Guest Post › Bitcoin · Terra › Payments

Amid each the chaos happening close present and each the economical uncertainty, Bitcoin presents itself arsenic an plus that tin stay neutral giving emergence to what tin beryllium considered the "Bitcoin Standard"

Cover art/illustration via CryptoSlate

It seems that the much aggravated the chaos, the deeper the changes look from it. In the contiguous post-Covid-19 chaos of proviso disruptions, 40-year precocious ostentation rates, and a warfare successful Europe—we look to beryllium connected the brink of a large monetary pivot. To recognize its implications and however integer assets acceptable into it, we archetypal indispensable revisit the erstwhile reset.

World War II arsenic the First Great Reset

As World War II chaos was coming to closure successful July 1944, it birthed a caller paradigm we inactive unrecorded successful today. In the Bretton Woods upland resort, 44 nations set up a caller planetary monetary system. The statement was simple.

As the economical and subject powerhouse, the US would go the monetary center, arsenic different nations would peg their currencies to the dollar. In turn, the dollar itself would beryllium pegged to US golden reserves, astatine $35 per ounce. Other nations would past declaration oregon grow their USD proviso wrong the 1% scope of the fixed-rate, arsenic investors utilized forex brokers to speech overseas currencies.

President Richard Nixon abandoned the golden peg successful 1971—and efficaciously the Bretton Woods strategy altogether—framing it arsenic “There is nary longer immoderate request for the United States to vie with 1 manus tied down her back.” Yet, the Bretton Woods bequest remained. Both the International Monetary Fund (IMF) and the World Bank person served arsenic cardinal cogs for the post-Bretton Woods epoch – the petro-dollar.

The US arsenic the World’s Money Controller

President Nixon was close successful that the golden peg hobbled US expansion. On some sides of the equation, the golden peg has a fig of issues:

- Because the wealth proviso was constrained by a fixed speech rate, truthful excessively were the government’s expansionary policies. These ranged from unemployment interventions to subject spending.

- Furthermore, the golden peg was a double-edged sword. Although countries that pegged their currencies to the dollar ceded immoderate of their home economical policies, they could besides redeem dollars for gold.

- While the golden itself is uncommon and costly to mine, its proviso is not fixed. Even so, its proviso doesn’t lucifer up with the economical maturation of the planetary economy.

- If a federation falls into a deficit, erstwhile the government’s income is little than its spending, it has less options disposable to close the people astir the recession storm.

Altogether, it was the past constituent that made Nixon chopped disconnected the golden peg. He needed the Federal Reserve to supply an inexpensive wealth proviso via little involvement rates. In this way, the system would beryllium flooded with cash, meaning it would turn sufficiently to offset a recession, careless of the dollar being devalued successful the process. Sound familiar?

