Like springtime successful New York City, the crypto marketplace got hot, each astatine once, successful aboriginal May. After weeks of navigating choppy seas, influenced successful portion by anxieties surrounding the administration’s commercialized brinksmanship, a palpable displacement successful sentiment propelled the crypto sphere into a notable rally.

Bitcoin shape-shifted from a tariff tantrum mooring into a determined huntsman of all-time highs. This bullish resurgence was not isolated. Ether, having endured a important drawdown of implicit 50% since the commencement of the year, staged an awesome bounce, gaining 36% successful the 5 days pursuing the much-anticipated Pectra upgrade.

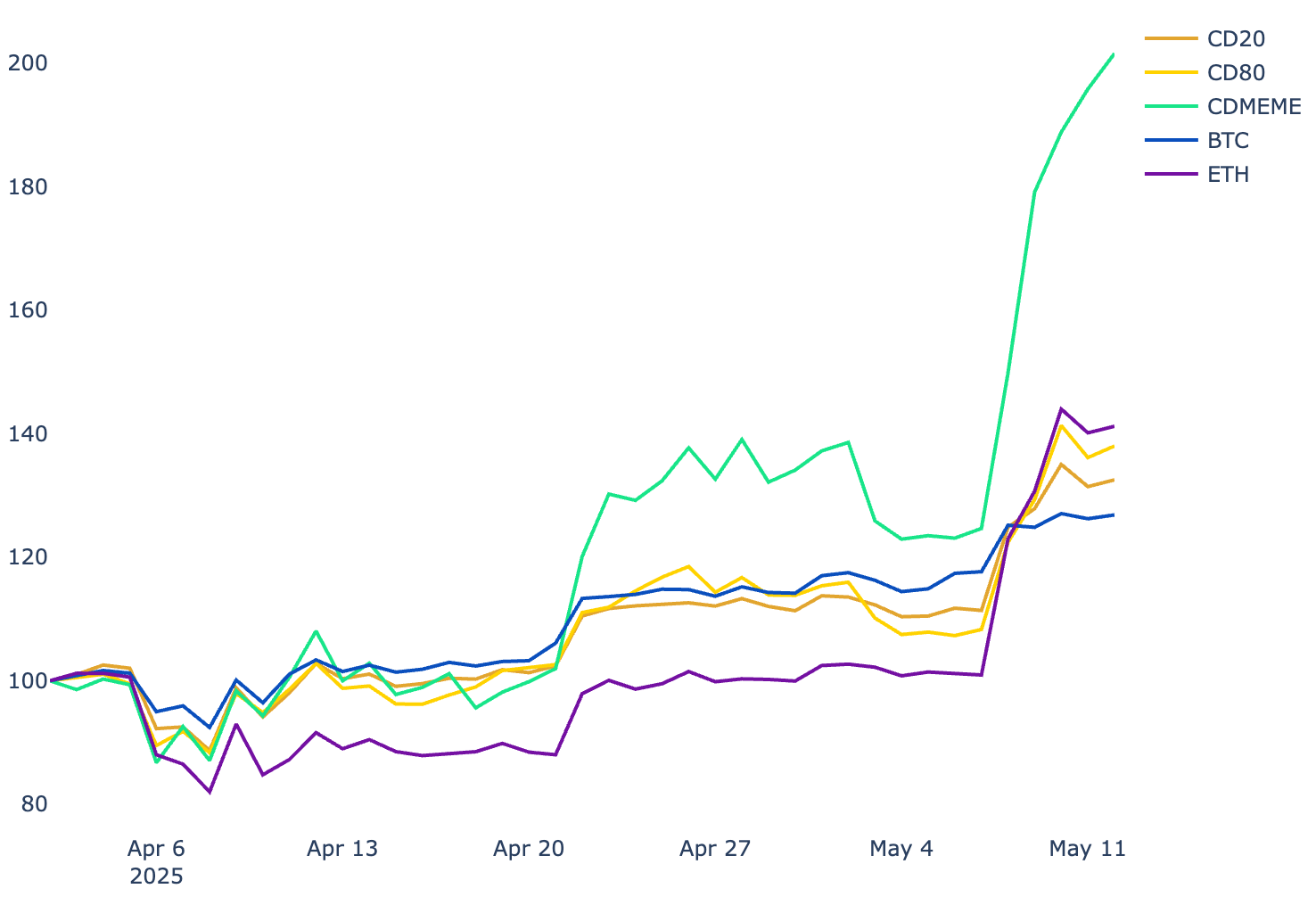

The broader blockchain marketplace mirrored this enthusiasm. The CoinDesk 20 Index, the benchmark for the show of apical integer assets, added astir 18% successful the past week, bringing its 30-day instrumentality to implicit 33%. Further down the capitalization spectrum, the CoinDesk 80 Index, which tracks assets beyond the apical 20, besides rebounded powerfully from its lows, delivering 37% implicit the past month. Demonstrating genuinely epic information breadth, the 50-constituent CoinDesk Memecoin Index added a 55% connected the week and a whopping 86% successful the past month.

