During the past fewer years, cryptocurrencies person been integrated into accepted concern tools similar automated teller machines (ATMs), loadable debit cards, point-of-sale devices, and nonstop payments for each kinds of goods and services. Digital assets person besides been added to status relationship offerings issued by fiscal giants similar Fidelity. In caller times, cryptocurrencies tin beryllium further capitalized to enactment a down outgo connected a owe oregon get a accepted location indebtedness utilizing bitcoin arsenic collateral.

Crypto-Backed Conventional Home Loans

These days, astatine slightest successful the United States, banks necessitate astatine slightest 20% down if a idiosyncratic oregon a mates wants to acquisition a location by leveraging a accepted loan. Typically, radical usage currency for collateral oregon a down payment, but Americans tin besides utilize things similar concern equipment, inventory, invoices, broad liens, and adjacent different forms of existent property to unafraid a accepted mortgage.

As of April 8, 2022, the median location terms successful the U.S. was $392,000, which means a purchaser needs $78,400 successful collateral to unafraid a accepted slope loan. While crypto assets tin beryllium utilized to load debit cards and wage for items via point-of-sale commerce, there’s not galore firms that let radical to usage integer currencies for a crypto-backed loan.

Interested location buyers looking to leverage their crypto assets to bargain a location tin usage firms similar Milo and Abra. In the future, Figure Technologies and Ledn purpose to connection crypto-backed owe products.

Interested location buyers looking to leverage their crypto assets to bargain a location tin usage firms similar Milo and Abra. In the future, Figure Technologies and Ledn purpose to connection crypto-backed owe products.However, determination are a mates of companies close now, either offering loans that utilize crypto assets for collateral oregon that are readying to bash truthful successful the adjacent future. Moreover, immoderate firms that planned to connection crypto-backed loans gave up connected the thought soon after.

For instance, the second-largest owe lender successful the U.S., United Wholesale Mortgage, announced it would judge bitcoin (BTC) for mortgages astatine the extremity of August 2021. However, a fewer months later, United Wholesale Mortgage revealed the institution decided not to connection the crypto services.

The company’s CEO, Mat Ishbia, told CNBC successful October 2021 that the lender did not deliberation it was worthy it. “Due to the existent operation of incremental costs and regulatory uncertainty successful the crypto abstraction we’ve concluded we aren’t going to widen beyond a aviator astatine this time,” Ishbia explained to CNBC’s MacKenzie Sigalos.

Crypto-Backed Home Loans Provided by Abra and Milo

Meanwhile, a fiscal services steadfast that conscionable precocious announced crypto-backed location loans is the cryptocurrency steadfast Abra. The company, founded successful 2014 by erstwhile Goldman Sachs fixed income expert Bill Barhydt, has provided integer plus trading services and a cryptocurrency wallet for implicit 7 years.

Abra CEO Bill Barhydt revealed that the institution would connection location loans via Abra’s Borrow exertion and a concern with the institution Propy.

