"But helium hasn’t got thing on," a small kid said. – Hans Christian Andersen, The Emperor’s New Clothes

The 21st twelvemonth of the 21st period was the infinitesimal erstwhile cardinal bankers’ masks came disconnected and the disfigured information was revealed: determination is nary maestro plan, nary adept guidance down the fiat monetary policy. The lone ambition is to footwear the tin down the roadworthy for astatine slightest a mates of much years.

Monetary argumentation of perpetual ostentation acts arsenic an inadvertent selling for Bitcoin, arsenic much and much radical look for a lifeboat for their purchasing power.

Inflation: Not So Transitory Anymore

Central bankers astir the world, fearful of the “deflationary spiral” arsenic they are, person been trying to incite ostentation for much than a decade, ever since the Great Recession of 2008. Finally they person succeeded. And marque nary mistake — the ostentation rates we are seeing close present are the nonstop effect of wealth printing. As Ludwig von Mises pointed retired already successful a 1959 lecture published successful 1979, ostentation is simply a policy, not an accident:

Inflation, erstwhile unleashed, is simply a beast that tin rapidly get retired of control. Even the cardinal bankers look a spot perplexed with however rapidly ostentation ran up. In Q1, 2021, the statement among “professional forecasters” surveyed by the Philadelphia subdivision of the Federal Reserve predicted an ostentation rate of 2.2% for the extremity of 2021. The reality? Almost 7% for the past 4th of the year. The European Central Bank (ECB) was likewise disconnected the mark: the predictions ranged from 0.9-2.3%, portion the existent ostentation climbed up to 5% by the extremity of the year.

Following this embarrassing amusement of incompetency, the Fed finally retired the connection “transitory” erstwhile addressing the ostentation rate, and the ECB astir doubled its 2022 ostentation forecast.

The Mandate Has Changed

"The monetary argumentation goals of the Federal Reserve are to foster economical conditions that execute some unchangeable prices and maximum sustainable employment." – Fed

"The superior nonsubjective of the ECB’s monetary argumentation is to support terms stability." – ECB

The main mandate of cardinal banks has for decades been to “maintain terms stability,” which usually meant keeping an ostentation complaint astatine astir 2% annually. The Fed ever had a “dual mandate” of terms stableness and maximum employment. Both the Fed and ECB look to person unilaterally changed their mandates implicit the people of the past 2 years.

In summertime 2020, the Fed redefined its ostentation target arsenic follows: “The Federal Reserve present intends to instrumentality a strategy called flexible mean ostentation targeting (FAIT). Under this caller strategy, the Federal Reserve volition question ostentation that averages 2% implicit a clip framework that is not formally defined.”

This means that the existent ostentation complaint of 7% is good successful enactment with the mandate, since determination is nary wide explanation implicit what clip play the ostentation should mean to 2%.

The ECB hasn’t changed the explanation of their mandate, alternatively they chose to disregard it altogether. When addressing inflation, they simply “expect it to autumn implicit the mean term.” But the ECB isn’t doing overmuch to combat the ostentation and alternatively keeps involvement rates below zero percent, which of people leads to much wealth being injected into the economy, with rising ostentation arsenic the result.

Now the existent question is, wherefore are they doing this? Why bash cardinal banks conscionable disregard decades-old mandates of keeping ostentation debased and not bash everything to halt it from climbing adjacent higher?

Because this emperor has ever been naked; the terms stableness mandate is simply a lie. Debt serviceability and banal marketplace show were ever the existent captains of this ship. The debased complaint of consumer goods inflation has been a effect of beardown growth deflation, with technological developments driving costs down owed to increases successful productivity. Alas, the maturation deflation effect whitethorn beryllium depleted for the clip being, with onerous regulations, commercialized barriers and ubiquitous superior misallocation among the main culprits. And erstwhile the technology-induced deflation is stripped away, each that remains is the disfigured look of the Cantillon effect. The monetary argumentation is determination to service the authorities and the fiscal sector, savers beryllium damned.

Any important involvement complaint hikes that could dilatory down ostentation would simply nuke stocks and marque debtors insolvent, with governments among the archetypal to fall. The US has a nationalist debt-to-GDP ratio of 120% (debt levels unseen since World War II), portion immoderate European countries person debts of 150% (Italy) oregon adjacent 200% (Greece).

Inflation is frankincense a conscious policy, preferred by the powers that beryllium implicit a deflationary clang and wide bankruptcies. Instead of outright clang and insolvency, the monetary argumentation aims for a brushed default done currency debasement, meaning that it is the savers, the fixed-wage earners and pensioners who are getting wiped out.

Bitcoin, The Conservative Lifeboat

Bitcoin serves arsenic a monetary lifeboat for radical forced to transact and prevention successful monetary media perpetually debased by governments. – Saifedean Ammous, The Bitcoin Standard

Since it doesn’t look similar cardinal banks volition prevention america from ostentation immoderate clip soon (since they’re the precise root of it), we request to look for solutions extracurricular of authoritative policy. The undoing of the effects of fiat monetary argumentation whitethorn beryllium hard connected the societal level, but it’s rather elemental connected the idiosyncratic level. Bitcoin is accessible to everyone, 24/7, without immoderate support required — if you bash your homework and steer wide of the KYC traps.

Bitcoin is sometimes described arsenic an concern oregon a speculation, but it mostly resembles savings. Bitcoin has each the characteristics of dependable wealth and tin beryllium securely held by an individual, frankincense eliminating counterparty risks and risks of dilution caused by changes successful monetary policy.

