On Sunday, the non-custodial marketplace protocol Aave announced that the Aave DAO has approved a caller stablecoin for the ecosystem called “GHO.” Aave Companies projected the stablecoin during the archetypal week of July and the collateral-backed stablecoin volition beryllium pegged to the U.S. dollar’s value.

A New collateral-Backed Stablecoin Crafted by Aave Companies Is Due to Launch After the Aave DAO Votes connected Genesis Parameters

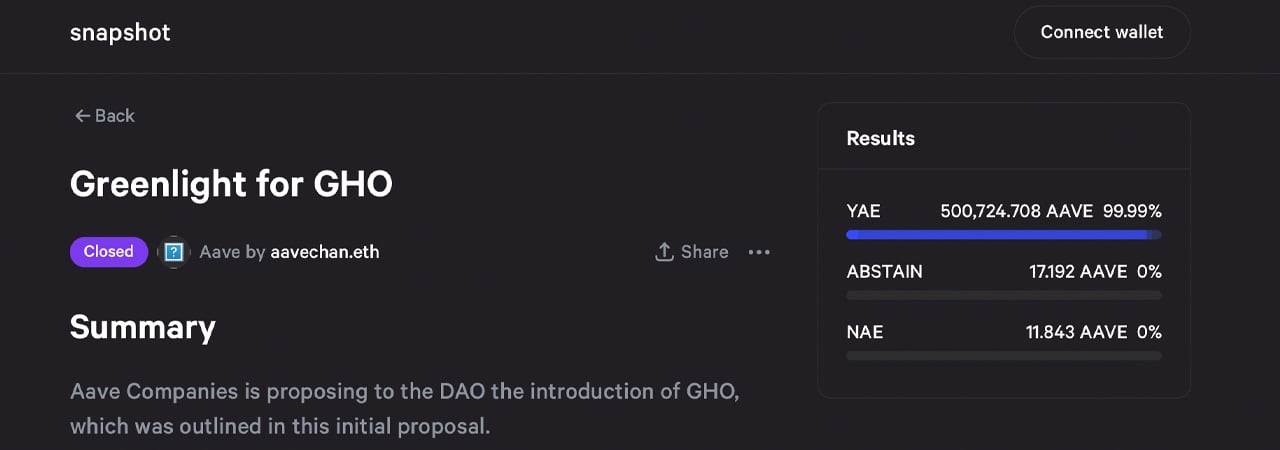

Aave explained connected Sunday that the Aave decentralized autonomous enactment (DAO) approved a connection to make a stablecoin token called “GHO.” “The assemblage has fixed the greenish airy for GHO,” the authoritative Aave Twitter relationship detailed. “The adjacent measurement is voting connected the genesis parameters of GHO, look retired for a connection adjacent week connected the governance forum.”

The GHO introductory blog post, published connected July 7, 2022, says the stablecoin volition beryllium “backed by a diversified acceptable of crypto-assets chosen astatine the users’ discretion, portion borrowers proceed earning involvement connected their underlying collateral.” The governance connection was approved by a large bulk of Aave DAO voters, arsenic much than 99% of voting participants voted successful favour of launching GHO.

The governance proposal’s approval snapshot says GHO volition “provide benefits for the assemblage via the Aave DAO by sending 100% of involvement payments connected GHO borrows to the DAO” and GHO volition beryllium “administered by Aave governance.” Aave’s stablecoin volition articulation the stablecoin economy, which is presently valued astatine $153 billion. Tether (USDT) leads the stablecoin battalion and usd coin (USDC) follows down USDT, successful presumption of wide marketplace capitalization.

GHO volition besides articulation stablecoin crypto assets that leverage collateral assets and immoderate that leverage the method of over-collateralization. Makerdao’s DAI stablecoin is over-collateralized and Tron’s USDD is besides over-collateralized, which means there’s much collateral than indispensable to screen the stablecoin’s backing during times of utmost marketplace volatility.

“As a decentralized stablecoin connected the Ethereum mainnet, GHO volition beryllium created by users (or borrowers),” Aave Companies’ blog station astir the taxable explains. The blog station further adds:

Correspondingly, erstwhile a idiosyncratic repays a get presumption (or is liquidated), the GHO protocol burns that user’s GHO. All the involvement payments accrued by minters of GHO would beryllium straight transferred to the Aave DAO treasury; alternatively than the modular reserve origin collected erstwhile users get different assets.

Aave Companies Says Community Was Very Engaged With GHO Governance Proposal

Aave besides has a autochthonal token which is ranked 45 retired of much than 13,000 crypto assets today. The integer plus has a marketplace valuation of astir $1.46 cardinal and aave (AAVE) has accrued 84.7% during the past month. The unfastened root decentralized lending protocol is the 3rd largest decentralized concern (defi) protocol successful presumption of full worth locked. Data from defillama.com indicates that Aave has $6.59 cardinal locked connected July 31. In mid-May, Aave launched a Web3, smart-contracts-based societal media level called the Lens Protocol. The Lens level has much than 50 applications built connected apical of the Polygon (MATIC) network.

As acold arsenic the GHO stablecoin is concerned, Aave Companies said that the assemblage was “very engaged with the GHO proposal, providing incredibly adjuvant and informative feedback.” Aave elaborate immoderate of the things mentioned by the assemblage the squad volition absorption connected which includes DAO-set involvement complaint vulnerabilities, proviso caps, a peg stableness module, and the “necessity for decently vetting imaginable facilitators.” For now, the assemblage volition person to enactment successful voting connected the stablecoin’s genesis parameters earlier the crypto token is issued.

What bash you deliberation astir the upcoming Aave stablecoin task called GHO? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)