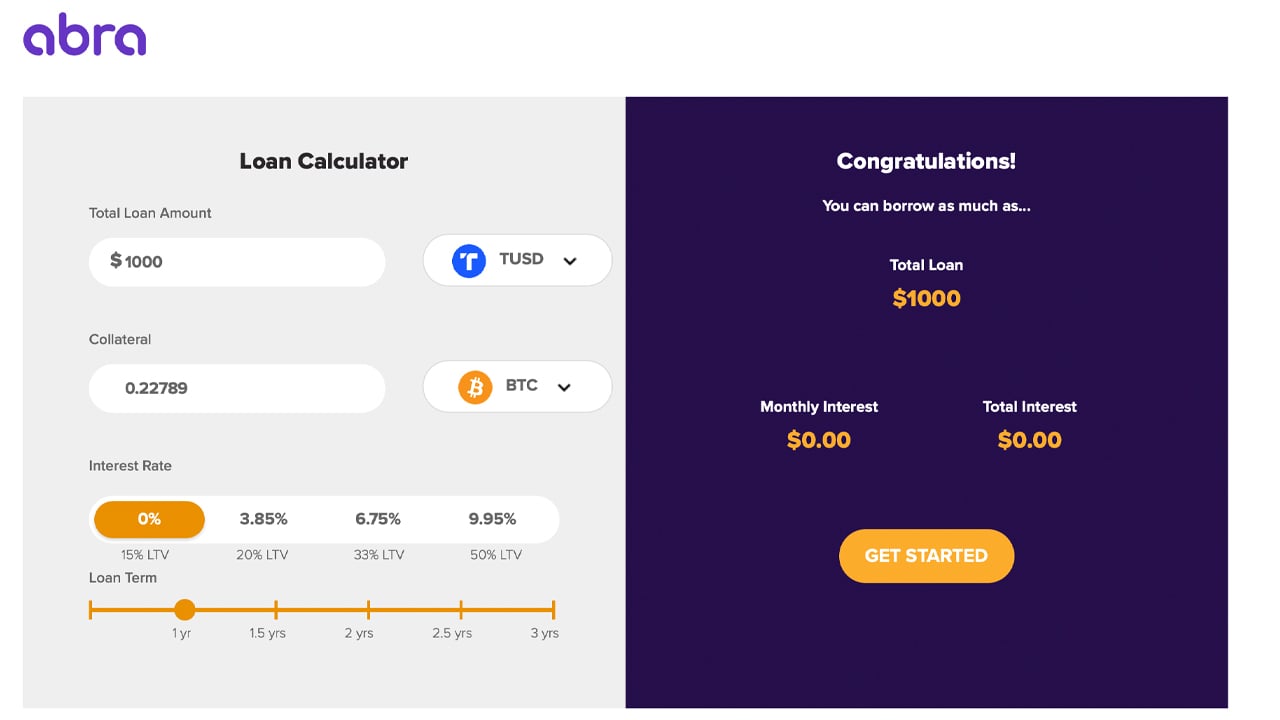

Abra CEO Bill Barhydt revealed that the institution would connection location loans via Abra’s Borrow exertion and a concern with the institution Propy.On April 28, 2022, Abra announced it has partnered with the institution Propy and homebuyers tin unafraid a location indebtedness utilizing crypto arsenic collateral via the Abra Borrow platform. The Abra lending exertion has assorted involvement rates, depending connected however overmuch crypto collateral is added, from 0 to 9.95%.

“While integer plus concern has skyrocketed, astir investors are incapable to usage their cryptocurrency holdings to straight money the astir important acquisition successful their life, a home,” Abra’s CEO Bill Barhydt explained during the announcement. “Our concern with Propy solves this and is simply a large measurement successful bridging the spread betwixt crypto and existent estate,” the Abra enforcement added.

In summation to Abra, a institution called Milo is offering crypto-backed mortgages for radical funny successful purchasing existent estate. Milo is simply a Florida-based startup that raised $17 cardinal connected March 9, 2022, successful a Series A backing round. The California-based task superior steadfast M13 led the backing circular and QED Investors and Metaprop participated.

Milo offers crypto-backed mortgages and accepts BTC, ETH, and a fewer stablecoins.

Milo offers crypto-backed mortgages and accepts BTC, ETH, and a fewer stablecoins.Milo offers 30-year loans for borrowers looking to leverage up to $5 million. Milo accepts stablecoins, bitcoin (BTC), ethereum (ETH), and involvement rates are betwixt 5.95% and 6.95%, with loans that person 2 to three-week closing times. When Milo raised $17 cardinal past March, Milo CEO Josip Rupena said the company’s efforts purpose to alteration crypto participants.

“This [funding] circular of financing is simply a validation of Milo’s imaginativeness to empower planetary and crypto consumers and the accidental to span the integer satellite with real-world existent property assets,” Rupena said astatine the time. “This is simply a multibillion-dollar opportunity, and we are arrogant to beryllium pioneering the efforts successful the U.S. for consumers that person unconventional wealth.”

