The concern speech astir crypto has transitioned from questioning the endurance of cryptocurrencies to discussing businesslike allocation strategies. Most notably, organization investors are moving connected from investigating the waters with bitcoin to seeking diversified vulnerability to the wide crypto market.

With a full marketplace headdress of implicit $3 trillion, cryptocurrencies correspond astir 1.5% of the marketplace portfolio of each listed, investable assets that are easy accessible to investors (Bloomberg, WisdomTree, 1/31/2025).

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

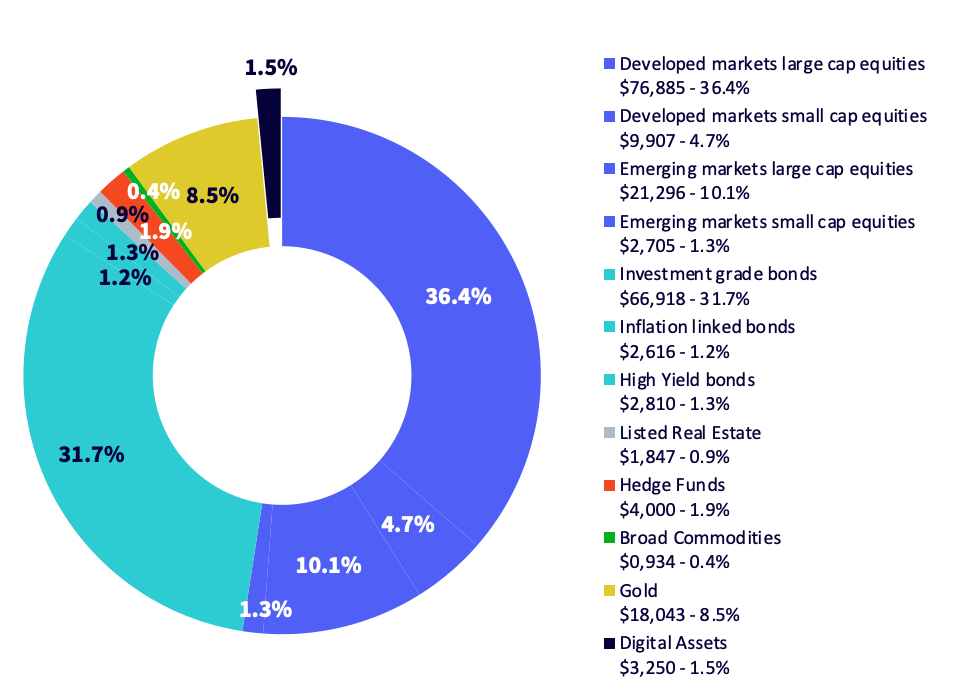

Figure 1: The marketplace portfolio

Source: Bloomberg, WisdomTree. Data arsenic of 31 December 2024. Market caps are shown successful USD billion. Historical show is not an denotation of aboriginal performance, and immoderate concern whitethorn spell down successful value.

In 2024, organization investors started to admit that the market-neutral presumption for multi-asset portfolios involves investing astir 1.5% successful cryptocurrencies, arsenic determined by the marketplace portfolio. They besides realized that including cryptocurrencies successful diversified multi-asset portfolios tin besides perchance amended their risk/return profiles.

While allocating astir 1.5% to cryptocurrencies became a tenable strategy for investors without a circumstantial concern thesis against the plus class, a question arose arsenic to whether investors should allocate the full 1.5% to bitcoin oregon diversify that allocation crossed aggregate cryptocurrencies.

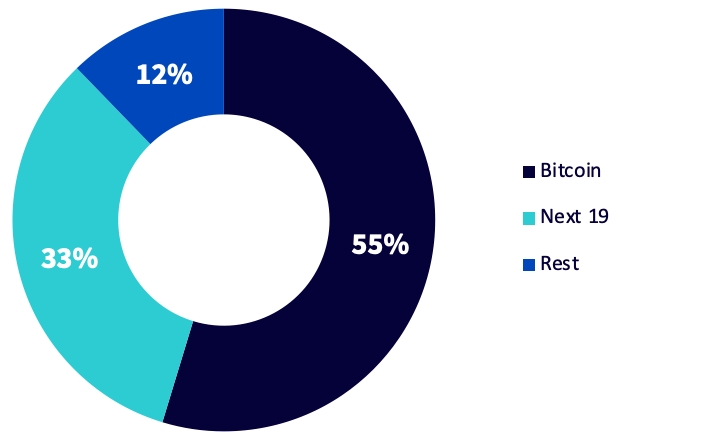

Figure 2: Cryptocurrency marketplace caps

Source: Artemis Terminal, WisdomTree. As of 31 January 2025, utilizing US Dollar marketplace caps. You cannot put straight successful an index. Historical show is not an denotation of aboriginal show and immoderate concern whitethorn spell down successful value.

For background, bitcoin dominates the cryptocurrency market, accounting for 55% of the full marketplace capitalization. The adjacent 19 largest cryptocurrencies collectively marque up astir 33%, portion the remaining 12% is distributed among each different cryptocurrencies.

This organisation has sparked a statement among organization investors astir the optimal attack to crypto investing. Advocates of a focused strategy often champion the thought of investing exclusively successful bitcoin. This penchant is mostly driven by bitcoin's established way grounds and its cognition arsenic a integer store of worth akin to gold. Bitcoin’s resilience and humanities show person rendered it an charismatic enactment for those seeking a comparatively safer introduction into the satellite of cryptocurrencies.

However, determination are besides beardown proponents of diversification. These investors reason that spreading investments crossed a handbasket of cryptocurrencies tin harness the maturation imaginable of emerging integer assets, portion simultaneously mitigating the risks associated with the volatility of immoderate azygous cryptocurrency. By diversifying, investors tin perchance payment from the emergence of caller innovative projects and technologies wrong the space, aligning their portfolios with the broader developments successful the integer economy.

Ultimately, the determination to absorption solely connected bitcoin oregon to follow a diversified concern strategy depends connected idiosyncratic capitalist preferences, hazard tolerance and marketplace outlook. Investors without a beardown sentiment connected the semipermanent crypto marketplace winners seeking a semipermanent concern whitethorn find a marketplace cap-weighted attack to diversification advantageous. As the abstraction matures, investors volition apt question allocations that germinate implicit clip successful tandem with the broader cryptocurrency market.

This worldly is prepared by WisdomTree and its affiliates and is not intended to beryllium relied upon arsenic a forecast, probe oregon concern advice, and is not a recommendation, connection oregon solicitation to bargain oregon merchantability immoderate securities oregon to follow immoderate concern strategy. The opinions expressed are arsenic of the day of accumulation and whitethorn alteration arsenic consequent conditions vary. The accusation and opinions contained successful this worldly are derived from proprietary and non-proprietary sources. As such, nary warranty of accuracy oregon reliability is fixed and nary work arising successful immoderate different mode for errors and omissions (including work to immoderate idiosyncratic by crushed of negligence) is accepted by WisdomTree, nor immoderate affiliate, nor immoderate of their officers, employees oregon agents. Reliance upon accusation successful this worldly is astatine the sole discretion of the reader. Past show is not a reliable indicator of aboriginal performance.

9 months ago

9 months ago

English (US)

English (US)