An in-depth look astatine assorted currencies and their charts arsenic good arsenic observations connected vigor commodity prices and however they’re affected by satellite events.

Watch This Episode On YouTube oregon Rumble

Listen To The Episode Here:

In this occurrence of the “Fed Watch” podcast, we absorption connected important macro charts. We screen bitcoin’s chart, currencies similar the dollar, the euro, the Hong Kong dollar, and golden arsenic good arsenic vigor commodities. We didn’t person clip to get to each the charts I prepared, due to the fact that the unrecorded amusement has clip constraints. I volition effort to get a 2nd portion retired this week to screen the remainder of my commodity charts, arsenic good arsenic proviso chains and shipping costs. You tin find the descent platform of charts here.

Other topics covered successful today’s occurrence see President Joe Biden and Federal Reserve Chair Jerome Powell’s gathering yesterday, wherever I effort to soma retired the value of this Wall Street (Powell) versus globalists (Biden) showdown, and we get into a mates of things from Davos past week, peculiarly the Kissinger comments astir Ukraine.

“Fed Watch” is the macro podcast for Bitcoiners. Each occurrence we sermon existent events successful macro from crossed the globe with an accent connected cardinal banks and currency matters.

Currencies

The archetypal currency we speech astir is bitcoin. I sermon the caller popular successful terms connected Memorial Day, and however it is simultaneous with a increasing bullish divergence successful the indicators.

However, I besides spell backmost successful clip to astir 1 twelvemonth ago, erstwhile determination was a precise akin situation. In June 2021, determination was a bullish divergence successful these 2 indicators and a breakout of a descending wedge. That determination was a fake out, chopped abbreviated by the Grayscale (GBTC) unlock question successful July. The existent concern is akin connected the chart, but not akin successful the fundamentals. I conscionable wanted to constituent retired a erstwhile illustration wherever a breakout similar this week failed.

I marque an effort to dislodge the “bitcoin emergence equals dollar collapse” mendacious communicative here. The dollar and bitcoin tin emergence unneurotic owed to deflationary pressures pushing radical to currency and distant from counterparty risk.

Next up is the dollar. On the unrecorded stream, I amusement the pursuing illustration and sermon however we could beryllium headed for a caller higher scope connected the dollar. Perhaps we spot different 5 to 7 years of the dollar scale (DXY) successful a scope of 100-110, benignant of similar however it jumped into the 90-100 scope successful 2015.

Dollar scale illustration with method investigation (source)

Dollar scale illustration with method investigation (source)

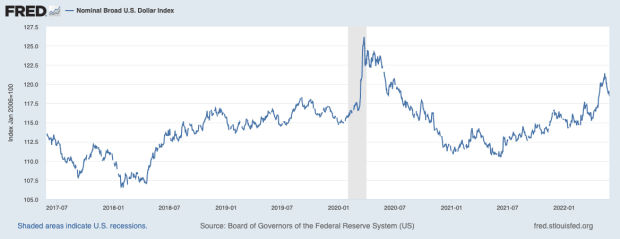

For galore who don’t similar DXY due to the fact that it is excessively constrictive (euro 57.6%, yen 13.6% and lb 11.9%), I supply a illustration of the trade-weighted dollar that includes 30-plus currencies including the Chinese yuan and Mexican peso.

In the beneath chart, we spot the aforesaid consolidation beginning, but the precocious that the dollar achieved (excluding the COVID-19 clang highs) is simply a caller high. I deliberation this symbolizes a stair-step relation higher for the trade-weighted dollar arsenic well.

Trade-weighted dollar with 30-plus currencies (Source)

Trade-weighted dollar with 30-plus currencies (Source)

Remember, a beardown dollar is the Fed failing and it besides provides monolithic accent to the remainder of the world’s economy.