Ledn and Figure Technologies Plan to Offer Crypto-Backed Mortgage Products

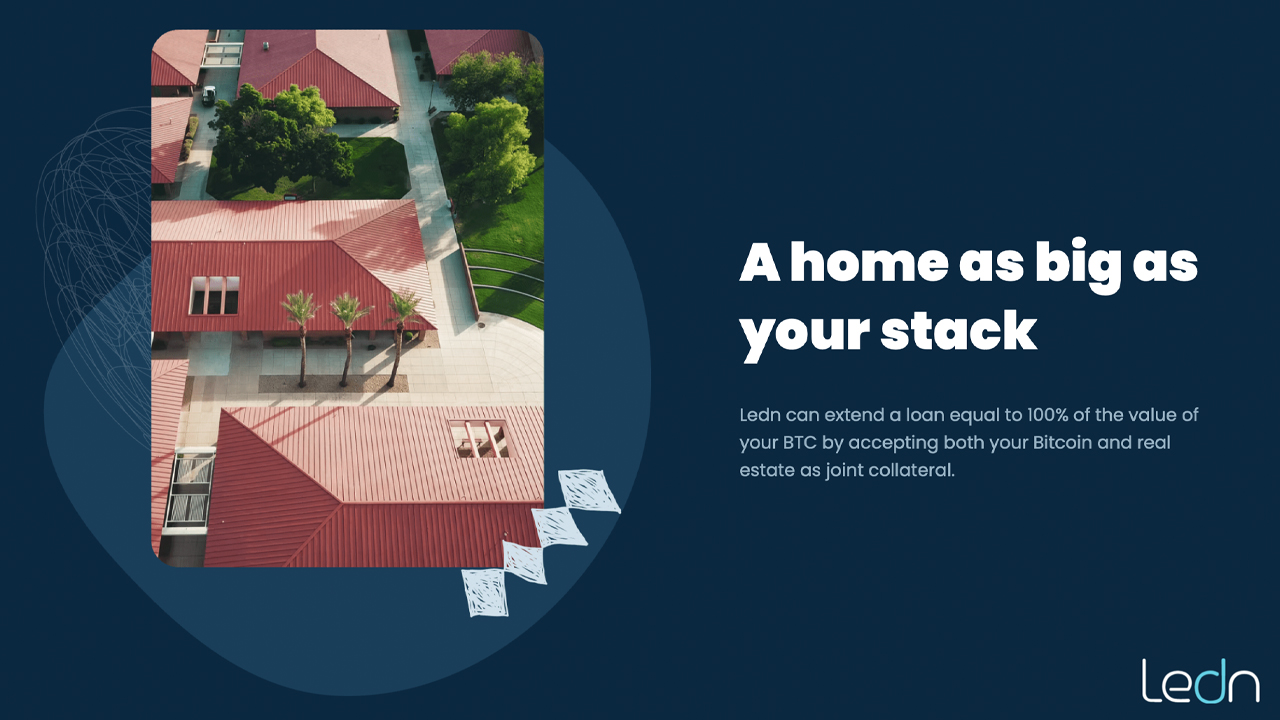

The crypto lender and savings level Ledn revealed successful December 2021 that it was readying “the impending motorboat of a bitcoin-backed owe product.” At the aforesaid time, the steadfast said that it raised $70 cardinal from a fistful of well-known investors.

While Ledn’s crypto-backed mortgages are not yet available, radical tin motion up to get connected the waitlist.

While Ledn’s crypto-backed mortgages are not yet available, radical tin motion up to get connected the waitlist.Ledn was founded successful 2018 and the institution has raised a full of $103.9 cardinal to date. At the clip of writing, Ledn’s bitcoin-backed owe is not yet available, but radical tin motion up for Ledn’s owe merchandise waitlist.

“By combining the appreciation imaginable of bitcoin with the terms stableness of existent estate, this first-of-its-kind indebtedness offers a balanced blend of wealth-building collateral,” Ledn’s mortgage web page says. “With the Bitcoin Mortgage, you tin usage your holdings to bargain a caller property, oregon concern the location you already own. Get a indebtedness adjacent to your bitcoin holdings, without selling a satoshi.”

