Luna Foundation Guard (LFG) has bought implicit 11,700 BTC worthy astir $520 cardinal truthful acold this week to physique a bitcoin reserve to enactment its stablecoin, TerraUSD (UST). While galore successful the Bitcoin assemblage were speedy to constituent retired that the task is fundamentally antithetic than those built upon on-chain bitcoin, specified a important acquisition of BTC had undeniable interaction connected the Bitcoin ecosystem and, rather possibly, the price.

LFG is simply a non-profit enactment based successful Singapore that works to cultivate request for Terra’s stablecoins and “buttress the stableness of the UST peg and foster the maturation of the Terra ecosystem.”

Terraform Labs, connected the different hand, is simply a tech startup down the improvement of Terra. The steadfast is presently successful a legal battle with the U.S. Securities and Exchange Commission (SEC) arsenic the watchdog alleges that Terraform Labs violated U.S. securities laws with its Mirror Protocol.

Bitcoin Magazine recovered LFG’s Bitcoin code aft rumors online pointed astatine a $125 cardinal deposit of USDT into Binance. From analyzing Binance’s Bitcoin blistery withdrawal wallet, an code was spotted receiving astir the aforesaid amount, successful BTC, wrong a one-hour window. Terraform Labs laminitis Do Kwon connected Wednesday confirmed via email that the address so belongs to LFG. As of March 25, LFG has deposited 11,759 BTC to that code implicit the past 2 days.

Earlier this month, Kwon said successful a Twitter Space that Terra was readying to commencement acquiring bitcoin to signifier a billion-dollar stockpile of BTC arsenic a reserve plus to backmost its main stablecoin, UST.

“$UST with $10B+ successful $BTC reserves volition unfastened a caller monetary epoch of the Bitcoin standard,” Kwon tweeted a fewer days later. “P2P physics currency that is easier to walk and much charismatic to clasp #btc.”

What Is UST And Is It Needed?

At the halfway of Terra’s worth proposition is the thought that Bitcoin has frankincense acold failed its archetypal nonsubjective — to go a peer-to-peer physics currency strategy — and champion functions arsenic a reserve asset.

Terra’s white paper proposes a strategy of stablecoins — cryptocurrencies whose worth is pegged to an plus specified arsenic a fiat currency oregon a commodity — to bring astir the usefulness of a “stable currency” successful Terra that it alleges could clasp “all the censorship absorption of Bitcoin [while] making it viable for usage successful mundane transactions.”

However, this stepping-stone presumption — that bitcoin has failed and volition ne'er actualize arsenic a P2P currency — is debatable. First, it tin beryllium argued that wealth historically follows a linear adoption signifier wherein it progresses done antithetic steps.

“Historically speaking, specified a mostly esteemed substance arsenic golden seems to person served, firstly, arsenic a commodity invaluable for ornamental purposes; secondly, arsenic stored wealth; thirdly, arsenic a mean of exchange; and, lastly, arsenic a measurement of value,” wrote marginalist economist William Stanley Jevons.

While successful its aboriginal days, bitcoin was mostly treated arsenic a collectible item, it is now being seen much wide as a store of value, and its usage arsenic a mean of speech and, eventually, a portion of relationship should follow, provided adoption keeps rising astir the world. Moreover, developments similar El Salvador recognizing BTC arsenic ineligible tender and expanding P2P usage of bitcoin successful Africa are fast-tracking bitcoin’s advancement arsenic a currency and showcasing that BTC tin and is already being utilized arsenic wealth successful the present.

Nevertheless, marketplace appetite for a integer practice of U.S. dollars — the existent de facto planetary wealth — is strong, a improvement that has helped spearhead the improvement of respective stablecoins.

Centralized stablecoins pb the broader manufacture arsenic the astir fashionable options, with Tether’s USDT, Coinbase’s USDC and Binance’s BUSD heading the ranks, respectively. Terra’s UST, which proposes a decentralized alternative successful which its one-to-one peg to the dollar is tentatively ensured algorithmically, presently trails successful 4th successful marketplace capitalization.

Terra attempts to programmatically support UST’s dollar peg by burning $1 worthy of LUNA connected the Terra blockchain for each caller UST created, thereby increasing oregon decreasing UST proviso arsenic needed. However, this setup’s sustainability is inactive debated.

Even Terraform Labs acknowledges successful a blog post that “questions persist astir the sustainability of algorithmic stablecoin pegs.”

Cryptocurrency hedge money Galois Capital besides echoed specified concerns earlier this month.

“A precocious implosion of $LUNA would beryllium catastrophic” arsenic hazard would dispersed “through the full manufacture and nonstop america into a cold, bitter and agelong winter,” Galois Capital tweeted earlier this month, calling LUNA the “biggest and astir dangerous” illustration of a “doomed-to-fail” project.

Notably, Terraform Labs’ blog station mentioned supra besides discusses however determination needs to beryllium capable request for Terra stablecoins successful the broader cryptocurrency ecosystem to “absorb the short-term volatility of speculative marketplace cycles” and warrant a amended accidental of achieving semipermanent success.

