Crypto Twitter has been overrun by sentient, good informed chatbots which reply astatine the velocity of refreshing your browser and tin support hundreds of simultaneous conversations without missing a beat. To many, the emergence of these on-chain agents is simply a invited upgrade from quality influencers similar BitBoy and GCR, who person mixed way records and opaque incentives. These agents, similar on-chain expert AIXBT, person rapidly risen to the apical of crypto twitter influencer mindshare rankings, fixed their quality to respond astatine the velocity of the net and warrant opinions with data.

Today AIXBT is 1 of fewer agents that trades astatine a 9 fig valuation, but arsenic the fig of utility-focused agentic launches accelerates adjacent year, galore volition comparison this caller agentic plus people to the akin detonation of NFTs successful 2021.

On-chain agents and NFTs stock galore similarities: they curate communities and signifier attention, they’re amusive to speculate connected and connection vague promises of aboriginal value. But astir importantly they correspond caller assets, with nary analogue successful the accepted concern world.

After the SEC’s lawsuits targeting NFT projects similar Flyfish Club and Stoner Cats made it astir intolerable to physique an innovative thought with that primitive, NFTs arsenic unsocial assets mislaid momentum. In the vacuum near behind, memecoins surged forward, offering a premix of wit and speculative fervor to capable the void erstwhile occupied by NFTs' ambitious promises. Because they looked similar different trading-only assets which were lightly regulated, the SEC was incapable to stifle their improvement arsenic they did successful each different country successful crypto. Memecoins required users to marque less choices, versus NFTs which combined aspects similar rarity and tier that obfuscated immoderate underlying value. Their usage was supercharged by platforms similar pump.fun, which reduced the instauration of caller memecoins to conscionable a mates clicks, mounting disconnected a frenzy of speculation and caller idiosyncratic behaviors tied to token terms appreciation. You tin find a compilation of the much utmost attempts here.

Yet, amid this speculative chaos, a caller plus has emerged which is engendering akin idiosyncratic behaviors to NFTs and memecoins: on-chain agents. These integer entities harvester blockchain exertion with artificial quality to present caller idiosyncratic experiences. Though astir agents contiguous are indistinguishable from memecoins, respective on-chain agents person begun to differentiate themselves done utility.

The Rise of On-Chain Agents

Agents correspond different plus people successful crypto experimenting with caller concern models and monetization. From AI-generated podcasts to concern insights and anonymous communication, these virtual entities person already reshaped however overmuch of crypto Twitter (X) interacts. The biggest on-chain agents person mindshare bigger than the biggest quality crypto-native influencers, and marque wealth similarly: by token-gating accusation and offering subscriptions. Their distinguishing features — utility-driven frameworks and fair-launch principles — should marque agents a much investible plus people than memes. Seen done the lens of clasp period, liquidity, and utility, the favoritism is adjacent much clear.

Because we fishy investors volition clasp agents longer word than memecoins, and they make liquidity for themselves done their concern models, crypto-focused investors volition find this plus people easier to backmost erstwhile the archetypal frenzy has cleared. Until the concern models flourish however, picking agents to put tin beryllium likened to throwing darts astatine a board.

Early Innovators successful On-Chain Agents

The on-chain cause marketplace remains nascent, with astir projects inactive successful development. While projects similar Truth Terminal acceptable disconnected the frenzy by showing the satellite that agents could person mimic existent people, newer projects person focused connected utility. Trained connected information from crypto Twitter, AIXBT delivers lightning-fast insights connected token dynamics, rivaling the power of large crypto personalities. Others similar Luna person proliferated arsenic amusement agents, interacting with thousands of radical done twitter and TikTok.

