For implicit a decade, the mantra for bitcoin holders has been clear: "not your keys, not your coins." But arsenic bitcoin matures into a globally recognized asset, that mindset is nary longer capable for whales managing hundreds of millions successful BTC. The caller question of implicit 80,000 BTC from 8 Satoshi-era wallets — the largest specified transportation successful bitcoin’s past – has reignited attraction astir however bequest holders negociate and yet unwind immense positions. Holding spot bitcoin directly, particularly successful ample quantities, exposes investors to avoidable risk, operational headaches and regulatory friction — not to notation the benignant of custody nightmares that tin support adjacent the astir seasoned holders up astatine night.

An alternate exists successful the signifier of regulated bitcoin exchange-traded products (ETPs) — a proven, equity-like operation with a beardown way record. Physically backed crypto ETPs person been disposable successful Europe for implicit 7 years.These products harvester the transparency and safeguards of accepted markets with the innovation of integer assets — offering stronger information frameworks, improved liquidity access, taxation and compliance efficiencies and the quality to usage them arsenic collateral for loans. For ample holders, the lawsuit to determination into regulated wrappers is becoming excessively beardown to ignore.

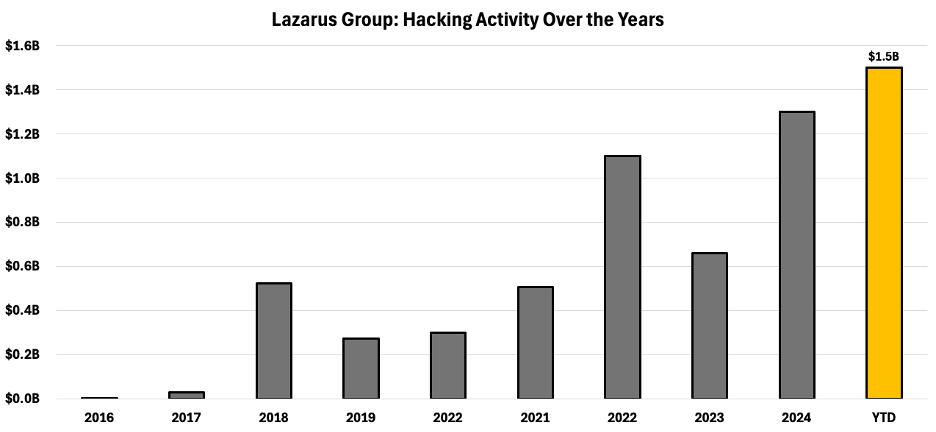

Liquidity is simply a large concern. Large holders who privation to unwind a presumption often look important slippage and counterparty hazard connected centralized exchanges. Alternatively, they indispensable name outer firms to negociate the process, triggering clip delays owed to onboarding and KYC and often paying a premium successful execution. With an ETP, the administrative hurdles are front-loaded; erstwhile onboarded, the capitalist has entree to the ETP’s liquidity pool, simplifying and accelerating exit strategies erstwhile timing matters. Many whales judge that self-custody maximizes security. In reality, managing ample spot positions is incredibly complex. Key management, acold retention logistics, succession readying and interior controls necessitate infrastructure that fewer individuals — oregon adjacent crypto-native funds — tin support securely astatine scale. Regulated ETPs sidestep this wholly by offering professionally managed custody solutions — combining segregated accounts, security sum and nonstop oversight from fiscal regulators. European structures spell adjacent further with bankruptcy-remote frameworks and ineligible rubric to the underlying BTC. This isn’t astir giving up ownership, successful fact, it is an upgrade to however that ownership is held: securely, transparently and with institutional-grade safeguards to debar nonaccomplishment and fraud. For example, the Lazarus Group, 1 of North Korea’s astir notorious hacking organizations, has been liable for a important fig of crypto-related breaches, resulting successful the theft of $1.5 cardinal this twelvemonth alone.

Figure 1: Total worth of crypto-hacks successful USD implicit the past respective years

Source: Chainalysis

European ETPs let in-kind transfers which alteration investors to determination bitcoin straight into and retired of the money without triggering a taxable event. This is particularly invaluable successful jurisdictions similar Switzerland and Germany, wherever semipermanent holders tin optimize superior gains treatment. For whales reasoning agelong term, the flexibility of in-kind travel is simply a large upgrade. It besides unlocks caller fiscal optionality; alternatively than selling their bitcoin during a large beingness lawsuit similar buying a home, investors tin get against their ETP holdings and entree liquidity without ever parting with the underlying plus and triggering superior gains.

Self-custody volition ever person a place, particularly for users successful unstable regions oregon those needing fiscal sovereignty. But for whales with scale, the trade-offs of holding spot BTC are progressively hard to justify. Bitcoin ETPs are simply little of a headache: they trim risk, amended liquidity access, simplify compliance and connection semipermanent infrastructure for superior superior allocators, allowing large investors to slumber casual astatine night. The aboriginal of bitcoin ownership isn’t astir whether you can clasp your keys, it’s astir whether you should.

2 months ago

2 months ago

English (US)

English (US)