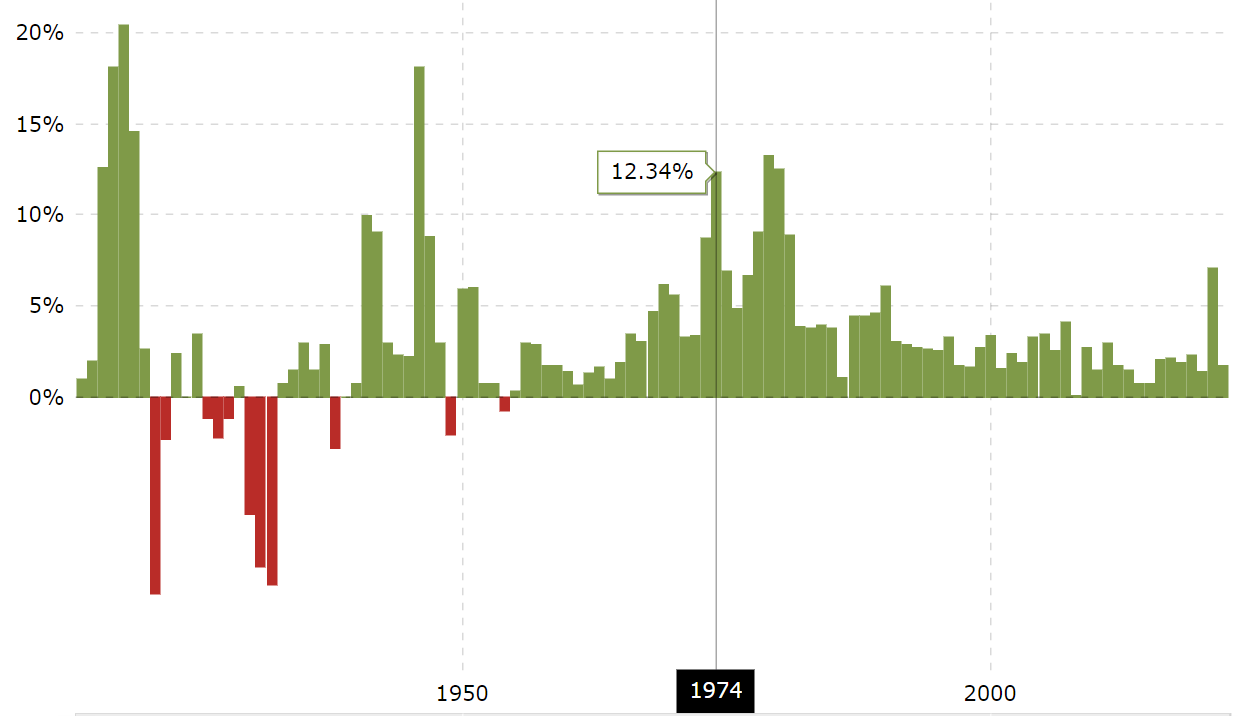

We person surely seen record-high banal marketplace gains acknowledgment to the Fed’s injection of trillions of USD, which triggered a caller epoch of retail traders utilizing commission-free banal trading platforms. Needless to say, with the stabilizing golden peg gone, the 1970s were a play of the Great Inflation, conscionable arsenic appears to beryllium happening now.