The euro is astir the inverse of the DXY. It besides shows a caller breakout, but successful this lawsuit downward. If the dollar rally is to consolidate earlier heading higher, the euro is going to consolidate earlier heading lower. One happening is for sure, the euro has breached its two-decade enactment inclination enactment and it’s successful large occupation of crashing overmuch lower.

Chart of the euro versus the U.S. dollar exhibiting a downward breakout (source)

Chart of the euro versus the U.S. dollar exhibiting a downward breakout (source)

The adjacent 2 charts are of the Hong Kong dollar versus the U.S. dollar. There is simply a peg successful spot that is plainly evident connected the archetypal chart: It is simply a scope betwixt 7.75 and 7.85. Recently, the speech complaint has raced to the apical of this pegged range, signaling monolithic dollar unit successful the Asian economies similar China, Hong Kong, Taiwan, Japan and South Korea. The dollar compression rapidly started this year.

Monthly illustration of the Hong Kong dollar versus the U.S. dollar (source)

Monthly illustration of the Hong Kong dollar versus the U.S. dollar (source)

The 2nd illustration of the Hong Kong dollar is simply a adjacent up of the regular timeframe. The peg was defended successfully this time, by the authorities selling U.S. dollars and buying Hong Kong dollars, but the large question is bash they person capable reserves to proceed defending this peg for the remainder of the year, similar they did successful 2018?

Daily illustration of the Hong Kong dollar versus the U.S. dollar (source)

Daily illustration of the Hong Kong dollar versus the U.S. dollar (source)

The Hong Kong authorities people their reserve data, truthful we tin get a hint to the severity of their predicament. At the extremity of April 2022, anterior to the peg experiencing its top pressure, their reserves stood astatine $465.7 billion, $16 cardinal little than March.

The past currency we look astatine is partially a currency and partially a commodity: gold. It has been hard being a golden bug for the past 11 years. Currently, the golden terms is beneath the 2011 precocious of $1,920, sitting astatine $1,840 astatine the clip of recording. Imagine, holding golden for 11 years and losing wealth contempt the communicative of wealth printing. Your prime astatine that constituent would beryllium either wantonness your faulty ostentation dogma oregon spell brainsick connected conspiracy theories. That sums up the golden assemblage astatine this point, successful my opinion.

Gold spot terms April 2021 done May 2022 (source)

Gold spot terms April 2021 done May 2022 (source)

Energy Commodities

Moving onto commodities, connected this episode, I lone person a accidental to screen 2 charts. The archetypal is Brent crude (U.K. crude terms successful orange) and West Texas Intermediate (WTI) crude (U.S. crude terms successful blue). They often are highly correlated, with a flimsy premium connected European Brent.

I wanted to screen this illustration today, due to the fact that of the headlines astir the sixth circular of EU sanctions connected Russian oil; it is an implicit joke. As you tin spot connected the chart, the orangish enactment really drops connected the time the theatrical sanctions were announced.

Brent crude and WTI crude lipid prices (source)

Brent crude and WTI crude lipid prices (source)

My thesis for lipid prices is arsenic follows: Global request is collapsing faster than lipid supply. Recent elevated prices starting successful March 2022 are owed to the struggle successful Russia and Ukraine causing marketplace uncertainty. Oil is precise overbought. The terms of lipid volition statesman to autumn soon, lowering prices and user terms scale (CPI), and coinciding with a maturation slowdown. This is not a stagflation scenario, it is simply a deflationary slump script aft a impermanent spike successful prices.

Natural state futures successful Europe enactment my conclusion. They person been radically elevated, acold supra rational marketplace fundamentals isolated from sanctions connected Russia. Russia has refused to beryllium affected by successive rounds of sanctions, and the illustration is telling america that these terms levels are chiefly owed to people’s worries, not marketplace fundamentals. Once those worries spell distant (when the extremity of the Ukraine concern becomes much clear), prices volition set downward quickly.

European earthy state futures (source)

European earthy state futures (source)

That does it for this week. Thanks to the readers and listeners. If you bask this contented delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)