Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin retreats from $42K arsenic Fed Chair Jerome Powell suggests that "front-end loading" mightiness beryllium the program for U.S. monetary argumentation makers arsenic they hike involvement rates.

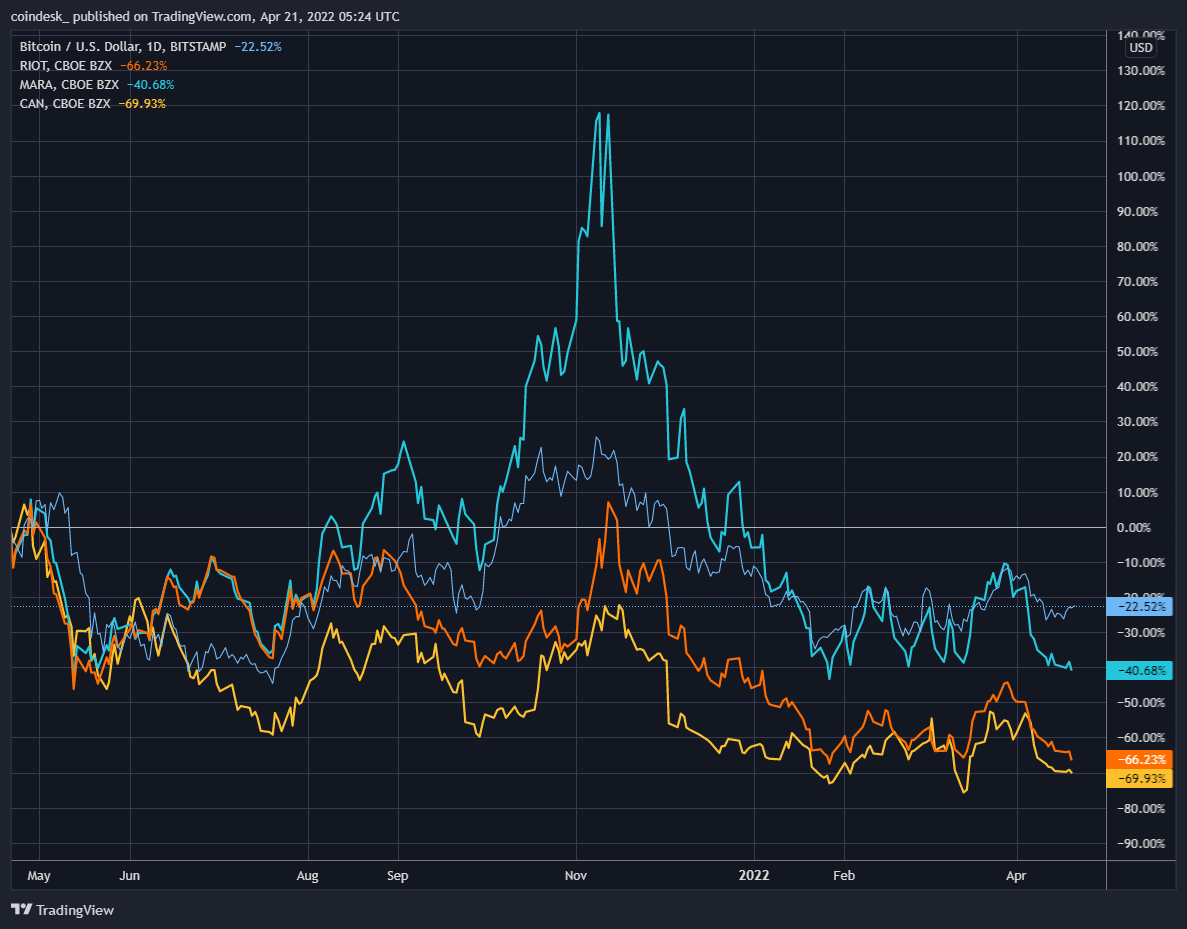

Insights: Listed crypto companies' stock prices person underperformed bitcoin (BTC) terms moves.

Technician's take: BTC is holding support, akin to what occurred successful precocious March earlier a 16% terms rise.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Sample HTML block

Top Gainers

There are nary gainers successful CoinDesk 20 today.

Top Losers

Bitcoin retreats aft touching $42K

"Front-end loading" sounds similar the aboriginal signifier of a operation project, and that's the operation Federal Reserve Chair Jerome Powell utilized Thursday to picture a imaginable strategy by the U.S. cardinal slope to tamp down ostentation moving astatine a four-decade high.

The thought is that the Fed mightiness enact a bid of steep interest-rate increases – say 0.5 percent constituent per meeting, versus the much emblematic 0.25 percent constituent – to marque definite user prices don't spiral retired of control.

“We’re truly going to beryllium raising rates and getting expeditiously to levels that are much neutral and past that are really tight,” Powell said connected a sheet alongside European Central Bank President Christine Lagarde, arranged by the International Monetary Fund (IMF).

The hazard is that higher borrowing costs crimp spending and concern and the system slides into a recession.

Bitcoin is seen by galore investors arsenic an ostentation hedge, and it's besides seen arsenic a risky plus that mightiness travel nether unit during a play of shrinking economical growth. So Powell's hawkish code was capable to nonstop bitcoin's terms little – conscionable arsenic the largest cryptocurrency appeared to beryllium gaining steam.

The terms reached a 10-day high, astir touching $43,000, but past slid backmost toward $40,000, erasing caller days' gains.