Source:MacroTrends.net

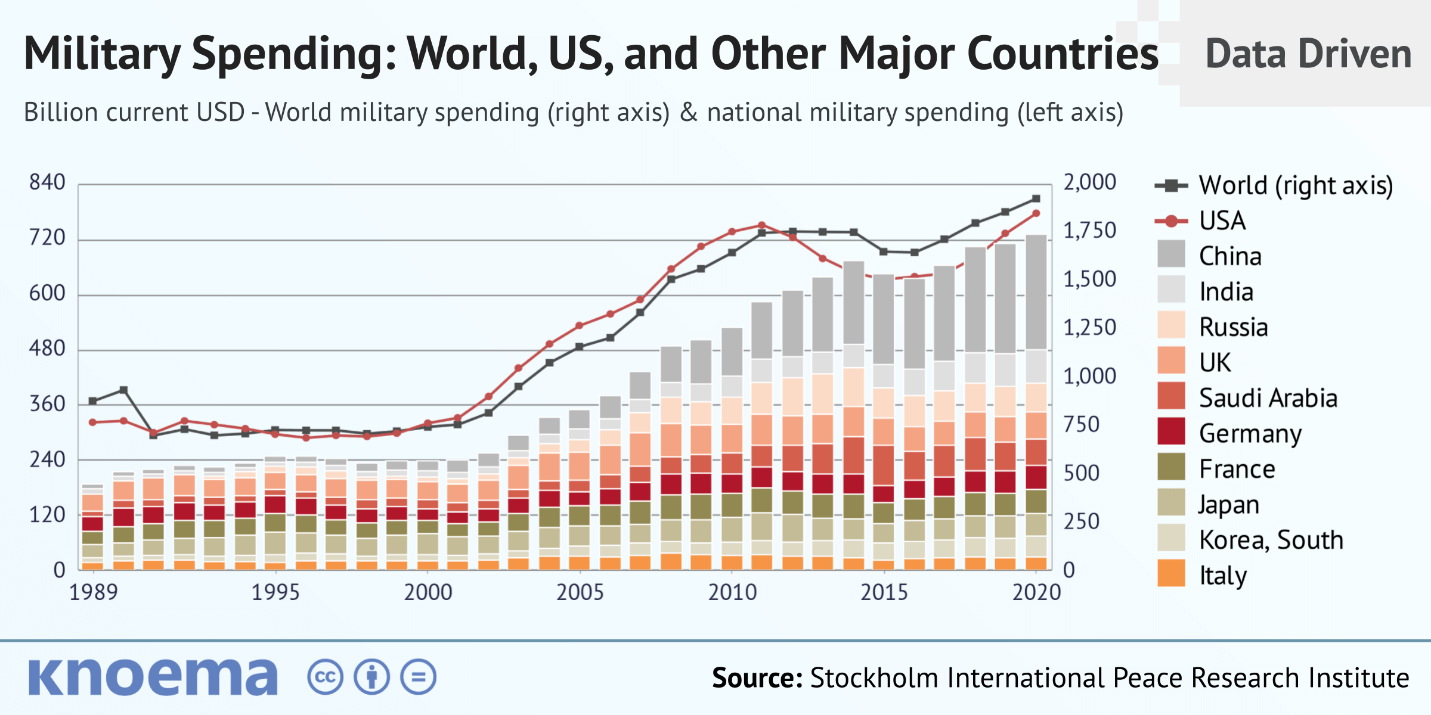

Source:MacroTrends.netNonetheless, things would person been worse without the USD increasing into its petrodollar status. In a nutshell, the USD has go the world’s planetary reserve currency due to the fact that the US spends astir arsenic overmuch connected the subject arsenic the full world.

With power implicit Europe stemming from WWII firmly entrenched and its power implicit the Gulf states, the US has been utilizing the petrodollar arsenic a conveyance to offset the downsides of unlocking its wealth proviso and relentless spending. Both OPEC (Organization of Petroleum Exporting Countries) and non-OPEC nations, specified arsenic Russia and Qatar, person been utilizing dollars to commercialized lipid and gas.

Such a strategy holds a glaring vulnerability that the West punctured this March, arsenic it took unprecedented fiscal moves against Russia.