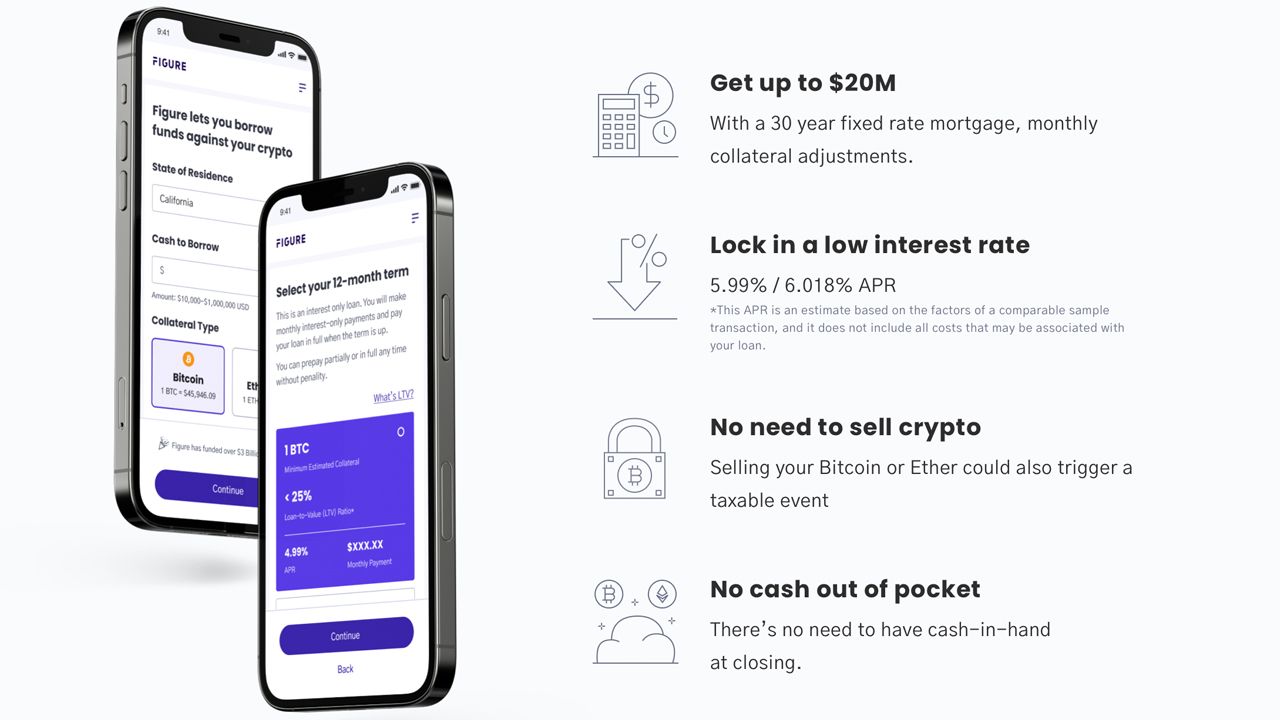

Figure Technologies besides plans to supply a crypto-backed mortgage and radical tin motion up for a waitlist successful bid to entree Figure’s upcoming product. Figure’s co-founder Mike Cagney explained astatine the extremity of March that the institution was launching the owe program.

Figure aims to connection crypto-backed mortgages up to $20 cardinal with varying involvement rates, from 5.99% to 6.018% APR.

Figure aims to connection crypto-backed mortgages up to $20 cardinal with varying involvement rates, from 5.99% to 6.018% APR.“Figure is launching a crypto-backed owe successful aboriginal April,” Cagney said astatine the time. “100% LTV – you enactment up $5M successful BTC oregon ETH, we springiness you a $5M mortgage. No achy process, nary cash-out, immoderate magnitude up to $20M, for a 30-year mortgage. You tin marque payments with your crypto collateral. And we don’t rehypothecate your crypto.”

While there’s not that galore crypto-backed owe products today, the inclination is starting to go a spot much salient successful 2022. If the inclination continues, similar crypto’s integration with ATMs, debit cards, and the myriad of accepted fiscal vehicles, the conception of buying a location with bitcoin volition apt go a mainstay successful society.

Tags successful this story

Abra, Bill Barhydt, Bitcoin Lending, Bitcoin loans, bitcoin mortgage, bitcoin mortgages, bitcoin-backed mortgage, crypto mortgage, crypto mortgages, crypto-backed mortgage, crypto-backed owe product, Ethereum, Figure Technologies, ledn, ledn bitcoin, loan, Mike Cagney, Milo, Propy, Stablecoins, waitlist

What bash you deliberation astir the conception of crypto-backed owe products? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)