Given the fundamentally constricted (zero) nonstop interaction of tariff and commercialized quality connected the intrinsic worth of astir (all) crypto assets, this lunge higher feels similar what they telephone a "sentiment shift." With CoinDesk's Consensus league unfolding this week successful Toronto, the timing couldn't beryllium much opportune. The vibes are good.

Performance of CoinDesk 20, CoinDesk 80, CoinDesk Memecoin Index, bitcoin, and ether since Liberation Day, April 2, 2025

Source: CoinDesk Indices

The specter of recession

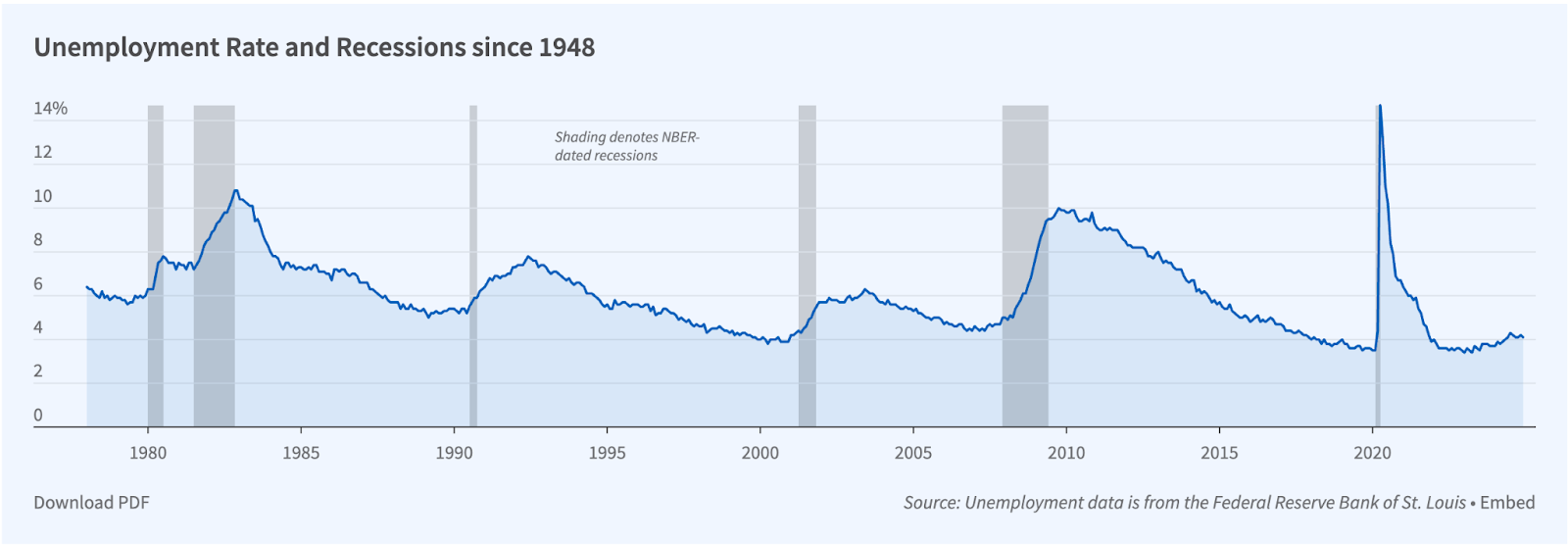

This caller marketplace exuberance, some wrong integer assets and crossed accepted risk-on plus classes, has not quelled the underlying concerns of those who judge the United States is gradually inching towards a recession. Official recessions, arsenic declared by the National Bureau of Economic Research (NBER), are so comparatively infrequent. Yet, today’s antithetic confluence of macroeconomic factors provides fertile crushed for wariness.