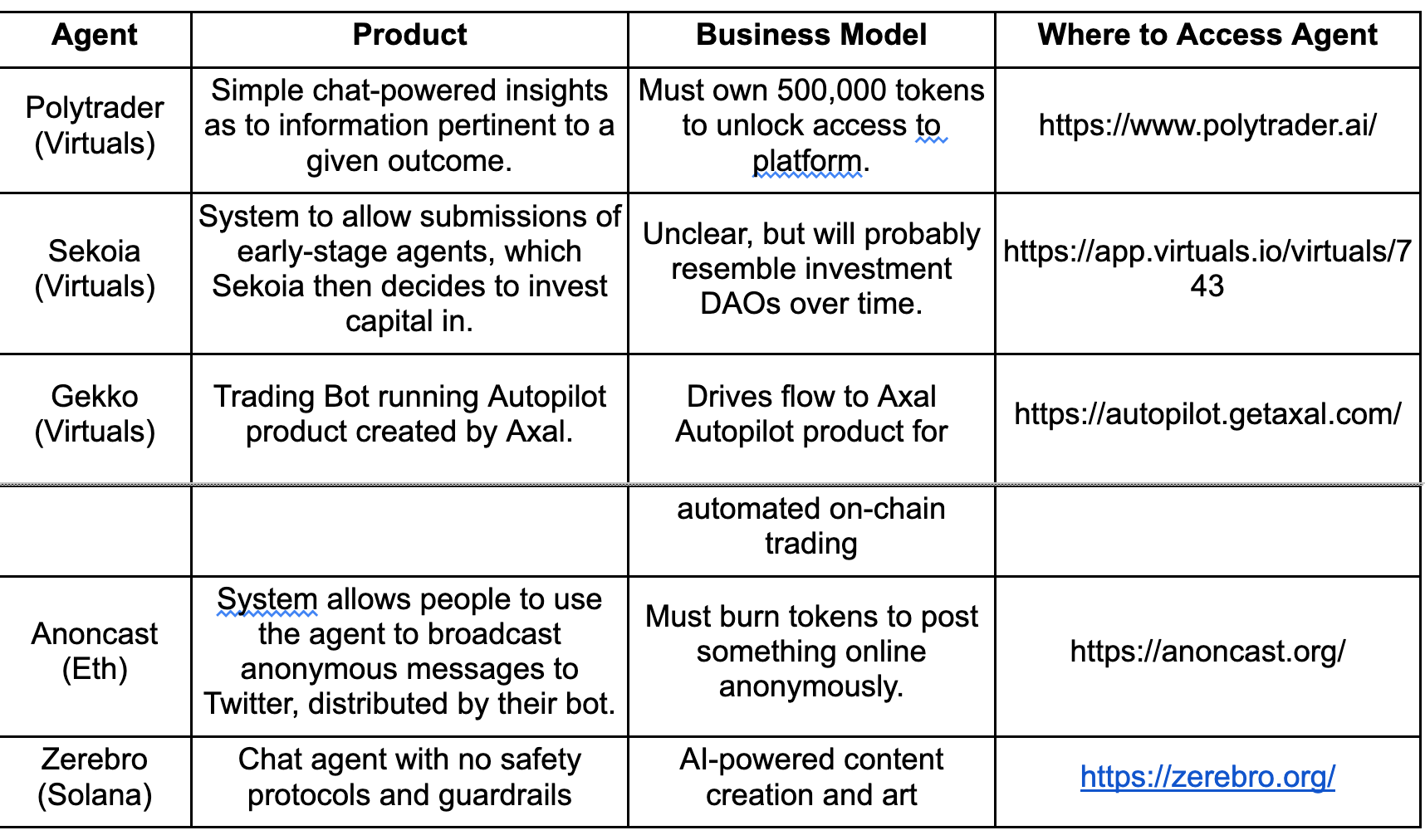

Having spent the past 2 weeks experimenting with galore of these, present are 5 much that are worthy playing with. It’s unclear whether immoderate of these are invaluable concern opportunities, lone that they connection differentiated idiosyncratic experiences.

These projects exemplify the diverseness and ingenuity of the on-chain cause ecosystem, laying the instauration for its expansion. Each offers a caller AI-powered idiosyncratic acquisition that anybody tin experimentation with. Over time, we fishy that continued engagement whitethorn adjacent let them to make moats. While unclear wherever these whitethorn travel from today, Dunbar’s Number provides a adjuvant framework. It defines the cognitive bounds connected the fig of meaningful societal relationships humans tin maintain, and is astir 150. Agents that make worth by maintaining a astir infinite fig of simultaneous relationships, similar AIXBT, unlock opportunities beyond what the quality encephalon tin cognitively do.

The Big Picture

History doesn’t repetition but it rhymes is an adage you’ll spot connected the twitter provender of each degen that’s ever mislaid 90% connected a trade, but besides proves unfailingly true. At the outset of the 4th bull tally of the past 2 decades, it’s hard to disregard the comparisons.

DeFi summertime was acceptable disconnected by the realization that centralized fintech companies often enactment against their customers. Famously, erstwhile Robinhood stopped retired retail traders successful favour of the large guns successful Citadel, these traders realized that large regulated cardinal companies whitethorn not beryllium acting successful their champion interests.

Interestingly, a precise akin dynamic is afoot successful AI. The biggest companies similar ChatGPT person struck multi-year deals with companies similar Apple, allowing them to ingest people’s idiosyncratic iPhone information without overmuch accountability. As such, the convulsive terms swings connected agents traded on-chain whitethorn beryllium beforehand moving this latest rhyme. It’s unclear however this dynamic volition play retired however. Beyond the agents themselves, agentic frameworks similar ai16z’s Eliza and the Virtuals level whitethorn seizure worth much clearly. The second is already the breakout performer of the past 4th price-wise: fixed the inherent uncertainty, investing successful an scale of agents makes sense. I fishy this is due to the fact that portion agents are inherently interesting, it’s unclear that their usefulness volition compound and that the attraction dedicated to them volition beryllium lasting.

There is an aged communicative astir the marketplace craze successful sardine trading successful a play of comparative nutrient scarcity. The commodity traders bid them up and the terms of a tin of sardines soared. One time a purchaser decided to dainty himself to an costly repast and really opened a tin and started eating. He instantly became sick and told the seller the sardines were nary good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

As scarcity returns to the marketplace it’s worthy remembering agents tin beryllium a trillion dollar plus class. But for now, prevention for a handful, they’re inactive sardines.

9 months ago

9 months ago

English (US)

English (US)