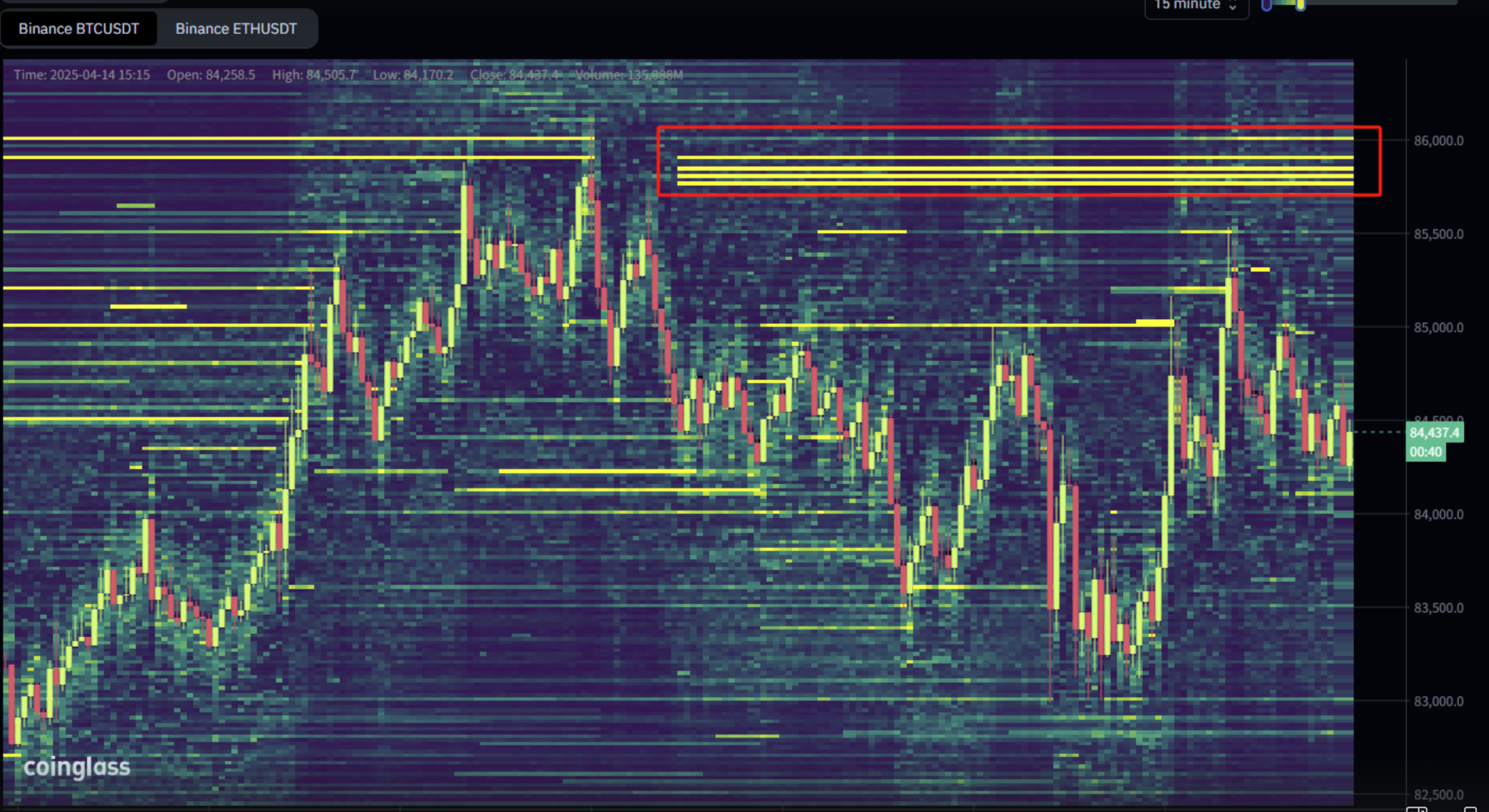

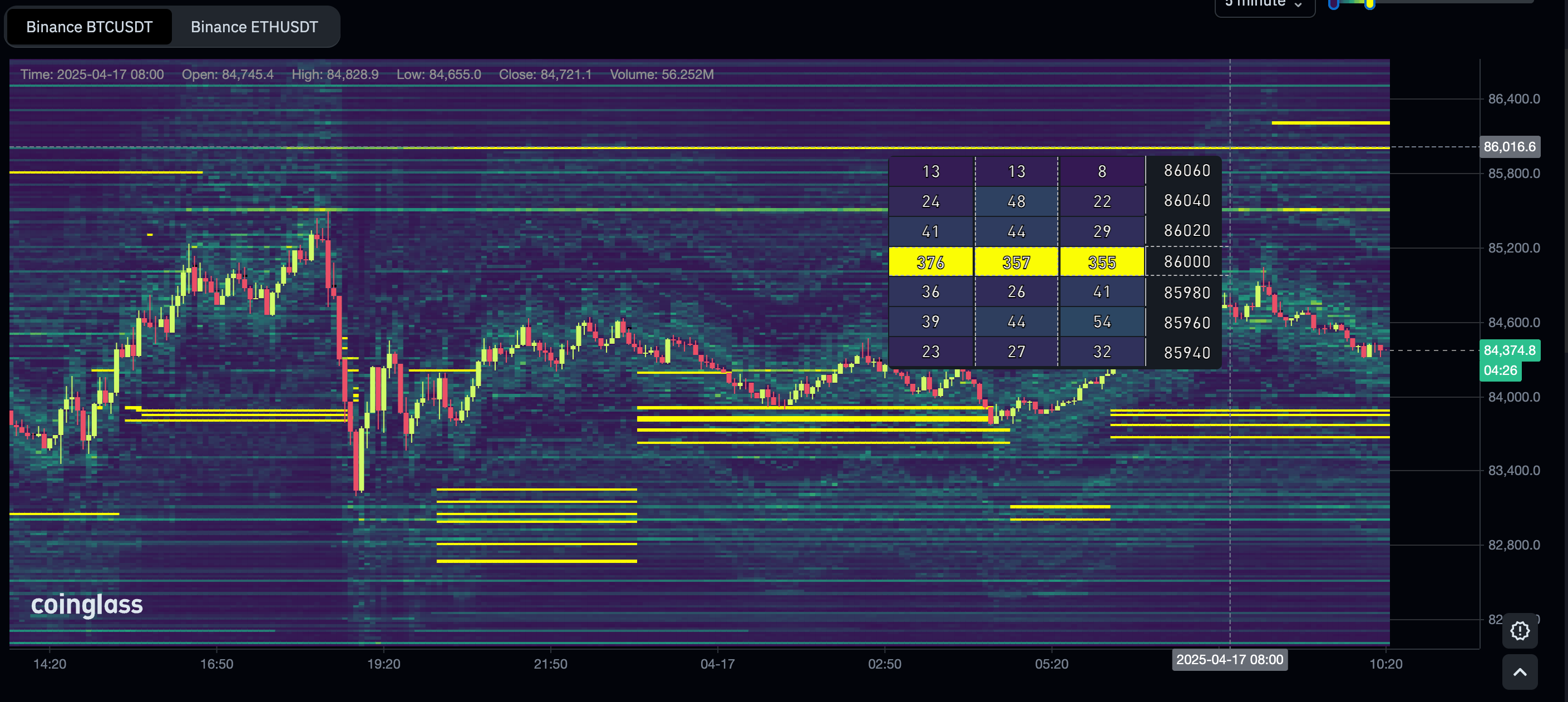

On April 14, idiosyncratic enactment successful a merchantability bid for 2,500 bitcoin, worthy astir $212 million, connected the Binance bid publication astatine $85,600, astir 2-3% above the spot prices trading astatine the time.

Seeing specified a ample order, the bitcoin terms started to gravitate to this level astatine astir 17:00 UTC.

Suddenly, the bid was gone, arsenic seen utilizing Coin Glass data, which caused a little infinitesimal of marketplace apathy arsenic bulls and bears tussled to capable a void successful liquidity.

The bitcoin terms astatine the time, however, was already connected shaky crushed owed to geopolitical concerns. Subsequently, it went little aft the vanishing bid caused chaos for the traders.

So what happened?

One reply could beryllium an amerciable method that involves placing a ample bounds bid to rile trading enactment and past removing the bid erstwhile the terms comes adjacent to filling it. This is called "order spoofing," defined by the 2010 U.S. Dodd-Frank Act arsenic "the amerciable signifier of bidding oregon offering with the intent to cancel earlier execution."

As seen successful the liquidity heatmap successful the representation above, connected the surface, the bid with a terms of $85,600 seemed similar a cardinal country of resistance, which is wherefore marketplace prices started to gravitate towards it. However, successful reality, that bid and liquidity were apt spoofed, giving traders the illusion of a stronger market.

