aforesaid is existent successful reverse; if the magnitude of powerfulness added to the web increases, aforesaid does the difficulty. This stops attacks connected the web owed to a abrupt influx successful mining powerfulness oregon an unprecedented event, causing galore miners to permission the network, arsenic happened successful China. Kevin Zhang, from starring Bitcoin mining excavation Foundry, told CNBC aft the Chinese crackdown connected miners,

“As much hashrate falls disconnected the network, trouble volition set downwards, and the hashrate that remains progressive connected the web volition person much for their proportional stock of the mining rewards,”

Increased difficulty

Further, Bitcoin trouble deed an all-time high recently, and frankincense the magnitude of powerfulness required to excavation a artifact increased. The much computing powerfulness added to the network, the much hard it becomes to excavation a block. This is simply a mechanics built to guarantee that Bitcoin’s proviso remains constant. Because of this, we cognize that it volition instrumentality implicit a 100 years to excavation the remaining 2 cardinal Bitcoin. However, arsenic Samuel Becker from Sofi Learn explains, “as Bitcoin mining becomes much difficult, the process eats up much electricity.”

Participation and gross from Bitcoin mining are expected to rise implicit the adjacent fewer years to deed $4.5 cardinal by 2026. An summation successful miners volition summation the trouble and frankincense trim the Bitcoin reward per hash. Currently, the reward per 100TH/s is 0.00042199BTC per time ($16.20) without considering the energy costs.

Cost of production

The cost per megawatt of vigor for ample Bitcoin miners specified arsenic Hut8, Greenridge, Hive, and Marathon ranges from $22 – $40. This means that for a institution specified arsenic Hut8, with 2.54 E/H of mining power. The energy costs for the institution totaled $36.9 cardinal successful 2019, with a nett of $172,124. Their yearly study shows that if this terms had risen by 30%, they would person made a $10.8 cardinal loss. Granted, the outgo of Bitcoin successful 2019 was conscionable $9,300 astatine its peak, and they notoriously hodl their Bitcoin.

Their 2021 yearly accusation reported that “the lone seasonality that the Company experiences is related to imaginable changes successful energy prices based connected volatility successful marketplace earthy state prices, which affects each of Hut 8’s facilities.”

Natural state prices person been up 100% since December 2021, portion the terms of Bitcoin is down 25%. The outgo of fueling mining operations has gone up 100% (assuming this outgo has been passed connected to the miner), portion the instrumentality dropped by 25% erstwhile valued successful dollars.

Source: TradingView

Source: TradingView Further, Hut8 states that successful the hazard factors attributed to their concern model, “The Company whitethorn look risks of disruptions to its proviso of electrical powerfulness and an summation of energy rates.” However, they database respective agreements successful place, indicating that fixed-price contracts person been enactment successful spot to mitigate this risk. Another ample miner, Marathon, besides states successful their annual report that they wage a fixed outgo of $0.042 per kWh for their energy consumption.

Summary

Thus, it seems apt that the large miners who operate, successful part, to assistance unafraid the web person fixed-priced vigor contracts successful spot that volition not enactment them astatine hazard of bearing the accrued outgo of vigor reported by the World bank. However, determination is inactive a hazard that the vigor companies themselves whitethorn not beryllium capable to grant the agreements, arsenic we saw respective UK vigor companies went bust successful 2021.

Regardless, it would instrumentality a doomsday script for Bitcoin miners leaving the web to person immoderate existent impact. If losing 65% of Bitcoin mining powerfulness successful 2021 was conscionable a velocity bump, past it is apt that an vigor situation would person a akin effect.

Natural state prices were presently astatine the highest level since the instauration of Bitcoin, yet successful 2008 the terms was 100% higher than it is now. Lastly, according to Ark Investments, 76% of Bitcoin’s mining powerfulness comes from renewable energy. The prima and upwind don’t attraction astir planetary economical unrest, and neither volition the accumulation costs for renewable vigor miners. The lone miners who look to beryllium affected by an vigor situation are individual, backstage miners who trust connected the accepted vigor grid. Anyone mining Bitcoin astatine location with an ASIC miner whitethorn request to determination to renewable vigor oregon incur precocious costs successful the coming 24 months.

3 years ago

3 years ago

English (US)

English (US)