Both Jerome Powell and Christine Legarde held caller property conferences wherever they spot blasted for ostentation connected factors extracurricular their control.

Watch The Episode On YouTube oregon Rumble

Listen To The Episode Here:

“Fed Watch” is the macro podcast for Bitcoiners. In each occurrence we sermon existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

In this episode, Christian Keroles and I perceive and respond to highlights from this month’s 2 cardinal slope property conferences with Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde. Central banks are 1 of the astir misunderstood institutions successful our modern world. Many analysts simply archer you what the Fed oregon the ECB thinks and what they bash to disrupt the planetary economy, but connected our show, we similar to springiness you superior root worldly from which you tin commencement to signifier your ain educated opinion.

We livestream astir of our shows connected the Bitcoin Magazine YouTube transmission connected Tuesdays astatine 3:00 P.M. Eastern time. Mark your calendars!

Highlights And Reactions From The Fed Press Conference

Powell’s comments were highlighted by a fewer narratives. These claims are simply what the Fed says they are doing:

- Their superior interest is warring inflation.

- They volition beryllium adaptive to caller data.

- A choky employment marketplace threatens to exacerbate inflation.

- They cannot impact the proviso side, truthful they volition tamp down request to bring down prices.

The main metric guiding the Fed’s people of complaint hikes is CPI and “inflation” expectations. There are respective ways to measurement these, but the Fed uses user surveys. There is simply a captious favoritism betwixt surveys and market-derived expectations due to the fact that surveys volition not separate sources of terms increases whereas the market-derived measures will.

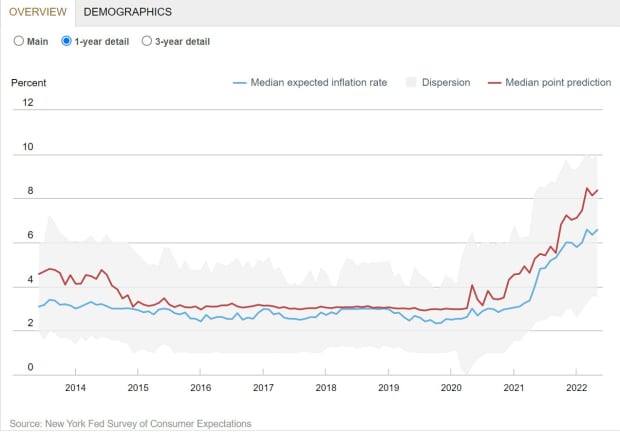

Below is the Fed’s survey of ostentation expectations. You tin spot that the median prediction is supra 8%.

(Source)

(Source)

However, the market-derived data, namely the 5-year and 10-year breakevens and the 5y-5y forward, are showing ostentation expectations astir 2.5%. What accounts for this immense difference? It is due to the fact that the market-derived information is measuring existent wealth printing, oregon successful different words, existent inflation. The survey information connected the different manus is measuring generic terms increases which are overmuch much highly affected by proviso shocks; successful this case, self-imposed proviso shocks.

5-year breakeven ostentation rate

5-year breakeven ostentation rate

10-year breakeven ostentation rate

10-year breakeven ostentation rate

5-year, 5-year guardant ostentation expectations

5-year, 5-year guardant ostentation expectations

Overnight reverse repo agreements

Overnight reverse repo agreements

Highlights And Reactions From The ECB Press Conference

We besides perceive to a fewer clips of Lagarde’s press conference. Here we get a spirit for the ECB’s formative narratives:

- Inflation is the responsibility of COVID-19 and Vladimir Putin.

- Their governing assembly has expertly formulated a travel to normality.

- They volition statesman to rise rates and tighten their equilibrium expanse successful July.

- They are dedicated to “anti-fragmentation,” oregon successful different words, avoiding a European indebtedness situation 2.0 and keeping the eurozone together.

- They person all-powerful tools.

The ECB faces a antithetic situation than the Fed. The ECB indispensable rise rates for immoderate of the much indebted countries, already with anti-European parties growing, and they are facing uneven effects, arsenic we tin spot with recognition spreads successful Italy for example.

That does it for this week. Thanks to the watchers and listeners. If you bask this contented delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)