Liquidity heatmaps visualize an bid publication connected an speech and amusement however overmuch of an plus rests connected the publication astatine each terms point. Traders volition usage a heatmap to place areas of enactment and absorption oregon adjacent to people and compression under-pressure positions.

In this peculiar case, the trader seemed to person placed a imaginable spoof bid erstwhile the U.S. equity marketplace was closed, usually a clip play of debased liquidity for the 24/7 bitcoin market. The bid was past removed erstwhile the U.S. marketplace opened arsenic the terms moved towards filling it. This could inactive person had the desired effect, as, for instance, a ample bid connected 1 speech mightiness spur traders oregon algorithms connected different speech to region their order, creating a void successful liquidity and consequent volatility.

Another crushed could beryllium that the trader placing a $212 cardinal merchantability bid connected Binance wanted to make short-term merchantability unit to get filled connected bounds buys, and past they removed that bid erstwhile those buys were filled.

Both options are plausible, albeit inactive illegal.

'Systemic Vulnerability'

Former ECB expert and existent managing manager of Oak Security, Dr. Jan Philipp, told CoinDesk that manipulative trading behaviour is simply a "systemic vulnerability, particularly successful thin, unregulated markets."

"These tactics springiness blase actors a accordant borderline implicit retail traders. And dissimilar TradFi, wherever spoofing is explicitly amerciable and monitored, crypto exists successful a grey zone."

He added that "spoofing needs to beryllium taken earnestly arsenic a menace arsenic it helped trigger the 2010 Flash Crash successful accepted markets, which erased astir $1 trillion successful marketplace value."

Binance, meanwhile, insists that it is playing its portion successful preventing marketplace manipulation.

"Maintaining a just and orderly trading situation is our apical precedence and we put successful interior and outer surveillance tools that continuously show trading successful real-time, flagging inconsistencies oregon patterns that deviate from mean marketplace behavior," a Binance spokesperson told CoinDesk, without straight addressing the lawsuit of the vanishing $212 cardinal order.

The spokesperson added that if anyone is recovered manipulating markets, it volition frost accounts, study suspicious enactment to regulators, oregon region atrocious actors from its platform.

Crypto and spoofing

Spoofing, oregon a strategy that mimics a fake order, is illegal, but for a young manufacture specified arsenic crypto, past is rife with specified examples.