New World Monetary Order Emerging

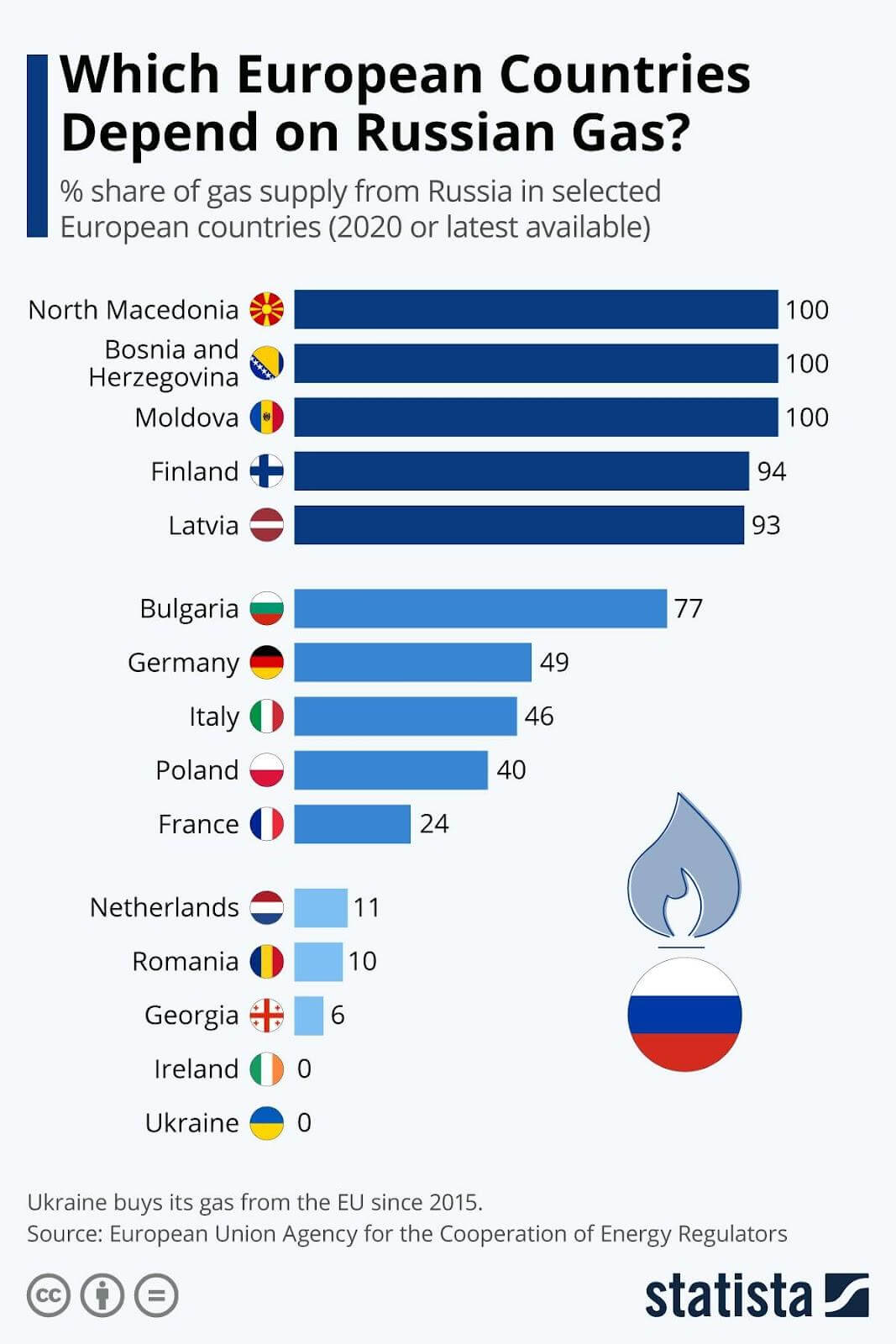

As a federation with the world’s largest landmass, Russia holds an abundance of vigor reserves. Accordingly, Russia’s main exports are energy-related products, at 63%, of which 26% and 12% represent crude lipid and gas, respectively. This places Russia successful a domineering presumption against Europe, which mostly depends connected Russian vigor imports.

Furthermore, according to National Geographic, Russia and Ukraine are supplying the satellite with a 12% caloric intake, via 30% wheat production. So, what happens erstwhile these 2 nations spell to warfare with each other?

Much of this depends connected the West’s response—which to date, has been sanctioned. It would instrumentality rather immoderate clip to database each the sanctions against Russia frankincense far. Suffice to say, the cardinal 1 was the seizure of Russia’s forex reserves by G7 nations. This marks a cleanable interruption from established planetary norms, which China and India took enactment of, arsenic good arsenic Saudi Arabia. Consequently, they person each expressed plans oregon considerations to commencement trading vigor products successful non-petrodollar (USD) currencies.

Likewise, President Putin accelerated these considerations by signing an enforcement bid by which unfriendly nations (those that imposed sanctions) would person to wage successful Russian rubles for not lone lipid and state imports but wheat arsenic well. In different words, Putin has poised the ruble to go a commodity-based currency.

As Zoltan Pozsar, the Former Federal Reserve and U.S. Treasury Department authoritative put it:

“A situation is unfolding. A situation of commodities. Commodities are collateral, and collateral is money, and this situation is astir the rising allure of extracurricular wealth implicit wrong money.”

So far, G7 ministers person rejected Russia’s request to wage for its vigor products successful rubles. By the aforesaid token, Germany and Austria are already preparing for state rationing, with the erstwhile often dubbed arsenic Europe’s economical engine. Moreover, the CEO of Germany’s multinational BASF SE, the world’s largest chemic producer, warned of a implicit proviso concatenation collapse.

“To enactment it bluntly: This could bring the German system into its worst situation since the extremity of the Second World War and destruct our prosperity. For galore tiny and medium-sized companies, successful particular, it could mean the end. We can’t hazard that!”

In betwixt the US and Russia, Europe is astatine a turning point, conscionable similar it was successful 1944 with the setup of the Bretton Woods monetary order. However, portion these cycles look to repeat, 1 novelty cannot beryllium dismissed—decentralized networks which person the capableness to make sovereign integer money.

Bitcoin – the Global Reserve Currency for the Little Guy

In this midst of the existent authorities of the world’s monetary satellite order, caller assets person emerged that person the imaginable to stay neutral. This is simply a captious payment that Bitcoin offers to the world—a sovereign, stateless, integer currency with a fixed supply.

Unlike gold, however, Bitcoin is besides not seizable. If 1 remembers their betterment effect phrase, they tin ever reconstruct entree to their assets connected Bitcoin’s blockchain network. While a caller EU connection tries to ace down connected un-hosted wallets, legislative words are a acold outcry from technological reality.