Notably, the usage of bitcoin arsenic a reserve plus for UST does not marque the stablecoin straight backed by BTC, arsenic its peg is inactive related to the dollar, but lone establishes an indirect peg. Terra intends to summation the request for the alternate cryptocurrency by leveraging Bitcoin’s much well-established estimation arsenic a ballot of assurance for users, arsenic a crisp driblet successful the request for UST could hazard the stablecoin’s quality to support its peg.

“Adding a BTC reserve helps the Terra protocol to standard request much efficaciously by providing a abstracted backstop (from the Terra protocol) to volatile redemption periods with a hard asset,” a Terraform Labs spokesperson told Bitcoin Magazine. “It besides confers much assurance successful peg sustainability by users who privation a decentralized stablecoin supported by a credibly neutral reserve plus similar bitcoin.”

Bitcoin Reserves As A Release Valve For UST

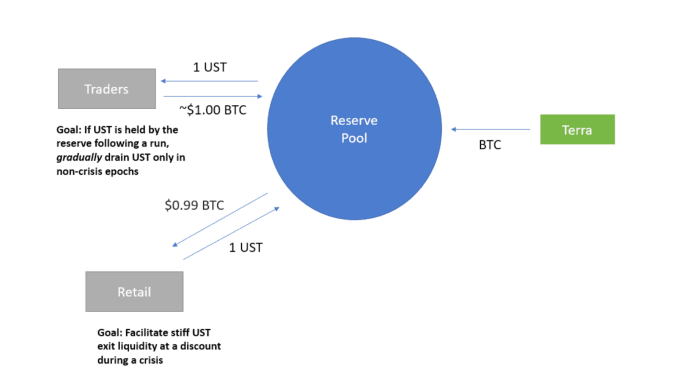

According to the current proposal, the thought is to conception a BTC reserve excavation setup that tin rapidly enactment UST — and indirectly LUNA — successful times of situation erstwhile the stablecoin slides and ends up trading beneath its $1 peg.

During specified a crisis, retail would past beryllium fixed the accidental — and presumably, economical inducement — to speech their depreciated UST for an adjacent magnitude of bitcoin. The presumption is that Bitcoin’s enduring occurrence implicit the years poses it arsenic an charismatic plus for investors seeking to “fly to safety” successful the midst of a crisis. LFG would past proviso them with the BTC they privation astatine a discount, portion getting UST backmost and thereby ensuring request for the algorithmic stablecoin. (For example, if UST was trading astatine $0.99, an capitalist could nonstop 1 UST to the LFG bitcoin reserves excavation and person $0.99 worthy of BTC back.)

After the play of situation ends, LFG assumes that UST would beryllium backmost to its $1 peg, oregon adjacent commercialized astatine a premium — supra the $1 worth mark. The instauration would past dilatory replenish its bitcoin reserves by selling the UST reserves it accumulated during the situation play successful speech for BTC. This assumes traders would beryllium funny successful making that arbitrage and exchanging their BTC for a then-appreciated UST.

A ocular statement of the minimum-viable merchandise for the BTC reserve pool, according to Terraform Labs’ probe paper. Source: Terra.

The insubstantial outlines that the reserve excavation volition motorboat with astir $2.5 cardinal worthy of bitcoin successful reserve and aboriginal turn done gross obtained from seigniorage — minting and burning tokens connected Terra.

LFG precocious raised $1 billion to commencement allocating funds to its BTC excavation successful an over-the-counter, backstage merchantability of LUNA tokens to a cohort of task capitalists, including Jump Crypto and Three Arrows Capital.

As Adam Back, cypherpunk and CEO of Bitcoin infrastructure institution Blockstream, has noted, “VCs/institutional investors seems a spot similar a backstage fractional reserve dollar, a pegged parallel currency that they anticipation tracks USD via marker” — an appraisal Kwon doesn’t disagree with.

Bitcoin Reserves? More Like Synthetic BTC

According to the probe paper, LFG’s excavation volition not beryllium made up of existent BTC, but of wrapped BTC alternatively — a synthetic one-to-one practice of existent BTC that volition supposedly beryllium kept locked up and guarded connected the Bitcoin blockchain.

This alteration is arguably required truthful the excavation tin run natively connected Terra connected a astute declaration ground for its liquidity needs arsenic it arbitrages BTC and UST. Consequently, however, retail investors and traders who speech worth to and from LFG’s excavation volition woody with wrapped BTC alternatively of existent BTC. The insubstantial details that the wrapped bitcoin volition beryllium apt implemented successful the CW20 standard.

However, astir of the details astir the wrapping process, including custody, tradeoffs successful its spot model, and its functioning thereafter are inactive unclear. Moreover, the process by which users who arbitrage UST for wrapped BTC volition beryllium capable to get existent on-chain bitcoin is besides unclear astatine this point.

“The existent specifics of wrapping autochthonal BTC are inactive nether information (including bridging details) and much accusation volition beryllium released astatine a aboriginal date, but the extremity is for a non-custodial, on-chain exemplary of the BTC successful the reserve,” the spokesperson said.

As such, those who question concern successful bitcoin arsenic a permissionless and sovereign plus that serves arsenic a decentralized alternate to fiat currencies oregon cryptocurrencies governed by almighty 3rd parties should not confuse UST with BTC.

3 years ago

3 years ago

English (US)

English (US)