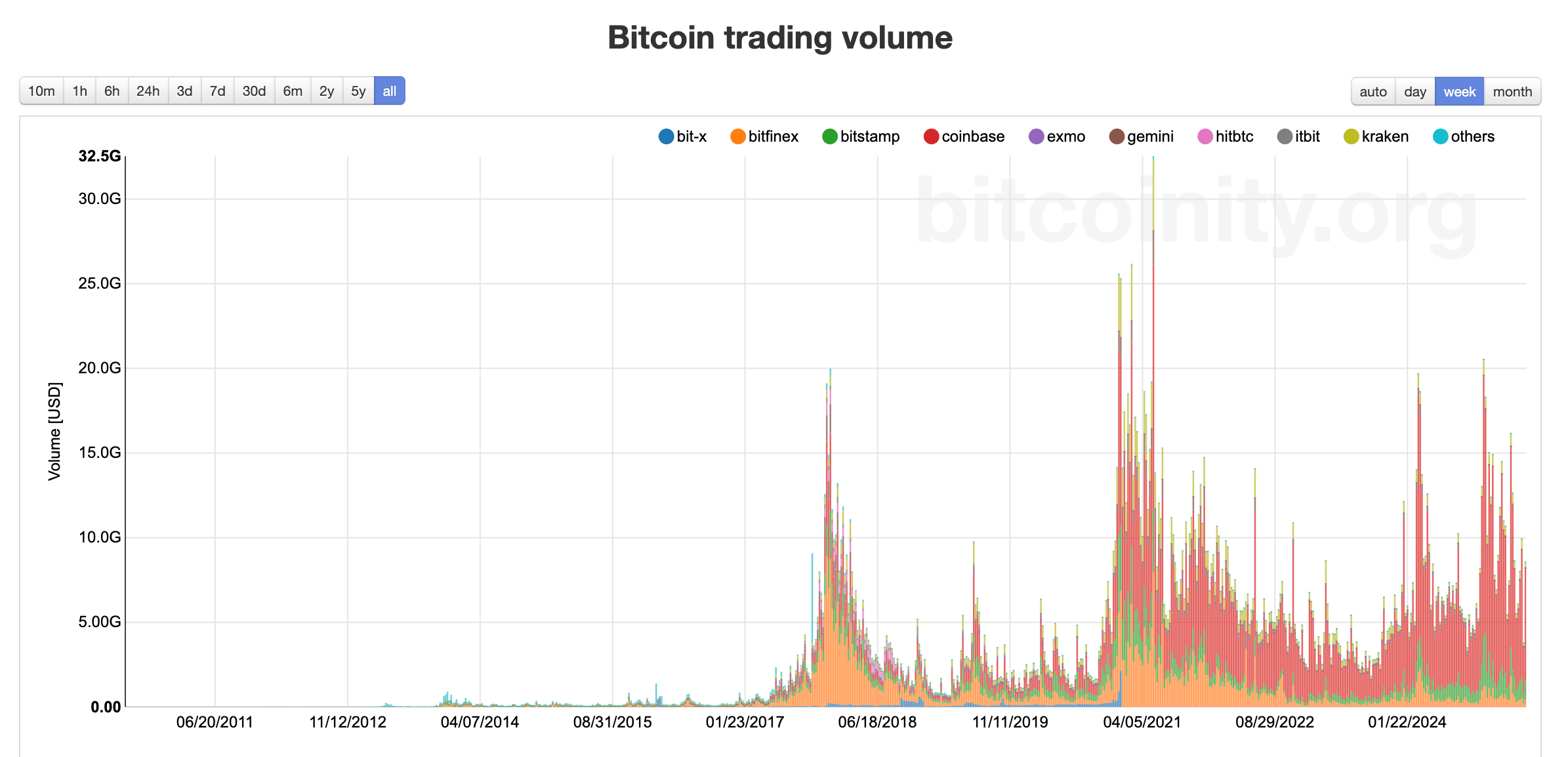

During 2014, erstwhile determination was small to nary regulatory oversight, the bulk of trading measurement took spot connected bitcoin-only exchanges from retail traders and cypherpunks, opening the manufacture to specified practices.

During 2017's ICO phase, erstwhile trading measurement skyrocketed, tactics specified arsenic spoofing were besides expected, arsenic institutions were inactive skeptical astir the plus class. In 2017 and 2018, traders regularly placed nine-figure positions that they had nary volition of filling, lone to propulsion the bid soon after.

BitMEX laminitis Arthur Hayes said successful a 2017 blog post that helium "found it incredible" that spoofing was illegal. He argued that if a astute trader wanted to bargain $1 cardinal of BTC, they would bluff a $1 cardinal merchantability bid to get it filled.

However, since the 2021 bull market, the crypto marketplace has experienced waves of organization adoption, specified arsenic Coinbase (COIN) going public, Strategy (formerly MicroStrategy) going all-in connected bitcoin, and BlackRock launching exchange-traded funds (ETFs).

At the clip of writing, determination are nary specified ample orders that bespeak further spoofing attempts, and spoofing attempts person seemed to person go little blatant. However, adjacent with billions traded by TradFi firms, examples of specified a strategy inactive beryllium crossed galore crypto exchanges, peculiarly connected low-liquidity altcoins.

For example, past month, cryptocurrency speech MEXC announced that it had reined successful a emergence successful marketplace manipulation. An interior probe recovered a 60% summation successful marketplace manipulation attempts from Q4 of 2024 to this archetypal 4th of this year.

In February, a trader manipulated the HyperLiquid JELLY marketplace by tricking a pricing oracle, and HyperLiquid's effect to the enactment was met with skepticism and a consequent outflow of capital.

How does the crypto marketplace combat spoofing?

The load yet lies with the exchanges and regulators.

"Regulators should acceptable the baseline," Dr. Jan Philipp told CoinDesk." [Regulators] should specify what counts arsenic manipulation, specify penalties and outline however platforms indispensable respond."

The regulators person surely tried to clamp down connected specified schemes. In 2020, rogue trader Avi Eisenberg was recovered blameworthy of manipulating decentralized speech Mango Markets successful 2022, but the cases person been fewer and acold between.

However, crypto exchanges indispensable besides "step up their surveillance systems" and usage circuit breakers portion employing stricter listing requirements to clamp down connected marketplace manipulation, Philipp said.

"Retail users won't instrumentality astir if they support getting front-run, spoofed and dumped on. If crypto wants to outgrow its casino phase, we request infrastructure that rewards just participation, not insider games," Philipp concluded.

5 months ago

5 months ago

English (US)

English (US)