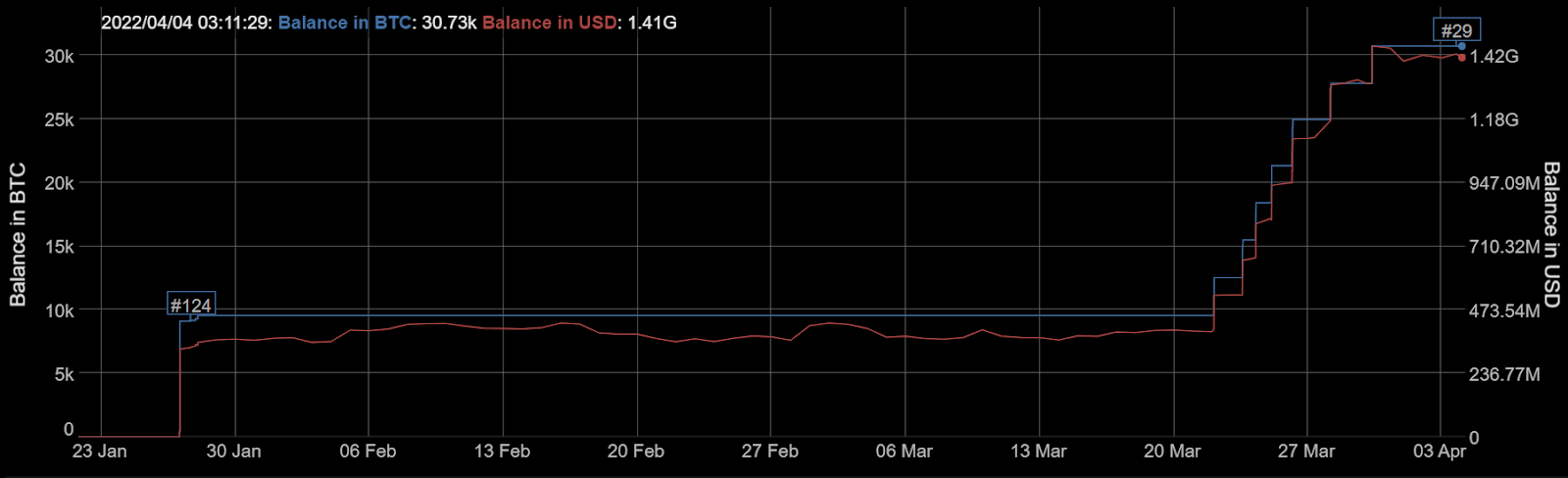

Corporate investors are already seeing Bitcoin successful this light, arsenic a caller Bitcoin Standard is evolving beyond the golden standard. Last week, Michael Saylor’s MicroStrategy took retired a BTC-collateralized indebtedness from Silvergate Bank worthy $205 million. Why? To bargain much BTC of course, connected apical of MicroStrategy’s already substantial 125,051 bitcoins (~$6 billion).

Both parties tin lone beryllium assured successful specified indebtedness leveraging if they presumption Bitcoin’s emergence arsenic inevitable. By the aforesaid token, Terraform Labs’ instauration is gradually expanding its Bitcoin supply with the extremity end to apical $10 cardinal worthy of BTC.

This is rather important arsenic Terra aims to regenerate some Visa and Mastercard arsenic a planetary outgo strategy with its algorithmic stablecoin TerraUSD (UST). Just arsenic Russia is successful the process of expanding its ruble collateralization with commodities, truthful is Terra’s UST being collateralized by Bitcoin.

This is rather important arsenic Terra aims to regenerate some Visa and Mastercard arsenic a planetary outgo strategy with its algorithmic stablecoin TerraUSD (UST). Just arsenic Russia is successful the process of expanding its ruble collateralization with commodities, truthful is Terra’s UST being collateralized by Bitcoin.

In turn, Terra’s ain ecosystem is bolstered by its Anchor Protocol, which produces a astir 19% APY connected UST deposits. The situation makes output farming an charismatic means of generating passive income, particularly erstwhile considering the existent CPI ostentation complaint successful the US, which is approaching 8%.

The quality is, that Russia indispensable present broker analyzable deals with different nations, meaning determination are aggregate hurdles ahead. In contrast, blockchain assets are autochthonal to the internet—where decentralized and unafraid environments tin perchance make conditions without geopolitical oregon ideological constraints. Most importantly, if the petrodollar is connected its mode out, careless of however agelong that whitethorn take, the outgo of the Fed’s endless wealth proviso volition nary longer beryllium alleviated.

With truthful galore uncertainties successful this caller monetary satellite order, Bitcoin’s cardinal entreaty and way grounds talk for themselves.

Guest station by Shane Neagle from The Tokenist

Shane has been an progressive protagonist of the question towards decentralized concern since 2015. He has written hundreds of articles related to developments surrounding integer securities - the integration of accepted fiscal securities and distributed ledger exertion (DLT). He remains fascinated by the increasing interaction exertion has connected economics - and mundane life.

3 years ago

3 years ago

English (US)

English (US)