When combined with the knowing that the roadworthy to hyperbitcoinization is bumpy and bear markets are a earthy occurrence, bitcoin tin really beryllium understood arsenic the blimpish prime successful today’s world.

2022: More Of The Same

It’s hard to instrumentality the Fed’s caller hawkish pivot seriously. They whitethorn rise rates a small spot lone to propulsion their hands successful the aerial a fewer months aboriginal and proclaim “See? We tried, but the system was going to crash!”

What volition hap alternatively is much of the same. As Greg Foss brilliantly enactment it, you can’t taper a ponzi.

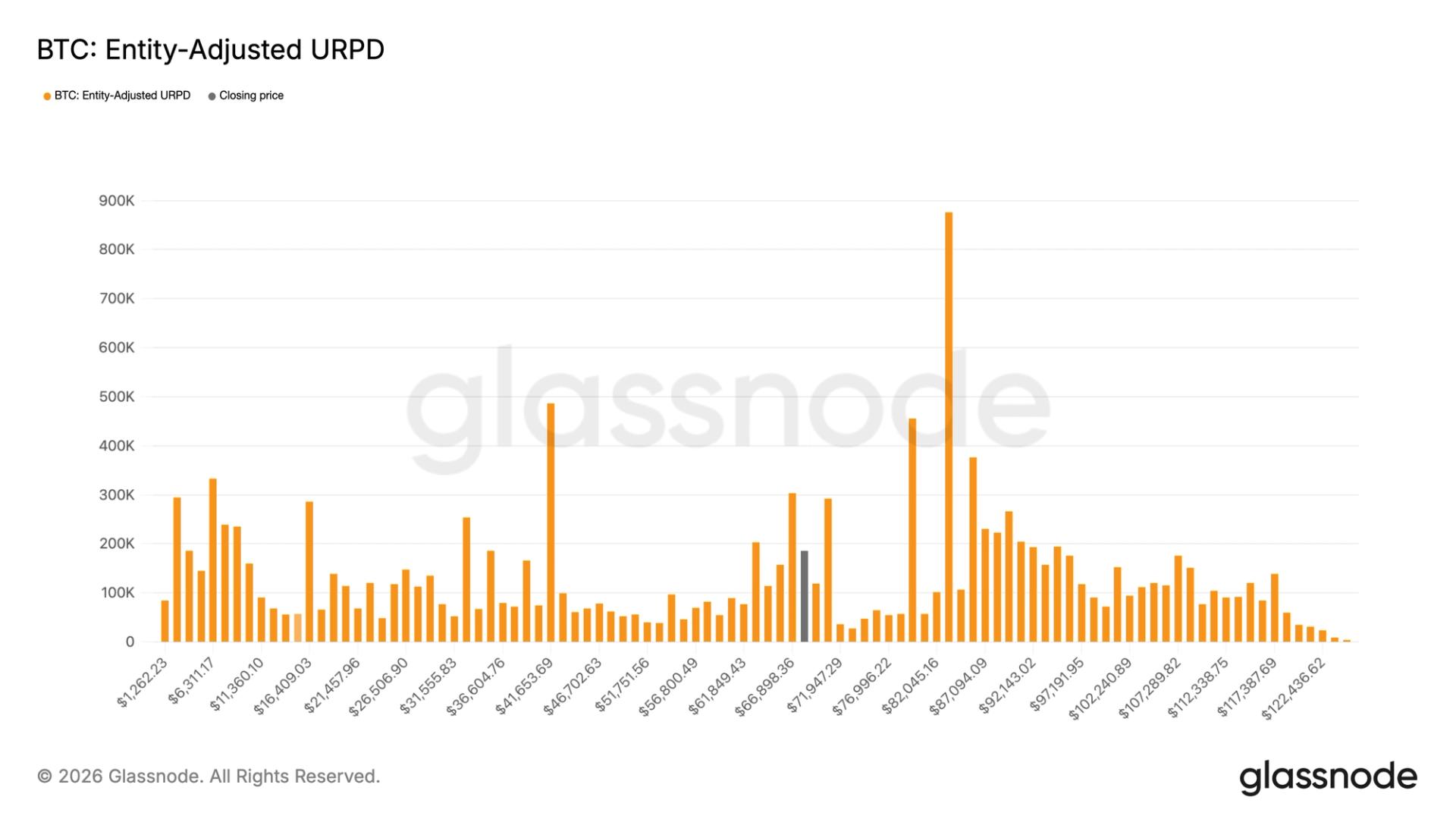

Bitcoin remains the lone viable lifeboat for astir people. But tin Bitcoin accommodate everyone that needs it, close present successful 2022? And astir importantly, tin billions of radical ain their bitcoin without reliance connected trusted 3rd parties? In the pre-Lightning era, this would person been impossible. Since Bitcoin connected the basal furniture tin process astir 300,000 transactions daily, it would instrumentality astir 10 years to make a azygous UTXO for each of the archetypal cardinal radical alone. The Lightning Network and Taproot (which opens up doors to worldly similar Eltoo, a much-improved Lightning Network protocol) bring the imaginativeness of a cardinal sovereign Bitcoiners overmuch person to reality.

2022 volition astir apt not beryllium a revolutionary year. Instead, the fiat monetary authorities volition support connected deteriorating, portion Bitcoin volition support connected improving. And the satellite volition gradually larn to despise the erstwhile and admit the latter.

This is simply a impermanent station by Josef Tětek. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)