The Financial Accounting Standards Board (FASB), which sets accounting standards for backstage and nationalist U.S. companies, has not developed immoderate accounting standards for integer assets. This has proved to beryllium 1 of the biggest barriers to the adoption of integer assets.

FASB solicited an “agenda request” successful September inviting comments from the nationalist connected identifying “pervasive needs” to amended mostly accepted accounting principles (GAAP), and inquiring astir imaginable areas for aboriginal accounting standards setting.

Perianne Boring is laminitis and CEO of the Chamber of Digital Commerce.

The Chamber of Digital Commerce has been advocating the FASB since 2015 connected the request for accounting standards for integer assets. Previously, the FASB has pushed backmost owed to perceived deficiency of “pervasiveness” of integer assets, and truthful did not allocate the resources indispensable to make authoritative guidance connected accounting for crypto.

The Chamber of Digital Commerce led a important effect to the FASB’s astir caller agenda, providing input from the Chamber’s much than 200 members, arsenic good arsenic insights from congressional leadership and different manufacture stakeholders. Our volition was to some amended the FASB and its advisory unit connected the pervasive impacts of integer assets, arsenic good arsenic to marque a beardown lawsuit for FASB to present undertake standards mounting for integer assets.

If you are wondering what adoption looks like, much than 52 cardinal Americans already ain cryptocurrencies today. It’s estimated that implicit 27% of millennials ain immoderate signifier of crypto.

We are seeing much and much investors look to integer assets arsenic a hedge against inflation. A survey from Fidelity Digital Assets recovered that 7 successful 10 organization investors from astir the world, including advisers, household offices, pensions, hedge funds and endowments, program to bargain oregon put successful integer assets wrong the adjacent 5 years. Deloitte’s 2021 Global Blockchain Survey recovered 76% of respondents judge integer assets volition either service arsenic a beardown alternate to fiat currencies oregon outright regenerate fiat wrong the adjacent 5 to 10 years.

Through the remark process, FASB received a important effect of 522 remark letters. Of these 522 responses, 445 (85% of the respondents) commented solely and exclusively connected accounting standards for integer assets, providing feedback connected the pervasive interaction of integer assets and the request to prioritize standards setting. More than 50% of the respondents indicated that modular mounting for integer assets should beryllium considered arsenic the highest precedence for FASB.

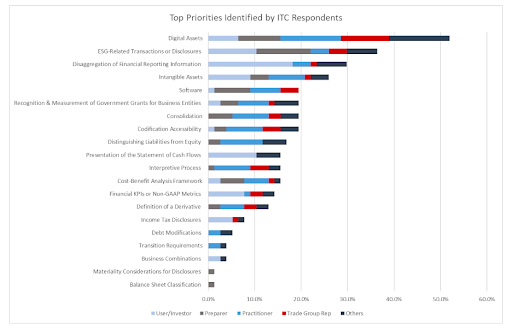

This illustration provides an illustration of the areas that respondents identified arsenic apical priority, successful bid of astir often identified to slightest often identified. (FASB/Chamber of Digital Commerce)

The Board volition see the interaction of this feedback successful upcoming meetings successful mounting scope and priorities successful modular setting.

“We sometimes accelerate projects, peculiarly erstwhile there’s important capitalist involvement successful an emerging issue,” FASB Chair Richard Jones told the Wall Street Journal.

Accordingly, the Chamber of Digital Commerce volition proceed to enactment with FASB to guarantee this important modular mounting is connected the docket and prioritized accordingly due to the fact that 2022 is going to beryllium a pivotal year. It is wide from the FASB survey that determination is request to code accounting standards for integer assets. At the aforesaid time, the U.S. and different countries look poised to make wide argumentation frameworks for crypto. It is important that each invested successful the maturation of the integer plus ecosystem proceed to enactment to summation this momentum to bring certainty to the marketplace for innovators and investors alike.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)