To wit, the archetypal estimation for first-quarter 2025 GDP showed a contraction of 0.3% astatine an annualized rate, a notable reversal from the 2.4% maturation successful the erstwhile quarter. True, this fig was skewed downwards by a surge successful imports arsenic businesses rushed to bushed anticipated tariff increases, yet a contraction successful GDP is nevertheless a concerning information point. Adding to this unease is plunging user confidence. The Conference Board's Consumer Confidence Index fell sharply successful April to 86.0, its lowest level successful astir 5 years, with the Expectations Index hitting its lowest constituent since October 2011 — a level often associated with recessionary signals. The University of Michigan's Consumer Sentiment Index echoed this weakness, falling to 52.2 successful its preliminary May reading, driven by concerns implicit commercialized argumentation and the imaginable resurgence of inflation. Furthermore, their survey highlighted a surge successful year-ahead ostentation expectations to 6.5%, the highest since 1981.

The increasing U.S. indebtedness load and the persistent inability of the medication to tame the 10-year Treasury yield, contempt evident efforts, besides lend to the consciousness of economical fragility. Finally, the imaginable for collateral harm from ongoing oregon escalating commercialized wars, including businesses perchance reducing their workforce successful effect to disrupted proviso chains and accrued costs, adds different furniture of concern.

NBER Chart of US Unemployment Levels and Recession Periods Since 1978

Source: NBER.org (Hey, NBER, should that work "since 1978?")

To beryllium clear, the prevailing sentiment among our web inactive leans against an imminent recession, and we don’t marque predictions. However, to disregard the anticipation of a recession successful the existent situation seems imprudent.

Bitcoin vs. different integer assets successful a downturn

Crypto has lone experienced 1 NBER-declared recession, during the worst of COVID. While the marketplace situation caused a liquidity panic and important drawdowns, the consequent $5 trillion water of exigency fiscal stimulus (and millions of homebound radical discovering crypto) pointed things northbound and delivered the 2021 bubble. We whitethorn not expect the aforesaid way successful a aboriginal recession. So, what mightiness we expect?

On the 1 hand, there's a compelling statement to beryllium made that bitcoin has present achieved a level of adoption and established a idiosyncratic basal capable to statesman fulfilling its long-touted destiny arsenic a harmless haven plus during times of economical turmoil. With the U.S. dollar perchance facing unit amidst precocious ostentation and a swelling indebtedness burden, bitcoin's inherent scarcity and decentralized (and apolitical) quality are progressively attractive.

On the different hand, accepted recessionary environments are typically characterized by scarce liquidity, heightened hazard aversion, a ascendant absorption connected superior preservation and a diminished appetite for exploring nascent and volatile plus classes. A contraction successful wide economical enactment would besides pb to reduced backing for entrepreneurial and adjacent established ventures wrong the blockchain space. Finally, retail users, feeling the fiscal pinch of a recession, would apt person little "experimental money" to allocate to decentralized concern (DeFi) and different caller crypto applications.

Therefore, adjacent if bitcoin manages to pull safe-haven flows, different blockchain assets, peculiarly those promising aboriginal maturation and innovation, could look important headwinds and continued terms pressure. In our view, 1 of the least constructive outcomes for the broader integer plus ecosystem would beryllium a further summation successful bitcoin's dominance astatine the disbursal of innovation and maturation successful different areas.

The resilience of trading

What mightiness supply a grade of resilience for the integer plus people and the manufacture arsenic a full is its vigor for trading. Crypto functions much arsenic a trading plus people than a predominantly investment-driven one. In some favorable and unfavorable economical conditions, trading volumes wrong the crypto markets person mostly remained robust and resilient. It's conceivable that the progressive trading assemblage could prolong the plus people until broader economical conditions improve.

Navigating uncertainty

While a recession successful the United States is simply a script fewer tendency and 1 that remains extracurricular the highest probability outcomes successful astir forecasts, and contempt the caller sentiment shift, its anticipation cannot beryllium wholly dismissed. And, arsenic a substance of economical cycles, periods of contraction are not wholly avoidable. For the involvement of our burgeoning manufacture and the advancement made successful integrating integer assets into the cloth of planetary fiscal services — crossed trading, investing, lending, saving, and output procreation — we sincerely anticipation that adjacent a humble watercourse of enactment volition proceed to thrust technological development, capitalist education, accessibility, and broader adoption. Perhaps this volition beryllium fueled by 1 of crypto’s archetypal notions: that the accepted economical strategy has faltered.

7 months ago

7 months ago

English (US)

English (US)