"Bitcoin terms enactment has continued to whipsaw betwixt a wider scope of $38-$47,000,” Tammy Da Costa, expert astatine DailyFX, told CoinDesk's Angelique Chen.

U.S. stocks ended the time lower, and U.S. Treasury yields rose.

One Year After Coinbase’s IPO, Most Listed Crypto Companies Are Underwater

The past 4th of 2020 was an breathtaking time. Bitcoin seemed meteoric, fixed the caller organization involvement successful the plus class. Coinbase Global (COIN) filed preliminary paperwork with the SEC for a listing, and soon after, pre-IPO contracts were trading connected FTX that valued the institution adjacent to $75 billion.

But conscionable implicit a twelvemonth since its IPO, Coinbase’s banal is down astir 55%, underperforming bitcoin, which is down astir 26% for the aforesaid clip play (to beryllium sure, galore tech stocks are besides down for this aforesaid period), arsenic investors’ appetite for listed crypto companies seems to person waned.

In a enactment published past year, Singapore’s QCP Capital wrote that investors were nary longer assigning a beardown premium to licenses and regulatory friendliness similar they erstwhile did, which would successful crook enactment unit connected Coinbase’s stock.

(TradingView)

“That premium has been connected the pretext that it would springiness them a escaped walk portion governmental agencies took their warfare connected crypto to different platforms and exchanges instead, similar Binance,” QCP wrote astatine the time. “If now, a regulated U.S. entity who is offering a merchandise that is already being offered successful the U.S., going done the due ineligible route, tin look specified harsh action, past cipher is assured to beryllium harmless anymore.”

Coinbase’s regulatory compliance and U.S. basal besides keeps it retired of immoderate of the much absorbing parts of crypto similar lending. It besides meant that Coinbase had a dilatory commencement successful the derivatives market, which overtook the spot marketplace for the archetypal clip successful June 2021, behind galore of its non-US-based rivals, apt turning investors distant from its stock.

Hong Kong’s BC Technology Group, which runs the institutional-focused integer assets level OSL, has seen a akin destiny with its stock. Although it had a little rally aft affirmative earnings, the banal is down astir 66% implicit the past year.

Mining stocks aren’t fairing overmuch better. RIOT Blockchain, which operates bitcoin mining farms passim the U.S., is down astir 66% implicit the past twelvemonth portion Marathon Digital, different miner, is down 40%. Canaan, a shaper of mining equipment, is down astir 70%.

Michael Del Grosso, an expert astatine Compass Point Research who covers miners, explains this mediocre show by saying successful a erstwhile CoinDesk interview “Mining stocks presently are leveraged plays connected the terms of bitcoin.”

These mining stocks had their infinitesimal erstwhile China ordered operations unopen in-country and the planetary hash complaint was successful flux. But arsenic that sorted itself retired and bitcoin flirted with all-time highs yet couldn’t prolong itself, the stocks sank similar rocks.

Currently, Compass Point maintains a neutral standing connected Riot Blockchain.

This begs the question, are determination immoderate listed crypto companies that are really supra the h2o line?

Indeed determination are: crypto banks similar Silvergate Capital and Signature Bank.

(TradingView)

Both of these banks, which supply banking services to crypto exchanges, person managed to outperform bitcoin implicit the past year. Given that they are tied to exchanges, their worth is based upon the measurement of transactions connected an exchange.

And measurement is maintained astatine a brisk pace, arsenic is demand for different tools Silvergate provides, similar Leverage.

So possibly the occupation with these listed companies isn’t a marketplace hostility to listed crypto companies, but alternatively that the marketplace needs much than them conscionable being a proxy for the terms of bitcoin.

Bitcoin (BTC) generated a affirmative momentum awesome connected the regular terms chart, akin to what occurred successful precocious March. That suggests buyers could stay progressive toward the $46,700 resistance level.

The cryptocurrency is up 4% implicit the past week.

The comparative spot scale (RSI) connected the four-hour illustration is declining from overbought levels, which typically occurs during a little pullback successful price. Still, support astatine $40,000 could support BTC's betterment phase.

Initial absorption is seen astatine $42,400, wherever sellers were progressive earlier successful the New York trading day. On the regular chart, however, the RSI is rising from oversold levels with stronger momentum, indicating a emergence successful bullish sentiment.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Japan: Jibun Bank Manufacturing PMI(Apr) PREL; Jibun Bank Services PMI(Apr) PREL

3:15 p.m. HKT/SGT(7:15 a.m. UTC): S&P Global Composite PMI(Apr) PREL

9 p.m. HKT/SGT(1 p.m. UTC): International Monetary Fund Press Briefing: Regional Economic Outlook for Europe, April 2022

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

A Use Case You Can Eat: California Crabs Tracked by Helium Netwo: The Helium Network is simply a crypto-powered web of Internet hotspots, but it has saved 1 amateur fisherman thousands of dollars connected crab pots each year.

BitRiver Calls OFAC Sanctions ‘Unfair’ Anti-Competitive Move to Benefit US Miners: The steadfast and 10 of its subsidiaries were added to OFAC's database of designated nationals taxable to sanctions.

US House Democrats Call for Scrutiny connected Crypto Mining arsenic Environmental Threat: Rep. Huffman and different legislature Democrats wrote the EPA main connected the imaginable harm to the clime and environment.

Will Rising Interest Rates Sink the Crypto Ecosystem?: Competition for superior is clobbering speculative investments similar tech stocks. Digital assets person held up comparatively good – truthful far.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)